Capital Controls, Half The World and The USD

All these asset bubbles around the world as we see the Chinese buy up real estate, wines and everything they can lay their hands on. And it is not just the Chinese, the Arabs and Russians were in a mad grab too and it is no wonder that Malaysians were the 3rd largest investors in UK and Australian property, after Singapore and China.

They have been selling! Although at least three funds active in London property appear to have some exposure to 1MDB’s multibillion-dollar debts, there is no evidence of wrongdoing at any of them. All face calls from the government to invest more at home to jump-start growth after the plunge in world oil prices and the value of the Malaysian ringgit—Malaysia First!

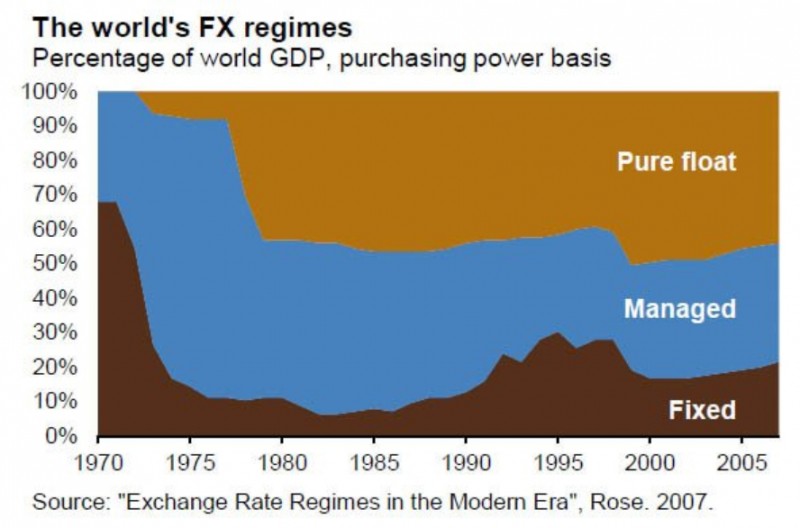

Living in a free country with a free economy , we cannot imagine a world of financial restrictions that half the world are living in with only half of the world’s GDP uses floating exchange rates (including the US which is 15% of total) until we consider the financial stability aspect for economic powerhouses like India, China or Russia, if capital flows were freely allowed.

With citizens hoarding cash for reasons that they do not trust their banks, or just because they do not trust their own currencies, or their governments (such as Zimbabwe with their trillion dollar bills), or they would just prefer a separate store of wealth.

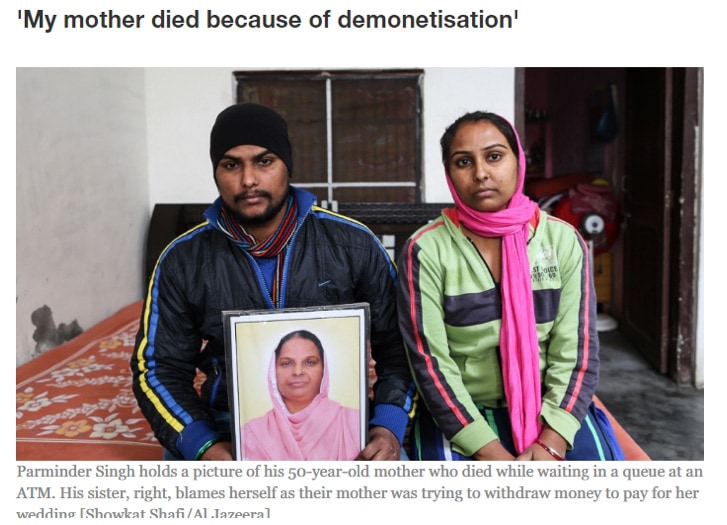

We cannot imagine that the Indians would be stashing their cash at home that abolishing the INR500 and 1,000 rupee notes would inflict so many deaths, reported and unreported. Are they afraid of their banks, or is the money illegally obtained, or is it tax avoidance or simply, the abusive spouse?

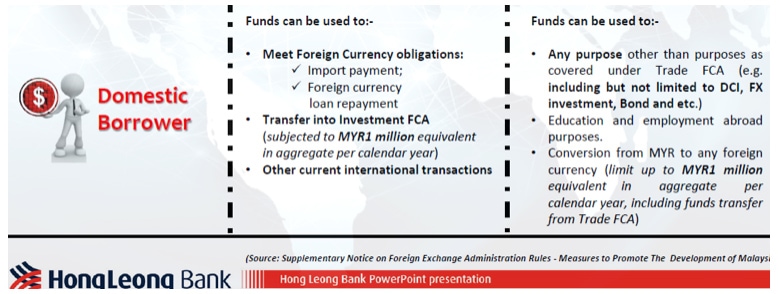

The recent Malaysian ringgit crackdown where the Malaysia central bank, Bank Negara, asked foreign banks to commit to stop trading the ringgit, may have stabilised the currency but it came with a heavy price of the biggest 2 months of outflows from Malaysian debt since 2008.

Now we know why Malaysian investors are anxious—because they really do not have a lot of options, if they have domestic borrowings of any sort.

Courtesy of HL Bank

For more details.

We know there is desperation when we read the headlines like the one below.

Gold is more or less banned in India!

“In a recent notification, government has made it clear that any ownership of jewellery above 500 grams of gold per married woman will be put under the microscopic scrutiny of tax authorities.

Steep taxes and penalties will be imposed on those who cannot prove the source of their gold. In India’s Orwellian new-speak this means that because bullion has not been explicitly mentioned, its ownership will be deemed to be illegal. Courts will do what Modi wants. Huge bribes will have to be paid.”

And India will not be the first because we had Argentina in 2012 and of course, the United States Gold Reserve Act of 1934 which lasted till 1975 before Americans could own gold again.

Capital Controls

Investopedia defines capital controls as measures taken by a government, central bank or other regulatory body to limit the flow of foreign capital in and out of the domestic economy which include taxes, tariffs, outright legislation and volume restrictions, as well as market-based forces that could affect many asset classes such as equities, bonds and foreign exchange trades.

Honest folks would just admit it does not explain a lot. It is simply just not possible to have a single definition given the countless possibilities we have, for us to recognise that it is just about free markets.

And the fixation continues as the Chinese continue to splurge on wines and vineyards, buy overseas real estate at inflated prices, from mining resources to pig farms in America, entertainment companies and JB condominium cities, as the idea of capital controls sends chills down investors’ spines, as it also happens that the top 20 non-corrupt countries in the world have more or less free exchange rate regimes (except for Singapore).

Source: Wikipedia

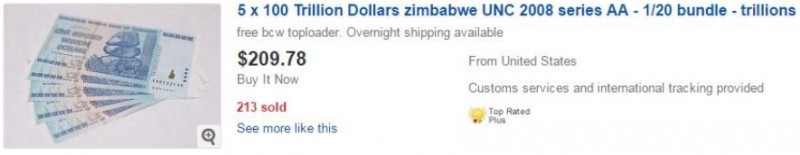

And we have living proof in Venezuela, once the richest country in South America, sank to eating dogs and hunting flamingos and anteaters for food as their president pulled their largest banknotes from circulation in times of hyperinflation, to prevent cash hoarding, perhaps taking a lesson out of Zimbabwe’s books where trillion dollar notes are worth more on eBay as souvenirs than their actual purchasing power, which is less than the paper they are printed on (note is obsolete).

Last known monetary value of 1 trillion = USD $0.40

As we write, we cannot imagine the plight of the Greeks when their ATM withdrawals were limited to €60 (https://fortune.com/2015/06/29/greece-atm-lines/) a day back in 2015 and Cypriots were bailed-in with a one-time deposit tax to help their ailing banks.

Coming To The Point

It is not to soon to address the capital control issue in 2017 and there will be no chickening out of it because Donald Trump is building walls, calling for trade wars and calling for America First.

One of Trump’s biggest “pre-election economic plans included a special one-off tax holiday, allowing U.S. firms to repatriate funds held overseas with only a 10% payment, versus the current 35% rate.”

We may say the US$2.6 trillion, if repatriated, will not affect fx rates by much because we know that American companies keep their USD outside America in the form of USD yet, nonetheless, this is USD in the banking systems of Singapore, Hong Kong, Caymans, Ireland, Luxembourg and where you may have it.

More importantly, this offshore USD has been re-circulated into the financial markets outside the US instead of onshore in the US.

As individual investors, we should be asking what will happen when cheap USD outside America goes home?

Yes, there will be a minor financial market earthquake as Apple takes USD 1 bio out of Morgan Stanley in Singapore and transfers it to JP Morgan, New York, for example, because the USD is probably stuck in an Asian loan somewhere and we get the gist.

Initial mayhem, followed by longer term repercussions as companies reassess their choice of funding currencies and we have the Chinese frantically boosting their onshore bond markets in broad sweeping reforms which have been viewed by skeptics as a bubble, but is it?

The PBoC has also taken the first step by hiking interest rates for 2017, with the Fed still twiddling their thumbs, demonstrating a certain foresight to get people used to their own currencies and worry less about money that they cannot use onshore?

And we know that China is getting serious when we have real estate sales in the rest of the world plummeting and Bitcoin taking a beating after the PBoC warned investors.

It is impossible to foretell the distant future but it would not be too presumptuous to imagine that America First means Emerging Markets Last, as Nomura put it and capital controls will be hanging around or padded on as we are seeing in Malaysia, India and China, until their systems are fixed, as money tries to flee which means China would have to ban overseas insurance policies next?

And we will have more capital controls coming, at this rate, pre-empting Trump’s agenda means we have only half the world to buy, of which, USD takes up 15%!