Thoughts on 2024: Seeing Only as Far as End January

It is only obvious that bonds would mock us with a rally for the rest of the year after most of us have been stopped out, or pulverised to surrender, for graphic effect. Thus, we have stopped searching for that asteroid or following Yellowstone for an Armageddon because it is starting to look like the joke has been (and continues to be) on us.

Yes, even the retail banker who recommended our godmother to a basket of Nasdaq stocks earlier this year as a hedge for inflation and rate cuts (Heavens and textbooks forbid), is looking like a super champ now

“It’s too good to be true, you grab it only to realise you have low standards and a high threshold for pain.” — Bond trader reflecting on 2023

John Wayne famously said, “Life is hard. It’s harder if you are stupid.” Markets in 2023 have been tough on us, if you lose money, can you say you are smart? Yet we have to dig deep think about the coming year even though every prediction for markets in 2024 has occurred in December 2023, priced to immaculate perfection right down to the rate cuts, so it looks like there is nothing much to expect left.

The theme for 2023 has been extremism and it is not about the Hamas terror organisation or terror attacks but rather the number of first-times in the market where crazy bond volatility has propelled seven stocks to safe haven status—up 75 per cent for the year and the mental challenge it has presented to some of us who think too much.

The latest cross-asset rally can only be described as animal spirits even if “Dumb Money” is officially a box office flop with Gamestop Inc. down almost 90 per cent from its all-time high and yet still technically 200 per cent above its pre-meme stock era days. And we have the meme stock crowd vested all-in into this memorable December rally with the Nasdaq 100 closing this week at a record high.

Source: Bloomberg

The last we read BofA, Michael Harnett had Crypto up 120.5 per cent for the year, stocks 16.9 per cent, gold 11.2 per cent, HY bonds 9.9 per cent, IG bonds 6.5 per cent, cash 4.7 per cent, gov bonds 0.4 per cent, US dollar 0.1 per cent, commodities -5.6 per cent and oil -13.6 per cent.

Trying to wrap our heads around the current market into 2024, we read voluminous tomes of analyst research that the livelihoods of armies of research teams depend upon. Such little faith these armies of “biological” (for wokeness) men and women have, that we even have an honest opening disclaimer about the impossibility of writing year-end outlooks and getting it right from past observations because big trends often change in late January. So we stopped reading right away.

The general mood going into 2024 from what we have read, so far, is somewhat pensive, with “not out of the woods” and “still searching for a landing,” so much for the battle cries of rate pivots this time last year with the Fed hiking all the way to July in 2023.

All we know is the average period from the last hike to the first cut in recent history is eight months. As we said above, with markets priced to perfection expecting a total of 152 rate cuts by central banks next year, according to BofA, we do not know what to expect anymore.

Greatest Wealth Transfer in History

Nonetheless, we have to share about something we finally wrapped our heads around although we are not the first. The answer to the question du jour/de l’année, for 2023, is why is the US government borrowing so much when the economy is running red hot? Or, as Zerohedge put it, if the economy is so great, why are tax revenues so weak?

Call it a revelation that many before us have already realised. For the past 15 years since Lehman, we have stumbled into the singular largest transfer of wealth in history – from governments to the private sector. We are not alone in our discovery because others have also figured it out – the Magnificent seven have nothing to do with the government and as the governments’ (AA-rated negative watch) borrowings balloon to infinity, Microsoft’s AA-rated coffers continue to swell.

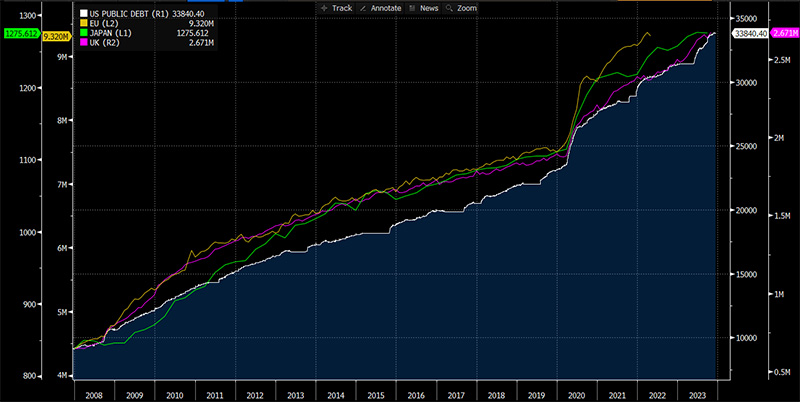

Chart of EU, JAPAN, UK and US outstanding debt since 2007

The typical modus operandi of normal governments would be to save for a rainy day a la Singapore style. But in other jurisdictions including America, there seems to be no intention to pay back any borrowings, and borrowing more and more is perfectly normal. Or business as usual because countries are forever but elected officials aren’t and they make promises to keep voters happy for them to get elected with the perks of office.

Where did all the money go?

Into the private sector, of course, into assets and as asset values increase, folks and corporations have profits to buy more and more to the extent of spawning new asset classes like the game changer in Bitcoin, created or invented from nothing more than the fiasco of fiat money (and not blockchain). The theme was AI earlier this year and chips, but come on, the majority are not buying for long-term yields, Buffet-style, the mindset is all about short-term capital gains and the urgency has never been more extreme (perhaps a reason for the extremism we have witnessed this entire year). Every fintech is looking to be bought out by Apple, Google, or Amazon so they can post photos of themselves on yachts on Instagram.

Buybacks fuel this greed because dividends are after tax items and the floating stock of Apple will continue to shrink as buybacks continue. Equities in a shrinking pool and bonds in an expanding pool – playing on a (doomed?) loop… Unless and until something breaks.

Break or buckle is getting likelier, and it is a simple proposition. Going back to the chart above, we note that the US Public Debt is nearly US$34 trillion, growing almost US$2 trillion since July which is equal to the GDP of Italy which happens to have the tenth largest GDP in the world. It makes us wonder how we will find the demand to buy those extra trillions of US government borrowings in the absence of QE?

On the contrary, Apple is trading at the value of the entire French equity market and it is perfectly fine because the supply of Apple shares will continue to deplete on their buybacks, so there is not enough to go around that even Koreans and Vietnamese day traders are vested in Nasdaq instead of Gamestop now.

Will the wealth transfer continue into 2024?

The unpopular thought would be that markets have condensed the entire 2024 into December 2023. But we will not claim to be able to see so far into 2024 as the end of January, which an honest strategist had confessed to the above.

Here are some sentiments from a hedge fund manager and a chairman of a bank: “Expect 2024 to be doom and gloom until the return of Trump which will bring world peace. World peace = World rally … but that’s in 2025 as he would only be sworn back in Jan 2025.” “乱, chaotic and messy.”

Hedge fund guy trumpeting Trump for world peace? He admits he is demented these days as another trader friend suffers PTSD. It just does not feel right for some people who have seen the Asian Crisis, Dot-com, SARS, Operation Desert Storm, Lehman, Greece, Covid and QE’s. We are rushing into 2024 like lemmings and headless chickens, but we have to be cognisant of what happened during Gamestop – the madness doesn’t stop, and Gamestop took over a year to fizzle.

There is plenty of reason to fuel December 2023 into 2024 because the party need not stop. It is the path of least resistance which is how 2023 has been—extremist! And also, we have a crazy notion that the wars will end sooner than later because Zelensky is running out of funds as his government frays and Israel has already almost flattened Gaza, for another dose of animal spirits.

Whilst we would also like to talk about elections, rate cuts, sticky inflation, defaults, social fragmentation, job losses, supply shocks, commercial real estate crises, private credit regulation and all that we really cannot predict with accuracy, it does feel like we are on the brink of something quite bad. We cannot decide what to park at the moment, because everything has rallied that maybe the most sensible trade would be the contrarian one.