No Moral Hazard in the Singapore Bond Markets

These months of lockdowns, partial lockdowns and WFH have got us used to things like the pimple on the same spot on the nose that would not go away, from the perpetual mask-wearing. We feel naked without one the moment we step outside along with feeling severe distress when we forget to bring our hand sanitiser or disinfectant spray. Yet more extreme friends feel on edge when the stockpile of toilet paper at home falls precariously under eight packs (of ten rolls each), having adopted the bunker mentality.

For others, it is about getting used to that phone call for a friendly loan or two.

This is just as the markets are getting used to the “Don’t Fight the Fed” mentality, for the US Federal Reserve and the other central banks have turned the markets into an absurd pantomime. Pardon the tautology, and a massive moral hazard in the making because the markets, economy and society would buckle over the minute the money stops flowing into the long list of lending facilities as if the US$3 trillion so far means nothing and the massive balance sheet expansions to date count for nought.

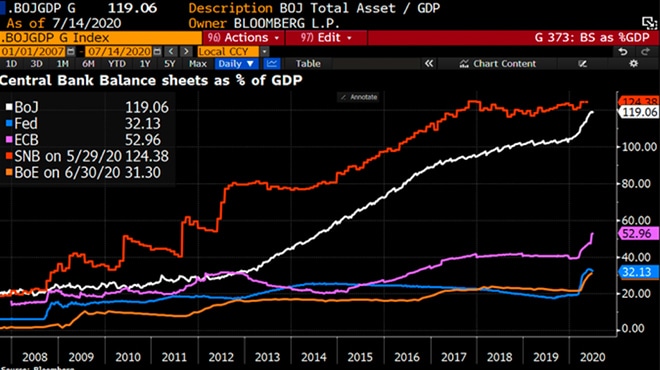

Graph of Central Banks’ Balance Sheets as Percentage over GDP

Graph of Central Banks’ Balance Sheets as Percentage over GDP

The bond-buying programmes, loan programmes, rate cuts and negative rates have “Japanified” bond yields while the German government makes billions annually selling bonds that pay negative returns, creating new problems for banks which are unable to model credit worthiness or delinquencies because ‘data that normally hints at pending losses on loans isn’t obeying the financial world’s usual laws of physics amid a slew of government programs temporarily propping up businesses.’

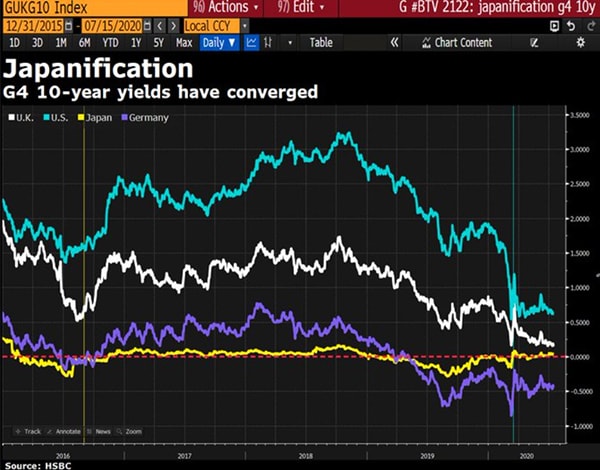

Graph of G4 10 year yields with nothing higher than 0.6%

Graph of G4 10 year yields with nothing higher than 0.6%

Just look at what they have done?

The NASDAQ’s market cap is higher than the EU27 nominal GDP (in US dollar terms) after 20 years (pre-Dotcom); Apple, Amazon, Microsoft and Google combined are larger than Japan’s entire stock market; and Amazon gained an entire Boeing and Tesla gained an entire Ford on July 21. This has spawned an army of “Robinhood” day traders with Charles Schwab reporting new retail brokerage accounts skyrocketing to 1.65 million just in the second quarter, which is more than four times of last year’s 386,000 new accounts as millions of unemployed Americans flood into the stock markets to make extra money. Market pros have all but given up trying with BlackRock’s senior quant seeing “stock valuation a mystery not worth solving” amidst all the warnings on earnings and number of zombie firms (43 per cent of Russell 2000) rallying even harder than profitable companies.

What about debt markets?

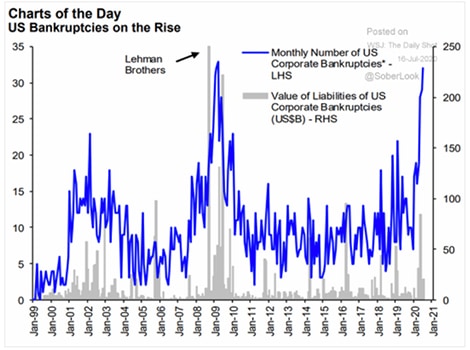

Commercial mortgage delinquencies are near record levels, retails bankruptcies are coming fast and furiously, credit downgrades hit a new record in Q2 as banks record bigger provisions for bad debt but bond markets are happily humming away judging by the tightening of credit spreads for their best returns in a decade since the March sell-off followed by a “torrid rally sparked by the Fed’s announcement in March that it would begin buying corporate debt.”

Source: WSJ

Source: WSJ

As it stands, more than 80 per cent of all developed market government debt yield less than 0.5 per cent and 10-year inflation-linked notes auctioned at -0.93 per cent this week. Yet fixed income ETF inflows reached record levels at BlackRock in 2Q fueling a massive jump in quarterly profits as bond trading in major American banks made record profits from central bank buying programmes.

Despite the moral hazard created for us to forget how bad things were earlier this year, the economy is in an even worse shape now than before. Being described as “dire” by the MAS, with recovery likely to be “slow and uneven,” the rally must go on.

Safe to say, though, we can rest assured knowing there is no more moral hazard in Singapore bond markets. That is because the central bank has not done much to fuel local asset bubbles and Singapore dollar corporate bonds are lagging their international counterparts by a mile.

Indeed in a recent interview, the MD of MAS, Ravi Menon, credited the Federal Reserve for Singapore markets’ lucky escape.

“The corporate bond market, especially the US commercial paper market is important for businesses in Singapore and in the region, who use this market quite actively for dollar funding. There was a period when this was under severe stress. This was not something that we saw even during the Global Financial Crisis. The tightness was real. We were dusting off our contingency plans for a financial crisis, but like I said earlier, thankfully, the Fed stepped in strongly and put in place measures that went even beyond what we saw in the Global Financial Crisis. Very creative new facilities, and that helped to stabilise markets. Swap lines were extended to an additional nine countries, of which Singapore is one—this helped to quite quickly restore the situation. At the same time, we were seeing capital outflows from some of the regional economies, but that also abated. So it was a period of great anxiety and stress for about two to three weeks, but quickly, that came under control in most of the region.”

#DoNothing has been good and bad; good for avoiding the moral hazard central bank-fuelled frenzy and bad for the investor returns which is evident in the Nikko AM SGD IG Corporate Bond ETF (NIKIGCB SP) which has only managed to post a paltry 2.9 per cent total returns year to date compared to 9.6 per cent for the iShares iBoxx US$ IG Corporate Bond ETF (LQD US) that was largely due to FED buying.

The government bonds managed to fare better on #DoNothing with the Singapore Bond Index Fund (SBIF SP) returning 8.2 per cent the year so far compared to the 9.5 per cent iShares US Treasury Bond ETF (GOVT US) delivered.

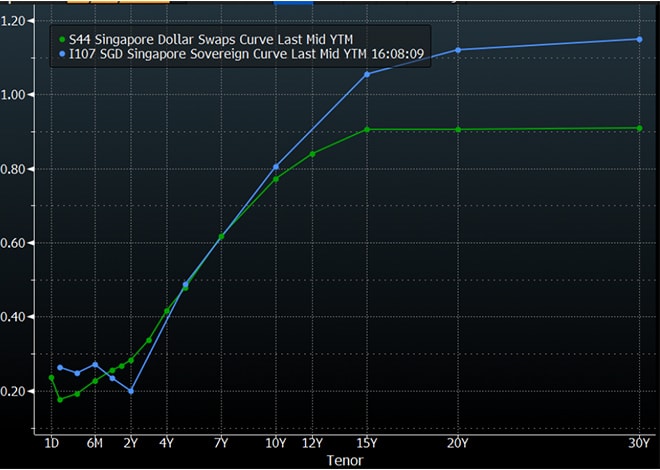

There is less risk of moral hazard because Singapore government bonds yields are one of the higher ones in developed markets and although there is not a single point in the interest rate swaps that are above 1 per cent, we definitely cannot find a single mortgage or loan out there that is under 1 per cent in effective interest rate. Even the latest benchmark SORA (Singapore Overnight Rate Average) home loan has an effective rate of SORA + 1.28 per cent despite a roughly-averaged SORA of 0.0755 per cent for the past 90 days and thus, no willful borrowing will be happening. The same observation for SIBOR-based loans and fixed rate loans which are all >1 per cent.

Graph of the Singapore government bond yields and interest rate swaps. Source: Bloomberg

Graph of the Singapore government bond yields and interest rate swaps. Source: Bloomberg

Even as the government unrolled ESG (Enterprise Singapore) loan programmes for the SMEs as part of the Resilience Budget, taking 90 per cent of loan risks and MAS stepped in to offer cheap funding to banks for those loans at 0.1 per cent, the final lending rates were between 2 to 4.5 per cent, as reported by The Straits Times. This is as US Treasury Secretary suggests the potential moral hazard of forgiving “small” loans distributed (some US$500 bio) with sufficient “fraud protection” for the government. Singapore Inc’s losses would be possibly capped at 90 per cent of S$4.5 bio (size of the programme)?

The prudence also extends to the funding of the various Unity, Resilience, Solidarity and Fortitude budgets which came from past reserves and not a government borrowing spree.

Bonds are not overvalued at all!

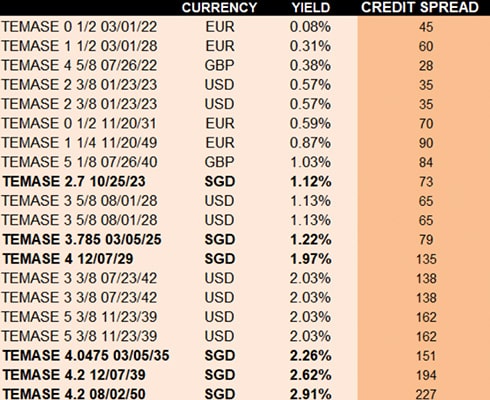

In fact, bonds are cheaper in Singapore dollars than elsewhere as we found Temasek bonds still offered above 2 per cent in yield when the highest yielding government bond scarcely delivers 1.1 per cent.

Table of Temasek bonds indicative yields and credit spreads (unverified). Source: Bloomberg

Table of Temasek bonds indicative yields and credit spreads (unverified). Source: Bloomberg

We were assured that some of them do trade and the market is not crippled despite the complaints we had from portfolio manager friends that the government bond market has seized up and turnover for individual bonds can be as little as 10 mio for a week, if any at all, and prices are as wide as 2 cents versus the recommended 0.6 cents for longer-end papers.

Safe to say, we do not see a bubble there albeit the absence of liquidity.

There is no rush to borrow as well, creating a situation of oversupply, perhaps because there is no central bank demand which has left the primary markets lagging some 40 per cent behind 2019’s run rate, according to Bloomberg. This contrasts the global debt spree abroad with Bloomberg reporting a US$1 trillion glut of just sovereign bonds coming into the markets in the months ahead and Reuters reports an estimated record of US$1 trillion new global corporate debt for 2020, global bond run rate at 48 per cent over 2019 atm (with the exception of Singapore).

Indeed internationally-recognised Temasek-linked companies have been tapping the USD bond markets, names such as PSA, ST Engineering and even, Keppel, rather than borrow at more exorbitant levels onshore, going by the Temasek yield levels above.

That leaves only the lesser-known names with the exception of Swiss Re which have come out to the markets, since all high-quality issuers in the past two months with some tapping on their indirect Temasek ownership links to sell their issues with little moral hazard to worry about.

It is a certainty that the unprecedented levels of intervention we have witnessed around the world in global markets will come to an untimely disaster of sorts. And we cannot be too upset if there is no bubble in Singapore because bubbles are moral hazards.

Singapore has come to acknowledge that #DoNothing is not a bad thing as Minister Chan Chun Sing signalled last week, that “more stimulus may not help amid global risks.” This leaves the markets in good stead to better weather potential meltdowns, perhaps?

For one, there is no moral hazard to be found in Singapore bond markets.