Markets Have Let The Dogs Out

The Real Face of 2018

What a difference a week makes when we have a dear friend of mine deciding she needed those 2-dollar notes for her ang pows after all. She just feels slightly less generous after the the plunges we saw this week in stocks, with the biggest 1 day point drop in Dow history (1,175.21 pts), junk bonds, oil and gold, even if she is lucky that she has no exposure in the XIV (VelocityShares Daily Inverse VIX Short-Term ETN) that was wiped out by the highest ever percentage move in history.

Game theory in anticipating less of a haul for her own children or the endowment effect “pain” of seeing wealth diminish in value?

If you were up 30% for 2017 going on to lose 10% in 2018, you would feel poorer naturally.

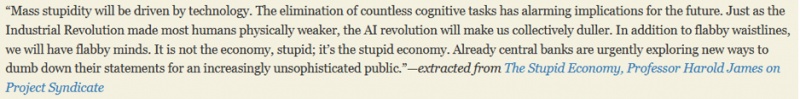

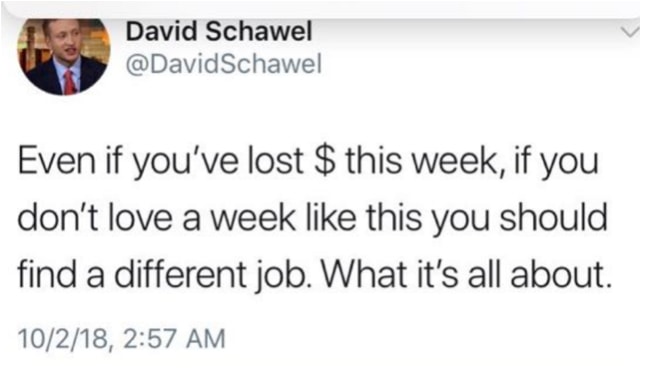

Yes, we were humbled just a fortnight ago by all the geniuses in our midst, who have made obscene returns in 2017 and are still holding on to substantial gains. Yet, when we wrote about artificial intelligence and technological advancements making people stupid last week, we had not expected those rogue algorithms to trigger off a house of cards-esque meltdown last week after a record-breaking run of 448 days in the S&P 500 without a 3% drawdown.

Source: 13D Global Strategy & Research on Twitter

Source: 13D Global Strategy & Research on Twitter

Is 2018 showing her true colours at last?

The Blaming Game

The blaming game does not stop there. Some would blame Yellen for her final parting shots—drumming down Wells Fargo and suggesting asset bubbles; some blamed Bitcoin which has turned out to be more stable than VIX (and Swiss National Bank’s shares) according to the chairman of the SEC; and the others would blame, albeit secretly or not, the Super Blue Moon lunar eclipse on 31st Jan where Janet Yellen stepped down as Fed chairperson which was followed by Groundhog day on 2nd Feb where the prime-hog forecasted 6 more weeks of winter (quite accurately so far).

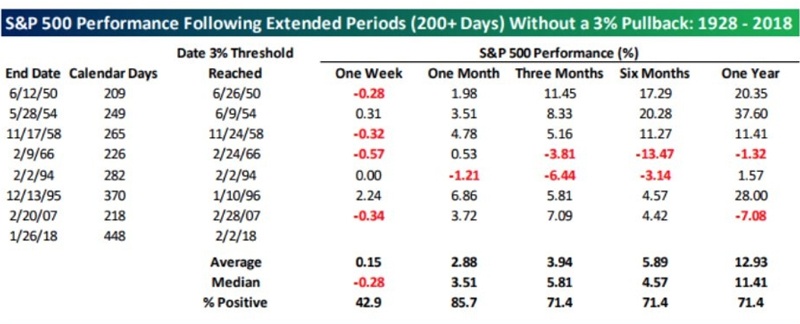

We have the blame now reaching out to the Millennial generation fund managers, with under 9 years of experience and who make up the majority of the marketplace right now.

Source: Bloomberg

Source: Bloomberg

We feel a need speak up for the poor kids. Give them a break.

Everyone was young once and having those old traders around did not count for much during those other crises. Some of us were just as young during the Asian Crisis or the dot-com bubble where the percentage of youngsters was probably just as high. The attrition numbers rose along the way, leaving the survivors or the losers who cannot afford to retire behind?

If anyone was watching the US treasuries on the screen this week and saw that 7 standard deviation move in the 2-year bond, we know it is hardly a shaky human hand behind that. The only advantage of having seen crises is to be able to retain a semblance of calm even if the rogue algorithms are probably manned by calmer Millennials who think that normal markets should be run by complex algorithms because that is the life that they know.

Blast From What We Wrote in the Past

Mass stupidity.

As NY Times nailed it, when we have a market where 40% of stocks are controlled by passive investors, where most of the work is done by smart algorithms, there is literally nothing left for humans to do but wait for the day everyone decides to get out at the same time.

Source: NYTimes

Source: NYTimes

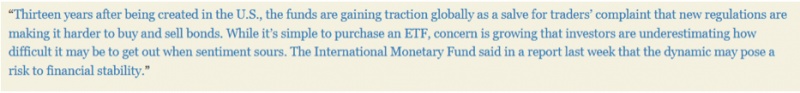

We are old-fashioned and never really favoured ETF’s, except for the top 4 that accounts for 45% of turnover, all that much because of the asset’s underlying liquidity and tracking error which we wrote about some 3 years back but we lost our voice with all the propaganda and hype from our authorities.

Source: hnworth.com

Source: hnworth.com

We reported the IMF voicing their concerns back then on the risks to financial stability but we have been wrong as the market ballooned to its current state where we can even find a whiskey maker ETF out there.

As guru investor, Doug Kass, summed it quite succinctly in Kill the Quants, Before They Kill Our Markets, it is a “distorted, dangerous world of new investment products and strategies” for the un-fundamentally driven move last week. The “proliferation of short vol, volatility trending and risk parity strategies when combined with an explosion of leveraged ETFs and ETNs — many of which were derivatives of derivatives and had no business existing except to please gamblers—had altered the market structure”.

Source: Realinvestmentadvice.com

Source: Realinvestmentadvice.com

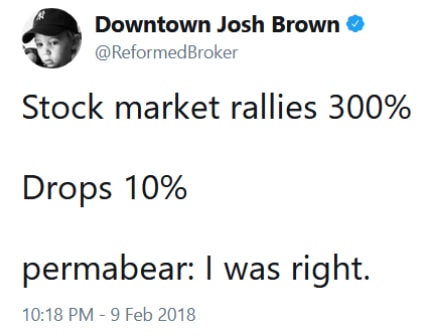

We cannot be gloating now, humbled and wrong as we have been, as top financial market influencer, Josh Brown, tweeted, pictured below.

And markets are technically not in correction yet because that takes a 10% decline to happen—the S&P 500 stands at 9% lower from its peak.

Enter 2018 and The Year of The Dog

Enter 2018, for all the Mad, Stupid, Evil and Greedy people who have profited all 448 days till 2 Feb 2018. Our commitment in 2018 was to Eat, Sleep, Sh*t, Shop… But Don’t Forget Breathe and Think about complacency and inflation.

Because, as the Japanese proverb goes, where profit is, loss is hidden nearby.

It does matter when a financial advisor told us that Singapore retail markets broke a new record for the largest volume of structured products sold in January this year. For the relationship managers, it is almost half a year’s work done that is expected of them i.e. they have made a half-yearly budget.

We can safely assume that 90% of those structured products to be in the equity space.

Now, why didn’t we see that coming?

Will the rest of 2018 shape up to be a year of the Bull Dog or Lap Dog or Mad Dog?

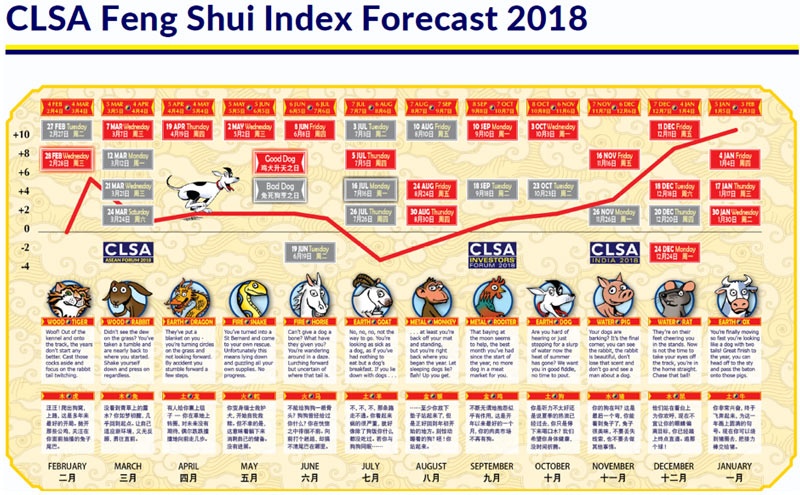

The CLSA Feng Shui Index says the almanac will be serving up an Earth Dog 2 days after Valentine’s day, on the 16th of February where we can expect a solar eclipse. The run-up, so far, is starting to look like an exit by Angry Birds (Rooster year) versus Mad Dogs.

Source: The CLSA Feng Shui Index (not to be taken seriously)

Source: The CLSA Feng Shui Index (not to be taken seriously)

Yet we know that Li Chun (立春) was on the 4th of February 2018, Sunday.

Li Chun is widely regarded as the real start of the lunar year when the zodiac countdown begins, and if that is right, the second day has been disastrous! The markets started the melting in a big way on the 5th.

From the Western astrological angle, we could point to the first Super Blue Moon total lunar eclipse in 150 years on the 31st of January (the day Janet Yellen stepped down) that was supposed to manifest the intentions of the first coast to coast total solar eclipse in 99 years for the U.S., last August.

Yes, we turned bearish in around that time, missing out the subsequent15% move even if it looks like we missed out about 5%, on the last count, humbled and shame-faced.

Maybe China knew all the long because it was reported that the China Securities Regulatory Commission asked brokerages to help avert sharp stock crashes the week before.

We are not a superstitious lot but we do love a good conspiracy theory when we see one and there is nothing like a good old-fashioned partial solar eclipse to dim things down on Lunar New Year except that it will only affect South America and lots of uninhabited territory.

Singaporeans need not worry because they will be in for a treat in July with another total lunar eclipse again.

The internet churned up some negative Feng Shui forecasts though.

“Fire years often boost people’s confidence about the economy bringing good performance to the stock market. This has been the driving factor behind the stock market boom since 2013 until 2017 with strong presence of fire element in these years. However, the cycle of fire elements ended in 2017 with the yin candle fire, and as 2018 year of Dog represents Grave of Fire, it means the optimism of fire is going down and the pessimism of water will come up. The coming years of 2019, 2020, 2021 are all years of water and metal and the fire element will not return until the next snake year in 2025. Therefore the general economic atmosphere is entering a bearish cycle and the economic pace will be gloomy and slowing down in 2018. The Dog in the Chinese calendar represents October which is end of autumn and beginning of winter, with fire going away and water coming up to generate fear. Looking back the history of Wall Street, most of the stock market collapse happened in “Black October” which is month of Dog.”—Raymond Lo

For it is the year of the Mountain or Earth Dog. Some Feng Shui sites have it as a possible wild dog that could be an obstacle to the traveller.

It is tricky indeed, this Feng Shui business but not all that difficult for the CLSA to always maintain optimism because stocks have the propensity to trend upwards over time with just the few down years in between that should not affect the track record.

We found our own reason to support the idea of a Bull Dog Year.

Take a look at the price trend of the S&P 500 below plotted against the nasty VIX Index.

The natural trend has been upwards but the gradient sharpened abruptly in November last year and went on a steep climb into 2018.

That was not supposed to happen and we should just have stuck to the plan/channel.

The August 2015 market flash crash was precipitated by the same VIX spike as well and we have fallen back into the channel of a comfort zone.

Explained by Zerohedge from another angle, the S&P has deviated too far above its 21-day moving average and is just reverting to mean, although there is still considerable room to fall noting at the same time, the 21-day moving average is still on an uptrend.

Source: Zerohedge

Source: Zerohedge

There is more evidence of support when we examine the 3-day chart of the S&P 500 and see the massive V-shaped recovery on Friday, after an ugly open, when the index bounced off its 200-day moving average support.

A mini Bull Dog Year?

Not really.

If we follow the trajectory of the trend channel, it does not look like we will revisit the year’s highs anytime soon in the coming quarters.

We like the ‘mad dog’ idea much better because there is so much up in the air right now—confusion and uncertainty to replace the complacency in the markets and we are beginning to warm up to it.

Regardless of whether we made money or not this week, it definitely made us feel alive and aware that it can be a dog’s life instead of the “fowl play” we had for 2017.

Whilst we wish everybody a Happy Lunar New Year in advance, and offer our commiserations to those who caught in the line of fire this week like our friend and her 2 dollar notes, we can offer little guidance or doggie treats on the days ahead except that we will stick to our broad themes of investor complacency in the new era of Man vs Machine (which are probably undergoing heavy re-tweaking this weekend), inflation (bond weakness and liquidity withdrawal as central banks unwind their balance sheets) and illiquidity (as we witnessed in ETF withdrawals this week).

2018 has truly begun and markets have let the dogs out.