Investing For Aging: To Look Death In The Eye

I believe many of us don’t think about death all that much, but this week has been all about the business of aging and death for me. A 95 year-old granduncle is lying in ICU, a good friend telling me about her contribution to SASCO, a charity championing dementia, and an impulsive purchase of a stem cell supplement from a direct-selling scheme that markets themselves as the “Rolls Royce of supplements*.

*On a side note, I am starting to believe that direct selling is the best way to milk the most profits from a unique and effective product that deserves better than the usual pharmacy shelf space.

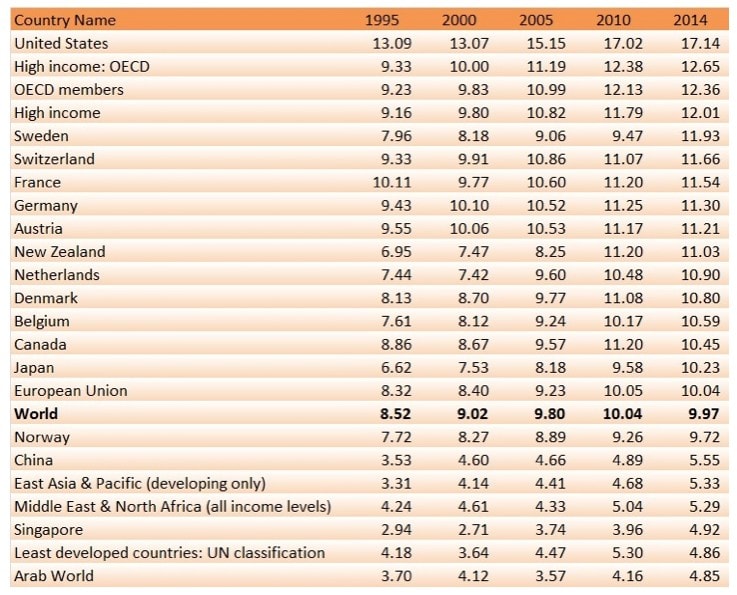

Healthcare could be the saviour of our fledgling economy, and as I have always maintained, cancer is probably one of the most economic value-added diseases, given the amount of spending involved, going into GDP where healthcare spending takes up a sizeable chunk in the developed nations. The USA with 17%, one of the highest in the world, Europe registering 10%, against China’s 5.5% and Singapore’s 4.9% for 2014. (source: World Bank)

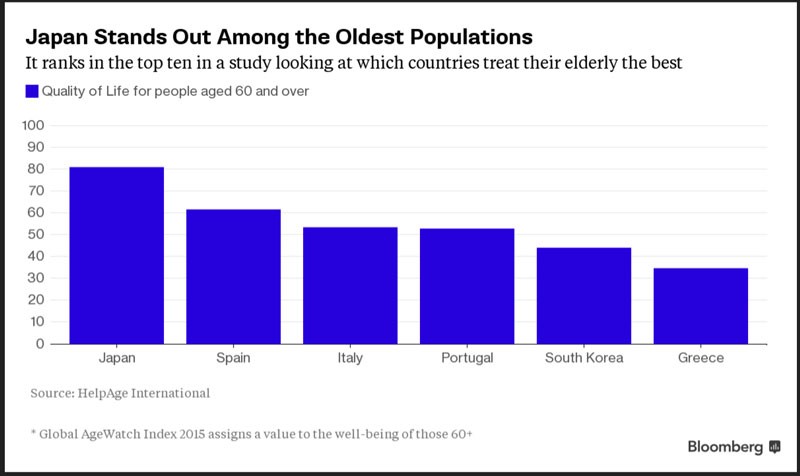

An “aged society” is typically defined as one where more than 14% of the population are 65 or older and we have quite a few of them now, led by grand old Japan, which incidentally ranks top in terms of elderly quality of life, a contentious claim perhaps – a recent FT article highlighted that Japan’s “Elderly Turn To Life Of Crime To Ease Cost of Living” because life in prison comes with free food, accommodation and healthcare!

We also approached this issue last year when we wrote When Is A Child A Commodity? Economics of Parenthood, and noted that while having children isn’t cheap, (it costs about US$245k or more to raise a child in New York), the Japanese traditionally viewed their children as economic assets.

But now, headlines about legalising assisted-death in the West, with Canada being the latest, and People Who Fail To Visit Parents Will Have Credit Scores Lowered, the business of aging and dying has become a lucrative one – a trend many investment managers have latched onto with their top picks of pharmaceutical companies, insurance and real estate companies (for those retirement villages).

This is spurred on by headlines saying that Alzheimer’s receives 13 times less research dollars then cancer – the latest claim to a cure by Singapore’s TauRX Pharmaceuticals* may make many investors rich.

*TauRX Pharmaceuticals did a few rounds of private capital raising in the past 3 years mostly from of accredited investors

The Investment Trend

Riding on the trading ideas of the trend of aging has been written to death but alas, annuities are not the way to go for the investor, especially if they read the bestseller Rich Dad, Poor Dad, where Robert Kiyosaki predicted in 2002 that “the stock market would crash in 2016 as the first wave of baby boomers began to hit 70 and half in 2016 and started taking required-by-law distributions from traditional individual retirement accounts… the sheer number of aging boomers could contribute to stock-market selling pressure.”

Demographics is the key, he said, and it cannot be more true.

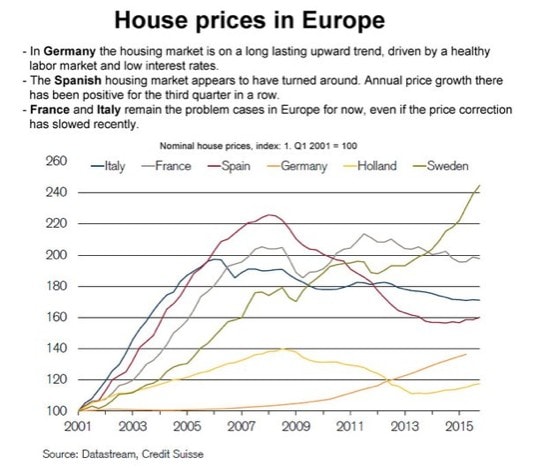

Helicopter money has buoyed asset prices in Europe, driven by low/negative rates – this, even as their populations age and with the EU not agreeing on accepting younger refugees.

We have to hedge for the future – a future where old people who are, mostly, afraid of death. While bonds may be their investment asset of choice, the better hedge would be one of buying an ambulance company, something a friend of mine did in the last year, buying a share in a hospice, or even better, hoping for that big reverse mortgage scheme* I thought up 10 years ago.

*If the majority have their wealth tied up in their primary residences, perhaps a review of the reverse mortgage legislation, to allow one to enjoy their later years in certain comfort, over the choice of nursing home that the children may, in their self interest, plunk them into, just in case. Netting off the proceeds from the young parents who will hedge their children’s future residences without a need for them at the present.

Dying will be big business in the near future. Those stem cell supplements will come in handy.