The Great Singapore Real Estate Sale

It just keeps getting crazier for us, the zombies.

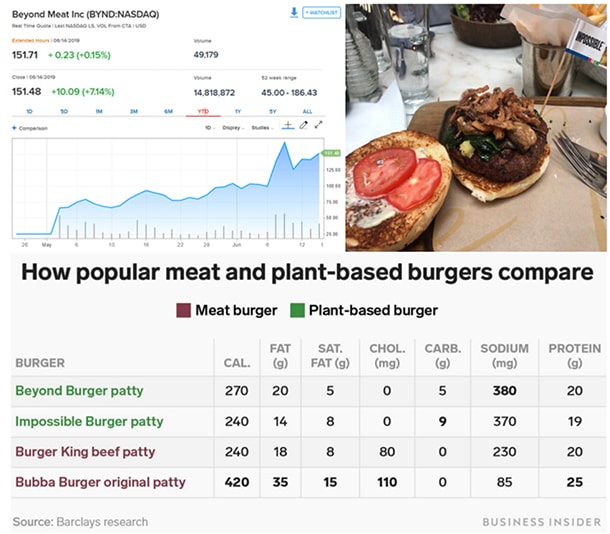

Toronto Raptors won their very first NBA finals in history, defeating San Francisco in a bad omen for Silicon Valley even though Beyond Meat (BYND US) is still up 505% since their recent IPO that compelled us to grab the exorbitantly priced Impossible Burger, which was amazingly good stuff but we will not be back for more at $29.5, not especially after we read up on the nutritional values afterwards and also errr, the Satan burger theory.

China is not getting more love in the past 2 weeks except for those living behind the cyber iron curtain and their information blackout. Who would feel supportive after last week’s Tiananmen anniversary and the Hong Kong protests that saw millions in the street and an elaborate DDOS attack on Telegram to deter protestors that had Made in China written all over it? Then the Chinese are cleverly switching to Made in Vietnam labels to skirt tariffs which is probably just as bad as if Americans would route their soybeans through Brazil to get to China?

It is hard to choose. While most people in the 2018 PEW global survey agreed that China plays a more important role in the world than it did 10 years ago, few preferred a world in which China was the leading power.

On the other hand, the leader of the world’s greatest economy continues to exhibit lunatic and erratic behaviour, declaring, “Ultimately I’m always right”, when asked about Russia and that “he might not report foreign help to FBI in 2020”, sparking domestic furore. And if Iran was responsible for the attacks on oil tankers, as Trump insists, it would be very clumsy timing because Shinzo Abe is visiting Tehran, with the blessing of President Trump and Iran just freed a U.S. resident imprisoned on espionage charges.

It is a zombie world for the markets which is best summarised in the Hedgeye cartoon below because it is impossible to make logical sense of what is happening.

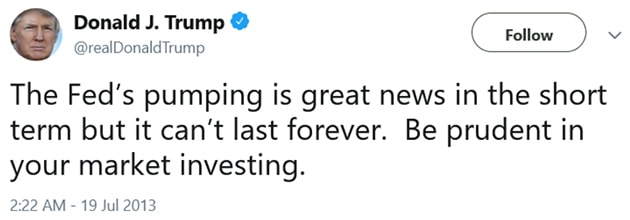

Then look at what Trump tweeted about QE in 2013.

What do you expect when the CEO of Morgan Stanley says that trading in the last 2 weeks has been “quite hard”? Finance ministers and central bank chiefs have lost their relevance along with economic data because they “can say what they want and it won’t amount to much. U.S. President Donald Trump has made himself the secretary of everything.”

The consolation is that the Great Singapore Sale is around the corner but the bad news is pockets are feeling the pinch because higher mortgage rates have left folks with less disposable income these days including real estate developers and investors as we received another list of properties for tender from a small developer gone bust in recent weeks. Plus we are reminded of the BT headline last month predicting just that.

Source: BT

Source: BT

All we can do is to commiserate with the investors in those projects on Hillview and Joo Chiat and a rich friend of ours who sold his GCB for a 1 million dollar loss which was probably a relief to him because he promptly flew off to Sorrento for a break. After all, he could have done much worse, Sentosa Cove just saw a unit sell at a 50% loss and we were informed someone just bought a District 10 GCB for around $900 psf.

Source: Today

Source: Today

Frothy bubble headlines like this one below for a penthouse on Orchard this week transacting at $4,805 psf makes us wonder if we are back 2011.

Source: BT

Source: BT

Commercial real estate is not spared despite the headlines that investments have jumped as we read of more losses this week.

Source: BT

Source: BT

There was headline mention of the 24,000 empty apartments (and 44,000 more on the way) in Singapore mainstream media so far and we waited but it looks like the last negative headline was the BT one in April mentioning the new record in mortgagee sales.

Source: Bloomberg

Source: Bloomberg

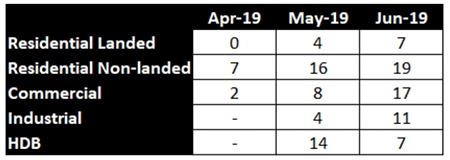

The Great Singapore Sale started early because mortgagee sale listing has broken out again in ERA’s auction listing for June which is 3 pages longer than May’s which was double the pages in April. More alarming is that there was just a single owner’s sale in May and none in June compared to nearly half of the auctions in April. The mortgagee auction listings for ERA are summarised in the table below.

Yet there are rays of hope, we hear the Honkies are coming! From real estate agents and verified by Reuters as far as tycoons are concerned.

Source: Reuters

Source: Reuters

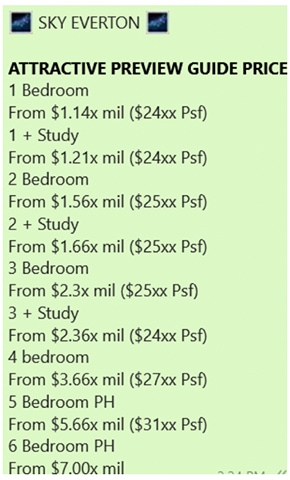

There is every reason to look at Singapore real estate, for instance, like the newest launch this weekend for Sky Everton. Judging from the picture, the crowds are healthy despite the “sky high” prices, to excuse the pun. Crazy, some would say.

It definitely looks on the pricey side and the 3 bedroom unit, from the table below, would be a tad squashy for Singaporeans at 900 square feet but luxurious by Hong Kong standards and the concept of freehold does not exist in Hong Kong. A screaming buy or just as crazy as everything happening in the world?

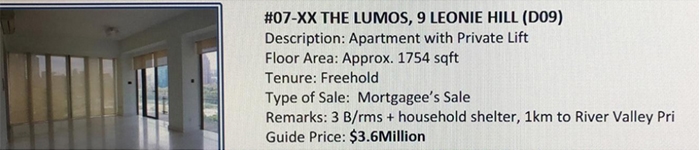

Not a screaming buy if you bother to scour through the mortgagee sale list and see you can get yourself a unit 30% larger in Leonie Hill! ($3.66mio/$2.7k psf = 1,355 sq ft)

Checking on the last done prices in the past 6 months of similar freehold condos nearby, we note no transactions anywhere near those launch prices which are on average 20-30% above the secondary market values.

The same goes for all the neighbouring developments around the much-hyped 99-year leasehold Woodleigh Residences which is going for some 30-35% over its older freehold neighbours.

Nevertheless, we have another bright spot which would be the sudden decision to reduce the supply of land of private housing announced earlier this month, which cited the oversupply as a concern along with the increasingly bearish economic and business outlook. For zombie investors, less supply = good news.

Source: ChannelNewsAsia

Source: ChannelNewsAsia

So, is there a Great Singapore Property Sale or not?

Unless you managed to get a nice GCB under $1k psf, we think not yet and we have a conspiracy theory on that. In the past months, we noticed a huge spike in re-financings out of DBS which is the only bank that does not offer SIBOR home loan packages and many are complaining that their mortgage rate is closer to 2.5%. The lowest floating rate out there SIBOR +0.2% which is 2.08%. It may be that if anyone buys a property at $2.5k psf when the neighbours are going for $2k psf (-20%), the value may just be $2k psf if there is a need for a fire sale, like the mortgagee sales mentioned above. 20% just about covers the downpayment and a 50% loss, like in the case of Sentosa mentioned in the news, may result in capital losses on the loan (80%).

Yet we are confident in the pre-emptive steps taken since 2015 and the land sales decision this month, all efforts are going in to engineer a soft landing, without considering the extra boon from the demand of Hong Kong buyers. Meanwhile, enjoy the Great Singapore Property Sale ahead and remember not to do anything too crazy.