From 2022 to 2023: FOMO to Slo-Mo

We spent 2021 searching for meaning or sense in the markets, wondering if we should “ape” down and join the FOMO or the “Fed put” crowds which kamikazed in 2022. For that, we only learnt the lessons of 2021 in 2022. As we reflect on 2022 with a bad case of PTSD and fatigue from watching the market, we take a page from Top Gun, that 2022 has been, “old man, old woman and old plane still wins,” to quote a friend.

We are old and did not exactly win like Tom Cruise did in Top Gun, but the 2022 markets feel more back to normal and somewhat healthier than the market absurdities of 2020 and 2021 that made us doubt ourselves, questioning if we were on a different planet.

Common sense and some crisis experience worked well for us and various “older” folks we spoke to in navigating the year. As for those poor at following instructions like a dear friend who is unable to fold a complex origami dragon nor obey the instructions of her GPS while driving, it served her well because she largely ignored the interest rate markets early on the year and managed to save a lot of losses in “disrespecting” the yield curve. Using her own model, which was fortuitous later in the year, helped her tackle the inexplicable curve inversion world which destroyed many portfolios with negative carry.

Now we head into 2023, sucker punched by markets (and various phone scammers), the dark side beckons, bringing out the cynics in us, veering us in the path of misanthropy and paranoia, unable to empathise much when we read about cyclist deaths and hear about yet another suicide of a young crypto trader. Humans are stupid and unpredictable, driven by envy (not greed) according to billionaire Charlie Munger even though we have descended from the most selfish and self-preserving of our species in the Darwinian race for survival (of the fittest).

Let’s see. Merriam Webster’s word of the year 2022 is “gaslighting.” Oxford Dictionary picked “goblin mode.” Collins Dictionary has “permacrisis” and the top search on Google is for “Wordle” (guilty here) over Ukraine or Kyiv. It certainly resonates with us with no further need to elaborate because most people would feel the same.

We will exorcise our demons in this tongue-in-cheek post to laugh off 2022 and discuss our strategy for 2023 and beyond.

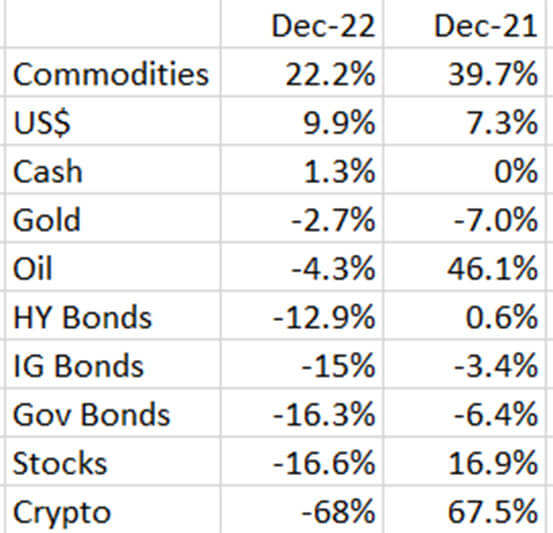

Let us glance through the rough performances of various asset classes between early this December and last, data taken from BofA’s flow report.

Only three asset classes were not decimated in 2022 and commodities prevailed again while the 60:40 portfolio looks rather dishevelled—crypto and NFTs died.

Some 2022 observations and lessons.

1. Volatility reigns supreme! According to Goldman Sachs, 2022 is likely to end up as the sixth-most volatile year since the Great Depression.

2. Dead, dead, dead! FOMO is dead. Fed put is dead. 60:40 is dead (if we refer to the table above, bonds -12.9 to -16 per cent, stocks -16.6 per cent).

3. It is difficult to find a profitable bond trader this year and the same for bond investors with Bloomberg finding just 1 per cent of bond investors who managed to record a gain in 2022. A trader friend can attest that it took every bit of ingenuity to pull the last bunny out of the hat to end the year on target.

4. Inflation hits mortgage payments with some friends forking out the extra $2,000 a month.

5. But inflation cannot hurt us if we stop spending.

6. There is a big difference between cash and cash equivalents (i.e. treasury bonds) because one is up 1.3 per cent (check table above) and the other is down 16.3 per cent which is so much for margin top-ups.

7. Sam Bankman-Fried was right on crypto when he said, “At some point, something is just real… if our collective imagination has given them value, now we just think about them having value.” Looks like it is now acceptable if “they”(crypto) have no value. The majority of crypto “investors” were actually just greedy punters.

8. Those wunderkinds of 2021 were gaslighting us after all—decentralised ledger? Earn 30 per cent staking your Luna? We are relieved the diamond hands and laser eyes are in hiding after all their trolling in 2021 and glad some of them will be going to jail soon.

9. Before reading any outlook for 2023, check out what general analysts wrote about 2022. Chances are if they did not know then, they probably do not know now and the loose consensus of a short recession in the first half followed by recovery in the second is a sort of run-of-the-mill analysis to keep oneself in employment. Would you rather trust them or wise old men like Druckenmiller or Howard Marks whose outlooks are less sanguine?

10. We are not getting out of bed for less than 4.5 per cent because that is the risk-free Fed funds rate and because Singapore treasury bills are paying around 4.38% so you can keep any paltry returning stock recommendations to yourself.

11. Everyone has become T-bill experts including Elon Musk who recently tweeted “Securities Analysis 101: As the “risk-free” real rate of return from treasury bills approaches the much riskier rate of return from stocks, the value of the stocks drops. For example, if T-bills and stocks both had a 10 per cent rate of return, everyone would just buy the former”.

12. Warren Buffet’s mantra is working.“It’s only when the tide goes out that you learn who has been swimming naked,” as we are just beginning to see the bodies washing in.

13. Lessons from Chinese real estate— when a real estate company starts paying 10 per cent for 12-month money in 2020, it is likely they will not be repaying their debts.

14. Central bankers do not have a clue what will happen or where we will end. Just look at the sampling of headlines below.

– *ECB’S CENTENO: HARD TO DETERMINE TERMINAL RATE RIGHT NOW

– *ECB’S HOLZMANN SAYS CANNOT PREDICT TERMINAL RATE JUST YET

– *ECB’S KAZIMIR: CAN’T SAY HOW HIGH RATES MUST RISE

15. Finally, for the Singapore rates folks, nobody understands SORA! And we personally cannot fathom how floating rate mortgages went from SORA +1.3 per cent in March this year to SORA+0.65 per cent in July and now SORA+0.35 per cent.

Yet, 2022 has been a much more meaningful year for us than 2021. Just as we read Man’s Search for Meaning by Viktor Frankl this time last year, trying to make sense of the inane rally, we are reading Against the Gods: The Remarkable Story of Risk by Peter L. Bernstein this time because we would not be caught dead believing any of those 2023 outlooks touting a 1H recession and a U-shaped recovery to follow in 2H. There is simply no rush to formulate a view unless it is your day job to churn out 2023 outlooks and reports at the end of 2022.

“Yet once we act, we forfeit the option of waiting until new information comes along. As a result, not-acting has value. The more uncertain the outcome, the greater may be the value of procrastination.” — Peter L. Bernstein, Against the Gods: The Remarkable Story of Risk

We will embrace procrastination for 2023 with a new motto, from FOMO to slo-mo to contemplate a future of globalisation, decoupling, slow population growth, antitrust, ESG, political unrest, populism and more. Those are precisely what data models cannot capture or represent and the danger lies in extrapolating those graphs from the 70s or 80s and trying to hazard a pattern from the past to predict the future, which is common in statistical modelling.

Sea change (idiom): a complete transformation, a radical change of direction in attitude, goals . . . (Grammarist)

Howard Marks of Oaktree Capital Management puts it best as a ‘sea change,’ and only the third sea change in markets he has seen in his half-century career and we summarise the main point of his latest newsletter.

– The investing world will be different from what it was over the last 13 years—and most of the last 40 years.

– The investment strategies that worked best over those periods may not be the ones that outperform in the years ahead.

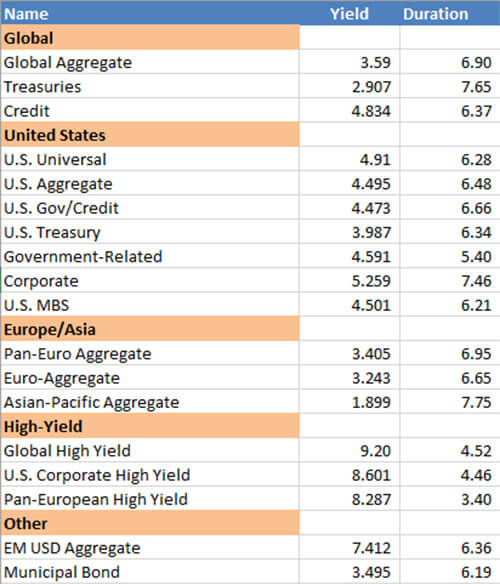

– Investors can now potentially get solid returns from credit instruments, meaning they no longer have to rely as heavily on riskier investments to achieve their overall return targets.

We must accept a paradigm shift and do things differently which means we cannot blindly use data from the past to fuel decision-making mechanisms.

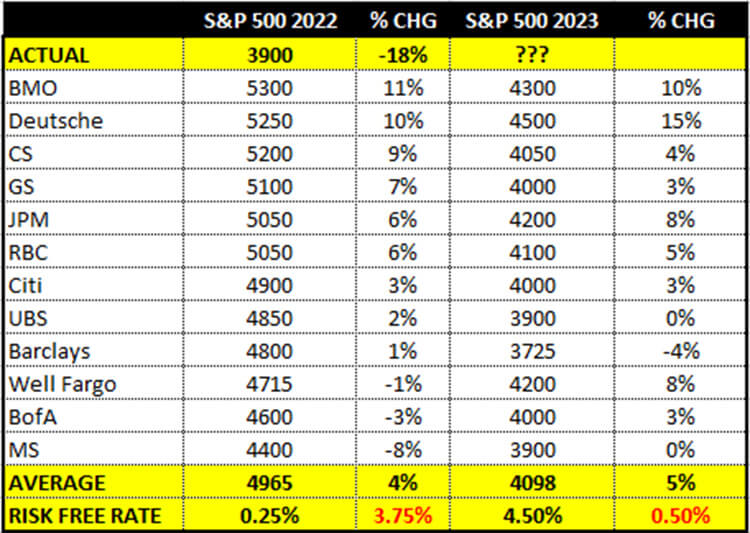

Let us look at the year-end S&P 500 projections by various major banks made last year and this time in the table below. The average return for end 2022 was 4 per cent against the actual return of -18 per cent or thereabouts. The expected return for 2023 is 5 per cent which is higher and yet when we subtract the risk-free rate then and now, the 5 per cent is only worth a paltry 0.5 per cent.

That does not stand to reason especially when some potentially less-risky credit instruments (mentioned by Mark’s above) are giving returns in the same ballpark as we can see from the returns and duration of various bond indices below.

Source: Bloomberg

Source: Bloomberg

“You don’t even need to talk about Black Swans to be worried here. To me, the risk reward of owning assets doesn’t make a lot of sense.” — Stanley Druckenmiller

From one old man, Marks, to another old man, Stanley Druckenmiller who warned that there is a “high probability” the stock market will be flat for an entire decade, it looks like we have plenty of time to do nothing. We also tend to agree with Druckenmiller’s assessment that the recession will be hitting hard and will probably be larger than the “average garden variety.”

Yes. Old man, old woman, old plane still wins, and old man Charlie Munger was dead right to call out cryptocurrencies and NFTs before they all blew up. As for us, we really have no view of what lies ahead, so we are going from FOMO to sl0-m0 in 2023.