O Bitcoin, Bitcoin, Whatfore Art Thou?

It is impossible to ignore the existence of the cryptocurrency universe. As much as we have tried to shelve the personal confrontation aside, which has ballooned into a nearly 2 trillion dollar market and spawned a parallel universe of NFTs for people who spend their lives online and prefer to pay more for a virtual Gucci bag than the real thing, we cannot wrap our heads around how Dogecoin, which is unlimited in supply has become a household name. It commanded a market cap of US$38 billion and overtook Goldman Sachs at one point.

We decided not to be dismissive nor disparate any longer, but to take a constructive stance this time. How? By delving into the psyche and mindset of a crypto investor for such assets are volatile, with less privacy than we imagine.

Unfortunately, most of the crypto folks in our wider circle are day traders (gambling addicts) in the 24-hour crypto casino and those who really know are either too rich or secretive to talk to us, but by a stroke of luck, we managed to find a proper crypto investor from, out of all places, a dear friend’s dating app, who was willing to share—and this is his playbook.

A conservative middle-aged banker in the risk business, his curiosity in crypto was piqued in 2017 because of his past dalliance in the IT business. And he was keen to know how it worked given it had survived all the nay years. He started his foray into the market before exiting his entire holdings in 2018 on Coinbase when they stopped bank transfers and shifted to card payments.

A divorce (hence the dating app) subsequently took up most of his time, but he spent 2020 watching the market’s meteoric rise before taking the plunge in January 2021 with a Coinhako account that is supported by DBS for bank transfers while sheepishly admitting it was 95 per cent due to FOMO with the excuse to diversify his ultra-conservative portfolio (and for the additional thrill of adventure).

What do you understand about cryptocurrencies?

“Cryptos are speculative investments comparable to assets which are not currencies yet, but with the intention to replace currencies, central banks and disrupt finance.” He admits to partial understanding of the decentralised ledger, unaware of regulatory developments like China’s clampdown on Bitcoin or crypto carry trades or crypto savings accounts.

What wallet to use ?

You can use trust wallet for hold bitcoin private keys.

Which are the investible ones? What about NFT’s?

“Definitely not the new ones in the 11,000-coin universe. Only Bitcoin, Ethereum, Ripple, Zil and Dogecoin, etc. Many of the new cryptos are destined for failure with little hope for mass adoption and created for the sake of satiating the need to punt and gamble. Would have laughed at the idea of NFT a few years ago but it is not crazy anymore with growing adoption and would like to consider it as “progressive thinking” on the part of the market participants and adoptees.”

What is the strategy?

“Haphazard. To put aside money each month as savings in cryptocurrencies, with no set time or amount. And eventually, build a portfolio.” So far, he has almost $100k sunk in and down about 20 per cent for the year with losses in Bitcoin and Zil. In addition, he checks on prices about three times daily, read articles to keep up to date with new developments before deciding on the next trade with a long-term view.

What doubts did you have and what were your emotions during times of volatility?

“It is a risky decision for portfolio allocation and all value could be lost (which is why only the reputable coins).” One must be prepared to lose all so there was little emotion felt (not unaffordable?) during the melt-up when he bought Bitcoin at $50k only to watch it fall to $35k because of the HODL strategy. He intends to keep investing (and doesn’t know that bookie markets are projecting a drop to $10k for Bitcoin and DCG’s CEO just came out to say that 99 per cent of cryptos are overpriced).

The increasing number of institutional investors vested with banks warming up to the idea sends the message that the market has grown too big to fail, is comforting along with the fact that third world countries like El Salvador (which has thrust into the crosshairs of the World Bank) are adopting Bitcoin as legal tender. The utility for Bitcoin is enormous in Africa and much of LATAM given the instability of their national currencies and payment systems.

What are your thoughts on the moral hazards of meme stocks and the likes of Robinhood allowing fractions of stocks to be traded by children?

“As a believer of liberal systems, stock markets should be opened 24 hours and there is no moral hazard in allowing fractions of stocks to be traded with proper caveat emptors in place, accompanied by financial education or perhaps some form of financial accreditation that is required. Financial literacy should be included in school curriculums, and maybe this meme stock movement could be better contained for the risks that many vulnerable retail traders face.”

“The need to be right is the sign of a vulgar mind.” — Albert Camus

Our reaction was a big WOW.

Have we been such narrow-minded purists on our parts to fancy ourselves as financial professionals to miss out on an alternative asset class because we decide to condemn its failure ten years ago? Just how good is fiat money anyway with the runaway inflation in asset prices all around the world as central banks continue to pump liquidity into our imploding systems?

We happen to know that authorities are worried about stablecoins just as Titan stablecoin (like Tether which is pegged to the US dollar) collapsed from $60 to zero in 24 hours. What’s more, Uranus soared 50 per cent after another Elon Musk tweet, 95 per cent of Bitcoin trading is a hoax, the pump and dumps in cryptocurrency markets, the Defi100 exit scam and we are following the Binance scandal as central banks around the world plan to launch digital coins.

So much was our prejudice that we have been religiously documenting every single Bitcoin absurdity we can endeavour to collect for the past three years and take every opportunity to lambast something that is gaining mass acceptance, noting that millennial millionaires have at least 25 per cent of their wealth in crypto. For all the occasions we had cheered any signs of regulatory pressures (that are building up rapidly) in China, India and even the Netherlands, we cannot ignore that “at some point, something is just real… if our collective imagination has given them value, now we just think about them having value,” to quote Sam Bankman-Fried, CEO of the FTX crypto exchange in Hong Kong. And that is how liberal systems are supposed to work.

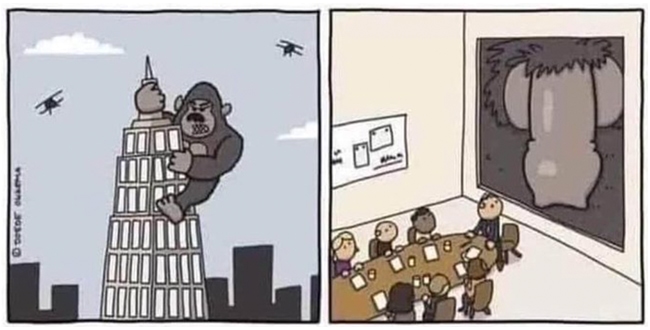

Take a look at our friend, he is no weed smoking, irrational rebel of the system, quite unlike some of the viral videos we had watched on the recent Miami Bitcoin conference with drugged-out-looking folks stripping on stage to reveal Dogecoin outfits. Bitcoin has come full circle indeed and we have missed the forest for the trees, best explained by the cartoon below (that is us in the room).

Yes, no, or maybe?

Maybe for now. But we have taken off the blinders for a start and will be exploring without prejudice henceforth while looking for more perspectives. We will be back soon for more discussion on the wild world of cryptocurrencies.