The Great Humbling: Markets Are Always Right

Why Think So Much And Be Too Smart?

The Great Humbling began when we spoke to a portfolio manager last week who told us that this year is all but done because he has achieved the firm’s projections for 2018, as laid out to clients last month, which is awkward because January is scarce from over and slightly troubling—they will still have clients to answer to for the rest of the year.

At the rate it is going, doubling projections is not good enough, without any signs of market losing steam, which means he should be expected to double returns before the end of February.

We also had a stockbroker confidently claiming that his best strategy for 2017 (and 2018 so far) has been to “not think” because listening to experts is a chore these days especially after last year’s bull run where his clients raked over 20% in just a bunch of Singapore blue chips without an afterthought. It was a windfall for a low-cost capital preservation strategy then by his retired local businessmen clients who lost millions in defaulted SGD corporate bonds recommended to them by none other than their “expert” local bank RM’s. Now they prefer to keep the rest of their millions safe, in the stock market and venturing bets on penny stocks with the loose change from their profits in the blue chips.

How humbling.

A pretty, not-an-airhead RM told us to keep our bond ideas to ourselves because she is not as smart as us to understand bonds. Nonetheless, she is fully loaded up on Nvidia (NVDA US), as she has advised her loyal clients to in 2017 with the stock up just 85.3% in 2017 and returning 24.3% in the past 4 weeks, keeping her clients and her family very happy. The assertion is that the trade did not require much analysis as name recognition for folks with global portfolios, quite differentiating them from the plebian local investors.

What a humbling encounter for us with our over-analysed bond portfolios and ideas.

We could not have been more humbled then, than by a friend’s 80-year-old auntie who forayed into Bitcoin sometimes last October against the advice of her RM’s and family. With the foresight to take off her bets 3 weeks ago to buy a nice Mercedes with her windfall, her words of consolation were not to think too much about the words of others, especially bankers who do not drive.

It knocked us off our feet, leaving us truly humbled. For us, the big mistake was to think at all since Donald Trump ascended the throne a year ago and emboldened everyone to be geniuses for they would be geniuses with the profits they have earned.

What is Smart?

The smartest person we know is the banker friend who turned down a more lucrative job so that he could stay in his current role which gives him more time to trade the Nasdaq which pays him more than his monthly wages and rewarded him with the down payments for 2 landed properties 6 months ago. Like all the other people we mentioned above, he is a fierce believer in not thinking too much about valuations and to go where the crowd is heading. For Singaporeans, it would be real estate and stocks?

Who Would Have Thought It Would Be So Easy?

Ask any fund manager in December how they saw 2018 and every single one of them would have expressed reservations of some sort. For 2017 had been a tremendous year, delivering returns that existed in their wildest dreams, leaving them wishing that those returns could have been a little more spread out to cover the next few years as well.

No one would have expected 2018 to be so easy that annual projections could be within grasp in January instead of June, at least?

Who would have thought that the S&P 500 is now just shy of Goldman Sach’s 2019 year-end target of 3,000, which factored for “rational exuberance”?

Thinking too much and analysis has become a bane in our existence and the existence of the financial experts. Fund managers who had succumbed to reflection and thought, instead of going all-in with the wisdom of the masses have lost out, just like many hedge funds have underperformed in 2017 just as the 2nd best-performing hedge fund of 2018 yet (according to the latest HSBC report), happens to be called Tulip Trend.

It says so much for the brain power of high-flying hedge fund managers and Wall Street bankers.

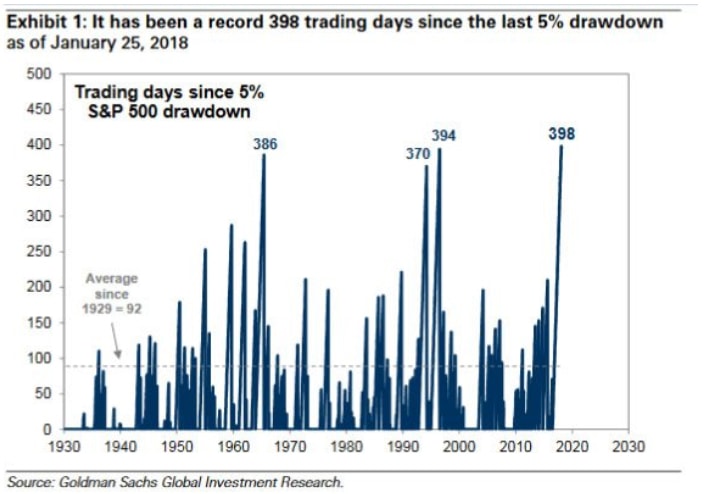

Anyone who has taken any risk without thought or care in 2018 has been rewarded as high yield bonds and emerging market debt are basking in the equity rally, while low-risk US treasuries and corporate bonds have floundered. Did we mention the 80-year-old auntie bought into Bitcoin again at mid-week? In a stock market where no sell signal has worked for the past 399 trading days, the FOMO (Fear of Missing Out) mentality is on full steam and there are no dips left to buy.

Source: Zerohedge

Stop to think and you would have missed out just as Bloomberg observed that “in a fast-rising market, investors tend to shoot first and ask questions later”, in specific reference to Chinese beer stocks which are rallying in winter. But they could be speaking for Nvidia or Netflix as well.

“If You’re Holding Cash, You’re Going to Feel Pretty Stupid…We are in this Goldilocks period right now”, said legendary hedge funder Ray Dalio last week, who is probably unaware that most investors are geniuses in their own right and beat his 2017 returns.

TD Ameritrade CEO warned that he has “never seen client cash levels this low” as fund managers remark “the intensity is crazy” which is “it is relentless and remarkable” as money managers’ exposure to equities hover near record levels with Bank of America reporting global stock funds taking in the most ever recorded inflows in the last 4 weeks.

Source: Bloomberg

Source: Bloomberg

The S&P 500 made as many all-time highs in January 2018 as it did for the entire decade of 2000’s, according to financial expert, Ben Carlson.

It stands to reason that markets were unfazed when the Dow set a new record for its relative strength index at 89.42 last week.

At the same time, other experts on Twitter are alerting the similarity between the current Dow Jones rally of 21% in 95 days as similar to the Dow rallying 29.9% in 1929 after 94 days right before the Great Depression 85 years ago where Yale economist Irving Fisher made the worst call of his investing career that “stock prices have reached what looks like a permanently high plateau”.

Yet, had he not gone broke in the Great Depression and focused on his academic career to produce one of the best economic theories for modern society, the debt-deflation theory, for Milton Friedman to posthumously pronounce him “the greatest economist the United States has ever produced”, global markets will not be where they are today!

The Great Depression? How about the Great Humbling?

That is the way we feel right now after deciding to Breathe and Think into 2018, as we wrote earlier this month.

We would not have imagined all this and we are not alone with Goldman hollering that “Risk Appetite is Now at Its Highest Level on Record”, JPMorgan warning that “Global Market Momentum Just Hit Extreme Levels, Profit Taking Imminent”, Nobel laureate Bob Shiller to call it the “Priciest Stock Market” and central banker, William White, to suggest that “All the market indicators right now look very similar to what we saw before the Lehman crisis, but the lesson has somehow been forgotten”.

Tell that to the Swiss National Bank which happens to be one of the 5 publicly traded central banks in the world and whose stock price has spiked 50% in 2018 entitling every Swiss citizen US$11,589 in US stocks, except that its shareholders (which includes Swiss municipalities) will reap the rewards. It does pay to keep those interest rates low?

Source: Zerohedge

Source: Zerohedge

The one who follows the crowd will usually get no further than the crowd. The one who walks alone is likely to find himself in places no one has ever been. — Albert Einstein

We stand humbled because the crowd is right this time.

More than half of the S&P 500 stocks are up 20% or more since Trump became president and the NYTimes reports that “for the first time since the financial crisis, every major economy on earth is expanding, lending support to forces of rising fortunes”, that comes with a host of systemic problems starting with the exponentially unbridgeable wealth gap (which will be a problem for the future).

It will be unacceptable if the richest 1% continues to make 82% of new global wealth again in 2018, after making 82% of global wealth in 2017.

Source: CNBC

Source: CNBC

The annual World Economic Forum in Davos has vice chairman, Dan Yergin commenting that “This World Economic Forum is about the most optimistic from an economic point of view probably in about 10 years that we’ve seen, and it reflects the strength of the world economy”.

There is a genius in the crowd!

We will be humbled because there is no history of companies beating such an aggressive set of profit forecasts and analysts have all upped their expectations for the current earnings season which we are in the midst of. The record stock market till now speaks for itself (Apple to report on 1 Feb after market close).

Sit Down, Be Humble

Kendrick Lamar’s Humble was picked as the top 3 songs of 2017 by Rolling Stones.

Girl, I can buy yo’ ass the world with my paystub…

If I quit your BM, I still ride Mercedes, funk

If I quit this season, I still be the greatest, funk

My left stroke just went viral…

Kendrick Lamar is Mr Markets telling his opponents that he is tops.

We are living in a Goldilocks era now. Mr Markets is always right and it is better to be lucky than smart, not think too much or be too smart.

Just because price records keep falling does not mean it will end in a pool of tears tomorrow. There is wisdom and faith in Trump, and his promise for higher stock prices.

Source: Yahoo

Source: Yahoo

We can now see how easy it is to say “we can’t expect another year of 20pc returns” as Telegraph did this week but it is something that you write about when you think too hard.

Source: Telegraph

Source: Telegraph

Speaking to a fairly astute investor who manages an indecent sum of money, we found that he has decided to reduce bond allocations to zero because 5-6% is not worth it in this Goldilocks era. He, who has never leveraged, intends to take on leverage to milk the most of in this leg of the race.

He is not thinking too hard too about it, being lucky is better than smart. He will not listen to us or his bankers because we will not be sending him a cheque if we are wrong and that left us in a certain awe and we wish him and the 80-year-old Bitcoin auntie nothing but success, humbled as we have been by their acumen.

We know that sticking to bonds is not such a good idea, as we have said last week, but there is so much money left on the table that there will always be room for some bonds in the portfolio and we cannot see Janet Yellen hiking rate this coming week (30-31 Jan). There has never been a Fed chairperson who presided over a rate hike on their last meeting as the chair.

We may not share the same belief as millions of Americans who believe God made Trump president but we believe that no amount of flood, hurricane, cold, hail and fire will stop the rally, humbly speaking.

Source: Politico

Source: Politico

It has been a humbling week and we shall take time off to breathe, think and watch for the first super, blue moon lunar eclipse in 150 years fall over the US on 30-31 Jan. This comes after their first total solar eclipse in nearly a hundred years last August.

With such rare astrological occurrences, extreme weather patterns and natural disasters to humble us, who cares about the daily new records in the stock markets?

We will just be humble, and sit down and watch.