A Bit on the Repo Market Fiasco, SOFR, SORA and Why It Matters

Absurdity rules the world as wildfires rage on all continents (Alaska, Congo, Greece, Indonesia, Amazon, Australia, Siberia etc) of the world except Antarctica and vapers are turning to cigarettes to wean themselves off the “healthier” soon-to-be-banned-and-bankrupted Juuls for the spare of mysterious lung diseases? Smoke away because burning is a new trend?

Source: Quartz

Source: Quartz

While we are scratching our heads wondering why would Iran be so stupid to attack a Saudi refinery with clearly China or Russian made battle drones, which they denied but Trump insisted, Opioid maker Purdue Pharma went bust to wipe out over 2,000 lawsuits just as conveniently as convicted Jeff Epstein was found hung. But the clear winner of the week would be the repo fiasco on Tuesday (a day before the FOMC) when overnight GC (general collateral) rates spiked to 10% on Tuesday, leading the Federal Reserve to conduct their first overnight repo (short for repurchase agreement) operation (technically, reverse repo by definition) for the first time in a decade to relieve the funding crisis with daily injections of up to US$ 75 billion until 10 October even after a rate cut on Wednesday. Then on Friday, the Fed went on to offer a further US$ 90 billion in 2-week reverse repos to reduce market strain.

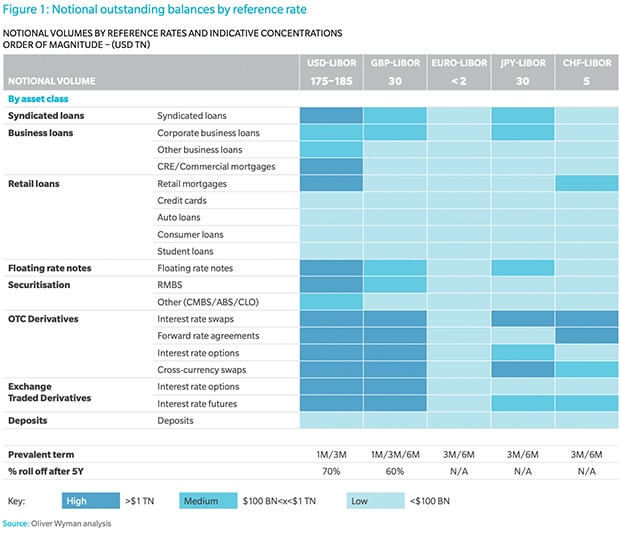

Hola, it was when we realise that 9 out of 10 folks on the street do not know much about repos or that the repo markets are the heartbeat of market liquidity and that this so-called overnight repo is in fact the proposed replacement rate for none other than LIBOR! Called the Secured Overnight Funding Rate (SOFR), it will be the new risk-free rate (RFR) to be used as the benchmark of an estimated US$ 240 trillion of wholesale and retail financial products, according to Oliver Wyman, from complex derivatives to simple loans although the method of use has yet to be decided (for instance, it could be averaged or weighted average to smooth out fluctuations).

Source: Oliver Wyman

Source: Oliver Wyman

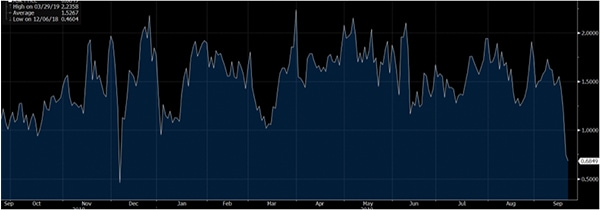

So this so-called risk-free rate, SOFR has been likened to the Effective Federal Funds Rate (EFFR) but has somehow failed to live up the stability of the EFFR since the Fed began publishing data in March 2018 as evidenced in the graph below.

Graph of SOFR vs Fed Fund Rate. Source: Bloomberg

Graph of SOFR vs Fed Fund Rate. Source: Bloomberg

Such volatility and such headaches to expect for poor derivative traders around the world and let’s not even think about the poor loan books living through the whipsaw price actions that can only be brought under control by dreaded central bank intervention in free markets that makes China look firmly in charge these days. As a slap to their face, the SOFR was endorsed by a NY Fed working group to be used in adjustable-rate mortgages in August as a replacement for LIBOR.

It is clear the Fed has lost the plot because it is only doing soul searching after the event with the president of the New York Fed (the one running the repo operation), John Williams, questioning, in an interview with FT, why banks with excess cash did not step up to ease market strains earlier in the week even when there was a “concentration of excess cash at a small number of banks”.

Bingo. “JPMorgan Chase and Citigroup, both large holders of excess reserves, declined to comment. Bank of America was not immediately available for comment”.

As veterans of the Asian Crisis and all the crises to follow, we can tell you point-blank, the main priority when we see anomalies like repo-rates at 10% when Fed Funds is at 2%, is to protect the bank, to paraphrase from the FT article’s quote from a trader that they “have to make economic decisions for the company”. Golly, who knows what is happening out there to cause such dysfunction and we are not employed by Santa Claus and could lose our jobs for doing something as silly as to lend money to save the world, let alone greedy markets.

A Bit about Repos…

Repos are only known to a small group of traders in the entire universe of trading because of its lack of relevance to their products—e.g. derivatives and forex. It is short for repurchase agreement which is defined by the International Capital Market Association (ICMA) as “one party sells an asset (usually fixed-income securities) to another party at one price and commits to repurchase the same or another part of the same asset from the second party at a different price at a future date or (in the case of an open repo) on demand”. The seller retains owner and risk on the asset which is usually a security. And the converse of repo would be the reverse-repo where the party buys the asset.

Looking at the transaction, it looks like a borrowing and lending and thus, it can also be referred to as a securitised borrowing or lending, by the fact that securities are “pledged” in exchange for cash.

It looks like boring balance sheet stuff so we would not be surprised if more than a handful of bond traders including corporate bond traders, do not even bother with repos (not just government repos) because the funding they need is taken care of, by the repo desk, of course.

For the layman, the closest this arrangement comes to would be the leverage or borrowing value for your bond purchases. Now you are sitting up.

Yes, it would be similar to the funding arrangement you make with your banker to finance your bond purchases while paying only a fraction of the cost of the purchase,

Yes, that term is called the haircut, in the repo world. How much your securities can secure when pledged for cash although it is hardly used in the wholesale market.

You see, there are just 4 uses of a repo, as suggested by the ICMA. Succinctly, as a safe investment (because you can lend against a collateral), a cheap borrowing (because you are pledging your assets which is similar to mortgage arrangements), yield enhancement (because you can borrow money to make more money) and, to cover short positions (specific short positions if you happen to short sell).

The users of the repo market so far, have been financial institutions including hedge funds and insurance companies, because a repo can only be transacted if you have a bilateral agreement (otherwise known as a GMRA and its alternatives) with each another. After all, you cannot be lending money to any Tom, Dick or Harry just because they need cash.

That is why no one cared about repos till…

With repos being on-balance-sheet (meaning physical cash exchanges hands) versus derivatives which are off-balance-sheet (no cash changes hands), it is not difficult to guess that a derivative trader would not have given much thought to the repo market and similar to the bond trader unless they were active in bond futures that need repo rates imputed into future prices (which has more or less been assumed to be a given until you realise, like ourselves recently, that the imputed rates were like -30% which accounted for some huge basis difference between the cash price changes and the futures price changes—a discussion for another day or never or give us a call).

What about Singapore?

Repos are pretty much impossible in hazy Singapore with 3 sets of interest rates now, as we speak, SIBOR, SOR and the new SORA, not including t-bills and MAS-bills.

Just look at the 1-month SIBOR versus SOR curve in the past year.

1 month SIBOR vs SOR curve for past 12 months. Source: Bloomberg

1 month SIBOR vs SOR curve for past 12 months. Source: Bloomberg

Now how do real repo transactions even happen in Singapore?

We have a bunch of banks who have USD and a bunch of bank (mainly local banks) who have a lot of SGD.

1-month SIBOR did not even budge after the Fed cut their rates on Wednesday but nobody cares unless they have a vested interest in SIBOR which is essentially, only everybody in Singapore but nowhere outside Singapore because no one outside Singapore can access SIBOR unless they bought a Singapore asset under SGD 5 million dollars (which in other words is known as the Non-Internationlisation of the SGD dollar policy—Notice 757).

Then we have the MAS (Monetary Authority of Singapore) setting up a steering committee to transition SOR to SORA (Singapore Overnight Rate Average) at the end of August.

Source: MAS

Source: MAS

So it means that SORA will be torn between SOR and SIBOR and of course, SORA has collapsed in the past days.

Singapore SORA chart. Source: Bloomberg

Singapore SORA chart. Source: Bloomberg

SORA collapsed because people were dumping their SGD dollars to borrow US dollars against the grain of the higher SOFR.

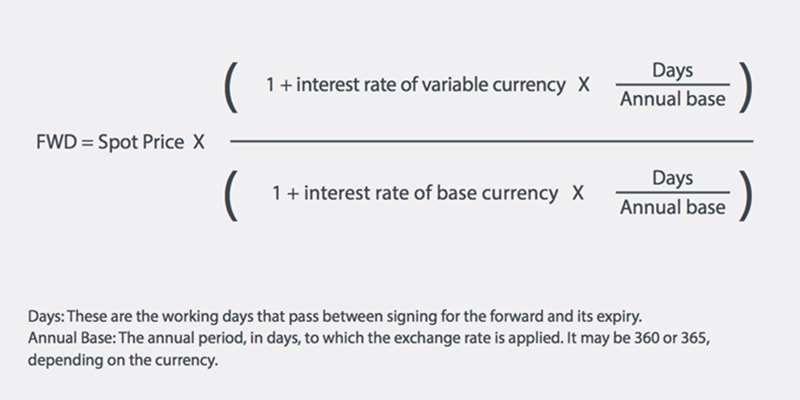

Not so much a conundrum to us because we will be a little rude here because we are not tuition teachers, and a little generous at the same time, to present you with the not so proprietary formula of fx forwards and forward pips.

Source: Kantox.com

Source: Kantox.com

What crazy days we have ahead.

Yet, if you really want to know, it is not the first time we had problems with the repo markets except that it has always happened outside the US and in an extended manner to warrant a Fed intervention, onshore. Severe currency basis issues have happened several times in the past decade and we should have taken the JPY basis problems last month as a clear sign, except everyone was too preoccupied with so many other of last month’s issues.

Sadly, and saddeningly, the problem with switching to this SOFR and SORA thing is that the public never had much information about repo rates in the first place and thus, along with bond, derivative and forex traders, cannot be blamed for not being aware.

That is a story for another day, but thank goodness we know a bit about repos and we figured out the whole gestalt for Singapore which we would not share for less than 5 million bucks (5 million is the new 1 million), or do a whole seminar on it for the right price. We would not guarantee you would make money except that you might just be a little smarter or informed.