The Social Media Investment Lesson From Ashley Madison

Warren Buffet said he would not invest in anything he did not understand but at least he has a team of folks doing all the technology investments for him.

Buying a tech stock after the IPO one can suppose that one would have lost out about several thousand percent in valuation gains that the venture capitalist would have made, depending on which cycle of fund raising they entered at which does not mean anything for the giants like Facebook and gang, that fledgling companies would beg for them to be a shareholder of.

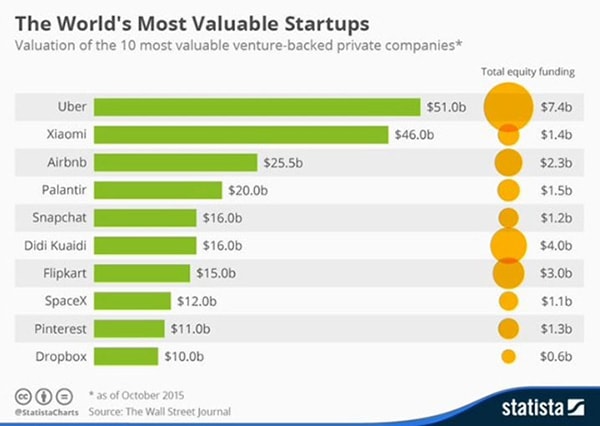

Yet it should be fair, one would suppose, given that not many of these tech companies make it to become a unicorn – “companies that have soared to a $1 billion valuation or higher, based on fundraising. The billion-dollar tech startup was once the stuff of myth, but now they seem to be everywhere, backed by a bull market and a new generation of disruptive technology.”

Ashley Madison is one such potential unicorn, now a fallen unicorn, whose value has been decimated by a hacking scandal where its user namelist was made public and, as a result, many notable public figures and a respectable person has suffered shame.

Not counting the lawsuits and divorce cases or the un-quantifiable reputation damage of the scandal that has rocked the largest public adultery website, the proceedings have been an invaluable lesson from an investor point of view.

First, it emerged that many of the site’s users were fictitious! And that male users outnumber females by a ratio of over 6 to 1. Then came the revelation that many of the women were not even women at all but were “bots” impersonating women. Does that not beggar the question if Ashley Madison was a successful site with a promising future that it so represented to investors and potential investors?

That investors have been buying into “negative” PEs for nought ? And is the world not a better place now that Ashley Madison did come very close to listing in London earlier this year?

The social media investment scene has erupted in our faces whether we like it or not and with it comes apps, programmes, platforms of sorts. It is beyond breathtaking pace as we are taken from the next best thing to the next better thing in this new world of the Internet of Things –”the network of physical objects or “things” embedded with electronics, software, sensors, and network connectivity, which enables these objects to collect and exchange data.” – where everything is linked at the touch of our smartphones and social media doctors help to save lives from halfway across the world with the right instructions.

From Fintech payment systems to crowdfunding, to service apps like Uber for car hires, there is no escaping unless one would choose to be left behind.

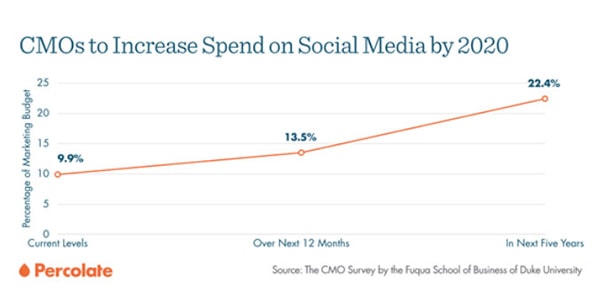

Social media budgets are bursting ahead at race speed and expected to take up 22.4% of total marketing budgets by 2020 even as ad blocking apps are rising up in importance and growing at record pace among users with almost 200 million people regularly using ad-blocking software according to reports.

It would strike one as a race to an uncertain finish that customer base growth with the odds stacking up against social media valuations, arming the ever fickle user, from personal experience in deleting apps as soon as one installs one, with the ad-blocking “vaccine” to one big revenue crushing ending.

And thus, user bases are possibly, at best, “revenue streams” that are plucked out of air for the thousand times PE that we are investing in.

We all know that for every Facebook, a Friendster, MySpace, Google+ and the once household names that are hard to recall these days, have given up. Household names that were worth a pretty penny to their investors.

Even Yahoo’s ambitious acquisition of Tumblr for $ 1.1 bio in 2013 is not living up to its investment potential even as Twitter’s US$ 14.2 billion IPO back in 2013 has netted investors about 16% in equity valuation returns while still running at a loss and at 93 times PE. At least, Twitter’s losses are narrowing and Foursquare was last valued at US$650 mio in April this year.

And that shall we the new world for us to invest in ? The negative PE world ? What would we know ? Except that Ashley Madison would be a screaming buy because some analyst say so? Or buy into some ETF that would own Ashley Madison because we are unaware that the ETF does not have a social responsibility mandate?

Facebook has a firm grip on the markets now because they have amassed that critical user base that would be difficult, if not impossible, to topple on top of their US$ 288 bio in market capitalisation which makes them the 7th largest company by market cap in the world and essentially larger than the largest bank out there, Wells Fargo (mkt cap US$ 281 bio). Facebook’s latest PE number is at 104 times and we shall have their results out in the next fortnight on 4 Nov.

Alibaba thrives as the 23rd largest company in the world because they have China mesmerised and users under their thumb as analysts are now putting a US$ 70 bio value on Youtube (owned by Google), that is tipped to replace TV in the future.

All 3 companies sell the same thing to investors – usage growth, user numbers that would translate to profits and such. Now if only Tupperware (TUP US) thought of monetising its “Tupperware party” social network 70 years ago? To our surprise, Indonesia is now the biggest market for our favourite Tupperware and it shows big promise still even if sellers are probably using Facebook to sell their wares.

The largest unicorns left on the table are very much app based, user based names like Uber, Airbnb, Snapchat, Didi Kuadi (another taxi app), Flipkart and Pinterest.

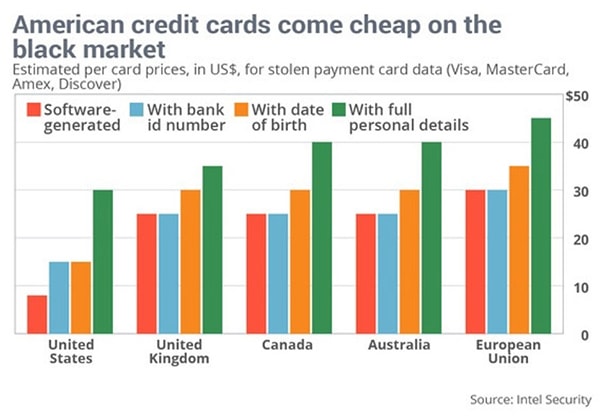

Throw into the equation the cybersecurity costs with hackers getting cheaper by the day as prices for credit card details fall and data breaches and internet fraud become commonplace.

How then are unicorn valuations are derived?

There is no better answer than this one from Bloomberg.

“The numbers are sort of made-up. For the most mature startups, investors agree to grant higher valuations, which help the companies with recruitment and building credibility, in exchange for guarantees that they’ll get their money back first if the company goes public or sells. . . valuations are just a placeholder number, part of an equation fueled by other, more important factors. Those can include market share, growth projections, and a founder’s ego.”

It does strike one as a trifle criminal from the end-investor point of view.

A crime nearly as bad as the social immorality of Ashley Madison’s adultery cause.