Getting Ahead with Carry Trades

I was looking at my grandmother, who is a hundred, thinking about the new Mexican 100 year EUR 1.5 bio bond issue, and feeling slightly guilty that I was comparing her to a bond issue.

There are 118 bonds out there right now that were issued with a hundred year maturity, and over a dozen of them have a longer maturity than Mexico’s Mar 2115 end date, all from Europe of course and we have Bolivia coming close with a 2114 maturity for their 99 year bond issued earlier this year denominated in their Bolivian Boliviano.

These grand old countries, Bolivia founded in 1825 and Mexico in 1821, have a right to be doing these 100 year bonds but I cannot see Singapore, founded just 50 years ago, attempting a 100 year bond issue not for any reason more than if the coastline will be swallowed by the rising seas in a hundred years time.

But at 4% (or 3.9% last traded) yield for a 100 year bond, it would be a slow crawl for those coupons, granted that Mexico issued a 100 year GBP 1 bio bond at 5.625% (current yield 5.32%) last year and a 100 year USD 2.68 bio bond at 5.75% (current yield 5.3%) back in 2010.

How do we maximise those gains within our lifetimes when the average yield on US corporate bonds have fallen to 2.94% against the 10 year average of 4.68%?

Enter my bond buddies, the good friends who are masters of the bond game or the carry game, as it is better known as, where returns are not just about the coupon interest but getting the most mileage on the investment via leverage and the currency of leverage.

It is always a good thing when friends do well because friends like me get to share in some of the spoils in the form of some fine 45 year whisky in the process.

I have Russia, this time, to thank for my stroke of luck. The Russian ruble rising 25% from its lows of the year against the USD.Without the exact details, I know that my friend bought the Ruble when it was about 65 vs the USD and it is 53 now, bought a Russian bond which has rallied and probably funded it with the EUR which is dirt cheap to borrow.

It is the return of the carry trade, made popular in recent times by Uridashi bonds, bonds that are denominated in higher yielding foreign currencies and sold directly to yield-starved Japanese investors back in their deflationary years.

Mrs Watanabes became the popular term for the typical Japanese retail investor which was unsurprisingly, the Japanese housewife (because the men had to go to work). And Mrs Watanabes of Japan are experts on the carry game, making big waves in Australia and New Zealand, for they have been accused of causing currency fluctuations many a time.

It was rather simple in the old days, buying AUD against the JPY and getting a 3% rate of return daily just leaving the AUD in the account at 5% (or buying a uridashi bond that yields more), paying JPY interest rates on the shortfall in the JPY account and voila, instant profits when the exchange rates are stable.

Nonetheless this carry trade has gotten many into trouble just this January when the Swiss National Bank decided to abandon their EURCHF peg causing half of Polish and Romanian mortgages funded in Swiss francs to sink underwater on pure currency losses.

What I am sharing is nothing new and perfectly legal and may cause some to wince in pain if they are reminded of personal experiences with say the AUDSGD where the SGD has been a cheap source of funding for Australian real estate and bonds.

Yet it has also been a great source of profits for others and free whisky for me and I feel that it is not an entirely bad thing.

Say if you bought a safe instrument like a Singapore government bond (SGS) last month at 2.5%, the rare occasion that Singapore bonds yielded more than their Australian counterparts. The banks allow you to borrow up to 90% for SGS purchases, so you only need 10% of the capital.

You sell EUR against the SGD required to make the purchase, borrow EUR at 0.5% for 1 month (interbank rate is 0.05%), get a net return of 2% on the money that you had borrowed and another 2.5% return on your 10% of capital. That makes it a 20.5% annualised return on your capital (10%).

The risks that would result in that dreaded margin call from your bank.

- EUR appreciates sharply against the SGD

- The bond depreciates sharply in value

For all the negative hype about carry trades and currency wars that we read about, I think there is a smart way to carry about this profitably.

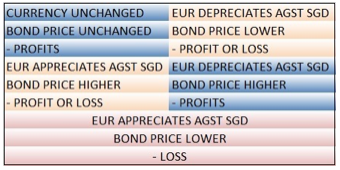

Using my example of the EURSGD carry trade, this is how I typically simplify my decision.

If we work out and assign probabilities to the 5 scenarios, we have a good chance of being on top of the trade and can proactively manage the position advantageously by unwinding the currency trade or the bond trade or both.

I do not like the idea of waiting even 10 years for a bond to mature, to say nothing of a hundred years (bless my grandmother).

Taking an interest in arbitraging the global capital flows like all the pros out there is a good way to get that portfolio ahead.