Thoughts on Snakes & Ladders and the Equity Markets

I do not think anyone would get past this weekend without talking about China’s weekend rate cut, the Gre-ferendum or the SCOTUS ruling on same sex marriage, in increasing order of importance. I am sure about 1.3 billion people will wake up with smiles on their faces on one side of the globe, jamming up the phones and internet to check the opening prices on the stock markets, even as people are turning pale in Greece and ATMs are emptied before the weekend is over.

Financially speaking, there is nothing too significant about the SCOTUS ruling, and the Gre-ferendum is likely to freak financial markets out in a big way when markets open at 4 a.m. (SG time) in New Zealand until they close on Saturday morning (SG time) with New York into the day of voting on 5 July. Let’s drill down on some areas.

China

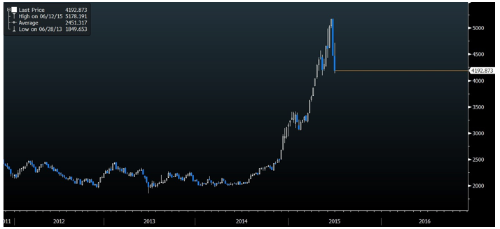

We have talked about China to death in the past months through their astronomical ascent to a 7-year high and simultaneous descent in the past 2 weeks, chalking up record weekly losses that have not been seen in 7 years.

Thank goodness for the Chinese, stock trading is just monkey business, as we have written about before, another study has proven that it does not take a lot more than monkeys to beat hedge fund performance this year.

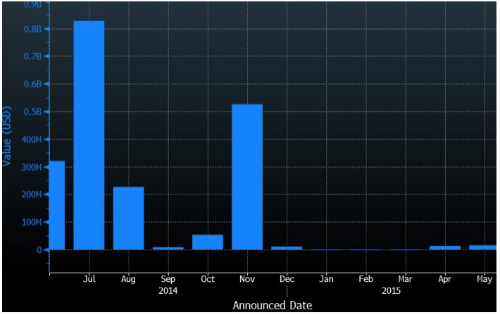

Take a quick look at Asia’s IPO statistics.

Early June harkened even better results, with all 144 of China’s IPOs jumping an average of 539%.

Rest of Asia

Yet China’s success is really bad news for the rest of Asia and America because it meant no business coming the way of say, SGX which had, by this time last year, garnered some S$ 950 mio of initial public offerings compared to the S$38.4 mio we have so far.

RIGHTS ISSUES AND ADDITIONAL SHARE PLACEMENTS

Indeed, the major trend for the rest of the world has been rights issues and additional share placements which has totaled US$ 575 bio this year with China responsible for roughly a third of it.

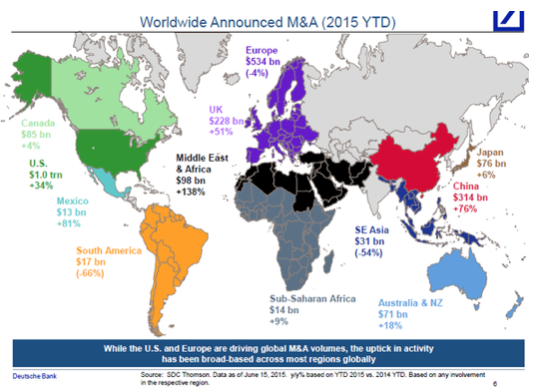

M&A AND STOCK BUYBACKS

The M&A scene is heating up as well, along with company share buybacks which is tipped to beat the 2007 buyback peak by 4% or US$ 900 bio worth, worthy of a Goldman Sachs warning as companies spend more on stock buybacks than R&D to draw political attention and scrutiny.

Valuations and Valuations

Global fund managers may think that shares are overvalued, but analysts have not been as bullish since 2011.

Even banks are hugely divided with Bank of America suggesting that thebiggest risk to stock markets is QE4 and Goldman Sachs’ President Gary Cohn thinks that the markets are not ready for the Fed hikes to come.

What I think and the trends?

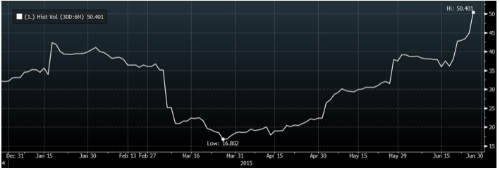

The SHCOMP’s 30 day volatility is now at a dangerous 50.4%, that is a level which screams red alert to me or for anyone who understands risk or the SHARPE ratio that we wrote about in early June.

SHCOMP Index 30 day volatility

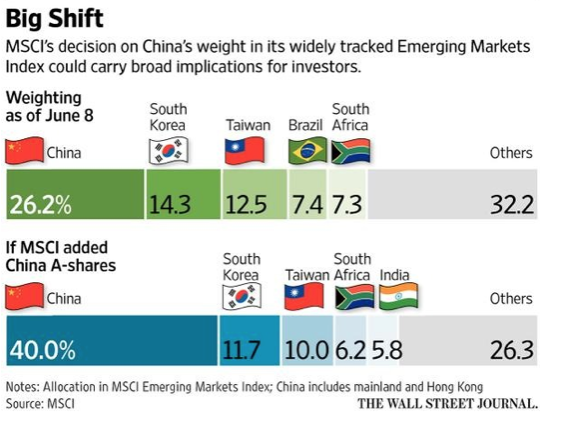

The trouble is that, besides China, there is no where else to invest in as China’s market capitalisation continues to grow exponentially (+63%, ytd including IPOs) which warrants the funds re-allocation to China, particularly if their inclusion in the MSCI comes about in the future at the expense of the rest of Asia.

The US stock market, at US$ 2.5 trillion, has not grown much especially with their record buybacks and M&A deals giving rise to scarcity which is propping prices up even as earnings estimates are going lower.

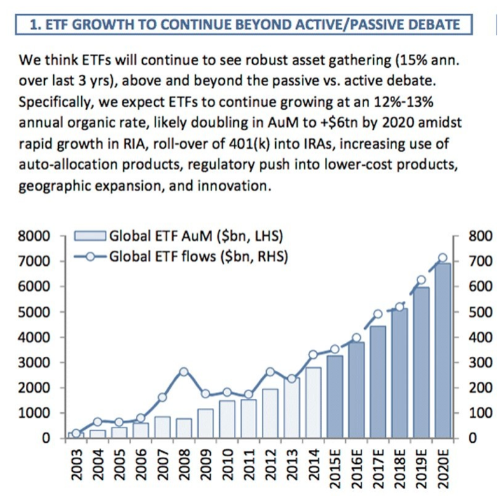

With ETFs growing in popularity and expected to double by 2020, we will find that heavyweight indices and stocks will dominate global trading which will tighten the noose on smaller markets such as Singapore and increasingly shut them out from global fund flows causing local retail investors to lose out.

Source: Business Insider

ETFs have a way of lifting all boats with the tide with their broad-based index investing methodology. That makes stock picking a tad more difficult.

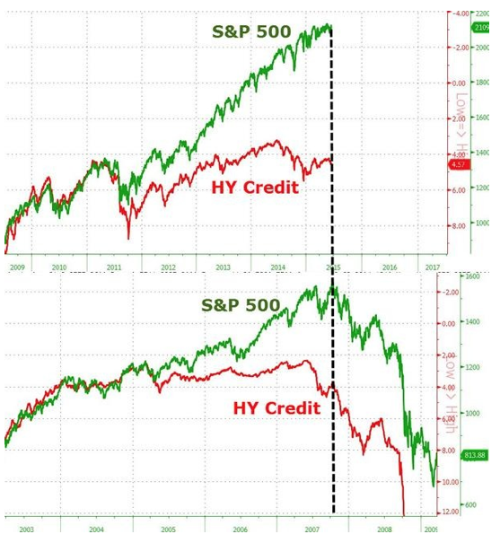

I have stopped looking at valuations closely because it is all a game of snakes and ladders now. Stock markets are now torn between Greece, China and the US Fed – sentiment driven and hanging onto the next word from the central banks.

As perfect as the regulators have tried to engineer markets, they have created a new monster – markets that concentrates on delivering returns to their masters and powerful markets that suck up the liquidity, giving smaller markets no room to breathe or grow.

China may have hit a ladder this weekend and Europe gets a snake but volatility will continue to prevail.

Retail investors not involved in global equities yet, do not worry. For I am not the only one who believes we are on the cusp of a correction like the one we saw in China last week, Carl Icahn, possibly the world’s most notorious activist investor, has come out to warn that markets are over heating.

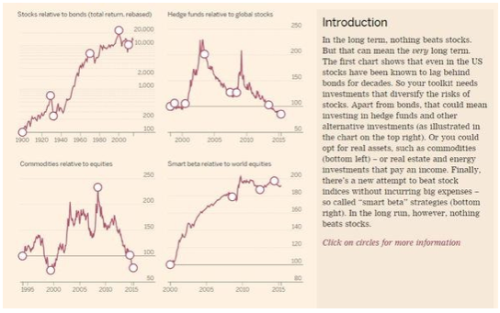

I shall leave with the encouragement that nothing beats equities in the long run as the FT has illustrated below.

Source: Financial Times

The smart beta way involves selective stock buying that is not quite index based, or using special indices and also, looking at the global trends and venturing to the markets that will be attracting the money.

I may write about this another time and will leave off feeling a little relieved that I do not have to step into a dealing room tomorrow and try to find something intelligent to say about this weekend’s developments to the team or to clients.