Thinking About Inflation and Lentils

Watching markets with that lump-in-your-throat feeling is the best description we can summon for the emotionally draining weeks of March. Two years on the anniversary of the start of Covid-induced global central banks stimulus and the situation keeps changing in the blink of an eye as a huge foreboding remains pent up within us.

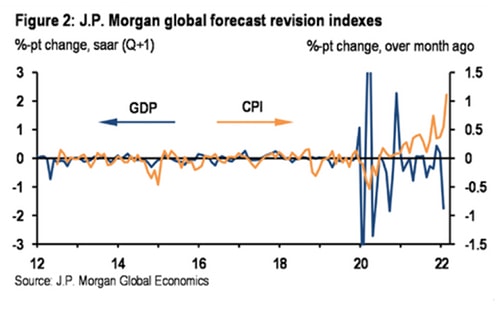

The war in Ukraine has tipped the scales of inflation, which was already building up last year and it is all but certain that we will dip into a stagflationary scenario of sorts. Ignore the central bankers who got the inflation story wrong last year; now they say there is no risk to the economy when Wall Street experts are predicting bone-crushing recessions and GDP and inflation outlooks are taking opposite trajectories (i.e. stagflation).

This will be a light-hearted article on how we will be changing our lifestyles as well as portfolios, which will not be construed as investment advice of any sort unlike Bloomberg’s snobby op-ed entitled “Inflation Stings Most If You Earn Less Than $300K. Here’s How to Deal,” which has drawn flack from nearly every single respectable media outlet. The tabloids are taking umbrage too.

Who would not be affronted when told that the best way to ride out higher prices if you are not rich enough is to sell your car and take the bus, not buy in bulk, forego chemotherapy for your pet and eat lentils instead of meat?

It is too happening too quickly and too many commodity prices made parabolic vertical ascents like the fertilizer price chart below that have not filtered into our daily lives yet, which will make today’s prices look cheap as countries exhaust their reserves while waiting for the outcome of the Ukrainian war and embargoes. This is even as champagne prices have risen quite sharply this month, up nearly 40 per cent for Krug and Dom. Mortgage rates have also jumped 40 per cent from 1.05 per cent for a two-year fixed rate loan to 1.8 per cent which works out to be just an extra $7,500 roughly per annum for a million-dollar loan or only an extra 600 bucks a month which is perhaps one less omakase dinner? And we hear unverified stories of how traffic bribes in a neighbouring country have shot up to $10k in their currency, a sure sign that cops are also facing inflation problems in their lives over there.

Chart of fertilizer price index 1993-present and Ammonia Prices 2000-present

Chart of fertilizer price index 1993-present and Ammonia Prices 2000-present

Bloomberg is not wrong because U.S. President Biden just acknowledged that food shortage is “going to be real” but we do not see it as such a bad thing to address the obesity crisis in America which is going at a run rate of 42.4 per cent through 2017-2018 before the pandemic lockdown stress-induced binge eating gave it another leg up. Maybe fat will become fashionable again as it takes money to eat.

The definite outcome of the spike in inflation would be an utter collapse in discretionary spending and things are going to get bad like those Omega x Swatch Moonface resellers that we read about and maybe reselling will become less of a career choice to ease the tight labour market as they return to work.

Our incomes are not rising fast enough and our investment portfolios have mostly taken a beating to various levels of severity depending on how much we have vested in Chinese tech stocks which are down some 50-70 per cent from their peak or bond markets which just dropped another US$750 billion this week globally to be down US$4.8 trillion from their peak, taking a toll on our bottom lines.

It is time for us to take drastic action and make some structural changes in our lives and portfolios during this period (at least until the inflation tsunami arrives) besides eating less and not buying that Omega x Swatch collab with the hope of reselling it to a greater fool. We may be proven wrong in these fluid times where we will be sure to change our minds with all the moving parts and goalposts. But we will be taking a much more active role in portfolio management and managing our assets and liabilities because we do not want to lose more money and have to eat lentils.

Yes, liability management is something we did not have to worry about much with near-zero interest rates, but it portends to be a real problem soon, especially in mortgage-ladened Singapore where folks have gotten used to cheap home equity to boost portfolio returns. With the yield curve inverted, short end borrowing rates are rising, paying off debt may be cheaper than struggling to find returns.

The first step of our action plan is to raise cash levels and reduce long equity and long bond positions, and keep only those that are less affected by higher interest rates such as the bellwether defensives such as utilities and consumer staples (note that financials do not typically do well with inverted yield curves) or the new FAANG conceived by Doug Kass on Marketwatch: fuel, agriculture, aerospace, nuclear and gold (and other critical metals).

The second step would be to save money and put off all discretionary expenses such as home renovations for the next two years, luxury purchases and high-ticket items such as plastic surgery procedures because they would probably get cheaper during a recession although commodities may continue to soar. Lock in mortgage rates if possible but the Singapore market does not have fixed rates for more than three years after which it reverts to a floating spread plus spread. We decided that we were better off not locking in ours because our loan floating rate margin is relatively tight and it would be a shame to lose, so it is better to just make money from hedges to make up for the shortfall.

Thirdly, to hedge the rising interest rates and inflation. Few of us have access to interest rate markets except for short bonds ETFs. Alternatively, we could be put on a short position on the Nasdaq or growth stocks taking advantage of the market disorientation at the moment because everything is happening too fast and hope that the retail accounts which account for most of the buying are unaware of the credit and bond market meltdown or the reallocation to commodity currencies. The option to invest in a rice mill is also on the table for us and we will be keen to take a close look at it.

Inflation/Stagflation = Higher interest rates = Lower returns. Simple. Nothing is spared. And it is coming soon, so we are worried. It may sound alarmist to sound so dire when GameStop and AMC shares are rising 40 per cent a session and stock markets remain well buoyed but we are convinced this is a window of opportunity. Time to act in the market confusion by rejigging those portfolios and changing our mindsets as we are not prepared to eat lentils or give up the car.