A Reality Check on the Property Market

“In a bubble, all of the conditions that make groups intelligent – independence, diversity, private judgment – disappear.” — James Surowiecki, Wisdom of Crowds

It would be hard to dispute that one of the most talked-about stories in Singapore this week would be that of the 28-year-old Secretlab CEO who snapped up S$51 million in luxury properties last week; a penthouse and a Good Class Bungalow, respectively, prompting a run-up in real estate agency stocks such as Propnex (+9.2 per cent on week) and APAC Realty (+11.75 on week) and BT to do a feature on the goldrush on the Singapore GCB market, that is leaving the majority of the population in the dust.

Source: BT

Source: BT

We would claim we helped him because nearly every parent with children who game and who are on a certain budget would have one of his chairs at home, making him a “tech-hardware” tycoon (chair = hardware). And we should be upset because if we had put that chair money or even the toilet paper stash money into Dogecoin last year, we would be up a nice car by now. But, then again, we are likely the reason why Singapore seems to have fallen off the Global Wealth list to number 10 for mean wealth per adult and 20 for median wealth per adult.

We have ourselves to blame because a dollar at hand today is worth less than it was last year, even though we are fully stocked on toilet paper—it buys a lot less in terms of real assets (stocks, cryptocurrencies, gold, commodities, real estate, art, NFTs and all) even as the MAS announced they remain “highly vigilant” to risks of the rise in Singapore home prices (which does not include GCBs) as preliminary 2Q21 private residential prices rise 0.9 per cent Q/Q.

Real estate agents are venting their frustrations with the sellers because sometime this month, some asking prices were raised by a non-negotiable 10 per cent (from S$6.9 to $7.7 million; a true example). And buyers are crying foul even as most sellers who had sold in the past months have informed us that it has never been so easy to sell above valuation (as much as 10-20 per cent) in such short period. A friend who recently sold a GCB in triple the time was given just 48 hours to decide to part with his investment at a much higher price than he thought it was worth, landing him a hefty 200+ per cent profit on value (assuming he was not leveraged).

What is going on, Singapore?

Rest easy, Singaporeans. Singapore is not where near red-hot compared to the rest of the world and it’s not just GCB’s in Singapore, Rolls-Royces and Bentleys are flying off the shelves as car prices soar in the U.S. and around the world (due to chip shortages and heightened demand).

Source: Fortune

Source: Fortune

The common asinine answer is FOMO or YOLO. Surely, not everyone can summon the cash to buy properties as flagrantly as that especially when a dollar is worth less now (leaving out the folks who have to buy a roof over their heads). How did the monies come about?

When the median Singaporean’s wealth is just about S$100k (including their real estate) and 39 per cent of Americans have less than US$1,000 in savings (was 58 per cent in 2019)? BT just reported that half of Singapore worry over job prospects this weekend. They are unlikely to be home buyers for sure.

Central bankers only talk about the economic crisis, high unemployment, transitory inflation and tepid economic recovery, so what is happening?

We will strive to put it together simply, our little layman hypothesis, with a little help from a few friends who have skin in the game, here goes.

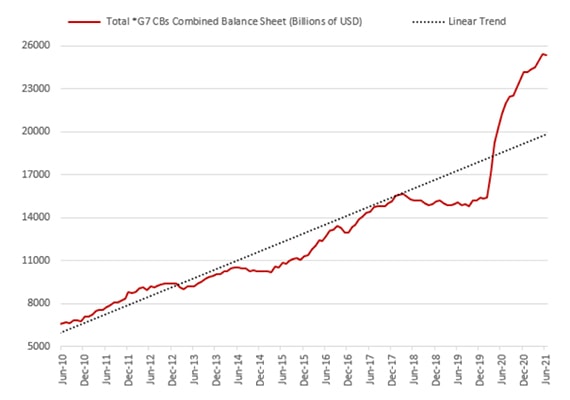

It begins with the Covid-19 pandemic and the financial stimulus undertaken by nearly all the central banks of the world in the past 15 months which will take the total amount of global monetary and fiscal stimulus to about US$30.5 trillion if Biden’s US$600 billion infrastructure plan goes through, according to BofA, with central banks accounting for a large share of it for their bond-buying activity.

Source: Christophe Barraud on Twitter

Source: Christophe Barraud on Twitter

Stimulus is good but bond-buying is better because stimulus needs to be funded with debt and typically, when debt is issued into the markets to pay for stimulus (spending and cheques) injected into the economy, there is a balance achieved. However, when debt is issued to pay for stimulus and that debt is bought back by the government, and thus removed from the market, then the balance is disrupted and we have just the stimulus bit. (Note that Singapore has made it explicitly clear that the stimulus would be financed by reserves and not new debt last year.)

Thus, there is a huge pool of liquidity in the system that finds its way to individuals (stimulus cheques), corporates (loans) and investors who are able to borrow cheaply due to their creditworthiness.

Financial assets would be the place to be in because, with the combination of government stimulus, easy monetary policy (zero rates) and the Covid vaccine comes the hope of recovery. There is the additional reason of inflation to throw into the mix but the biggest factor would be the massive disruption caused by new technologies that have risen in response to Covid and such.

Wealth Creation

The stock market rally saw household net worth jump nearly US$5 trillion in the 1Q21 to a new record of US$136.9 billion led by a US$3.2 trillion gain in the value of equities and nearly US$1 trillion from real estate.

Cryptocurrencies now command nearly US$2 trillion in value compared to paltry billions last year. This is wealth creation at its finest because cryptocurrencies can be valued at anywhere between zero (no value) or the moon (crypto lingo) and we will not start on NFTs and SPACs which are essentially private companies that create wealth for their owners by listing on the stock markets.

This is after U.S. households added US$13.5 trillion in wealth last year, the biggest increase in records going back three decades, according to the WSJ.

Wealth creation will not end with Robinhood’s lenders looking at a 43 per cent windfall once the company lists, a windfall that cannot be realised if the company remained private—we had a bubble tea IPO that created (realised) US$2.4 billion for a Chinese couple last week. There are countless stories with the global IPO market hitting an all-time high of almost US$350 billion for the first half of 2021, eclipsing the previous record of U$282 billion set in the second half of last year.

Private equity deals broke a 40-year record with US$500 billion in new deals for the first half of 2021, which created wealth for all the investors as valuations get realised and freed up to be used.

We will not forget the commodity markets which are arguably the best performers this year with oil back at US$75 a barrel and industrial metals et al. stage impressive comebacks including the humble tomato (+30 per cent on the year), creating a lot of riches for owners of the assets and hedge funds.

Wealth begets wealth, the Japan Government Pension Investment Fund booked a gain of 25 per cent for its year ended March, the most since the fund started managing reserves in 2001, from both stock and bond investments, that will surely be reinvested into other assets.

It does not end, but even if just a fraction of the wealth is deployed into real estate like in the case of our local tech tycoon and all the small-fry investors who made millions in Dogecoin, for example, then real estate prices are justified.

Asset Management

Macquarie just announced a plan to invest more than a billion pounds into the U.K. rental housing market just as Blackstone and pension funds and other institutional investors pile into U.S. markets, pricing out the typical retail investor (who had not made a killing in crypto or stocks or NFTs or whatnot) in the residential space as well as the foray into commercial and logistics assets.

Driven by low bond yields and borrowing costs, there is every reason for credit-worthy institutions to enter the space with access to cheap capital and loans and so on, but we do not think it’s worth delving into this space for the sake of this article.

Fear

We would save the best for last. It is from financial-market-friends-turned-real-estate-investors and their genuine reasons for plunking down their hard-earned monies into rock and mortar over other asset classes with gold coming a close second but for the risk of buying “paper” gold.

The consensus amongst market folks right now is that the situation is getting increasingly untenable as central banks will be ensuring that policy rates will remain low for a very long time for political reasons but mainly for the fact that most in the markets have lost faith in the central banks’ ability to dig itself out of money printing for fear of a populist backlash and markets have paid scant heed to any threats of policy withdrawal given the political repercussions (for those who have not profited from the past 15 months of stimulus). The central banks’ unanimous disregard for inflation when prices and wages are rising is a clear sign.

A conservative but forward-thinking friend invested in not one but three properties lately, two commercial properties in Singapore and Malaysia and a residential unit in London. It is no ordinary decision for allocating his wealth.

Another friend who runs a treasury unit is of the same opinion. Debt can be inflated away and, for that, central banks will live with insane asset valuations.

Real estate is the more sticky asset with less propensity to depreciate (as quickly or suddenly) as stocks, especially when the stock market is chock-a-block stuffed with loss-making companies or companies with zero or negative cash flow.

The only way to preserve wealth (with a decent 70 per cent leverage) is to buy gold or property or land or any hard asset that will not lose its value overnight (unless the sea claims it?).

On the other hand, our other friend who had divested his GCB at xxxx per cent returns envisages fewer potential buyers going ahead even though he still has more than a few more GCBs to go. Not a lot of Singaporeans would be able to afford a S$30 million pop at a time.

He has instead vested himself into some handpicked stocks with decent property exposure for expected returns of just xx per cent.

As for us, we are just glad we finally put this down to paper for posterity.