Food for Thought: SORA, Ever the SOR Be?

We notice a new breed of pedestrians in the city; the ones important to our city’s financial markets and have made their way from Hong Kong. Well, our new breed of pedestrians will continue to relocate to Singapore especially after school terms in Hong Kong end in July and they are the amazing folks who brazenly traverse four- and five-lane roads like Kim Seng Road and Church Street because jaywalking is not against the law where they come from just like the UK. We wonder if it would be sensible for the authorities to throw in a defensive driving module into driving tests for novice drivers to avoid this new breed of pedestrians along with the bicyclists, food delivery riders and private hire cars.

We also have a new interest rate benchmark in Singapore. SORA will replace SOR and SIBOR, which will be phased out by mid-2023 and end-2024 respectively. A credit savvy friend informed us that his bank tried to pitch to him a new SORA loan to replace his SIBOR-based one. The terms were that his SIBOR+0.5% loan would be replaced by a SORA+1% one. And the reason for higher margin was that his margin of 0.5% was still the same except that, loans all start at SORA+0.5% and thus, his loan was actually SORA+0.5%+0.5%. So when he asked for a two-year fixed-rate loan, he was quoted 1.98% which is 2Y SORA minus 0.25%, roughly. It is not hard to guess which loan he chose.

Other friends working on bond desks also lament about the crazy funding rates they are getting which deviate from the overnight SORA. Credit trader friends informed us that they bumped up their credit spreads for short-end bonds by 0.4 to 0.5% a few weeks ago (following the results of t-bill auctions) to make up for the artificially low SORA rates, making a mockery of the concept of credit margins which reminds us a little of the SORA+0.5%+0.5% story above. Other folks tell us they loathe to use SORA derivatives as hedges because it is difficult to hedge the fixing risk of the underlying SORA from which the derivative is derived.

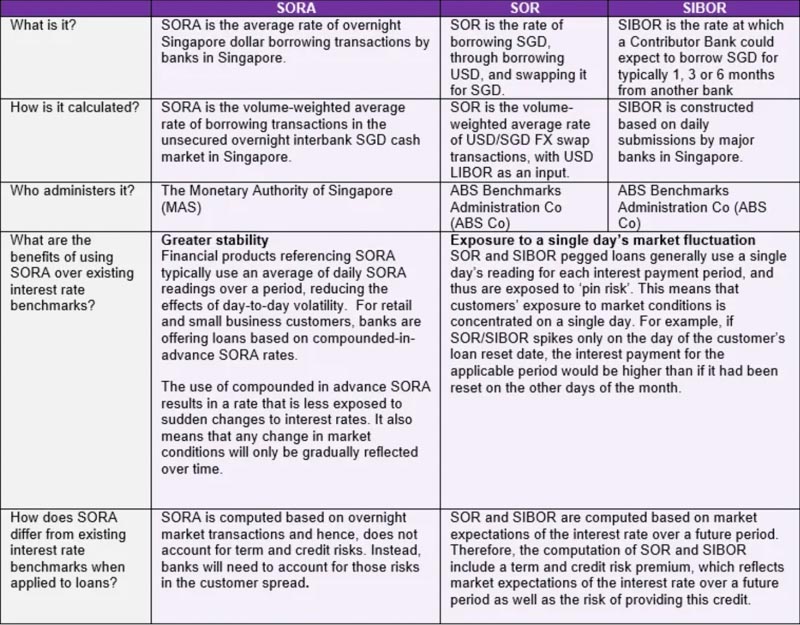

We decided to learn more about SORA which we will share today. First, we found a nice table on the Association of Banks Singapore’s website that compares SORA with her predecessors, SIBOR and SOR.

Source: ABS

Source: ABS

Then we pulled out the 12-month chart of the daily overnight (O/N) SORA fixing from MAS, the 3-month compounded SORA (from MAS) that is used in the loan we talked about above, 3-month SORA trading in the market and SOFR from the NY Fed, which is the USD replacement for LIBOR—and the result is quite ghastly.

Chart of O/N SORA, 3-month compounded SORA, spot 3-month SORA and SOFR. Source: MAS/Bloomberg.

Chart of O/N SORA, 3-month compounded SORA, spot 3-month SORA and SOFR. Source: MAS/Bloomberg.

First, O/N SORA looks like a wild animal and is the most volatile of the lot. Second, 3-month actual SORA is about 0.7% above the 3-month compounded SORA used for most loans.

We will stand to be corrected, being amateurs at this, barely paying attention to SORA and avoiding it as much as we could but these are our thoughts from our chats with friends.

– Singapore does not have an interest rate policy and thus O/N SORA’s fixing is “wilder” than SOFR which promptly increased along with the Federal Reserve’s rate hikes.

– Under the recently (2015-2019) introduced Liquidity Coverage Ratio framework (MAS Notice 649), banks are encouraged to fund/borrow >1 month and do not gap the short end of the curve which means there is less O/N direct borrowing and lending done in the past years.

– Banks run their books with FX swaps instead, swapping one currency for another for their daily wholesale funding needs.

– O/N SORA is more dependent on the FX swap market which works on the interest rate parity model that prevents arbitrage between two currencies, in particular, the US dollar and its hegemony in the market.

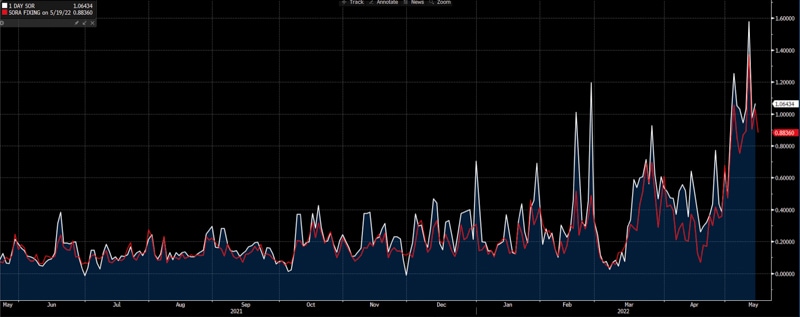

That leaves us with the amateur conclusion that SORA is perhaps nothing much more than O/N SOR, based on the last point above and we pulled out the chart for that and voila.

Chart of O/N SORA (Source: MAS) and O/N SOR (Source: ABS).

Chart of O/N SORA (Source: MAS) and O/N SOR (Source: ABS).

Food for thought: Did we just change our interest rate benchmarks from 1-month, 3-month and 6-month SOR to a 1-3-6-month weighted-average O/N SOR of sorts?

To complicate matters, we note a troublesome point in all these SORA-pegged loans like the one a friend shared with us.

The 3-month SORA fixing is on the first Monday of the month and the rate plus agreed spread will be paid for the next three months.

There is a slight problem there.

Weighted-average SORA is backward-looking which means, technically, you should only know the SORA rate for July-September at the end of September after you compound it daily from July to September.

Source: Bloomberg

Source: Bloomberg

It means that the July-September fixing rate used for the friend’s loan is the April-June SORA average which is good for him as that rate is lower and good for all folks on floating SORA loans in a rising interest rate environment like the one we are in.

However, the head-scratching question for dumb old us is how would banks hedge this sort of risk for their new loans (which is actually not a lot)? Must be a trade secret or some complicated computation involving the use of concepts like heteroskedasticity or kurtosis (do not ask us what it means).

Or they can just tell clients every loan starts at SORA+0.5%+spread? And hope for the best or change it to SORA+1.5% when they get desperate?

We are not sure and do not have the answer.

Unfortunately, SORA derivatives adopt the backward-looking SORA and users will have to abide by the rules, which is a headache because previously, you just needed 6-month FX swaps to figure out what the fixing will be in SOR. Now you need to wonder where O/N SORA will be everyday for the next 6 months to get your answer at the end but derivative traders are highly quantitative people and they probably can work it out via the USD futures markets (there are no interest rate futures for Singapore) or SPS (single period swaps). Fortunately, that is not our problem.

Finally, we would stand to be corrected on everything we wrote above just like we stand corrected on our claim that Hibiki saved us from the kid’s Covid infection. New pedestrians and new benchmarks are just food for thought.