How a Singaporean Auntie Traded GameStop

“No Time to Die” has been delayed again until October 8, but for us observers on the side, there can be no other greater irony than watching the Great Reset agenda presented at Davos being silenced by GameStop (GME US) on the very same week because the public managed to redistribute US$91 billion of wealth and counting from the hedge funds to a few million people.

Whilst the world leaders are discussing promoting societal equity, we witnessed another Live Die Repeat of the US Capitol Hill riots happening in the stock markets with Facebook and gang coming out to silence Reddit’s WallStreetBets just like they did with Parler and the rest three weeks ago.

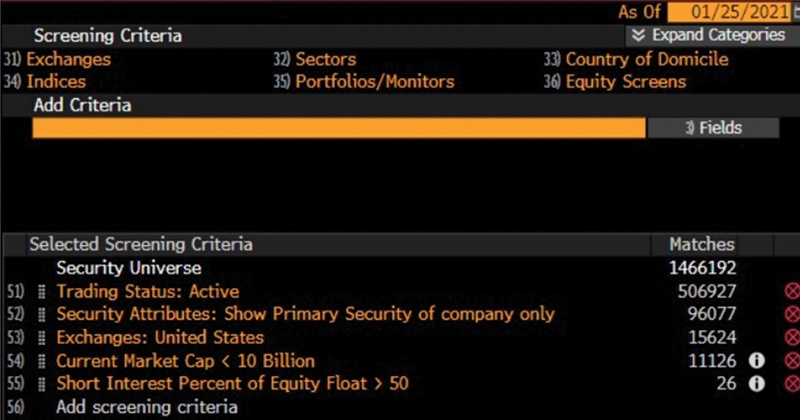

Is Finance 101 dead along with all that education when it is easier to make money stock picking using the criteria on Bloomberg below.

We would have loved to weigh in, too, and give our two cents’ worth on the matter except that it has almost been written to death in the past week from every single angle that it would only be rehashing the obvious. So we’ve decided to do the next best thing—an exclusive interview with a Singaporean non-Millennial participant in last week’s GME action, for a behind-the-scenes take of what our Singaporean Auntie friend experienced and how she lived to tell the tale.

A handful of other friends have since fessed up with someone’s brother making $112k in 20 minutes and another chap who bought 200 shares the week before at $43 at the behest of his young son and ended up $60k richer.

Who needs equity analysts when we have kids? An old friend was ruefully lamenting over the stern lecture she gave to her son on Ponzi schemes when he pestered her to buy Tesla at US$143 last April (it is US$800+ now) and he wanted to buy CD Projekt last month too, but who would have expected Elon Musk to tweet about it?

For the memories will be all too painful for the newbie traders who marched into the banking hall in 2000 with bonus cheques all cashed in demanding to buy tech unit trusts to have bonuses lost within months and selling precious Swatch collections to make up for the losses in other tech punts then.

GME GameStop, Bygone Revisited?

Not for our sleep-deprived spunky Gen X Auntie friend who was nearly as breathless as when she was in the thick of GME action. Here, she recounts her week’s adventures to us on a lazy Saturday afternoon, “Hanging with Reddit bros especially giants like u/DeepFuckingValue has been the most exhilarating and liberating experience in my 15 years in finance and investment banking.”

How did it start?

She had been on IBKR for some months now after leaving her finance job early last year. She picked up on AMC Entertainment Holdings Inc (AMC US) after noticing it was top 10 in volume mid-Jan and saw its double-digit returns daily for the worst cinema she has ever known for her time in HK. GME was not even on her radar, but the Reddit posts got her attention and she got on the WallStreetBets (WSB) thread quickly.

The intraday volatility of GME was insane but you feel comfort in the Reddit environment knowing you are not alone.

What are your initial impressions of WSB?

It is not really about investing. It is akin to a social movement of vendetta trading or class warfare and pure casino-style punting amidst the tonnage of profanities and millennial lingo. There is huge distrust of the authorities and institutions.

You start to read about the people and their motives, and you realise that most of them are just ordinary folks who have nothing to lose from YOLO-ing (wagering their entire paltry savings).

Statements go like this: “I YOLO-ed 5 stonks today when the paycheck came in because me and my mates will be flipping burgers for life anyway” or “My father retired and got his pension and I told him he will be on food stamps forever or I can YOLO GME for him.”

There are people who are looking for money for cancer treatments, wedding expenses, loan repayments and all sorts of sundries.

What other jargons should you know about?

Stonk = stock

Retards/Autists = what Reddit users call themselves for the Buy and Hold Strategy which incidentally makes Warren Buffet a cult hero on WSB.

Gamma Short Squeeze = when hedge funds capitulate

Suits = the enemy in WallStreet

To The Moon ?= Squeeze the price up

420.69 = Target price of GME, 420 = marijuana, 69 = sexual position

Why and When Did You Buy GME?

It was exciting to watch initially, but if you get around to reading the older Reddit posts (some which have since been removed after the SEC investigation on Friday) late last year, you would realise it is a buy. DeepF**kingValue, the cult hero of WSB (we now know as Keith Gill after he gave an interview to WSJ), did an extremely thorough analysis of the stock calculating its residual value, the lack of free float, thinly traded and the extremely short hedge fund positions that were expensive to maintain (in borrowing costs). The message was “Do not sell, switch off and sleep.”

The plunge came with just a $10k investment at $90 and the game began. Cashed out at $300 after Elon Musk tweeted GameStonk and did a total of 20 trades for the week on GME alone.

Describe the Trading Experience

You feel like a trooper in the war, holding the line when under attack for it is true, the Reddit community came under attack so many times from hedge funds. You know it is under attack because the price would be ticking slowly with small lots traded and then there would be a tidal wave of selling as the funds came in for the price to drop $50 in a blink.

WSB did extremely well in coordinating the defence, sending out alerts for troops to pull their stop losses/autosell orders (to prevent the hedge fund from taking profit), calling for reinforcement buying and forcing the fund to cover its position at a higher price. WSB counter-attacks when people on the platform notice the hedge fund covering and tell folks to pull their profit targets, leaving the hedge fund unable to cover its shorts and give firm instructions to brokers not to allow your stock to be borrowed.

There are as many as 17 volatility spikes a night.

There were many heart-wrenching moments for instance with the Robinhood outage late week and you see GME plunge after hours to $180 (when you had bought at $330) and with the Reddit blackout of WSB, there was despair. Fortunately, other threads on Reddit kept it up and held the community together even as the hedge funds wised up (because they were closely monitoring Reddit) and probably had advance knowledge because the attack came swiftly at market open. But the wall held to be tested again and again throughout the night.

The feeling was dreadful on that fateful day, yet somehow WSB held the line and chased it to a new high for that position to close out at $440 which was a relief and the last trade on GME for good.

There were lighthearted moments too when you press “Buy” and had a misgiving and decide to “Sell” simultaneously, and still end up with a $1k profit as quickly as you clicked.

The support from WSB was invaluable, there are real experts on the forum who had privy information on their Bloomberg terminals etc. on hedge fund positionings (to call out the lies of those funds which claimed they have closed out their shorts) and also the cost of borrowing GME, working out extremely detailed analysis on target prices and pain threshold levels, giving lots of comfort to users. Not to mention all the encouragement, memes and videos for a feeling of community support.

Did You Lose Money at All and What Are You Buying Next?

Yes. On AMC, where a short position was forgotten about and covered at an obscene loss that GME profits made up for. For the eyes were glued to GME price the entire week.

Still long for American Airlines as it is a proper cyclical stock, unlike GME.

Final Thoughts – It is Just the Beginning

It is not over yet, we have retail trading armies springing up all around the world, from Australia to Singapore to India, trading everything from GME to TopGlove or even GME’s namesakes listed in Australia. GameStop has become a household name everywhere around the world with an internet connection.

The number of mentions of GME this week in conversations we come across or eavesdropped on has been astounding. The buzz is in the air for the quick profit and the distrust of establishment continues to brew.

What started as a value analysis proposition forum on Reddit, WSB, has become a sprawling populist army that Davos is a little bit late in fixing the problem.