It’s Just Too Hard to Think About Central Banks

It is just too hard to think about the central banks these days and I, for one, have been rather pleased with my New Year resolution, shared with my good friend, where we resolved not to read too many of those mind-numbing reports for 2016 as we noted in February.

All good if you had Not Read a single strategy piece for 2016 because Goldman Sachs has just abandoned 5 out of 6 of their top 2016 top trade picks, 5 weeks into the new year. And my Dear Friend is right as usual… “My dear friend, who is now back in a trading role had cautioned me against reading too many of those mind-numbing 2016 reports. Want to tell us what will happen in the next 12 months ? How about just getting through the next 12 hours?”

The mighty feat of ignoring the central banks for someone who has been following their every move , in the grand old tradition of the generations of bond traders before me (and perhaps the need for self-validation)?

I shall sheepishly admit that I have not been religiously following the central bank superheroes in the past months and quite given up on following the rhetoric in market opinions and analyses of the Fed watchers.

My loss of faith goes back a few years, starting with my dim assessment of the currency wars that erupted as an inevitable result of the Fed’s ZIRP (zero interest rate policy) and the QEs’ that followed and I still hold the Fed accountable for the negative rate policies that the G2 (Europe and Japan) along with the Scandinavians.

While I may be the biggest nobody to write about this in the world, there are fewer out here in Singapore who would venture an opinion, quite happy that the MAS’s latest efforts to dis-appreciate the SGD dollar ended up giving the currency a boost, rising 0.6% since 14 April against the USD, with her bond yields out-performing as well.

We have finally arrived at a world tired of manipulation as we hit jackpot with the Panama Papers affair that seeks to implicit the most powerful politicians, actors, sports stars and influential members of societies globally. It does make Deutsche Bank’s recent admission of silver price manipulations in the US, along with the Bank of Nova Scotia and HSBC, look a tad lame.

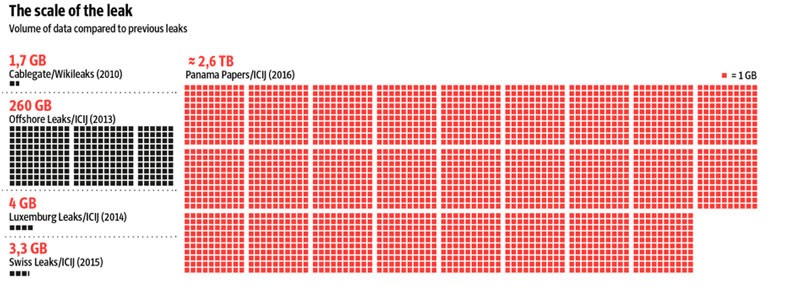

Source: techinsider

The amount of data in the Panama leak is astronomical yet who will order prosecution? When the prosecutors would be guilty and surely national leaders cannot really send themselves for trial?

Are we tired of manipulation yet?

Or perhaps we have been living in denial for too long? Manipulation has been around for the 3,000 years that money has been a part of human history and that the only we worship the only incorruptible being around—God!

The creation of money begs the dilution of money and that a dollar today is worth more than a dollar tomorrow is the basis of financial markets (or no one would be holding cash) and the concept of inflation.

Yet it cannot be more true now! Negative interest rates is artificial inflation and will do the work of inflation for the central banks who cannot resuscitate her.

Manipulation is one thing but playing around with human logic is another – the logic that money is a depreciating asset used to hold true when we have inflation but substituting inflation with punitive negative interest rates does screw up the thought process for me.

Therefore I finally lost it with the central bankers but never felt more helpless as we watch their new campaign to abolish physical cash notes in the system which technically gives the central bank the absolute power to pauper us tomorrow on their whim and fancy.

The Death of A Salesman

When the Bank of Japan joined her developed market counterparts in Europe to take that leap of faith into negative interest rates back in January, I had a vision of Arthur Miller’s Death of a Salesman and wrote back then “the contradictions besetting the family of the protagonist, Willy Loman (Dustin Hoffman in the film), who was unable to accept change in his life and society, choosing death as his ultimatum.

“A salesman/circus master/central banker cannot be successful forever, as we have seen in the past with Greenspan and gang, and if they chose to construct a fantasy world for themselves, to distort reality because markets will not behave as they expect, we end up with Governor Kuroda, for one, whom only the Prime Minister of Japan believes in right now.”

And it is not just me because the markets did not buy the central bank meetings since then because the reaction of financial markets was one of rejection – a massive strengthening of the JPY and a crash in the Nikkei, in the case of Japan.

The European Central Bank has also similarly lost its clout in March when they took the market off guard with cut to further negative and upping the ante on bond purchases that was rejected by markets and the EUR dollar strengthened to their disbelief and red-faced chagrin.

The humbling has led to inaction from the 2 of them in their last meeting and we have the Bank of Japan back in spotlight this Friday, a few hours after the US Federal Reserve is expected to do nothing.

And we shall not even talk about the criticisms mounting from the intellectual elites and eminent thinkers out there (that is quite beyond me!).

When I read that in a meeting of 4 Fed leaders from the past and present, Alan Greenspan admitted that “The real problem is that monetary policy is very largely economic forecasting and our ability to forecast is significantly limited and we have to keep the context of what we say in the context of what we know.”, we can suppose that their guesswork has not worked to well recently.

And the public relationships cum politics aspect that President of the European Commission, Claude Juncker, admitted to “We all know what to do, we just don’t know how to get re-elected after we’ve done it.”

What I Think?

We have reached a new era of unknown repercussions from policy actions and ineffectual central banks.

It is likely that markets would take more kindly to news of Kuroda resignation than further policy action at this rate because a regime change would inject an element of hope rather than throwing in even more good money after bad.

Indeed, it is too hard to think about central banks in this big week ahead and I found it useful to just ignore them this year.