The Forever Fairy Tale Rally

It’s déjà vu when Donald Trump said stocks would pop when the trade deal (with China) is done last Friday but wait a minute, he says that every Friday that markets are not up.

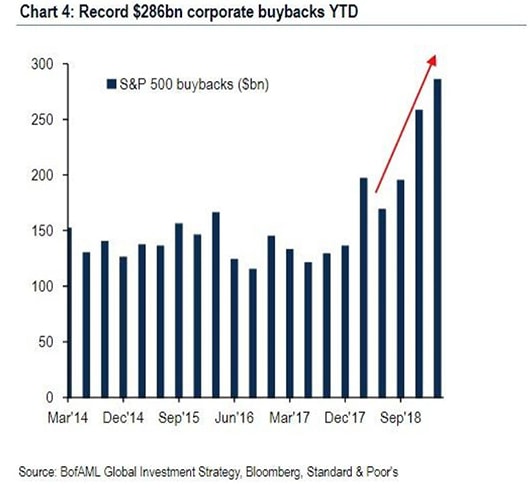

Well, stocks popped this week and we would tend to associate it with Trump until we find ourselves blindsided by the barrage of central banks speeches which bordered on senseless. Before we knew it, it was neither of the above because it was the largest ever buyback and short-covering exercise in history with an overdose of insider sales in the process (highest in a decade to be exact).

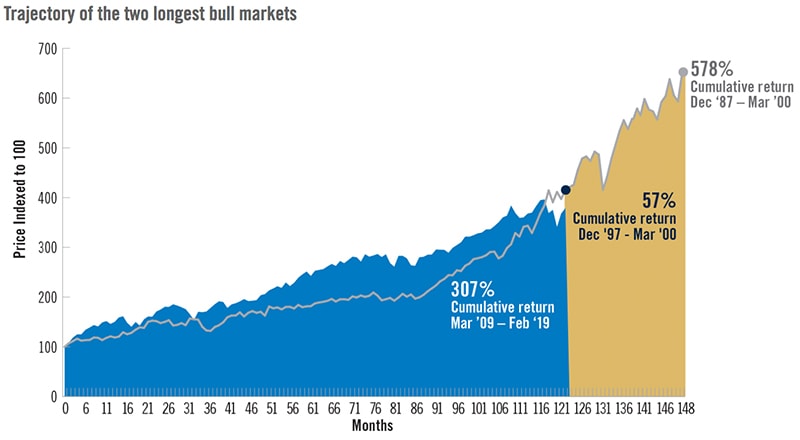

Thus S&P 500 is up 12.6% in the first 51 trading days of 2019, the best start to a year since 1991 amid worsening, or rather, atrocious economic data, marking 10 years of bull market (without a 20% correction) on 9 March.

Source: PGIM

Source: PGIM

Folks are not stupid enough to buy into this inane rally yet, and we say yet, because it is starting to look like a “forever rally”, and Citigroup, Goldman and JP Morgan have all come out to say that this has been a “flowless rally” with equity outflows out of line with higher equity indices.

Much as we like to imagine there is an army of dumb lemmings out there, barking to orders like the Chinese stock market perhaps, that managed to sell off last Friday just by “interpreting” a sell rating out of brokerage as a “government warning” or, like the numerous people who called the police when Facebook and Instagram were down for the longest 8 hours since 2008, no one has been buying much simply because they are not stupid to be buying in one of the best starts in 55 years for the Dow Jones Industrial Average when economic data is collapsing and recession fears are back.

And, as much as we have always sided with the perma-bears, we suddenly find ourselves embracing the idea of the forever rally. We need to rant and vent our frustrations in this post to come a conclusion as we are still not sure at this juncture—if this is not another senseless one-sided Battle Royale massacre at 2 mosques in N.Z. this week that we cannot bear to talk about—while feeling nothing but sorrow for those mentally scarred or who will be mentally afflicted by the event.

The Forever Rally

The inspiration for the Forever Rally came from Ben Carlson’s tweet on Twitter which got us envisaging a fairy tale situation for the rest of our lives, playing out it has over the past decade, with economists calling for recessions in the next 12 months, journalists speculating on an impeachment as part of their job, Donald Trump hinting on a trade deal and angry perma-bears calling for a massive crash.

And central banks? On full replay mode which is what is happening in the world with central banks turning dovish and suggesting more stimulus 10 years after the global financial crisis with the Fed, ECB, BoJ and gang turning dovish quite abruptly while applauding the success of their past actions and insisting there is no recession ahead.

At this juncture, it is important to distinguish between an economic recession and a market rally because in a Forever Rally situation, it is entirely possible for a Recession Rally too!

Let’s take a look at the parts of the puzzle and everything that is wrong—the economic data, the central banks and the companies.

Buybacks and the Earnings Recession

A blitz of buybacks would not be an understatement, observing from the chart below by BofA, the pace has been nothing short of astounding

Insider sales are following in the same stead which suggests regulatory probes to come after a disturbing finding by the SEC that “corporate executives sell significant amounts of their own shares after their companies announce stock buybacks”.

Source: Luke Gromen on Twitter

Source: Luke Gromen on Twitter

Yet, it could well be that there is less opportunity for Capex these days with the amount of disruptions going on in the market, as Citi pointed out that stock buybacks top Capex for the first time since 2008.

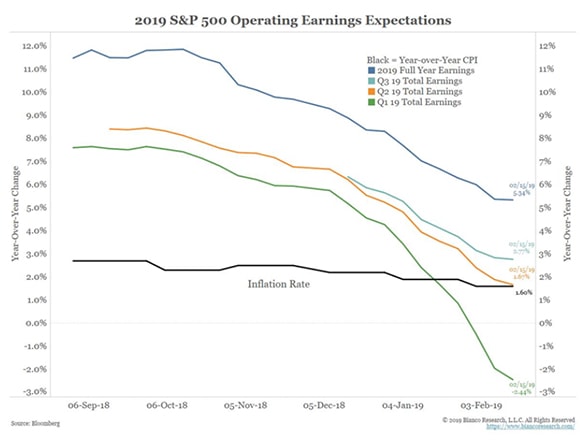

Unsurprisingly, Bianco Research highlighted the growing potential of an earnings recession in 2019, a fact echoed by Bloomberg pointing out that “more than 200 firms in the S&P 500 are now expected to earn less in Q1 than they did a year ago. That’s a lot more than were in the same boat three years ago, a stretch generally viewed as the worst profit recession of the bull market”.

CEOs’ have been quick to jump ship, according to the FT, and at the highest rate since the financial crisis, too.

“The key reason for the departures may be a sense of diminishing returns. We’re at the end of a very long credit cycle, and more corporate leaders know it can’t last. Most share buybacks are done at the top of the market. Perhaps we should view CEO resignations in the same light. Chief executives tend to like to go out at the top of their game.”—FT.

Source: FT

Source: FT

Recession or Not?

“We are prepared for a recession,” Dimon said at the event. “We’re not predicting a recession. We’re simply pointing out that we are very conscious about the risks we bear.” Source: Bloomberg

“The global economy’s sharp loss of speed through 2018 has left the pace of expansion the weakest since the global financial crisis a decade ago, according to Bloomberg Economics.” Source: Bloomberg

– Core US Factory Orders Suffer Worst Slump In 3 Years. US core factory orders (ex-transports) fell for the second month in a row in December. This is the worst sequential drop since Feb 2016.

– Auto Market Turns for Worse With Lowest Sales Rate in 18 Months. It’s been a cruel winter for auto sales, as slowing deliveries of even once-hot sport utility vehicles signal the rapid onset of a widely expected downturn…

– U.S. Budget Deficit Widens 77%. The U.S. budget deficit widened to $310 billion in the first four months of the fiscal year, underscoring the revenue hit from Republican tax cuts and …

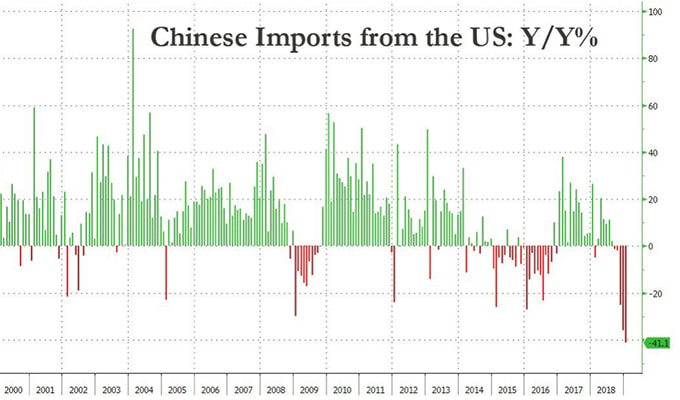

– Trade Deficit Soars to Record Level. The trade deficit in goods ballooned to its highest level in history, reaching nearly $900 billion in 2018 as Chinese imports slump.

– US Real GDP up 3.1% year-over-year, highest growth rate since Q2 2015 due to another huge inventory buildup and consumption, largest component of US GDP, slowed again.

– U.S. credit card debt hit $870 billion—the largest amount ever—as of December 2018: Fed data. The biggest contributor to this debt was paying for everyday expenses like food, utilities, gas & medical bills

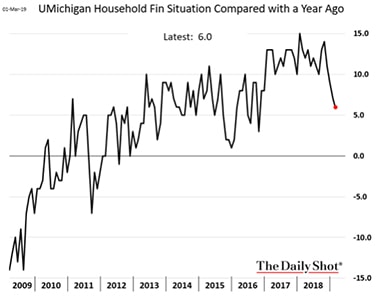

– Retail Sales Suffer Biggest 2-Month Drop In A Decade Despite Jan Rebound with Household Financial Situation Index plummeting

– Residential Spending Slumps For 6th Straight Month As Infrastructure Spending Soars Most Since 2003

– Thailand trade deficit biggest in 6 years as exports slide

– Japan Machine Tool Orders Fall 29.3% in February

How long before central bankers get the boot?

Central Banks’ Doom Loop

At the moment, every single central bank in the world is blaming “external forces” for their inability to do their job efficiently and have all vowed more stimulus even though there will be no recession.

10 years after the financial crisis, and we still need more stimulus?

Source: Bloomberg

Source: Bloomberg

“An overreliance on central banks exacerbates the crisis of trust. It creates the impression that the central banks favour banks and the financial system, rather than the real economy….central banks would act only as lenders of last resort in times of financial crisis, lending without limit to solvent firms against good collateral at high rates. Instead, they’ve become lenders of first resort, expected to step in at any sign of problems.”

“It’s not encouraging that the global economy is still struggling a decade after the worst financial crisis since the Great Depression. And that’s after central banks pumped trillions of dollars into the financial system. As of February, the collective balance-sheet assets of the Fed, ECB, Bank of Japan and Bank of England stood at 36.3 percent of their countries’ total GDP, up from about 10 percent in 2008.”

Do they know what they are doing?

– Mario Draghi in 2019, “In a dark room you move with tiny steps. You don’t run but you do move”, ECB In Period Of Pervasive Uncertainty—ECB Sees Chance Of Euro Area Recession As Very Low.

– Mario Draghi in 2012.

– On the BoJ’s Kuroda in 2019, “Inflation is barely halfway to the 2% target. Wages are still walking in place despite the longest expansion since the 1980s. And the BOJ now owns more than half of the government bond market and 80% of exchange-traded funds. Its balance sheet is now bigger than the entire $4.9 trillion economy.”

– Kuroda in 2013, shortly after Draghi.

Source: SCMP

Source: SCMP

– March 2019. “Fed kept rates at 0 for 7 years, barely hiked after + QE to encourage levering up. Now Robert Kaplan says high levels of corporate debt is why he DOESN’T want to hike. Kaplan acknowledges trap Fed in but doesn’t understand that the Fed is who set it.”

“Fed’s Kaplan says U.S. corporate debt a reason for rate hike pause. A $5.7 trillion borrowing binge by U.S. companies could make a slowdown in the world’s biggest economy even more painful. Are these Fed people brain dead? Can’t raise rates because of too much corp debt? The reason: there’s too much corp. debt is because the Fed has suppressed rates to such low levels it encouraged taking on of debt (all kinds). Want to reduce debt problem: RAISE RATES.”

Source: Bloomberg

Source: Bloomberg

The Forever Fairytale Rally

The best scenario would be for the global economy to struggle forever.

And because the markets and the economy are so closely linked, central banks help the markets more than the economy in their efforts to try to prevent the next recession because the only things stimulated will be market sentiments, hardly trickling down to the real economy.

“Encouraging big banks to supply credit to companies and households has been a centrepiece of the ECB’s policy efforts in recent years, via successive programmes of cheap loans from the central bank. However, some banks have elected to shore up their balance sheets by buying government bonds—which require no capital to be set against them—rather than generating new loans.”—FT.

And thus we shake our heads, because everything looks wrong and everybody knows it which is why not a lot of people are buying into the “flowless” rally on justified scepticism.

“This backdrop—low positioning, the high likelihood of a trade pact, and dovish monetary policy—should pave the way for further outperformance of risky assets.”—Bloomberg

After 10 years, we are starting to see the light, starting to believe that recessions are just figments of our imaginations, starting to believe that inflation does not exist, bonds are bullet-proof and this fairytale will last forever.