First World Problems: The Kid or The Ferrari

Over drinks in a well-heeled neighbourhood, a child wailed “No, no!”—breaking the peace of the night as the angry father shouted and whipped the boy. Is it PSLE season? The child probably convulsed, and only the father’s yells lingered.

Looking back at the child-rearing years, we can only understand why our young friends are choosing designer pets over children like the Poshie (Sheltie Pom) in front of us, at a premium of $10k for the blue merle coat, $1k for dental and more for doggy daycare and all.

A wealthy friend lamented to us some years back that he was only driving a Porsche because his three kids cost him about a Ferrari each. We did not quite understand but made a mental note to revisit it one day—in the wake of China’s abrupt draconian push in the child sector, which will impact an entire generation and generations to come; clamping down on private tuition, gaming, pop culture, idol worship, plastic surgery and all things unwholesome.

It was fortuitous for us that our dear friend who has been addressing mental health issues was willing to share, for one of her issues is the empty nest of singlehood given her child will be going abroad.

We decided to test the Ferrari claim without putting a price on the stress, emotions, time vested and other non-monetary burdens of child-rearing by doing the math.

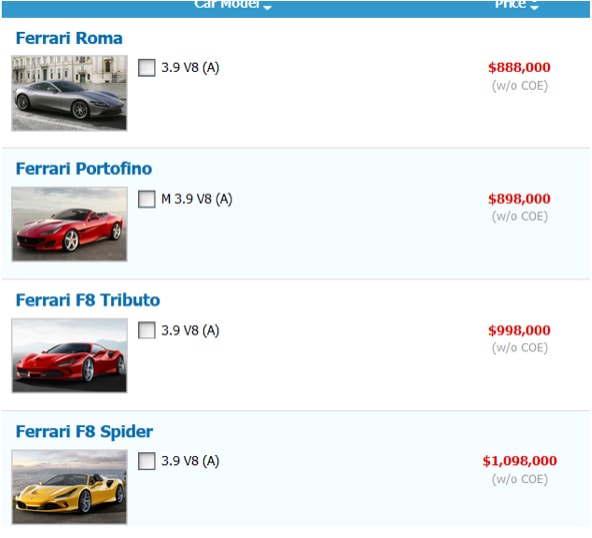

Googling Ferrari, we found the cheapest models below and it starts at $888,888 before COE.

Source: SGCarmart.com

Source: SGCarmart.com

Not taking into account the tax rebate ($60k) she missed out on because she had the kid in 2001, we estimated $20k for maternity costs, throwing in the gynaecologist, hospitalisation, newborn paraphernalia, confinement lady and post-natal massages, etc., which suddenly looks kind of cheap compared to now where we have all sorts of treatments, organic and all.

The first two years were only consumed with paediatric care, vaccinations, clothes, baby formula, toys and books, which we estimate at $3k per month, including the maid (total $54k). Then the enrichment classes at 18 months or so, home visits from a play teacher and those Mandarin enrichment play classes before piano lessons and Montessori half days to full days.

Tennis, swimming and golf lessons started at four, along with abacus class, Shichida class, Suzuki violin and two different Chinese classes, plus a full-time Chinese tutor. We estimate the cost from 18 months to pre-primary at about $4k per month, throwing in food, clothes, toys, books, helper and petrol, but not including the other luxuries because Hugo Boss winter jackets are not really recurring expenses (total $216k).

Primary school expenses without the Montessori were mostly towards private tuition: Chinese, math and science with the pain of sourcing for celebrity tutors and being waitlisted, as with the tennis coach. Food, clothes, toys, books, maid and games take up the rest and it is still at least $3k a month (total $216k). Birthday parties must be mentioned too as those are a costly affair: catering, cakes, booking laser tag, clowns and magicians. But we would leave those out as discretionary expenses.

The international school fees for the next six years would be the bulk of the expense and we still had Chinese tuition, math and science, followed by economics tuition. For the two major exams, the ICGSE and IB, there was the life coach on hand for encouragement and support. And the ancillary costs would be Xbox subscriptions, a Spotify account, sports gear (tennis rackets) and of course, the pocket money which was $10 a day. School fees plus the school trips would roughly average about $35k a year and the rest would add up to a conservative $2k a month (total $354k).

The army years have been relatively cheaper, just transport costs like the occasional Grab and credit card bills ($400 a month mostly cab fares), driving lessons and food.

Totalling up, we have $860k so far, pre-university (excluding NS) but we left out the annual holidays, some of which have been extravagant voyages to the Arctic and Patagonia, interspersed with cheaper trips to Australia, Bhutan and Europe, some on business class (but we will not count those). A very lowball estimate for 18 years minus NS and Covid, would be $3k per year (total $54k).

We must also mention the insurance tab. Besides taking out a huge policy on herself, which is necessary as a single mother with a dependent (but there is no need to throw that in), the kid’s annual insurance tab is $5k that includes critical illness riders and a hospitalisation policy as well.

Voila, a Ferrari lost and a child gained.

The university bill is budgeted at $300k but it is expected to overshoot slightly and now we need to find a more expensive Ferrari to talk about or even start talking about new condominiums.

Since we have proven the Ferrari point, we have to acknowledge that it does not have to cost so much to bring a child up for goodness sake. Other friends have given their ballpark numbers to be anywhere between $250k to $500k, and it is well possible to spend even less without compromising the quality of the child’s outcome, from an asset point of view.

Is it any wonder folks are picking pets over kids these days? Yet perhaps it is not just the cost, there is the commitment of time and emotion.

We are grateful that the child turned out well and quite trouble-free. Imagine some of our friends who have to pick up party bills or deal with illness. We are glad we do not know anyone who had to post bail. The visits to the A&E after midnight were not particularly memorable. And the recent visit to the ENT specialist costs a cool $1k. They are all part and parcel of the warm journey of parenthood that a Ferrari cannot provide (no sour grapes) and the memories and experience of it all will resonate with us as the future holds untold promises of more to come.