The Irony of Woke in Financial Markets

While we risk getting cancelled for writing this op-ed about woke financial markets, we shall also pose the question of how to model the “woke risks” involved in our financial system.

A friend who was complaining about being “racially profiled” at a Holland Village eatery that served a predominately expatriate crowd, was chastised by her grown Gen Z son for using the word “retarded” because it could get her “cancelled” these days for being unprogressive. This is the same kid who responded that he would not help the girls with their bags on a school hike because he is a feminist, too (although he did volunteer to carry the common rations) and that his favourite colour is pink because boys can like pink, too. To add, he had a boyhood crush on Ellen Page who has since transited to become Elliot.

Wokeism is part of the school curriculum for them as we learnt that body positivity is another word for fat. Woke, which originated as a black racial prejudice concept, has now been appropriated to encompass social awareness in general and spawned cancel culture in society. This extends to even melting down a historical statue of a slaver/statesman to create societally inclusive art even as an African American gay actor is found guilty of staging a hate crime to evoke public outrage which “woke media” (and President Biden) are unlikely to pursue for decrying the supposed crime in the first place.

It is amazing how polarised the world has become, taking sides on the Kyle Rittenhouse case based on political allegiances instead of logic. And we have our own little political scandal in Singapore that we will not talk about, as a rule. It is perhaps ironic to note that police in Portland have stopped work on non-life-threatening crimes on the woke movement to defund the police.

It is pretty much the same for anything to do with the environment, race, sexuality, the wealth gap, mental health, vaccination and so on. Best to keep mum unless you are on the side of wokeism and happen to agree that math is racist and George Orwell’s estate just approved the retelling of “1984” from a woman’s point of view while we remember reading somewhere about assigning animal rights to crustaceans for feeling pain (so bye to drunken prawns?).

It is alleged that 78 per cent of covid fatalities included people that were obese or diabetic with two or more comorbidities and scientists may have discovered why, but it is wrong to fat-shame, so best not to talk about it because Nordea just fired two senior analysts for research that “questioned the efficacy of vaccines.”

The need to appear progressive involves a great deal of virtue signalling, like the first postwar German chancellor, who removed “God” from his oath of office and in Australia, calling your boss “a wanker” under your breath at a Microsoft Teams meeting is not serious enough to warrant immediate dismissal.

All this stuff is not made up and it is increasingly hard to navigate the news or what is called news these days as Nobel Peace Prize winner, Maria Ressa, warns that fake news is exploding like an “atom bomb.” Technology companies censor and manipulate news; Twitter has banned popular accounts that tracked Nancy Pelosi’s portfolio and Ghislaine Maxwell’s trial just when we find out that Facebook’s “fact checks” are just a matter of “protected” opinion.

What about financial markets, a topic closer to our hearts?

On fake news, CNN reports that the White House, not happy with the news media’s coverage of the supply chain and economy, has been working behind the scenes trying to reshape coverage in its favour which is exactly what was exposed this week, that the logjam of ships at Port L.A. has been ordered offshore to reduce the number of “anchored” ships. As Fed chair Powell persists to argue that the Fed’s ultra-easy policies absolutely do not add to inequality, French economist Thomas Piketty, an expert on wealth gaps, has found that the share of global wealth held by billionaires surged even faster during the Covid-19 crisis to a new record. And no one would dare opine publicly in 2020 that a good hedge for inflation would be to buy real estate (as many have done privately) because of the prickly (un-woke) affordability issues, riding on the largesse of the central banks.

It is just as well, as we have been going along with Chinese data all these years which appears to be getting even more obfuscated. It is difficult to criticise China in any way without repercussion and of course, Citibank would say Chinese ADRs are oversold after they applied for an onshore securities license.

A different kind of woke is happening in the financial markets. A progressive financial woke. Yes, social wokeism has been the theme of investing for the past few years, for all things ESG that folks and funds buy to virtue signal, only to find dubiety in ratings as reported by Bloomberg.

The new woke in finance has been fintech such as blockchain and financial instruments like SPACs. Then banks have now started piling into the cryptosphere and NFTs in the metaverse and to deny these would be terribly un-woke.

It is one thing to be in the blockchain game (although we hear it is not-so-blockchain behind the scenes) which is useful tech, but another to get into the crypto/NFT game which is just getting started as we read about all these real estate and land deals in the metaverse which should have an unlimited amount of land/space (or else, we can create a metaverse 2?).

There is a certain irony in woke finance because the initial ideology behind cryptocurrencies has been to disrupt traditional finance and a system rigged by billionaires and politicians. Interestingly, it is reported in un-woke media that Biden’s head of security is leaving for a job in Wall Street.

And the other irony is that the new order would be controlled by a set of different billionaires, possible money launderers and even dictators in El Salvador.

Therefore, we will attempt to be un-woke and talk a little more about this exploding phenomenon that is threatening to become another Lehman moment. Cryptos are not the new Woodstock to millennials as Woodstock was to boomers because there is the financial system at stake here. We happen to be Gen X so we are, technically, impartial.

“You have to be in the game,” a fintech multimillionaire informed us. He, who has to constantly maintain his fintech image with the latest gadget, car and crypto portfolio which has become an accidental source of wealth (he does not believe in it), and so he is looking to swap the Ferrari for a McLaren. This cannot be truer, why banks and the world of finance are forced into the cryptosphere mainly due to FOMO as Bloomberg pointed out, that even the smartest investors are falling for the FOMO in crypto in spite of the risk of regulatory clampdown looming because it took a while for the regulators to close in on the risks in the gig economy of Didi, Deliveroo, Uber, etc.

The main problem with crypto is the need for mass adoption or the 15,000+ coins out there would be worthless or worth just about the imaginations behind them. There is no legislative framework behind most of them but it is happening with celebrity endorsements, like the Matt Damon promo of Crypto.com. We actually found it logically befuddling as with the dozens of celebrities who have embraced cryptocurrencies, SPACs and NFTs without knowing the difference between what they ascribe to and the number on their bank accounts.

Keanu Reeves would be one of the honest ones left, besides Charlie Munger who reiterated this week that he wishes that cryptocurrencies had “never been invented,” when asked about NFTs which are “digitally scarce” yet “easily reproduced.” A case of un-woke oxymoron, perhaps, which is also exemplified by President Biden’s explanation this weekend on the need to raise the debt ceiling so the United States can pay its due when it is time?

Yet we have a near 2 trillion USD worth of cryptos and all those NFTs right now. Authorities are keeping mum as millions in real estate deals are transacted on the metaverse and architecture firms are getting paid money to design houses in a metaverse. Gucci, Balenciaga and Burberry are making millions for stuff that cannot be used and is unlimited in supply.

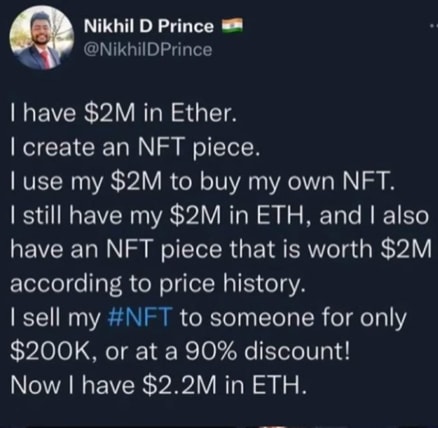

This is as Bloomberg has exposed that a small group of insiders are profiting or profiteering from the NFT craze just as SPACs are seen to be coming to an end. Indeed a study of 6.1M NFT trades finds a few folks at the centre of the market; the top 10 per cent of traders account for 85 per cent of transactions and trade at least once. 97 per cent of all assets, 10 per cent of buyer-seller pairs have the same volume as the remaining 90 per cent. Kind of rigged? Take a look at the tweet below and arrive at a plausible Ponzi conclusion?

Source: Twitter

Source: Twitter

It is a potential big-time (global scale) Ponzi and the trouble is that very few people know what is happening when everyone is jumping on the bandwagon. We have many friends who have decided to buy crypto as a New Year’s resolution, for “portfolio diversification” but mainly for FOMO. For instance, you don’t really need a blockchain at all for NFT uses because a cryptographic signature would do the trick. You only need a blockchain if you want a thriving secondary market.

The conclusion is that, without regulation, the entire idea of exchanges on crypto and NFTs are nothing but pump and dump schemes which have already been highlighted in academic studies that “there is at least one pump on 133 days out of the 175 days, indicating that there is almost one pump per day on average. Such a high rate of manipulation is unprecedented in financial markets.” The idea of trading on an unregulated exchange is merely a façade for the concept of financial exchanges as we know. And it is not funny that the latest casino proposal for New York City would also include a 24/7 crypto trading floor. But regulators are still keeping mum even as Bloomberg and mainstream media have caught on the scent of Tether stablecoin in recent weeks.

Yet, we know it is flex culture behind the rise of retail trading, promoted on social media. It is the gold-plated Ferrari you see on the ad with Peter Lim telling you all about digital options trading—so much for the purist ideology of disruption behind cryptocurrencies and DeFi. And the other flex culture example we can purloin would be the local Envysion scandal that caught many sophisticated investors off guard. The purists behind the original plan are all but silenced as we welcome a certain breed of charlatans and tricksters with no intention to stay in the game as described in the image below.

The woke movement has erupted into a FOMO movement in the markets, and whilst it has yet to hit the bond markets, we anticipate a rude awakening soon as long as regulators stand by to watch for both bonds and meme stocks. It is all becoming a get-rich-quick scheme.

For our dear friend who was racially profiled as a poor Singaporean by a fellow Singaporean manager of the new Tex-Mex joint in Holland Village, discrimination is perhaps in our DNA because we find out that not all identities are created equal in the metaverse (which does not even exist yet). Or maybe she can exact revenge by investing in the PE firm behind that joint and demand the chap and his hostess get the boot? Does it matter? Woke in financial markets is becoming an irony in itself.