Singapore Bonds and Rates: 2018 Recap and What to Expect in 2019

No one is happy with anything this year and it is difficult to even start figuring out how everything went wrong or if we are in an existential crisis that we mentioned in our outlook last year. And somehow, if we think hard enough to work it out, we may even find ourselves back to the square one a decade ago and the financial crisis which has brought us years of largesse to come to a reckoning in 2018.

Looking back at this time last year, we can safely say 2017 was truly a fairytale come true, from Bitcoin to en-blocs to junk bonds and all things tech and fintech.

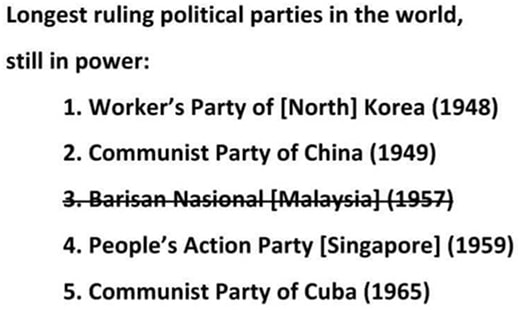

2018 had Singapore markets caught up in global political crosswinds that left no corner unturned, from the far reaches of America, to our northern neighbour, Malaysia which held the title of the longest ruling elected political party in the world till May this year, to our own shores and the topic of political succession to the current longest democratically-elected ruling political party in the world.

Source: Quora

Source: Quora

Thank goodness for stable politics and policies that played a part in keeping markets orderly and growth stable for all seemingly endless days of grief we have suffered for most of 2018 had has stripped us of any hope for semblances of normality to return in 2019 as we note the MAS 2018 Financial Stability Review is just a short 96 pages compared to the 115 pages of good news we received in 2017.

There cannot be too much to say, really, as we will keep this short.

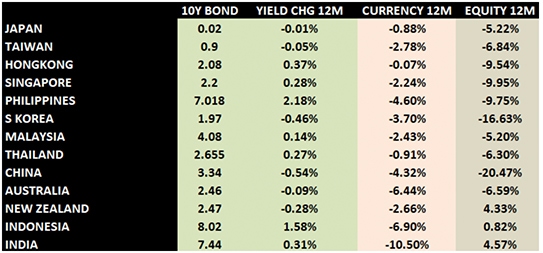

Recap for the Year: Regional Markets at a Glance

Singapore markets may be caught in global markets crossfire but are largely spared the “extremes” that some other regional markets are subject to, with a relatively neutral performance.

Economy at a Glance

Graph of GDP, PMI, Unemployment, Industrial Production and CPI.

Graph of GDP, PMI, Unemployment, Industrial Production and CPI.

With PMI and Industrial Production tailing off and GDP tipping lower, Singapore will still benefit for the last quarter (at least) while trade wars drag on although it would be a stretch to hazard a guess for the months that lie ahead.

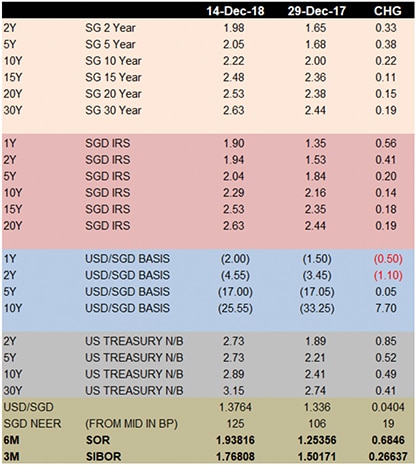

Rates and Currency at a Glance

- SGD rates outperformed the US again

- SGS underperformed SGD interest rates swaps (IRS) again

- 10 year highs in 1Y (2.03%) and 2Y (2.24%) IRS, 1Y (2.07%), 2Y (2.12%) and 5Y (2.41%) SGS

- SOR rose 0.685% to a new 10 year high (1.99944% on 22 Nov)

- The SGD dollar fell 2.24% against the USD

- SGD NEER strengthened against the basket of currencies

On the bright side, only about half dozen currencies beat the SGD dollar this year and these are just the USD, HK dollar, JP yen, Swiss franc, Thai baht and Gold, by a small margin. We can be sure it is partly to do with the 2 “slight” increases in the slope of the S$NEER policy band this year after a 2-year drought. And 2 “slight” increase = 1 normal increase, or tightening as some people like to say.

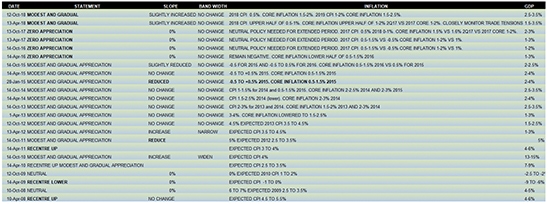

Table of MAS policy statements since 2008

Table of MAS policy statements since 2008

Government Bonds

Government bonds would have appeared to have lost out but it is not as it seems, really. The curve flattening handed over handsome profits to all participants in SGS bond auctions for everything above 2 years.

For instance, the 30-year bond has delivered capital gains of over 6% since its auction in February this year, followed by the 20 year bond with 4.3% profits since June with the 10-year auction in April giving 3.5% and the 15-year paper up 3.2%, in just pure capital gains.

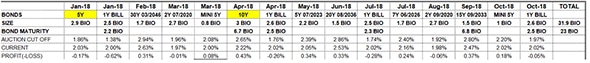

Table of SGS issuance and their performance in 2018

Table of SGS issuance and their performance in 2018

2018 saw the heaviest SGS auction calendar in the history with MAS throwing in 2 mini auctions to bring SGD 31.9 bio into the market versus just SGD 23 bio in maturities.

Is it no wonder that corporate bonds have fallen out of favour? Even for Temasek papers, as we check out their massive underperformance against the SGS in SG dollar bond space.

Price of 20Y SGS vs Temasek paper in SGD sourced from Bloomberg.

Price of 20Y SGS vs Temasek paper in SGD sourced from Bloomberg.

Fortunately, HDB papers are not displaying the same underperformance as Temasek.

Yet it really does look like it would have been more astute to have participated in SGS auctions over corporate bonds this year because more than half those 90 odd new issuances are under water for the year and even the most profitable ones like the new Shangrila 7Y bond does not come close to the 6% capital gains that we saw in SGS auctions.

We will leave that story for another time.

The 2018 Verdict

Last year we called for an existential crisis in 2018 and we do not know what we were talking about then, to be indulgently self-critical.

We called for 20-30 bp correction in the SGS which was easy enough because 10-year yields started 2016 at 2.6% and ended 2017 at 2.04% which made a 20-30 bp correction a reversion to mean. SGS yields rose 11 to 38 bp for the year.

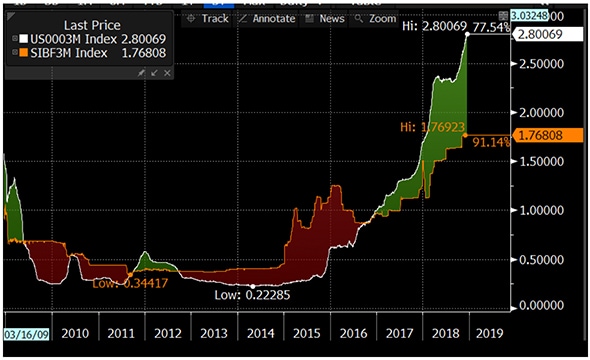

We called for SIBOR to cease to desist the LIBOR trend and we were wrong because the difference between 3M SIBOR and LIBOR broke a new record and sits at its widest in 10 years as we speak at a differential of 1.03%, a new record set on Friday.

10-year graph of 3M Libor vs SIBOR

10-year graph of 3M Libor vs SIBOR

We called for the MAS bills to behave more like a safe haven government bond and trade under SIBOR but it has not happened since early May and appears very comfortable in higher yield space that is not available to retail investors (because MAS bills can only be bought by institutional investors and don’t ask us why).

Graph of 3M MAS bill vs 3M SIBOR

Graph of 3M MAS bill vs 3M SIBOR

We called for the USDSGD to test lower in 2018 but we should have qualified it as a strengthening of the S$NEER instead because USDSGD did trend along with the ADXY as we had said.

2019 Big Bang

2019 can only start with a bang because we have the new 116th US Democratic-led Congress starting work on 3rd Jan 2019 and we will just have to wait and see, really, as Paris riots enter the 5th week, Brexit remains unresolved and we have chaos around the world from Sweden snap elections to Venezuela. That is just politics, what about central banks and markets?

The 2019 bond auction calendar is set to be a landmark one because we have the largest maturity in history coming up—some SGD 26 bio worth, compared to the previous record of SGD 23 bio in 2017.

As such, MAS conveniently slotted in 1 extra auction in October, on top of the 2 optional mini auctions in the year. What a busy, busy year ahead.

![]() Bond auctions to expect in 2019.

Bond auctions to expect in 2019.

What is surprising is that MAS has chosen not to extend the yield curve as popularly expected given the 3 ultra-long-dated LTA bond issues in 2018, namely the LTA 2048 (SGD 1.2 bio), 2053 (SGD 1 bio) and 2058 (SGD 1.3 bio).

Yet this will be the first time in 3 years that MAS will issue a new 20 year SGS.

We suppose it suggests that MAS and the markets prefer to leave the >30 year part of the curve alone yet at the same time cannot afford to let governments like the US go borrow another US$1 trillion to fund their projected deficit to reduce Singapore’s share of global bond markets.

As it stands, Singapore’s outstanding government borrowings have grown just 25.3% from March 2015 (S$ 192.1 bio) to September 2018 (S$240.8 bio), as the corporate bond market expanded a more modest 19.4%.

However, there is no reason to expect SGD interest rates or other global rates for the matter to rise by a lot because they already swap to a much higher equivalent in USD terms, which in other words, means that it is more worthwhile for an investor to buy a SGS at a lower yield and hedge it for currency risk to receive a much higher yield than a US treasury bond.

In addition, we have global credit markets on the cusp of a sustained correction, to be politically correct and non-alarmist, which would keep central bankers on hold from being too hawkish.

The big-time qualifier to that argument would be all the other risks around, nasty political impasses, populist movements and corporate scandals that seem to be mounting as the tide flows out and we see those who have been swimming naked, to borrow from Warren Buffet.

What about the liquidity? Where is all that money to buy bonds going to come from? A thought we are still pondering on since we wrote about Asset Rich and Cash Poor Markets. Do we expect SIBOR to fall when it is already running a 1% gap against LIBOR or become any more accessible to borrowers?

For those reasons, we would not expect 2019 to deliver those 6% SGS auction returns but we forgot to mention that would have only rewarded the buyer if they did not chicken out in the meltdown in between. And it is really 6% as of Friday, not knowing how prices will shape up in the days ahead.

Also, we cannot see USDSGD heading much lower than 1.33 (we are at 1.3764) and SIBOR to fall lower which when coupled with weaker bond appetite and excess supply, we would expect interest rates to remain stable and bond swap spreads to outperform later in the year when supply tones down.

A Last Word

We cannot believe 2018 is all but over in spite of the final FOMC and a possible rate hike in the US next week.

2017 has been a real Alice in Wonderland experience and we are still hard trying to figure out the extent of the existential crisis of 2018 before the year ends but shhh… 2019 is almost here.