Why Are Singapore Government Bonds One of the Worst Performers in the World This Year?

While we are still on boycott crusade, Deliveroo lost another customer this week, when a friend complained about how her free 20 dollar voucher expired because she did not manage to activate it within a week, missing out the fine print at the bottom of the email, thoroughly disgusted by the company’s lack of sincerity.

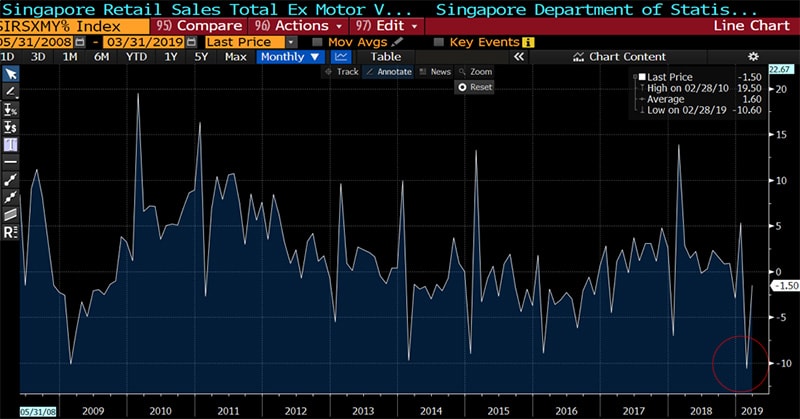

Every cent of savings counts now in Singapore as retail sales registered another yearly decline for March after the largest year on year plunge (since 1998) in February (which was conveniently blamed on the timing of the lunar new year on 5-6 Feb 2019 vs 16-17 Feb 2018).

Graph of Retail Sales Growth Year on Year 2008-2019 (Source: Bloomberg)

Graph of Retail Sales Growth Year on Year 2008-2019 (Source: Bloomberg)

And why should retail sales not collapse? If DBS has hiked mortgage rates some 3-4 times since last year causing folks to feel a bigger monthly pinch, there is no reason to be spending more this year over last year, especially when there is a trade war out there and our investment portfolios are not delivering outsized returns.

Cost-conscious it has become, department store sales slumped 11.8% in Feb and another 4.6% in Mar while grocery sales fell 13.2% in Feb before climbing 0.9% in Mar (to be blamed on Redmart).

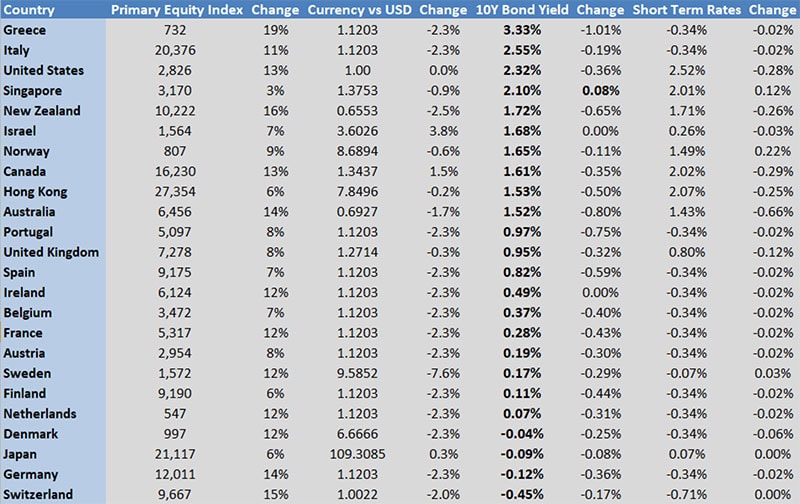

Is that how Singapore government bonds are now one of the worst performers in the world this year?

It cannot be true when we were informed about it by a dear friend and we could not believe our eyes when we dragged out the developed markets summary on Bloomberg.

Developed markets at a glance, sorted by 10 year bond yields (Source: Bloomberg)

Developed markets at a glance, sorted by 10 year bond yields (Source: Bloomberg)

Singapore stands out as the only developed market to have higher bond yields in 2019 (+0.08% so far), with the 4th highest 10Y bond yields at 2.1% in the developed world and 4th ranked for highest short term interest rates, 2.01%. To give foreign investors even less reason to buy, we add the currency depreciation of -0.9% to the risk.

The situation here cannot be as dire as Hong Kong, Canada and the U.S., with their short term rates towering over bond yields and we wonder what is up in the APAC space. Again, Singapore sticks out as the only one with higher yields.

APAC countries at a glance, sorted by 10 year bond yields (Source: Bloomberg)

APAC countries at a glance, sorted by 10 year bond yields (Source: Bloomberg)

Blaming SIBOR

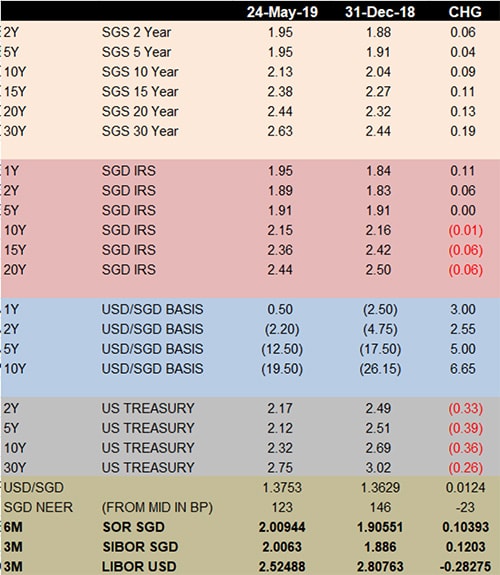

Delving into the details, we glanced at a summary of the Singapore markets and highlighted the culprit in bold below.

Singapore rates and bonds at a glance (accuracy unverified).

Singapore rates and bonds at a glance (accuracy unverified).

Why did SIBOR and SOR rise since December when US LIBOR has fallen? Just as recent as 13 May, 3 month SIBOR took another tiny step higher to break 2% for the first time since 2008.

Chart of 3M SIBOR and 6M SOR 2017-2019 (Source: Bloomberg)

Chart of 3M SIBOR and 6M SOR 2017-2019 (Source: Bloomberg)

That explains part of it, we suppose. The bond markets are just not used to 2% and like we said in With All Due Disrespect to SIBOR and the Mortgage Market last month, “SIBOR has no reason not to stay elevated because it matters little” and it is “sometimes nothing more than a good expert’s guess”.

Blaming Demand and Supply

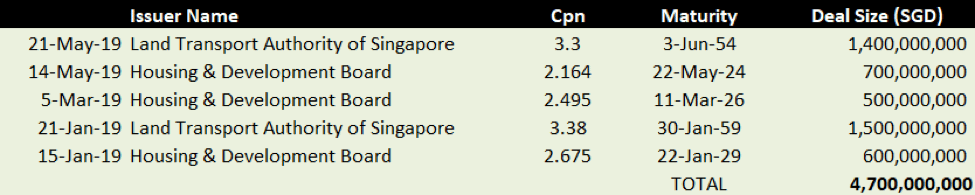

Corporate bond issuance is up 40% in 2019, largely anchored by some gargantuan long-dated stat board issues that are necessary for insurance portfolios and changes in the international insurance accounting standards to a risk-based capital framework (wef 1 Jan 2020) with recalibrations that will create “more conducive environment for insurers to invest in equities and long-dated bonds”, to match their liability profiles.

As such, over 40% of the SGD 11.4 billion issued this year is taken up by LTA and HDB, as we have tabulated below, although we shudder to think of what the markets would be like in 2054 and 2059.

Table of statutory board issuances in 2019 (Source: Bloomberg)

Table of statutory board issuances in 2019 (Source: Bloomberg)

Totaling up the number of SGS auctions we had so far this year which is shaping up to have the potentially the most number of auctions ever, we note that approximately SGD 8 bio of new supply in the absence of any maturities so far in government bonds, with another SGD 3.5 bio to come in the final week of May.

Given the absence of any bond maturities, the market is obviously groaning under the weight of the new government issues and the statutory boards that must have cannibalised demand for government papers, at least for the insurance companies.

Blaming Retail Sales

Investment strings are tight just as purse strings are tightened. This is a 2% world now and money is not free anymore. In the rush for yield we find billions of investor monies going into some cool new products such as the DBS Global Income Note that raised $1 bio in 3 months from retail investors for a minimum investment sum of $50k and available to only accredited DBS clients, and Singapore has their Bill Gross in the making in the DBS CIO Office which makes all the decisions on this fund that pays US 4.25%.

Not to give the same credit to Credit Suisse, the Business Times had a more cautionary headline on their leveraged bond fund which also has 100 issues, like the DBS one, that sold like hotcakes this year as well.

News clippings from May 2019 on DBS and Credit Suisse

News clippings from May 2019 on DBS and Credit Suisse

It all just means No Thank You to government bonds except for the safe haven currencies like the USD, EUR and JPY, leaving SGD out cold even though the public’s appetite for Singapore Savings Bonds is riding high with oversubscription in the past 3 months.

We Do Not Know Why

The truth is that we do not really know why except for all the reasons. We do know that there will be big maturities coming up in June though with a SGD 8.7 bio maturity of a government bond and around SGD 2.7 bio worth of corporate bonds coming due although we do not hold too much hope for SIBOR to head lower unless the experts say so.

Still, it works out because Singapore does not have a monetary policy and this makes Singapore less of a “U.S.-labelled currency manipulator” despite a foreign exchange policy because there is obviously little manipulation this time around.

Other folks blame the collapsing global M1 growth and others blame the weakening SGD dollar but perhaps the majority of institutions and individuals just do not have the spare funds to buy too many government bonds at the moment.

Maybe it is just that simple.