Bond Market Thoughts: Sitting Around Waiting to Catch Covid

2022, where a day feels like a week, a week feels like a month and a month feels like a year, for us at least and the markets.

It has just been over a month where we are busy regifting those tins of pineapple tarts while sitting around waiting to see that inevitable double line for our ART test. Everyone around us is falling like flies and watching markets with a sinking feeling in the pits of our stomachs with everything melting and portfolios looking the worse for wear.

Feeling the same are our bond market friends, who report feeling sick and nauseous as they await more capitulation and volatility like a deer caught in the headlights of an oncoming truck.

There is no safe haven trade even as we note many friends preparing to dig their heels in for a long winter and others still banking on the stock market ATM machine even as the signs are all there, according to some market veterans who remember the times of crisis. The market gyrations of 2022, so far, have all the symptoms of an impending crisis.

Let us examine the situation so far.

Screaming inflation, roaring at a record pace all around the world, and in Singapore, spurring MAS to an unprecedented inter-meeting tightening as opposed to their only other unprecedented inter-meeting loosening back in 2015. Central banks around the world are facing political pressure to fix the problem with the only tool in their toolkit, which is monetary policy and interest rates although places like France is making state-controlled companies like EDF cap energy prices.

Inflation is attacking on all fronts starting innocuously as Covid-linked disruptions but escalating into wages, energy and fuel prices and commodities, not to mention asset inflation with real estate prices out of control everywhere except China. This is affecting rents and politicians are feeling the heat from their electorate in times when populist politics is the fad and yes, America is heading into the midterms and President Biden is recently seen to be taking a tougher stance.

And now inflation is finally attacking our portfolios which are getting pulverised by the stock and bond (and for some, crypto) market meltdowns. We are feeling properly poorer by the day before the Singapore Budget and the dreaded GST hike as if the cab fare hike is not bad enough.

State of the Portfolio

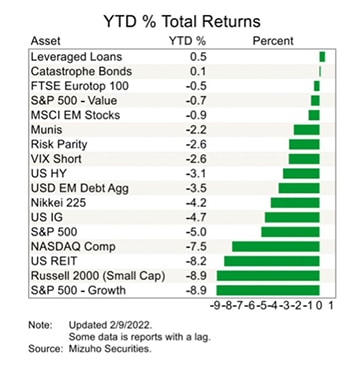

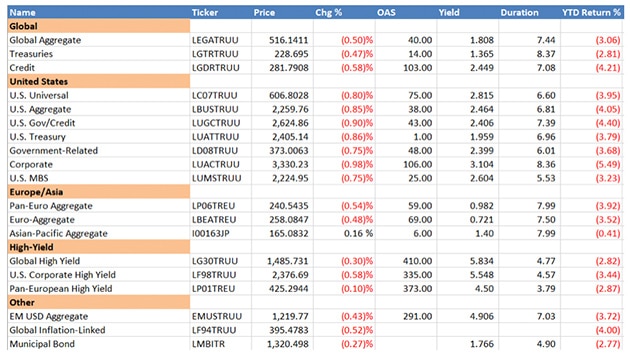

2022 and the Year of the Tiger is off to a rocky start with junk and government bonds both down some 4 per cent, investment grade bonds and stocks down some 5 per cent with oil leading commodity prices higher by some 20 per cent.

All of a sudden, central banks around the world are making policy U-turns and turning hawkish on the inflation front with Goldman Sachs now predicting as many as seven rate hikes for the U.S. in 2022, which is 1.75 per cent in the next 12 months—sending bond prices crashing. Just for context, the two-year U.S. government bond yield was just 0.25 per cent less than six months ago and it is now 1.6 per cent after starting the year at 0.7 per cent. Bunds saw a six standard deviation move within a week and investors are nearly 5 per cent poorer than where they started the year at.

Table of year to date returns on bond indices

Table of year to date returns on bond indices

Two Major Concerns: Taper and Rate Hikes

The Fed and other major central banks have been buying their own bonds, which have the effect of injecting liquidity into the markets since the start of the pandemic albeit at a reduced pace since late last year of just US$200 billion year to date. And that is coming to a halt in March after two long years when they are also expected to hike interest rates by 0.5 per cent and another 1.25 per cent thereafter if Goldman Sachs is right. Three months ago, the consensus was that the market could handle the end of quantitative easing—i.e. the bond-buying, but the Fed will take its time with rate hikes. Yet nobody could have foreseen inflation rising to 40-year highs just three months later.

The Impending Crisis

2021 stunned most of us for the euphoric rally and growth story and we were stung by the many twists and turns that made professionals look foolish in the face of central bank inaction, making us question the meaning of it all. We would choose to be constructive in 2022 instead of pointing the finger of blame for the confluence of various factors (largely central bank judgment) that led us to this moment.

The U.S. is undoubtedly the central bank of the world for its far-reaching policy effects that influence everything from prices to capital flows and there is no mistaking that Singapore will be spared from their actions.

Fed tapering, balance sheet reductions, and rate hikes affect two types of liquidity: cash/monetary liquidity and market/price liquidity. The former would refer to the cost of borrowing money and its availability, which would be hampered by the cessation of monetary stimulus that will feed into the system and probably back into inflation as companies pass the cost along.

The latter, which is our bigger concern, is the price discovery process for stocks and bonds given the uncertainty of the rate hike trajectory especially when the central bankers do not know themselves how inflation data will shape out. There is a massive loss of faith from the markets after their repeated denial of sustained inflation in 2021, calling it transitory when it was obvious that sticky wages and commodity prices, if anything, were here to stay.

Nonetheless, we should rewind back to March 2020 when markets seized up. Remember the days of the liquidity crisis and markets collapsing under the weight of selling for those raising cash. This time it will be worse because there is even more cash to raise at such valuation levels and there will be no buyer of last resort like the central banks this time around.

The signs are there in Singapore. January has been a drought for bond issuance with only three local corporate bond issues—the lowest number we can remember for a while without sieving through past data. This would probably be attributed to lack of demand, and we see most of the bonds issued in 2020 and 2021 trading at a discount to their issued price in spite of inflation, compared to the outsized equity market gains for stock investors (although SREITS have taken a severe beating in 2022).

We are hearing of investors unable to get decent bids or bids at all for some of their bonds not just in Singapore. Market makers are holding back on loading up their books in the face of such uncertainty, which will lead to heightened volatility in even safe-haven government bond markets causing prices to whipsaw. It is entirely their prerogative with the only consideration being customer goodwill and memories are short these days so heroics will be underappreciated.

Retail investors are largely unable to hedge higher interest rates with little access to hedging instruments such as bond futures or derivatives unless they want to plunk more money into short bond ETFs and such.

The good news is that losses will be limited if there is a need to sell at all and coupons will cover back everything in time. Like cryptocurrencies, the HODL strategy still works best. The bad news is that the casualties will be our bond market friends who will not be spared from the days of volatility and illiquidity ahead.

It is like us sitting around and waiting to catch Covid like a deer caught in the headlights.