In Protest—What Markets and Riots Have in Common

Fearful of being harassed on the roads and streets of Singapore, most recently by a mean-looking private hire black minivan which bore down fiercely, on high beam after a tiny preventive honk, a friend decided to take a few days off to hide in the safety of home, on an anime binge, in protest. Fatigued from the constant stream of anti- and pro-Trump rhetoric, 2 mass shootings in the US within 24 hours of each other by a 21-year-old and a 24-year-old, 2 teenage killers in Canada and the “riots” (termed by Trump) that would not end in Hong Kong (spreading to Melbourne and France), as well as more riots erupting in Russia and Zimbabwe.

Stress levels are running high in societies and in markets causing mental distress sparing few of the 7 billion inhabitants of the planet including peace-loving Singaporeans like the traumatised but fiercely determined lady in red at the Hong Kong airport a few days ago (pictured below), somehow evoking a tinge of national pride in us as we celebrate SG54 with her as our heroine in our minds.

Source: SCMP

Source: SCMP

Don’t mess with Singapore because this could have happened to her—tied up and beaten for angering the inflamed hordes, perhaps because he was a mainland reporter and spoke Mandarin?

Source: Bloomberg

Source: Bloomberg

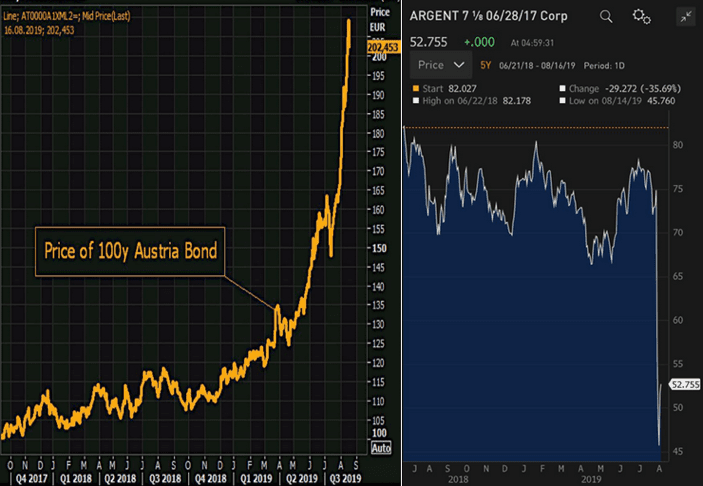

Somewhere our minds, we also know the last thing the characters in Les Misérables would be worried about is a RECESSION, obsessed as they are in demand for bigger things in life. Yet every other post on financial Twitter has recession mentioned and fear has gripped markets all over the world, giving bonds Bitcoin-like returns. Bonds such as the Austrian century bond, issued in 2017 and maturing in 2117, is up 102% since its issuance, with trading ranges of between 10-20% each day, making Bitcoin look like child’s play. While a similar Argentinian bond issued in the same year managed to lose 30% in a single day (stock market -37%, or an impossible 17 standard deviations), and half of its value since issuance, to blame their election of a leftist (socialist-leaning?) government this week. Even the conservative risk-averse Singaporean who had bagged the Singapore 20Y bond at its auction last month would be sitting a fat profit of nearly 10%.

Price charts of the Austrian and Argentinian 100-year bonds issued in 2017

Price charts of the Austrian and Argentinian 100-year bonds issued in 2017

There is no doubt markets are in crisis even if reality has not sunk in because of the ferocity of the moves and uncertainty in the air, courtesy of, mainly, Donald Trump. The negative yielding debt pool is exploding by the day, breaking USD 16 trillion last week (when it was just 13 trillion a month ago) as the value of global bonds hit a fresh high of US$56 trillion, which means we are looking at a pile of unrealised profits/paper gains on the table as the FT reports that “only 3% of the global bond market now yields more than 5%—the lowest on record”.

The markets are protesting. We cannot even list all the records broken this week and it would appear too late even if Trump caved and claims a trade deal soon.

Source: Bloomberg

Source: Bloomberg

- K. Yield Curve Inverts for the First Time Since 2008

- S. 10-Year Yield Below 2-Year Rate for First Time Since 2007

- S. 30-Year Yield Falls to Record Low 1.97%

- GERMAN 10-YEAR GOVERNMENT BOND YIELD DROPS TO NEW RECORD LOW OF -0.72%

- 30Y Singapore Government Bond Record Low 1.86%

- Taiwan sells 10Y bonds at 0.64% yield, lowest on record

- Entire Dutch yield curve trading negative

- Entire Swedish yield curve trading negative

- 10-Year Notes at Negative Coupons Hit Covered-Bond Market

- Canada 30s vs. 2s Negative for the first time since 2007

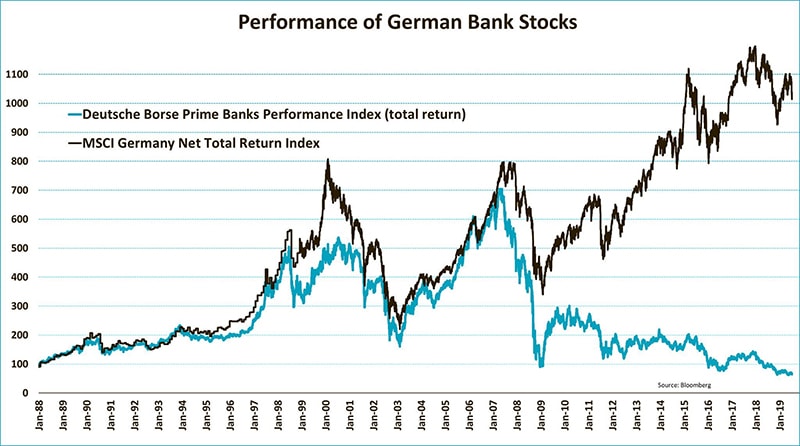

- German bank stocks have lost 90% of their value since the great financial crisis (Commerzbank mkt cap is less than Hong Leong Bank Bhd)

Source: Jeroen Blokland Twitter

Source: Jeroen Blokland Twitter

- Deutsche Bank hits record low as EuroStoxx Banks Index has dropped below critical threshold of 80

FOMO begone! It is now JOMO.

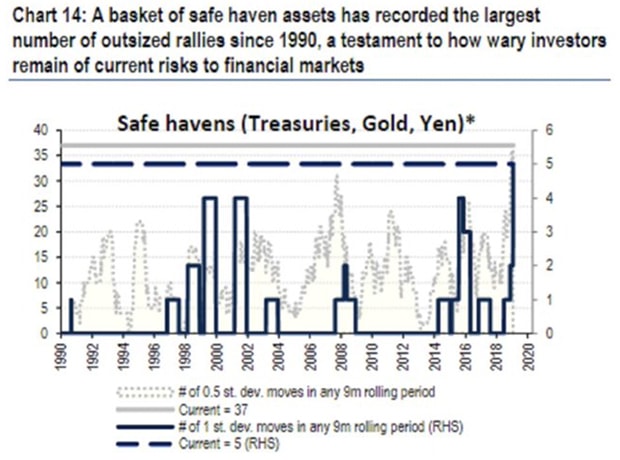

It is the biggest flight to safety move in decades and of a generation, as put by Bloomberg, and “truly historic and dangerous times”, according to David Rosenberg, one big-time permabear having a field day he deserves. While we are not in the camp that buys a recession for inverted yield curves, we believe the markets are still screaming in protest for a recession.

Source: Bloomberg

Source: Bloomberg

Perhaps the kids know something for their shooting and rioting. It’s gotten too hard, not just in America … and now with crazy bond yields and central banks cutting rates to negative, only a tiny sliver of the population will truly benefit.

Source: Bloomberg

Source: Bloomberg

We revisited the concept of Plutonomy in March and quoted the 2005 Citibank report that “At the heart of plutonomy, is income inequality. Societies that are willing to tolerate/endorse income inequality, are willing to tolerate/endorse plutonomy”, and Plutonomies die with social backlashes, labour backlashes, protectionism, anti-immigration sentiments and so forth. It was Yellow Vests in March and Hong Kong riots in August. Because societies allow plutonomy when enough of the electorate believe they have a chance of becoming a Pluto-participant… the embodiment of the “American dream”. But if voters feel they cannot participate, they are more likely to divide up the wealth pie, rather than aspire to being truly rich.”

As we said in 2015 in The Wealth Gap and The Tall Poppies, rich is a relative concept and you only feel rich by comparing yourself against your neighbour, which partly explains why some of us feel exceedingly poor among richer friends and peers. And relative riches does bring happiness and satisfaction whereas being poor in an inequitable environment leads to unhappiness even with rich middle-class folks when they watch the richer spiral out of their reach, getting unhappy and frustrated in the process. Paul Tudor Jones put it in a 2015 TED talk, “This kind of gap between the wealthiest and the poorest will get closed. History shows it usually ends in one of three ways—either higher taxes, revolution, or war. None of those are on my bucket list.” How crazy is that?

It is a sign that markets are just as mad now and it is timely that one of the original analysts, Ajay Kapur, who had coined the concept of Plutonomy has now come out to say, after decades, the game is over.

Source: Bloomberg

Source: Bloomberg

Yet, “no one is ready for this new world”, according to him, an assessment that is echoed by 13D Global Strategy & Research, “what we’re about to see is a backlash against the second gilded era, and it will have a massive impact on the world—and the markets” because, according to the FT, the age of wealth accumulation is over, “This isn’t the end of the world— we’ve been going through cycles of wealth accumulation and distribution forever. But it does mean that the rules of the road for investors are changing.”

In our words, “for years, we have been watching and patiently documenting, noticing voices grow louder as discontentment and stress levels grew, billionaires getting worried… What will come out of this now that Plutonomy’s cover has been blown? We can see increasing demand for Singapore passports for wealthy migrants looking for a haven… thinking of Hyflux and how the SIAS is requesting the presumably richer senior Hyflux bondholders to waive their share and take the same payout as retail perpetual bondholders, rewriting the law in the process”.

What is more obviously coming next is a financial crisis of sorts or a recession, or maybe both and recessions are good for redistribution except that the world has devolved into a less democratic place since 2012. And central banks are unwilling to give up the fight to keep the good times rolling even if a recession is way overdue.

This means we are going to get a fight within economies, societies and between economies and societies. There is nothing much we can do because the laws and rules are going to change and if we have any bright ideas, we are definitely not sharing, in protest.