My Education From A Bond Seminar

The good fortune of residing in Singapore struck me when I saw a policeman the other day who was quite little, whom I suppose would have a hard time if he had to confront larger-sized suspects and I started picturing those riots in the US, my heart going out to them and the relatively tougher job of a US policeman.

*******

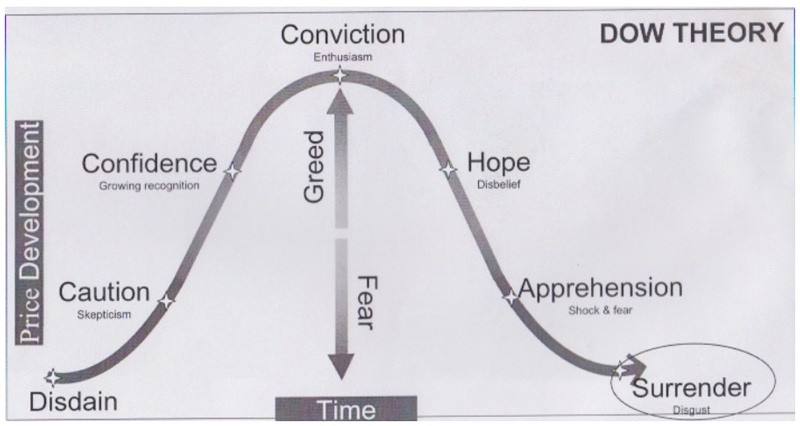

We conducted a bond seminar over the weekend which was refreshing despite reeling from the shocking US Non Farm Payrolls number on Friday night, a number too good to believe in that it had to be unreal, discounted and interest rates headed back even lower than ever, markets trading on heightened fear of the unknown, reminding me of the “surrender” mode in an old trading psyche chart.

Yes, I am quite sure we will be able to make light of the situation after as the summer holidays approach and weary reporters will take a break from committing glaring errors such as reporting German services PMI “falling” to 53.7 when it was really higher than the prior month.

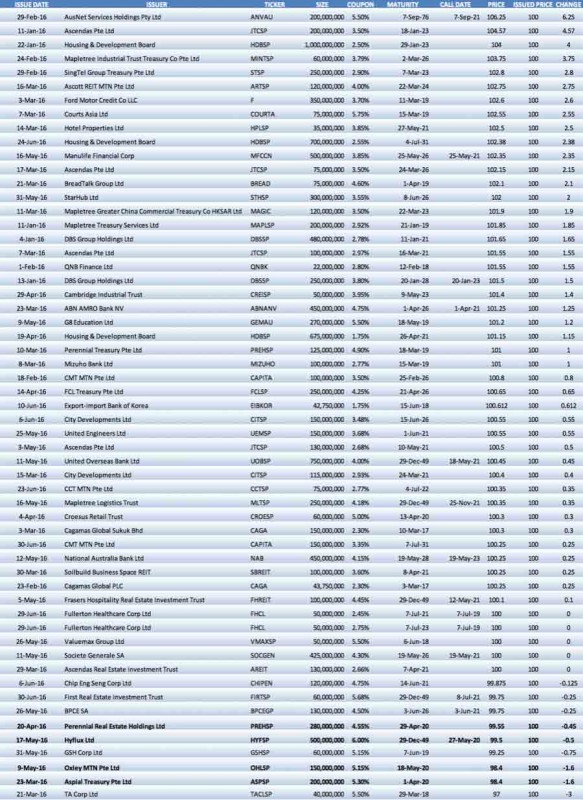

People who attend bond seminars do so with the aim of improving their education amongst other things and it was hilarious when a certain market professional had to admit there was little education needed to figure out the Singapore bond markets.

A story was shared that a relatively senior sales person was overheard commenting that if a corporate bond is issued at 100, then its price should not change after the issuance no matter what, and letting the price drop is “not good”. And so the Singapore market trend of keeping prices afloat after issuance, much like the stock markets where we have price support after an IPO.

Nobody would have much to complain about including the trading desks and banks because when prices do not change, risk numbers such as VAR (Value at Risk), look magically “unvolatile” and it would work out well except for poor me, teaching about interest rates and credit spreads at the seminar—concepts that cannot be applied in Singapore space.

Yet customers lose interest in unchanging prices which defy logic, in a market where they cannot profit when interest rates collapse as what happened in June and credit spreads generally improved, and we had bond prices rising around the world except Singapore, with bankers rushing to assure clients that they should be happy that they have not lost money on their investments whose prices have held up, not knowing that clients can attend seminars that teach them a little about credit spreads these days.

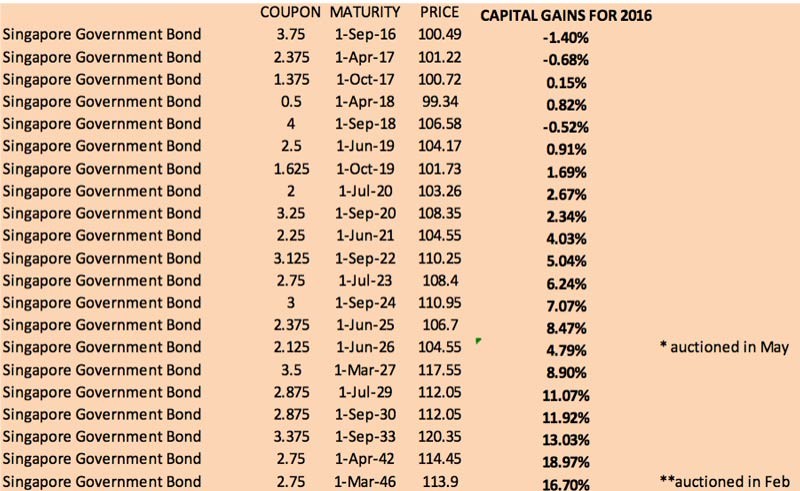

In a year that would have been best for the MAS to boost retail bond investor confidence, the Singapore corporate bond markets have little to show against ATM-IPO- available 30 year SGD Government bonds which have rallied for their IPO price of 97.59 in Feb to its current 113.50 price level, a sterling (thanks to Brexit and the other Sterling) return of 16.7% on capital gains alone.

Even the new 10Y SGD govi, issued on the 1st of June has delivered capital returns of nearly 5% for the month, outperforming every single corporate bond issued in Singapore for the record breaking month of May 2016 (largest monthly issuance of SGD 4.8 bio).

It did my job of justifying a bond seminar so much easier because the idea is to learn how to spot mis-pricings and we can safely say, that but for a small handful of names like Manulife 2026, most of the bonds issued in 2016 have under-performed in terms of their credit spreads, many of which are wider than their USD bond equivalents.

Time for the best performing bonds of the year besides the govis and here is a little table summary we did, with SGX traded retail bonds highlighted in bold. And retail bonds fared the worst in the “year that would have been best for the MAS to boost retail bond investor confidence”.

Perhaps the underperformance can be attributed to “market distortion” as the Straits Times put it in June.

Image taken from straitstimes.com

While the top arranging banks in Singapore claim that the Singdollar bond market is “still quite unaffected by the situation” and the market remains “resilient” in the Straits Times today, they are probably referring to the fact that prices will not be changing, corroborating the overheard comments mentioned above.

It may not be doing buyers any favours because bonds issued when interest rates were higher see their credit deteriorate away (in spite of the positive “distortions”) and we have Temasek bonds like ST Telemedia widening nearly 0.5% and Capitaland will have to pay more to issue in SGD compared to USD at rate their bonds are going even though Temasek recently wrote up their investment in ST Telemedia by 1 bio dollars in their annual review and Capitaland’s reits have outperformed on the month.

The distortions continue with Singapore Airlines paying about half of Capitaland and gang despite the recent rally in oil prices that surely cannot be too good for the airline sector? Just as another example.

For a bond seminar designed to boost investor confidence, I would admit it did a better job in the intimidation front, when an investor would be mildly shocked to find that the market operates in such a haphazard manner, although I did hasten to assure that logic ultimately prevails and value investing will pay off in the Singapore bond markets if we do our homework and ignore what those senior sales people say about how bond prices should work, granted that they would definitely have comfortable retirement jobs in the equity marketplace with their pricing mindsets.

The news assures us that there will be more issues coming up in the near future with interest rates 0.5 to 0.95% lower since Jan this year. For me, I shall just bask in the slight gratification that my friends will be able to discern value in a country and a market where a robber robs without a gun.

And oh, did I mention there will be a SGD 20Y govi auction at the end of the month?