2023 Is the Year of the Lucky Trader

We have been too busy chasing asteroids than write. The past months have been those periods in a trader’s life when one is too confounded and overwhelmed by markets, usually when one is not making money, that we desperately seek an asteroid, comet, earthquake, volcano, or solar flare that will end the world for the insanity in the markets.

Go ahead and unleash the radioactive wastewater from Fukushima, bring it on! (Cancer can be good for the economy.)

It is truly an everything everywhere all at once 2023, thus far, and we have come to a point at this very week where every commentary has given up offering to explain why Nasdaq goes on to rally 2 per cent when bonds are selling off and cost of funding is soaring. Now reports use phrases like “no apparent reason” or “no catalyst” for market moves and headlines like “Sudden Rally in China Stocks Has Traders Scratching Their Heads.”

Not everything is unexplainable as we notice fewer gold-plated two-toned Rolls Royces plying the streets since the money laundering arrests. But what is happening in this market and world is mentally and logically debilitating, for that matter, because McDonald’s is now cheaper than many hawkers and we are buying plastic bags because they are banning plastic bags. We are assaulted from every front imaginable, from the daily scorch of El Nino to exploding submersibles, Russian assassinations after coups, bank failures leading to equity bull runs, AI hype as blockchain was in 2021, French riots, and not to mention political clown shows.

The time has come to sit back and take a breather and stop searching for the latest news on a super Yellowstone eruption (last 631,000 years ago) or another Carrington event (occurred in 1859) and contemplate the reasons for our edginess.

When we said 2022 was the year of the Top Gun trader, where the old man, old woman and old plane still win, 2023 is the year of the Lucky Narrative trader who rides the change in narratives for quick profits, for it does not pay to have a strong view when the central bankers themselves are in the dark with the FT reporting that ‘There is no pre-existing playbook’ with current policy models reassessed at Jackson Hole.

2022 rewarded the experienced chaps just as it is ironic that Japanese banks are looking to hire traders who survived the 1980s this year. Luck, not smarts is more important in 2023 because you could have been bulldozed by Wednesday’s innocuous Nasdaq rally which was followed by Thursday’s massive bearish engulfing candle that skittish headlines cannot change fast enough to follow. And we have headlines reporting rally and crash at the same. Lucky for those who picked the right side on the right day to feel like Michelle Yeoh running from one alternate reality to another in the movie.

Another one praying for Armageddon is a friend who is giving up because she trades the nightmarish bonds market where every rate hike by the Fed since last December ends up with US treasuries rallying on the day, making it feel like a rate cut instead. It doesn’t matter how hard you slap yourself because the impossible and illogical will happen, just like last week when US bonds sold off, ignoring bad news on the economic front and the narrative of structural oversupply issues. Lucky for those who latched onto the right narrative at the right time because central banks’ Jackson Hole symposium got the market all flummoxed and uncertain again.

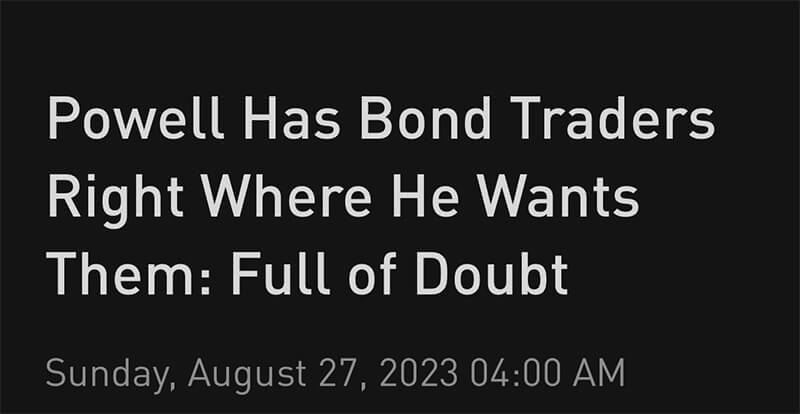

The root of all the anxiety is in R* or R-star which is the real neutral rate of interest that equilibrates the economy in the long run according to Investopedia. With central banks still on a tightening bend and unable to guide markets on where R* will land, heightened uncertainty sets in as we can see from the shape of the unhinged/unmoored back end of the inverted US yield curve below over the months.

Graph: US bond curve swinging like a pendulum over the months.

Graph: US bond curve swinging like a pendulum over the months.

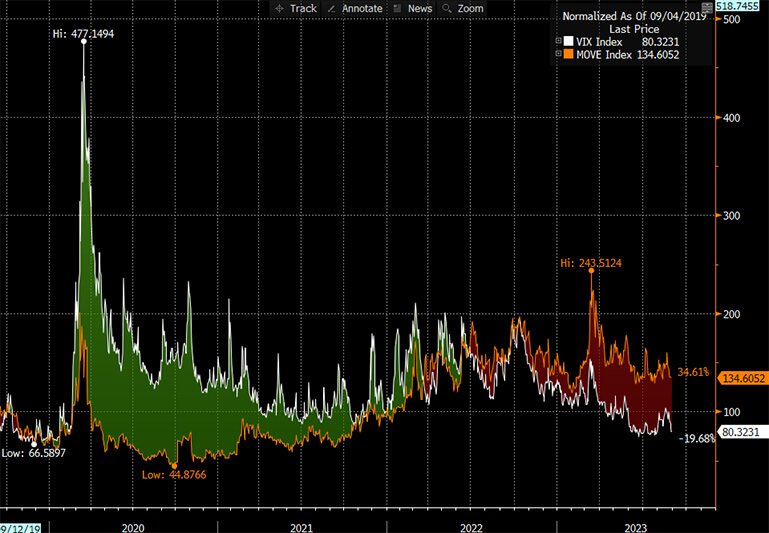

The graph below depicts price range (i.e. volatility) levels unseen since the 2020 crisis.

Graph: US 10Y bond yield trading range for 2023 giving 2020 a run for its money

Graph: US 10Y bond yield trading range for 2023 giving 2020 a run for its money

And, there is more. Here is our list of gripes besides the fact they are still fighting in Ukraine, so we can read more reports about Zelensky buying mansions in Egypt like he purportedly did in May this year through his mother-in-law.

1. Where is the recession we were promised? Everyone is asking, the latest being Kevin O’Leary who thinks “it is weird there’s no recession yet.”

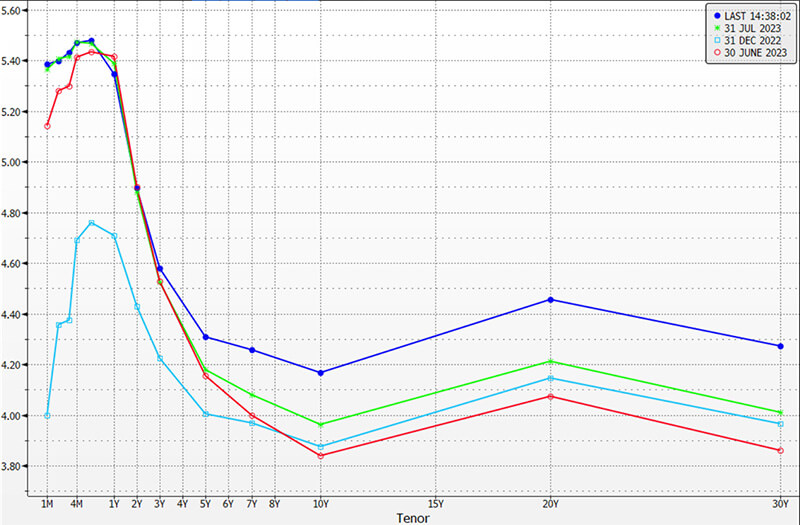

2. Inflation does not deflate assets! Nasdaq is up 40 per cent year to date. Sure, commercial real estate is floundering in the US but not much else because nearly every single asset class is up this year with the exception of China equities (see point 7 below), according to the BlackRock map.

Source: Blackrock

Source: Blackrock

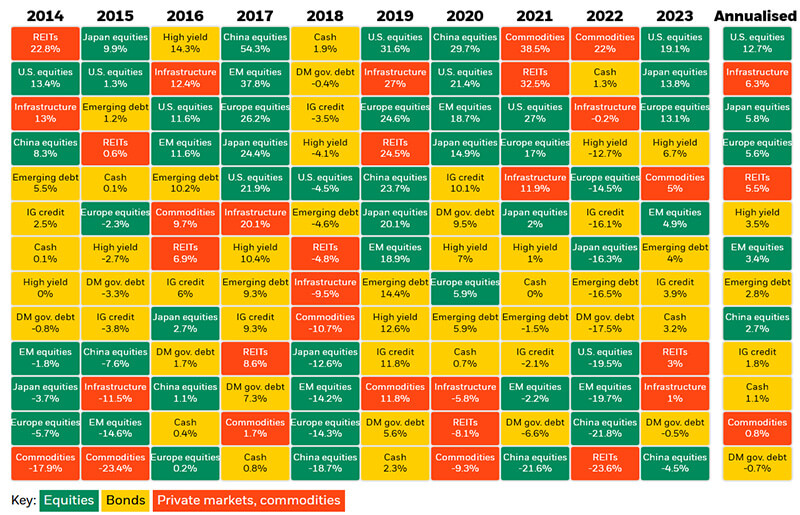

3. 2023 was supposed to be the year of the bond from almost every single report in December 2022 but we only count on 0.39 per cent returns on the global aggregated index and losses in our books.

Bonds are for the bold and stocks are safe havens if we go by volatility measures, using MOVE index for bonds and VIX for stocks.

Normalised graph (pre-Covid 2019) of Move and Vix index showing bond volatility surpassing stock volatility starting end 2022 till now

Normalised graph (pre-Covid 2019) of Move and Vix index showing bond volatility surpassing stock volatility starting end 2022 till now

4. The Yield Curve has never been inverted for so long since the 80s, getting steadily worse from July 2022. The two-year is yielding 4.81 per cent, the 10-year is just 4.11 per cent against the Fed fund rate of 5.5 per cent. How is everyone happy with negative funding?

Graph showing the prolonged inversion between the 2Y and 10Y bond yields going back to the 1970s

Graph showing the prolonged inversion between the 2Y and 10Y bond yields going back to the 1970s

5. Banks went bust in March and markets are unfazed. Silvergate Bank, Silicon Valley Bank, Signature Bank, First Republic Bank and Credit Suisse. First Republic, Silicon Valley and Signature represented the second, third and fourth largest bank failures in US history (Lehman is not considered a bank but an investment bank/securities house). Credit Suisse was a Global Systemically Important Bank (G-SIB) too!

6. Credit Suisse also taught us that textbooks are wrong! Stocks are safer than bonds. Credit Suisse perps were written off to zero but their equity holders got paid.

7. When China sneezes, will the rest of the world catch a cold? That’s not happening. Every single Chinese economic stimulus or initiative or rate cut is accompanied by stock market weakness.

It has been two years since Evergrande caught the world’s attention with its defaulting debt pile and we have now a grand total of 52 defaults (as of June 2023). Bonds of $140 bio are worth about $20 bio now (according to Bloomberg). And, in tribute to Credit Suisse bondholders, Bloomberg pointed out that their equity market cap is worth more than the market value of their bonds for a nice slap in the face.

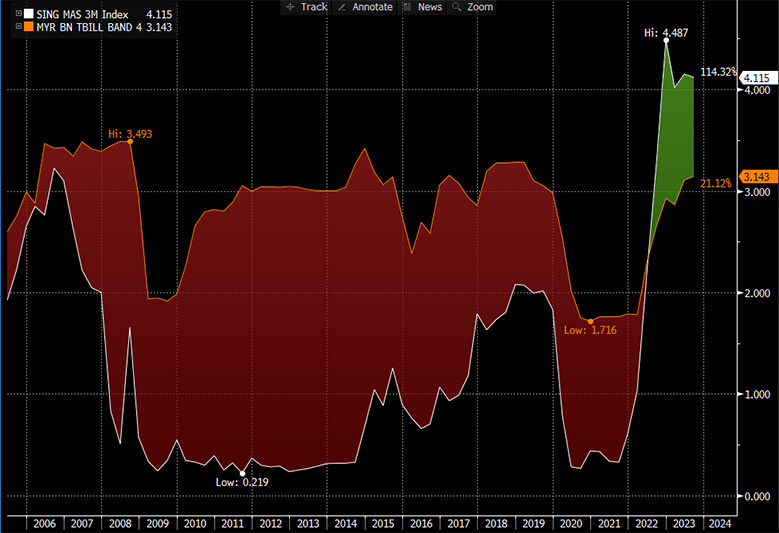

We will end with our favourite one. Singapore’s interest rates have never been higher than Malaysia’s and what started as a joke in June 2022 has now celebrated its one-year anniversary and is still a joke no more. We illustrate by comparing Singapore’s three-month t-bills to its Malaysian equivalent.

Graph: Singapore Treasury Bills Yielding More Than Malaysia’s

Graph: Singapore Treasury Bills Yielding More Than Malaysia’s

Are markets gaslighting us or are we missing out? Or maybe we are living in a different reality and going mad without Michelle Yeoh to save us.

We spent a good part of the year desperately seeking asteroids, comets, earthquakes, solar flares or natural disasters of any sort to make the gaslighting stop, but we finally figured it out.

It is luck. We need nothing more than lady luck as traders and investors need not FOMO because no asset class will be running away from us when nobody knows what will happen next. The retail banker’s scary stories to our aunt that a 75-year-old should be buying Nvidia to prepare for rate cuts next year is as ludicrous as it gets. Why not treasury bills if interest rates are high?

“So I’m working every day to be a little more lucky,” as the chorus of Crash Adams’s Lucky song goes. That is our game plan and the idea is to trade more often, trade smaller sizes and sift through the constant stream of narratives.

How is that supposed to work? It is a little like the Law of Large Numbers where the probability of success increases the more you try, with a caveat that all of this is not to be construed as investment or trading advice of any sort. We will not be responsible for anybody’s bad luck.

In conclusion, Everything Everywhere All at Once really epitomises the year which has blitzed by and we are heading into the final quarter, not searching for asteroids as much as we are trying harder to be lucky.