Musings on the Year of the Bull, Ox or Cow – Bull Run or Bull Shit?

Groundhog Day 2021 and Punxsutawney Phil the groundhog was right on February 2 when he predicted another six weeks of winter. It is just that we did not expect Texas (and Saudi Arabia and Greece) to freeze over, raising the cost to charge a Tesla (US$900), which is now a Bitcoin holding company of sorts, making more money from its Bitcoin holdings than making cars.

February 19 was the first anniversary of 2020’s all-time highs in the stock markets before the painful crash and one year later we have 12-year-olds making 43 per cent returns trading stocks becoming a retail trading icon in South Korea, where “teenagers make up more than two-thirds of the total value traded in the nation’s shares” well before they reach legal drinking, smoking and voting age. How marvelous.

In case anyone thinks their kids are behind the curve, we suggest a quick tutorial from the link below.

Source: SSRN.Com

Source: SSRN.Com

For it has never been so easy to make money and the only thing that is OK to short sell for big profits would be bonds (US long bonds lost 9.3 per cent year to date) and we have regulators talk of banning short selling in stocks?

Bull Run or Bull Shit?

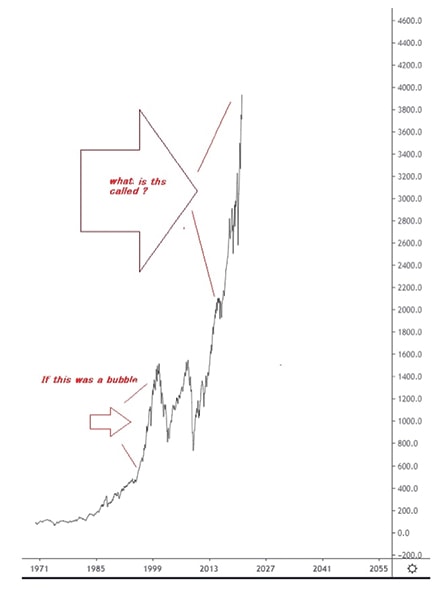

Chart of the S&P 500. Source: Twitter

What can we say, running up to the year of the Bull, Ox and Cow? It has been nothing short of a Bull Run that has killed the Bull Shit crowd and every single person and child outside financial markets are latching on, with the son’s bunkmates in the army talking about opening Tiger Brokers accounts (a Robinhood copycat available to Singaporeans) and friends’ children in Secondary Two talking about their classmates taking stock market punts through their parent’s accounts. No doubt inspired by those TikTok videos of 12-year-olds ranting about the difficulty in getting approval to trade equity derivatives on Fidelity compared to Robinhood.

“My 12-year-old nephew and my niece suddenly want to trade stocks and open a Robinhood account. My good friend who barely traded a stock in his life is up 189%. And friends I haven’t heard from in 10 years – out of the blue – are calling me about stock trading. Frothy???”—Mark Minervini

And it is not just stocks, it is Bitcoin and SPACs in blind faith as well and oh, Reddit is on the case of the short-term triple leveraged VIX Index (UVXY US), adding to their longs for 12 consecutive days, after their failed attempt to drive Silver to the moon ?.

The cognitive dissonance is at the danger zone of borderline insanity and we find ourselves unable to reconcile with the happenings in the marketplace of higher stocks, Bitcoin, bond yields and all.

– High oil prices (due to supply shock) as people are expected to buy more than a dozen new electric vehicles to be launched in the U.S. this year (which is not good for meme-stock Tesla, hovering at record highs).

– Regulators telling us there is no fear of asset bubbles or inflation and the economic situation is dreadfully dire to warrant a US$1.9 trillion (or perhaps 3 trillion) “Go Big” stimulus package in the U.S. when Bitcoin’s market cap just passed 1 trillion at US$ 55,000 (was 860 billion less than a week ago at US$49,000) and banks are rushing to upgrade their GDP forecasts for Q1 to 6 per cent.

– We have the Japanese Finance Minister Aso saying consumption has completely stalled the same morning Softbank Group (9984 JP) shares ended 4.1 per cent higher, eclipsing its dot-com bubble peak.

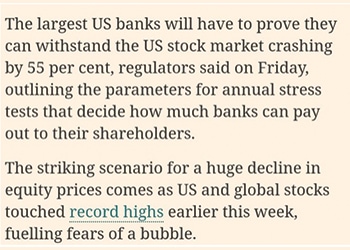

– Why has the Federal Reserve has increased its stress test threshold for banks’ ability to withstand 55 per cent fall in equity prices (up from 50 per cent) this year?

Source : FT

Source : FT

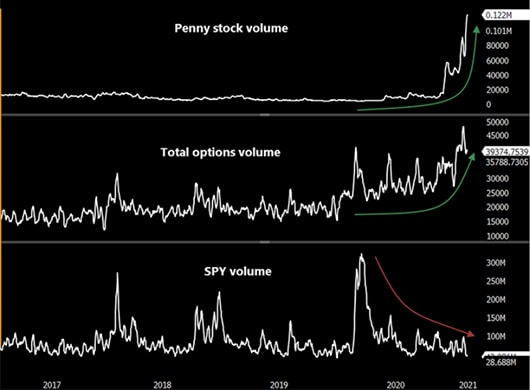

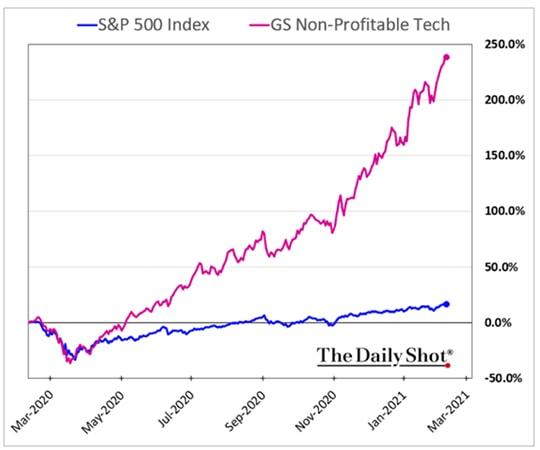

We read about millions living in poverty in the U.S. and millions of small businesses in danger of closing and many million more behind on rent, but penny stock volumes and stocks of defunct companies are in frenzy territory as retail trading booms. Unprofitable tech companies are beating the S&P 500 by 30 per cent this year and marijuana stocks are rising and falling in the hundreds of per cent.

Source: Bloomberg

Source: Bloomberg

Source: The Daily Shot on Twitter

Source: The Daily Shot on Twitter

Dissecting the Bull Run

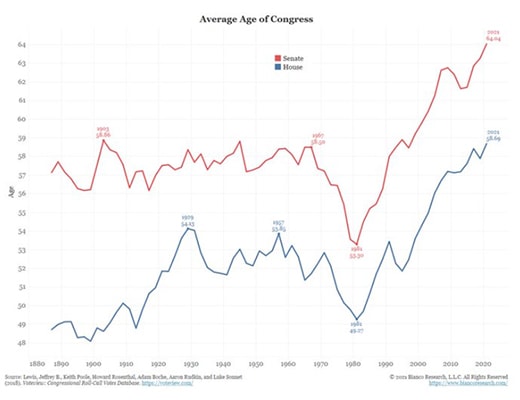

Central banks, regulators and politicians—are they are from a different planet? Cocooned in their positions of power to dictate policies and we have even more of them at high risk of Alzheimer’s than ever, judging from their average ages in the graph below. P.S. Lagarde (ECB) is 65, Yellen (FED) is 74, Kuroda (BoJ) is 76.

Why are central banks so dismal in their outlook that the ECB would send out Valentine’s greetings on Twitter to assure markets of abundant liquidity as a moral hazard because Bitcoin and stocks made new highs and bonds collapsed the following week anyway.

Why does the FOMC minutes show that the Fed will continue to ignore “temporary inflation pressures” despite “elevated asset prices” to send a message that the show can go on? Even as BofA calls out a “Mother-of-all policy bubbles: global central banks bought $1.1b of financial assets every hour since March, Fed balance sheet now 36 per cent of GDP (vs 3 per cent WWI, 11 per cent WWII, 15 per cent after GFC), US government spend 32 per cent GDP (vs 24 per cent WWI, 42 per cent WWII, 24 per cent GFC).”

The US$1.9 trillion stimulus package has startled many (an independent economist and academic alike) fearing that it would unleash 1970’s style inflation from “overheating” the economy given that economic turnaround appears to be taking hold with successful vaccine rollouts taking place. The refusal to back down or scale back is starting to appear politically motivated as part of Presidential Biden’s campaign pledge because Powell (Republican pick) can “act big” even if his staff was less sanguine about the prospect as the blame will just lay on the other party eventually.

The World Bank forecasts a “lost decade” in its latest Global Outlook report (a lost decade is not ten years of zero growth, but a very weak improvement in GDP, productivity, and with it, jobs and salaries) while RBA minutes signalled “very significant” monetary support for some time and the ECB officials warn of “wide-scale corporate distress” when government guarantees are unwound, despite banks painting a far rosier picture. In Singapore, DPM Heng also warns that the full brunt of Covid-19 is yet to be felt.

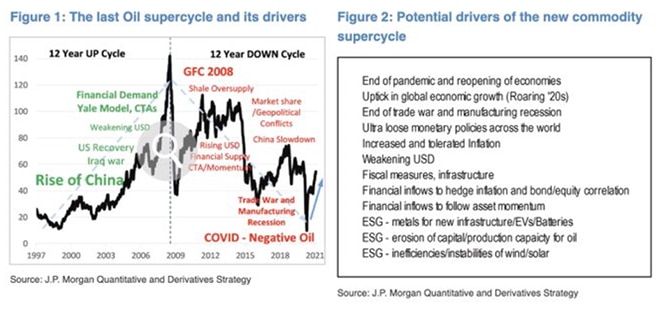

We cannot be sure why all the regulators are happy to go along with the reflation theme (reflation as opposed to inflation) when JPM and gang are calling for new commodities supercycle.

Yet we know we definitely have a problem with relating to central bank talk these days (given our age gaps or knowledge gaps?) and know we are not alone because… just take a look at Bitcoin and alt-coins which have surpassed US$1.7 trillion in total market cap, all entirely out of any monetary policy consideration given they are unregulated (do not come into any monetary policy considerations) and 1.7 trillion is now too big to fail for global markets, in our humble opinions.

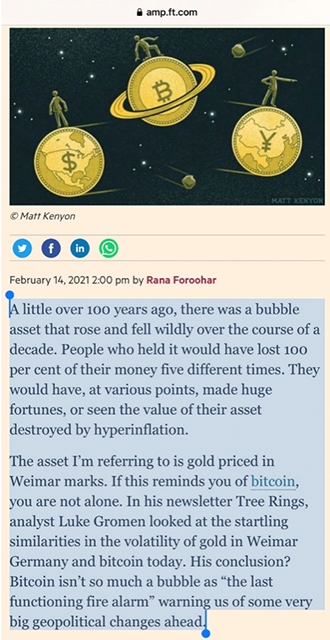

For Bitcoin is a case of bubble or belief, and its value is “a sum total of our collective belief in a story” (according to Compound Investors), it is not about the distributed ledger or whatsoever but rather the antithesis to our faiths in the fiat money system which is not holding up to the printing presses (see above BofA’s $1.1 billion per hour printing story).

Bitcoin could well be an emblem of things to come as FT suggests, but we are not even halfway there to know for sure if it can be a long-term playbook.

Source: AFR

Source: AFR

Nonetheless, there is no doubt that anti-establishment sentiments are growing (against regulators and central banks) because Elon Musk, Cathie Wood and Chamath Palihapitiya are the new Masters of the Stock Market Universe, influencing millions of retail investors around the world from Korea to India to Australia (and Singapore and what happened to Oceanus shares last week) without further elaboration or insult.

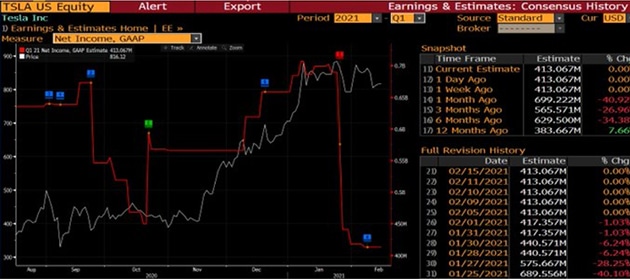

In any case, the case for inflation by former chairman of Bundesbank.

Source: Project Syndicate

Source: Project Syndicate

Inflation or Reflation?

Kraft Heinz, Conagra may raise some product prices as grains, edible oil costs surge. Platinum at a 6 year high, Copper at 8 year high, shipping rates, the global semiconductor shortage, UK house prices climbed 8.5 per cent in 2020, the highest annual growth in six years and all.

Some Commodity Prices:

Copper: Up ~16 per cent in a week.

Cobalt: Up 54 per cent YTD.

Crude: Up 21 per cent YTD

Corn: Up ~32 per cent since Dec.

Wheat: Up ~15 per cent since Dec.

Pork: Up 16 per cent in 4 days.

Lumber: Up 53 per cent YTD.

Nickel: Up ~10 per cent in a few weeks.

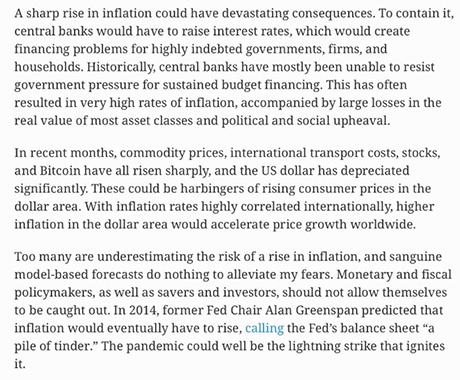

And who can doubt the wisdom of the crowd? The surge in U.S. inflation expectations continues unabated—the highest levels in over 8 years as evidenced in the U.S. inflation breakevens.

Our thoughts? “Who knows?” (but we are inclined to believe that goods will be balanced by service weakness in the long run.)

Perspectives vary, like in the picture below. We are talking about different time frames and viewpoints here.

The above picture can apply to the Bull Run in stock markets as well and perspectives are certainly clashing.

Assuming further fiscal aid, Goldman Sachs estimates a huge boost to GDP this year, with the bulk coming in Q2 and EPS have been exceeding expectations and a case for more Bull Run.

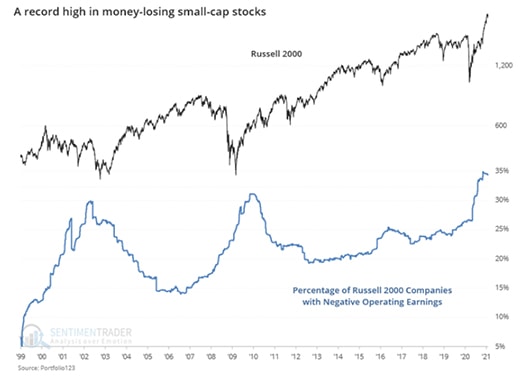

Yet, only a minority of U.S. companies actually made money last year (41 per cent) and how long can unprofitable companies continue to rally? There are also not a lot of profits. 40 per cent of S&P 500 companies have a dividend yield below today’s 10-year Treasury yield, according to Factset.

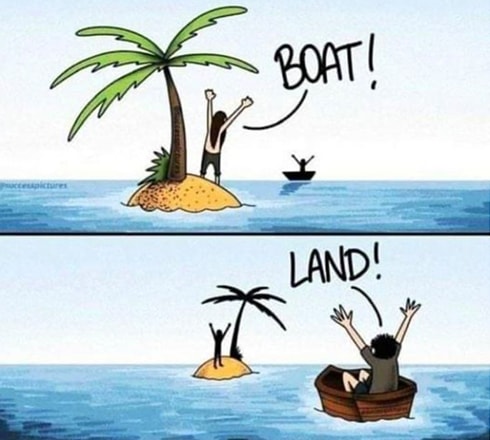

Or would Tesla be beating the next round again because consensus for Q1 2021 net profit just dropped by 41 per cent in 2.5 weeks ($702m–>$413m)? The lowest level since last August. The plunge downward came on January 28, the day after a poor earnings call. Full-year estimates also down 12 per cent.

Source: Bloomberg

Source: Bloomberg

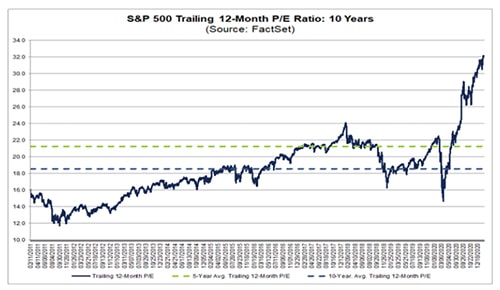

Traditional valuation methods do not work for loss-making companies so the trailing 12-month P/E ratio for the S&P 500 of 32.2 which is well above the 5-year average (21.3) and well above the 10-year average (18.5) does not sit well with the Bull Run camp.

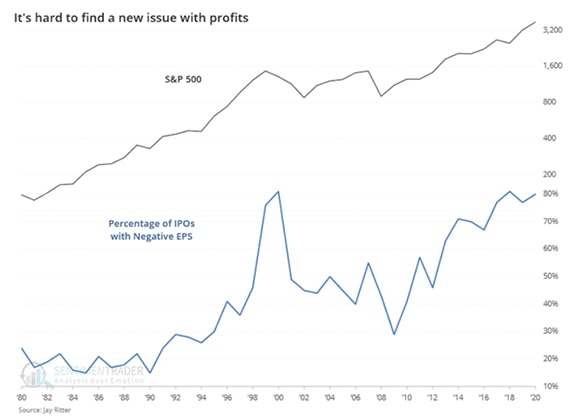

How about unprofitable IPOs’ at a new high since dot-com?

Or an all-time high in money-losing small-cap stocks?

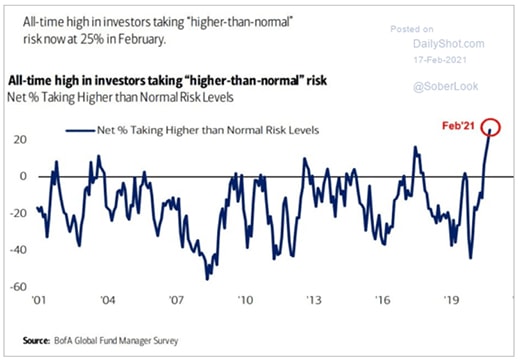

How about just irrational exuberance?

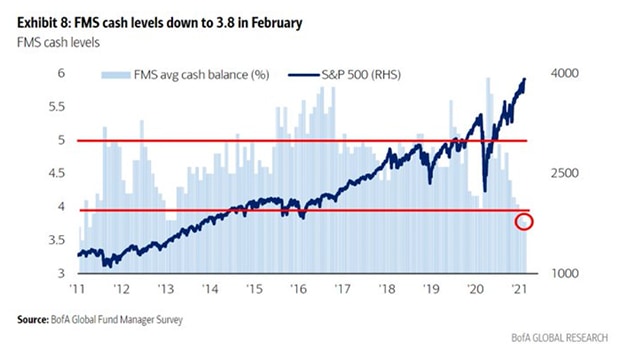

“The only reason to be bearish is there is no reason to be bearish,” BofA fund manager survey. The survey shows global growth expectations at all-time high, cash levels at an 8-year low (since 2013 pre-taper tantrum), equity and commodity allocations at the highest since 2011, and only 13 per cent say it’s a bubble.

Source: Reuters

Source: Reuters

A JPMorgan Chase gauge of cross-asset market complacency is nearing the highest level since the time the dot-com bubble burst.

Citibank thinks a 10 per cent correction in U.S. stocks is ‘very plausible’, “Our current caution reflects several factors, including ebullient sentiment readings, stretched valuation levels and slipping earnings revision momentum,” the bank’s chief U.S. equity strategist wrote on Tuesday. “With limited upside even to others’ bullish targets, a neutral stance is realistic.”

Then we have the Reddit speculators and their fans who are buying “meme” stocks at new records, sometimes sponsored by their parents who are impressed by the 12-year-old investor in Korea, to force U.S.’s SEC to suspend trading in four “meme stocks” this week just because they are technically defunct companies.

There are a thousand and one ways to look at it; Goldman may be right in recognising that all these stimulus would lead to “households have accumulated about $1.5tn in ‘excess’ or ‘forced’ savings, and we expect that to rise to about $2.4tn, or 11 per cent of GDP, by the time that normal economic life is restored around mid-year… with 20 per cent of the excess savings will be spent in the first year.”

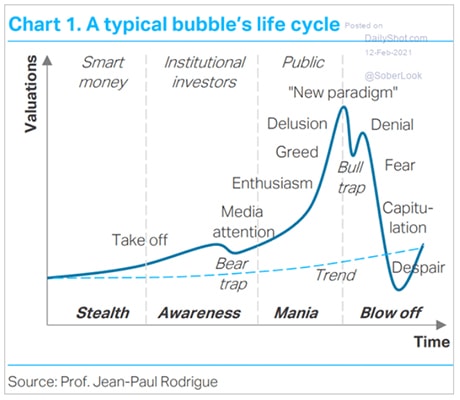

“In all bubbles, there are two types of participants: those who believe there is a new & lasting paradigm that justifies much higher prices; and those who recognize the bubble & trade it intending to exit before the blow up. Or so they intend.”— Simon Mikhailovich

We confess we are stumped!

Therefore, we did the Who Wants To Be a Millionaire thing and “asked the kid” (who had pestered his mother to buy Tesla last April).

To our surprise, his answer was sobering, “It’s a bubble. It’ll pop.”

Will it be the year of the Bull, Ox or Cow?

The main difference between Bull and Ox is that the Bull is a male individual of cattle and Ox is a common bovine draft animal. A bull is an intact (i.e., not castrated) adult male of the species Bos taurus (cattle). Oxen are commonly castrated adult male cattle; castration makes the animals easier to control. Cow = adult female.

It is definitely looking like a Bull Run right now but it’s really the year of the Ox, isn’t it?

RIP to Wall Street Charging Bull sculptor, Arturo Di Modica, who passed away on February 20.