Singapore Market Buzz and Round Up 2

Between Gold and the other Black Gold that we know as oil, the world has moved into a deflationary mindset in less than 4 days which could possibly explain the poor Black Friday sales numbers, in addition to the fact that many retailers started sales earlier in the week.

Last Thursday’s OPEC meeting on Thanksgiving followed by Sunday’s Swiss referendum rejecting increased gold purchases by the Swiss National Bank, has seen commodities take another dip down on the first trading day of December and reports are starting to surface that a deflationary mindset may not be as good for economic growth despite the benefits of lower oil prices.

As a consequence, we have the STI index close the week on a heavy heart with the bulk of the maritime O&G stocks making new yearly lows.

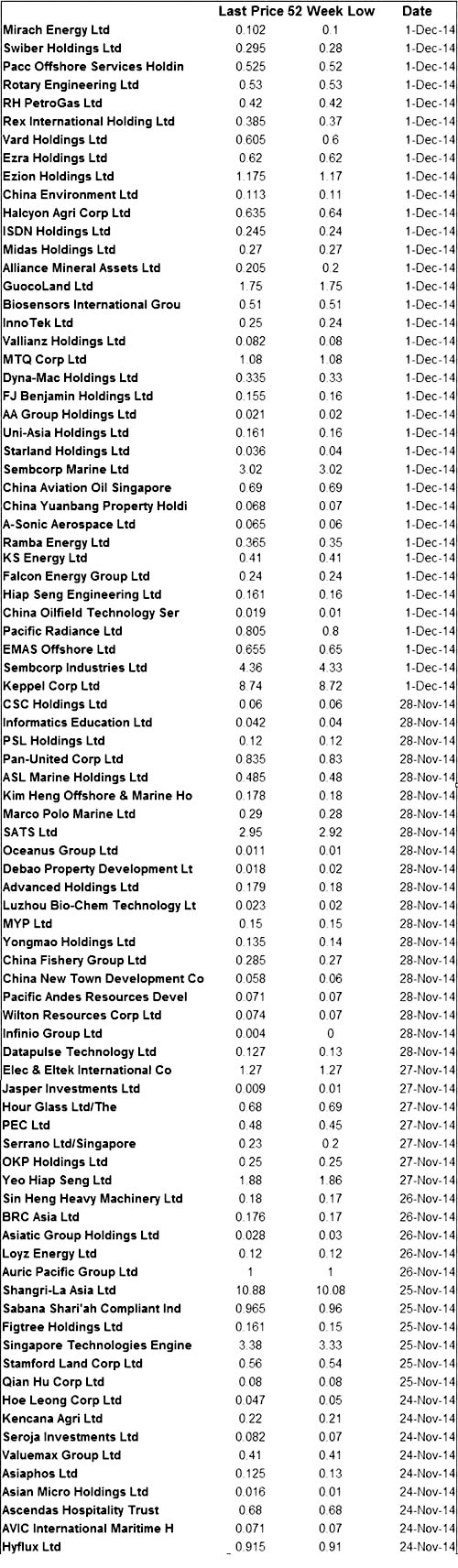

I dragged out the list of stocks making their 52-week lows for the past week and we can see that few of the O&G names are spared the brunt of the sell-off that is nothing compared to the billions wiped out around the world.

At the same time, we have the beneficiaries of lower fuel prices such as SIA making new highs today along with rare phenomenon like CH Offshore, a O&G name, at a new high last Friday.

The dust may take longer to settle as companies come out to announce Capex spending cuts with the latest being Petronas (Malaysia) announcing a 15-20% Capex cut in 2015 and Fortescue Metals (Australia) to halve their spending in the months ahead.

Yet, in the face of falling global yields, the Keppel DC Reit IPO, which will be put to a Keppel T&T shareholder vote on Tuesday, will be warmly received with their potential 7% dividend yield. At S$512.98 mio, it would be the second largest IPO this year after Accordia Gold Trust’s S$758.56 mio.

The main talk of retail punters would be the Olam short covering for last week and the mad scramble to cover 13.2 million shares last Friday, of which only 4.1 million was managed because of the Temasek consortium’s 80% block ownership that has severely crimped liquidity.

Some rumours suggest that the short position was the result of a fat finger trade but others speculate it was on the back of the expectation of lower commodity prices which now, thanks to the short seller, Olam shares will be blissfully immune from, for the time being.

The other big news is the other drag on the economy – real estate. REDAS, Real Estate Developers’ Association of Singapore, is anticipating home vacancy rates to top 10% in the next few years as 68,000 new home completions will hit the streets.

REDAS suggests that the government must ready itself to support the market in that event, which brings me to the annual MAS Financial Stability Review released last Thursday.

My personal take on the report is that we can continue to expect the local property market to cool further, even as it was announced this morning that experts are expecting a government cut in the release of private housing land for next year.

There is a heightened risk of that happening in the deflation mindset which could potentially trigger a domino effect in the already elevated private sector debt market where much is borrowed using property as collateral.

More contradictions too as we read that Singapore developers are now the largest foreign investors from the region in the global real estate arena buying from New York to Tokyo and MAS warning retail investors on the risks of overseas property ownership which has risen from S$1.9 bio in 2012 to S$3 bio in 2013.

As USDSGD approaches its 3 year high today at 1.3085, we realise that Singapore markets would be very much at the mercy of global and regional trends. China equities, on the other hand, is trading off their own tangent at a 3 year high.

While some Singaporean investors are busy licking wounds and others are wondering if it is the right time to enter the markets for some of the beaten down names, I should point out a WSJ article on America’s ultra rich and their plans to increase allocations to cash and private equity for this current quarter.

This should have spared them some pain in the current market’s volatility.

Private equity activity has slowed in the 4th quarter. Real estate and debt private equity deals have dried up while buyouts and real asset/co-investment deals have increased as a proportion of the total.

I would expect distressed commodity asset funds to start emerging into 2015, sourcing for cheap bargains. That is unless the central banks do not start another round of pre emptive rate cuts when there is already very little to cut from and cut to.

For all we know, Gold is a 6,000 year old bubble as eminent economist Willem Buiter would have it, but countless wars have been fought over Gold and that other Black Gold. And for all the cheer of lower oil prices, history has shown that the effects are often less predictable than we think.