Singapore Rates Outlook 2015: I Wish I Could Say A Good Year

2014 Retrospect

The year has been transitory, with a lot more behind-the-scenes work on the policy front that will show up in tomorrow’s news.Yes, the dreaded real estate measures has slowed the real estate market but not sufficiently, to rein in the corporate bond market exuberance for most of the year until oil prices got crushed, resulting in a highly uncertain future and ending to 2014.

The stock market has been neatly cleaved between the favoured and unfavoured names over the past few weeks, making 2015 a tricky path to navigate for equity, a topic I will undertake soon.

In Summary

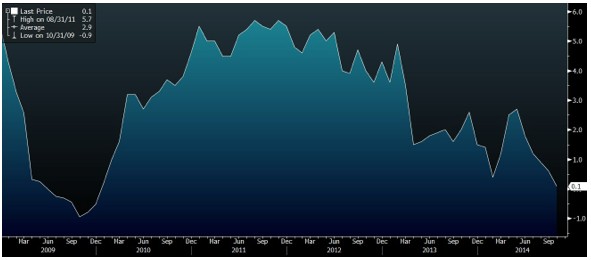

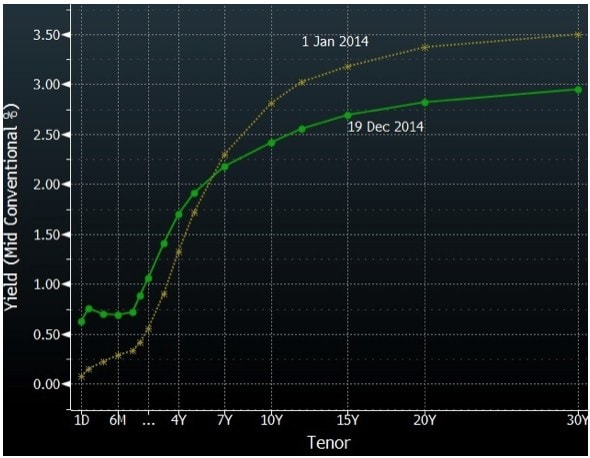

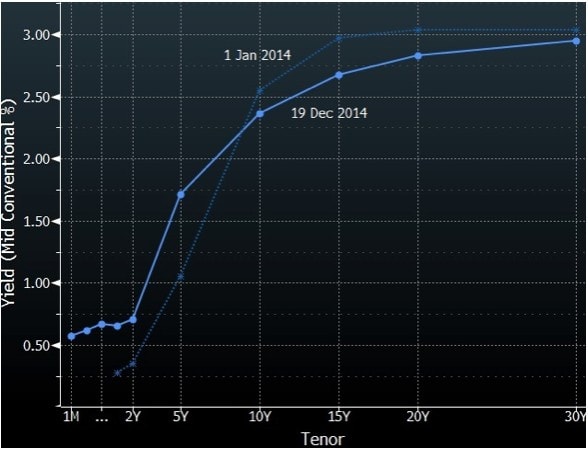

- We are ending 2014 on a flat interest rate curve. 10-year interest rates are ending the year lower than they were a year ago.

Singapore interest rate swaps curve

Singapore Government Bond Curve

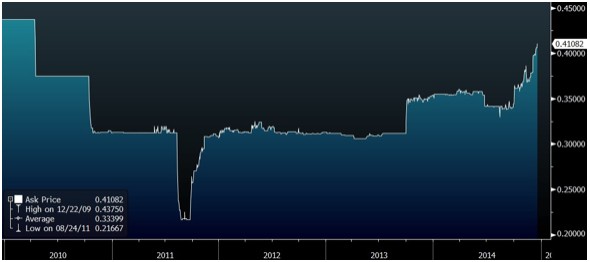

- We are ending the year at 4-year highs for funding/short end interest rates.

SGD 1-month SIBOR

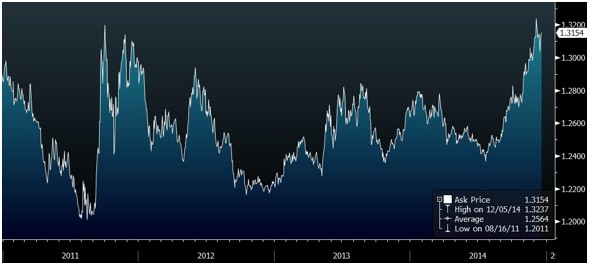

- SGD is trading near a 4-year high against the USD, although the SGD has strengthened against most of her peers in her trade basket.

SGD performed well against her peers in her trade basket.

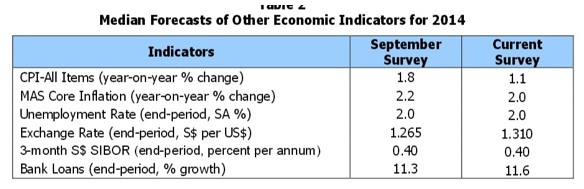

- The outlook for 2015 is looking increasingly dim as shown from the recent MAS survey of professional forecasters who have made some drastic revisions to their expectations for the economy.

- CPI is closing the year on a multi-year low even as the SIBOR is heading higher. Transport costs account for most of the drop, falling for 4 consecutive months even as COE prices held steady as consumers spend more on motor vehicles causing October retail sales to climb the most since March 2012.

Singapore did the right thing this year, shying away from the model of growth, choosing instead to consolidate, much like what China is doing. This is the path of least resistance in the face of the global financial turmoil which is still brewing and buffeting the markets about, especially those of the smaller economies like ours.

Efforts to strengthen the financial markets, bringing financial institutions up the curve in Basel 3 efforts, changing stock market listing rules, REITs regulations, retail investor regulations, and bond market dynamics, will continue into 2015, which also happens to be the year of the general elections are touted to be held – usually, elections bring good news for the economy – although the best election results were recorded in the worst year back in 2001.

Despite past skepticism of the 6 years of QE, we had control as we knew a rising tide would lift all boats. With that measure, Central Banks could not have failed in their goals of employment and inflation, because the crisis originated from the financial markets. This time round however, there is an apparent crisis in the commodity space, in which central banks cannot directly intervene. But the conundrum here is that lower oil prices, is, in general, good for overall economic growth, which clashes with the ambitions of the ECB and BoJ to boost inflation.

Singapore shall be caught up in both the headwinds and tailwinds that will confront our resource rich neighbours. It is virtually impossible to predict the future without forming a view of the global economy. My view is that Singapore will reap the rewards of her stable policies, and will continue growing as a global financial hub. As such, a strong SGD is warranted as far as monetary policy is concerned.

The USDSGD may trend upwards in any global panic, but retain its strength against the rest of the world. Staying long USDSGD into the first quarter is a good idea with 1.35-1.40 in sight, buying into pull backs if we see 1.27-1.28 as we may perhaps see the potential of a second quarter of negative GDP growth.

I believe that short-end interest rates will be capped at current levels ie. 1M SIBOR will find it hard to break above 0.50% unless the FED brings forward their rate hike agenda.The rest of the curve will probably re-steepen into 2015 as supply is injected into the system via the government bond auctions. Therefore, it would pay to stay out. Here is my outlook for the 2015 auction schedule.

The corporate bond business has been seeing some lull, and we are unlikely to experience the same sort of issuance mix next year, as we have witnessed this year as the chase for yield diminishes in the face of higher rates and capital losses – this while I cannot say that prices and levels have corrected sufficiently to make an investment decision on most of the names.

We can conclude that staying under-invested in bonds is probably a prudent decision going into 2015. Seek instead opportunities to re-enter the markets on signs of deeper correction.

The risk of widespread credit defaults appears relatively slim, but I would not rule out that the commodity crash would not lead to contagion in other asset classes, such as real estate, affecting the yields and valuations of for instance, the SREITs market.In conclusion, I wish I could say 2015 will be a good year but I think we shall have to wait at least a quarter or two for that.