The Widow Maker in Real Estate

I noticed that conversations do not centre around property as much as they used to compared to even as recently as last year, real estate is not the hot topic these days.

Well, my phone number is on some property spam lists and I get about over a dozen SMS-es a week re some real estate deal or other. For instance, this week I received 3 on Cambodia, 2 on Manchester, The Panorama at Upper Thomson, Citygate at Beach Road, Mount Sophia, Tiong Bahru, Ang Mo Kio and a talk on Cambodia.

Flashback to a year ago, given that I have not cleaned up that old phone for a while, there were a lot more SMS-es then. Like the Mega Pioneer Industrial Ramp-Up, Lexicon-Islington, Kallang Riverside Condo, Citygate (again), Bukit Indah Condo (Johor), Cambodia (again), Iskandar Waterfront… wow!

Of course, that was all before the currencies went mad besides all the onshore regulations that started limiting borrowings. Things are not looking too optimistic.

London

(We can say the same, to a lesser extent, for the GBPSGD which has risen 7% in the past 12 months.)

Singapore

Australia would have been a good bet for Singaporeans as the SGD has gained 10% against the AUD in the past 12 months or even my suggestion from last year for Japanese property.

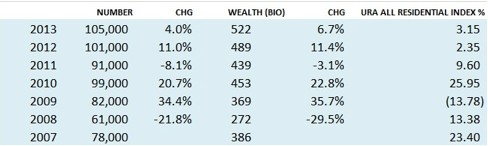

I follow real estate markets as a matter of personal interest because I have noted for years that real estate is really the only practical route to the mass-market wealth effect.

And it has been true with Singapore registering an even slower growth of millionaires for 2014 (source: WorldWealthReport), adding only 2,000 millionaires at a pace of less than 2%, the slowest in 3 years not counting 2011 when the numbers shrank and when the rest of the developed world is slapping on the millionaire count, some at double digit growth pace.

Table compiled last year which excludes the 2014 numbers.

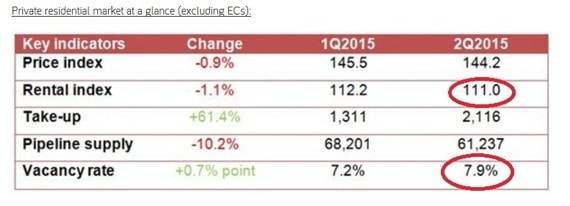

Property supply will peak in 2016, rentals are falling even as interest rates rise which is a double whammy for owners who are leveraged on their property. Thus it is no wonder that the banks are having it tough.

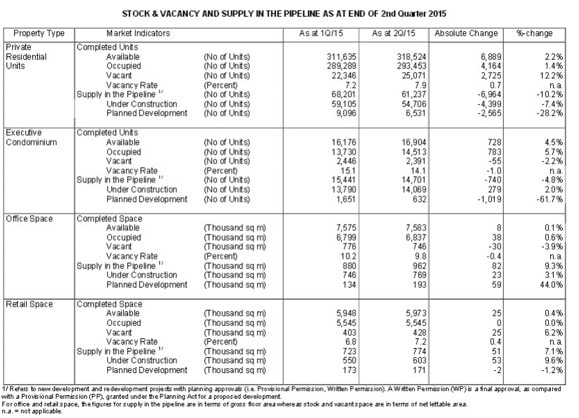

As we noted earlier this year, “Residential vacancies are the highest since Dec 2005, office space vacancies are highest since Jun 2012 and factory space vacancies are highest since Jun 2006. Taking a pinch of salt from the reports we read about prime office rentals that have jumped 14% last year, I personally would not expect the same for 2015. The residential property market is unlikely to recover soon with heavy supply in the pipeline.”

Take a look at the latest URA property survey published last month. There is still a lot of “Under construction” across the board, from residential to commercial units. While “planned development” is registering a sharp drop, the supply would hit some time next year.

Well, residential vacancies are even higher now with the double whammy of falling rents!

It feels bad to be right especially when Singaporeans have 47% of their total wealth tied up in real estate compared to Americans who have about 28%.

How does this double whammy of lower rentals and higher funding costs work?

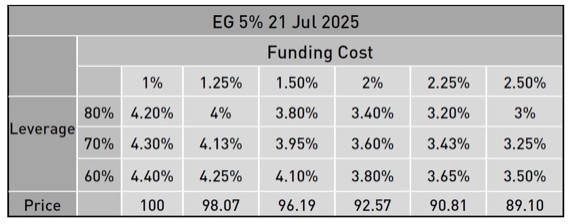

Pretty much like an amortising bond on leverage where ultimately, the principal of the bond/property would have to compensate for the reduced returns. I use a table from my seminar last week for a 10Y bond paying a 5% coupon with illustrated returns for different levels of leverage and the commensurate drop in bond price.

What I wrote in Jul 2013 for rough math correction numbers in prices which some people criticised as too harsh back then.

“There are 2 risks going ahead in the business cycle.

1. economic slowdown or mini crisis (say Europe or China), banks downsize and since Singapore’s rental market is still specifically more leveraged to the financial sector (mass market homes less so, but there is a trickle down effect), if Orchard Road and CBD rentals collapse, Jurong will be affected.

2. interest rate rise which looks probable after 5 years of near zero.

My question is this : How much will property price come off by for a 1% up move in interest rates? This is entirely plausible because our mortgage rates are still about 1% and moving on to a 2% handle is not an impossible scenario. It will really start to burn when it hits 3% bringing about the dreaded margin calls on those loans that are leveraged to the hilt (= sub prime foreclosure scenario).

Using rough math, 1% for 25 years = 25% more you will be paying (the amount should be less due to amortisation effect), on 80% leverage, so we have about 20%! Unless you have a wage hike of 20% or a rental hike of 20%, the property prices should come off by 20% to equalise?

The bad news is that Singapore residential yields are not near the 5% level.

Taking some statistics from the Global Property Guide website, I compiled the price cum returns for countries around the world.

Do note that the price levels are based on urban city centres and the US and UK have been left out.

With a bit of commonsense, as I pointed out last year, it is worthwhile to calculate the affordability of the property based on price/GDP capita.

“Do not buy the next luxury development in Cambodia, for Heaven’s sake. Based on upscale home prices over the country’s GDP per capita, Cambodia is the 2nd most unaffordable country in Asia and Europe (I excluded Africa and America) where it would take 319 years of work to buy an upmarket home. Yet do note that the average monthly income in Cambodia is US80 dollars and if that doubles to US160, the affordability would be reduced to a 160 years thus it does make sense to invest if there is high expectations for minimum wage raises in places like India with their reforms and their young population, vis a vis China which is facing an aging problem.”

Table from last year.

Source: globalpropertyguide.com

34 years to pay off for a luxury home in Singapore? So I worked backwards, starting from GDP per capital to verify the results back in 2012 and the conclusion was near similar – we are near maxed out as far as property prices were concerned.

“In Singapore’s case, it does look like we have hit the limit for property prices. Just from rough maths. Assume dual income household. SGD 120k borrowing a 90% 30Y loan. We are looking at a SGD 1.5 mio property. Assume that we need 800 sq ft for comfort. That is SGD 2,000 psf and I am hearing Bishan condos are going at SGD 1,700 psf.”

Yet, we were given ample warnings.

And Li Ka Shing.

The richest man in Asia cannot be wrong. To be able to grow and preserve wealth, you definitely need some acumen. And Li Ka Shing’s acumen is kindred in spirit to Warren Buffet’s, to buy when all are selling and to sell when all are buying. And because of the sheer size of their funds, they need to move 2 steps ahead of markets, or they will fail to unload their holdings. And Li Ka Shing would qualify to be property guru emeritus for Asia for he started out in real estate. So, Li Ka Shing has been selling alot of stuff and Reit-ing much of his holdings since 2013.

Real estate can be a widow maker for those who remember the crash of 1995-1998 when property prices fell some 45%.

Some headlines from those days.

Bloomberg 1 Oct 1998: Number of Singapore Public Housing Owners in Arrears Soars

Asiaone 21 Sep 1998: Singapore Developers Delay Launch of 5,000 Residential Units

Bloomberg 8 Sep 1998: Returns on Singapore Prime Offices Among Lowest in Asia

With our GDP per capita one of the highest in the world, all we can do is to grit our teeth and dig in our heels and wait out those 10 years before we see the “greater heights” that MAS MD Ravi Menon envisages in 2026.

It is only 4 months to 2016 which gives us ample time to beef up those war chests for bargains as well.