2016 Singapore Rates Outlook: Diminished Prospects is like “Alamak, It is Buay Pai But Sian”

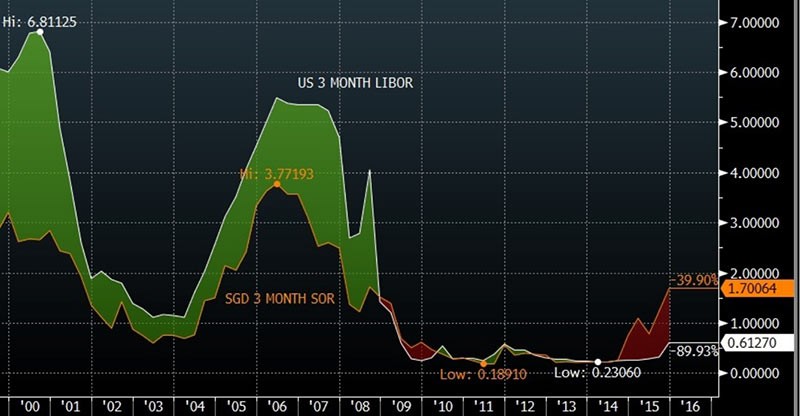

2016 requires a lot more contemplation than any year in the past decade, just in case you have not thought too hard about it, emerging bleary eyed from 2015 that had ended on a big bang. No, not because of the Fed hike to kick start the festive season, or the highs that SOR and SIBOR rates ended the year on – 3 months SOR breaking a new 6 year high at 1.70064%, or going back further to the passing of the nation’s founding father, Lee Kuan Yew, which was followed by a euphoric election result for the incumbent PAP leaders and a prolonged period of suffocating haze, or even the 2 corporate bond restructurings at hand. Apart from the glorious displays of fireworks all around the world, 2016 is off a rocky start, sprinkled with little incidents of terrorism or would be acts of terrorism, around the globe, along with unusual weather patterns and some major political storms brewing in the Middle East with Saudi Arabia’s Sunni rulers riling Shi’ite muslims with some controversial executions.

It cannot be a happy new year, really, for Singaporeans with a floating rate mortgage which is the subject closest to any Singaporean’s heart given the estimated 90% home ownership rate for the island state, having to set aside an estimated additional S$10,000 per million liability per annum with the rapid ascent of funding rates.

Can we expect folks to be cheering or spending now after enjoying average interest liabilities of 0.5% for the past 5 years ? To be stuck with 1-1.8% interest expense bills? With median household income at about S$8,290 and average home loan at about S$350,000 (as mentioned in ST back in 2013), households would just have 3-4% less to spend, which to some, may just mean one less handbag a year.

My good friend was telling me that she is thoroughly enjoying her new job, back in the bustle of Singapore’s financial hub even as she grimly observes the large number of gloomy faces in the streets each morning, of employees (who should be grateful for employment as she is) somehow unhappy about their situations that probably stems from personal economic insecurity or frustration at their stations in life. She informed me that her friends in Hong Kong see the same in their financial hub, and the large numbers of homeless in McDonalds at midnight that has become commonplace.

In a world of materialism, the measure of success is largely prosperity for most and when the opportunities to prosper dim, majority would feel stress and frustration. In 2015, most Singaporean investors would not have found much cheer in the stock, bond and real estate markets which is not uncommon especially when we have hedge funds all under water and hedge fund managers should be considered the smarter and brighter ones that society has to offer.

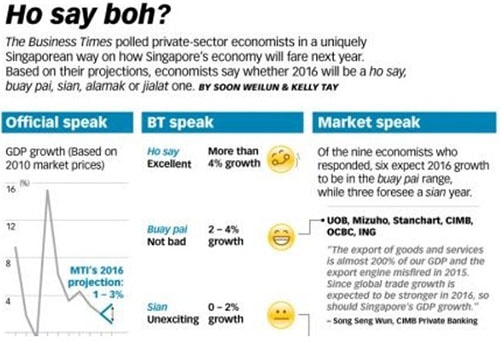

And opportunities are diminished for 2016 if BT’s colloquial poll of economists is on track with not a single “Ho Say” response, all stick to “Buay Pai” and “Sian” and no daring to spook the market with a “Alamak” or “Jialat” reply although Singapore does not practise the “dead, detained or missing” policy that China has embarked upon for her financial markets.

It will be a mini “Buay Pai” because expected GDP growth for 2016 is just 2.2% after economists recently cut their forecasts in a hurry, from the 2.8% they had expected in September after a sharp slowdown in manufacturing.

Singapore is not alone, for 2016’s global prospects hinge solely on the recovering American consumer and less on mergers and share buybacks, Eurozone’s epic QE efforts and lastly, China and her reform push. Throw in all the top 3 risks for 2016 starting terrorism, picked as the biggest risk, followed by BREXIT – UK exiting the Eurozone and cyberattacks on the financial system, assigned probabilities of 25, 20 and 10 percent, it is no wonder that the manufacturing sector has not been this dispirited in the past decade safe for the dip during the Global Financial Crisis.

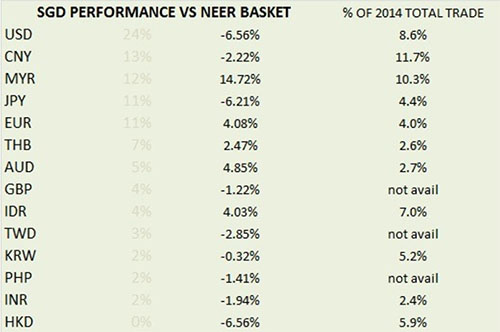

And they cannot really blame the SGD’s foreign exchange strength this time because the SGD has tumbled 6.56% against the USD for the year after abruptly re-centreing the SGD lower against the NEER basket in Jan 2015.

Singapore Rates Outlook 2015: I Wish I Could Say A Good Year

“Singapore did the right thing this year, shying away from the model of growth, choosing instead to consolidate, much like what China is doing. This is the path of least resistance in the face of the global financial turmoil which is still brewing and buffeting the markets about, especially those of the smaller economies like ours…

Singapore shall be caught up in both the headwinds and tailwinds that will confront our resource rich neighbours. It is virtually impossible to predict the future without forming a view of the global economy. My view is that Singapore will reap the rewards of her stable policies, and will continue growing as a global financial hub. As such, a strong SGD is warranted as far as monetary policy is concerned.

The USDSGD may trend upwards in any global panic, but retain its strength against the rest of the world. Staying long USDSGD into the first quarter is a good idea with 1.35-1.40 in sight, buying into pull backs if we see 1.27-1.28 as we may perhaps see the potential of a second quarter of negative GDP growth.

I believe that short-end interest rates will be capped at current levels ie. 1M SIBOR will find it hard to break above 0.50% unless the FED brings forward their rate hike agenda.The rest of the curve will probably re-steepen into 2015 as supply is injected into the system via the government bond auctions…

The corporate bond business has been seeing some lull, and we are unlikely to experience the same sort of issuance mix next year, as we have witnessed this year as the chase for yield diminishes in the face of higher rates and capital losses while I cannot say that prices and levels have corrected sufficiently to make an investment decision on most of the names.

We can conclude that staying under-invested in bonds is probably a prudent decision going into 2015. Seek instead opportunities to re-enter the markets on signs of deeper correction.

The risk of widespread credit defaults appears relatively slim, but I would not rule out that the commodity crash would not lead to contagion in other asset classes, such as real estate, affecting the yields and valuations of for instance, the SREITs market. In conclusion, I wish I could say 2015 will be a good year but I think we shall have to wait at least a quarter or two for that.”

Verdict and Predictions

Wrong about the short end rates, right about the currency and half right about bonds, the market tarnished by 2 debt restructurings from non oil-related companies.

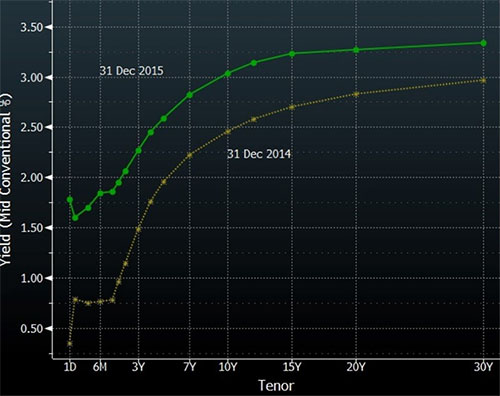

We had a few first’s for 2015 being the first time since record keeping that Singapore rates have led US rates for such a sustained period and by the widest margins ever.

3 month SOR towering 1% over 3 month US Libor makes no excuse for the rate hikes to come from the US.

It spells fear for Singaporeans if the Fed decides to raise rates further but I really cannot see a non interventionalist approach by the MAS should the gap keeps widening just to prove that Singapore does not have an interest rate policy especially when we just made a new 6 year record on 29 Dec 2015 for the overnight versus 3M SOR spread, a sure sign that banks are profiting against those home loans which are fixed at 1.7% against daily funding costs of 0.4%.

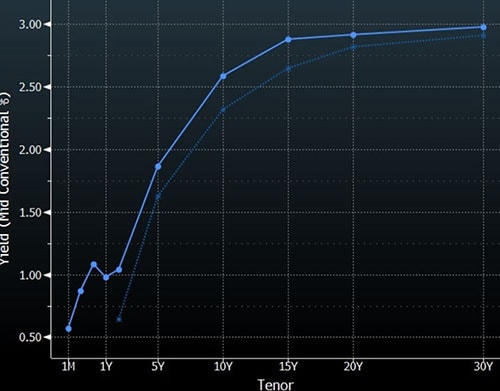

Government bonds have beat corporate bonds with Bloomberg’s Singapore sovereign bond index registering a 0.7% annual return despite the higher rates, staging an admirable rally for the month of December that resulted in an MAS 28 day t-bill auction coming at 0.05% which says much about those home loan rates again. As a whole, government bonds sold off slightly, on the average of 1-2.5% on their prices which translates to a 0.05-0.4% rise in yields.

This compares well against the 0.37 to 1.08% rise interest rate swaps which were led by the short end SOR fixings.

To let the cat out of the bag, market professionals know and attribute the crazy move in rates to the implementation of the new Basel 3 framework to foreign banks on 1 Jan 2016, which imposes reserves on their non-SGD liabilities under a new Liquidity Coverage Ratio framework (refer to page 37 on link).

Short of another EM meltdown (other global catastrophes are too short-lived) that would affect Singapore and the SGD dollar, it would be hard to expect the short end liquidity squeeze to continue, not if reporters start reading this and wake up to the 0.4% (overnight rate) vs the 3M SOR 1.7% spread to alert disgruntled mortgagees.

I would not expect much more resilience than now for government bonds given the auction calendar which promises 3 more auctions and thus, more supply to come for 2016. (More of my observations can be found here.) On the flip side, we shall have the carry trades that will buoy bond prices and Singapore stands out, oddly, as one of the last remaining 2% sovereign bond in the developed world which would hopefully attract some of that European QE money even if central bank reserves around the world are not growing enough to buy them.

The other glaring anomaly in bond swap spreads that have narrowed (bond yields much lower than swap rates) considerably, in a disparate contrast to the US where the phenomenon of widening has not gone away, also a freak event, shall do the bond market no favour next year even if swap rates correct or catch-down to converge with the US.

My view on the USDSGD has mellowed and I believe we have found ourselves in a sweet spot with the SGD closing the year at mid Neer and in a happy place. The big re-pricing has been done and there is less cause for speculation of future weakness on the part of monetary policy now that Singapore is resigned to a lost decade of sorts, that the Managing Director of MAS has termed as the “third phase” of Singapore’s economic history which would span 2011-2025.

What about inflation? The driver of lower rates, only in the case of Singapore, which is expected to pick up above 2% again as labour and import costs eat in?

The USDSGD shall go with the crowd in the crowded USD trade and for that reason, I believe that the USD will not enjoy a smooth 5th year of appreciation which I will talk about soon. I suppose it is buy on rumour and sell on fact, buy USD when you expect hikes but borrow the USD when they start hiking. Singapore interest rates to outperform the US?

The Inconvenient Truth

Singaporeans, a pampered bunch, need some good news which is usually never good enough for them in the past but the episode of 2015 has opened up the inconvenient truth of diminished prospects for the future which has never happened in the long run before. Yet, surely it cannot be as bad as a Tibetan mastiff breeder in China who are selling their prized dogs for a tenth of the $20,000 that they used to fetch.

Yes, Raffles Place could feel like the land of the walking dead, all glum and stone faced sometimes. But you wait till they remove the ABSD or the next mega IPO, people will start smiling when there is hope of making money again.

Feels like Alamak, it is Buay Pai but Sian.