Move Over Banks, We Have A New Singularity In Our Lives

Bleary-eyed from World Cup matches which are the best distraction for the madness in the markets, the trade war can wait. Trump has been nothing but hot air and dramatics in the past 18 months and has not followed through with his empty threats except for this week’s outrageous kidnap of 2,300 or more children, which has made Boko Haram’s kidnap of 110 schoolgirls in March this year (and their 2014 kidnap of 276 girls), and even the ISIS’s efforts look a tad tame.

Sickened by the reports of wailing toddlers kept in pens which have been slammed as fake news, we still have the heart to imagine the fear racing in their small minds and pause to wonder if America has become a lost cause and we have “to obey the laws of the government because God has ordained them for the purpose of order”, to quote US AG Jeff Sessions reading from the Bible.

It does not feel like a world anyone over 35 would remember, or for those born before the world of laptops, mobile phones and fake news at a snap. The world where the US stood for everything good against the Cold War “baddies”, and the world Donald Trump is supposedly trying to recreate by making America great again?

No celebrity suicides this week but we had the homicide of 20-year-old XXXTentacion brought to our attention by the mourning teenager at home and we wonder if we will spiral into depression at this rate, especially if the World Cup ends with a Donald Trump election sort of victory.

A Week of Horror—Goodbye, Thomas Edison

The World Cup has saved this week of horror, really, for people who are watching the markets. The horror of seeing the oldest company in the Dow Jones, General Electric, founded by none other than Thomas Edison, dropped from the 30 companies weighting the Dow Jones Industrial Average after more than a century as an original member of one of the oldest, most well-known and frequently used indices in the world.

Why do we like the Dow? It is one of the few price-weighted index, meaning that market capitalisation is inconsequential in the pricing and all 30 companies are equally weighted.

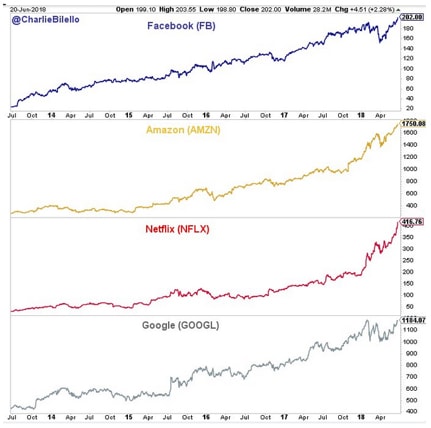

The most-watched S&P 500 is market-weighted, which means Apple, Amazon, Google, Microsoft and Facebook take up about 16% of the most followed index in the world versus the other 495 companies that make up the rest. Is it any wonder that Facebook, Amazon, Netflix and Google chalked all-time highs on Wednesday despite the trade wars, threats of regulation and the potential for internet tax collection.

Taken off Twitter feed of Charlie Bilello, Pension Partners

Taken off Twitter feed of Charlie Bilello, Pension Partners

The FT has it that the market capitalisation of Facebook, Amazon, Apple, Microsoft, Netflix, Nvidia and Google (FAAMNNG), has risen by US$ 772 bio in 2018, compared to the entire S&P 500 which has only risen US$ 673 bio (which includes that $772 bio!) which means that FAAMNNG is taking up a bigger share of the index and, horrifyingly, tying the fate of the S&P to their stock prices as we keep going.

If not for the FAAMNNG, the S&P 500 would be down for the year and the S&P Consumer Discretionary Index would not be gaining 13.3% (US$ 318 bio) but losing 1.9% but for the market cap gains of just Amazon and Netflix which accounts for US$ 375 bio.

Netflix has had an amazing run after surpassing Disney in market cap last month, and now has overtaken Citibank this week for all its 5,400 employees compared to Citibank’s 209,000 staff.

Citibank, a G-SIFI—Global Systemically Important Financial Institution, has been overtaken by a junk-rated cash flow negative media company?

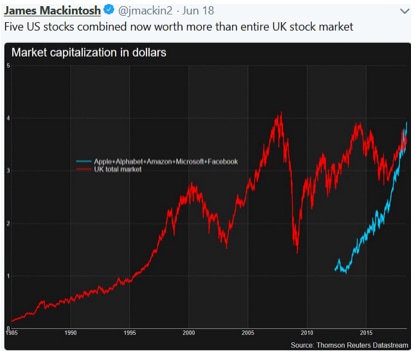

That is why 5 US stocks combined are now worth more than the entire UK stock market, a mighty feat indeed.

The next time we buy an ETF based off an index, we should think how much more MARKET-WEIGHT these guys are going to get?

Too Big To Fail?

There are just 260 companies in the world with their current market capitalisation over US$ 50 bio. 113 of these 260 companies returned better than the S&P in 2018.

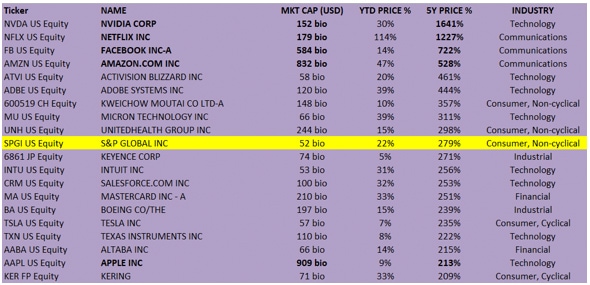

Ranking the top 20 companies of this 113 market movers in 2018 (i.e. mkt cap >US$ 50 bio) with the best price returns, we note that the leaders are the usual culprits.

Top 20 companies of 2018 which beat the S&P500 with mkt cap >US$ 50bio and their 5Y price returns

Top 20 companies of 2018 which beat the S&P500 with mkt cap >US$ 50bio and their 5Y price returns

None too surprising is the fact that S&P Global Inc, the provider of the S&P 500 Index is number 10.

Let’s backtrack a little to realise the horror of the market-weight problem which has made big even bigger and created “too big to fail” technology companies by adding trillions of dollars to their market cap, their worth and their influence in our passive portfolios.

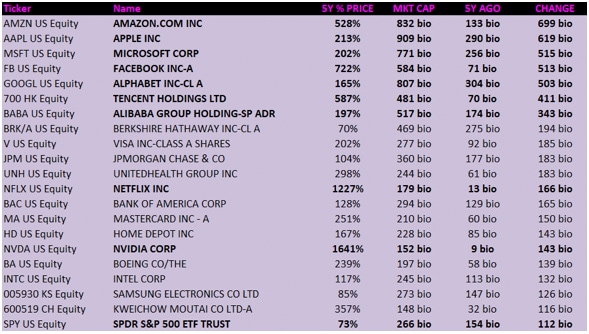

Largest 5-year absolute change in market cap (in USD terms) of the top 21 global corporations

Largest 5-year absolute change in market cap (in USD terms) of the top 21 global corporations

It is really not much even if the largest ETF of the world joins the gang at number 21, with 16% of its holdings in FAAMG and about 17.5% if we count the FAAMNNG which have all outperformed the S&P’s 73% 5-year return.

Bitcoin, with its 6000% price surge in the past 5 years, will still be some way behind with its 100 bio market cap barely holding as we type this as it breaks under US$6,000 on a Sunday.

To throw in China’s BAT (Baidu, AliBaba and Tencent) along with their TMD (Toutiao, Meituan-Dianping and Didi Chuxing), it does look like we have arrived at the too big to fail technology list, as we await the Xiaomi IPO for its 100 bio valuation and its potential few hundred percent return, if history says anything.

Now This Is Not What We Want To Talk About

Is it not strange that Netflix is valued above Citibank and Disney? Or that Tesla is nearly double the value of Goldman Sachs?

How did newly listed AliBaba vault over Tencent and all the big 4 Chinese banks?

We ask ourselves if we have come to a point of singularity in the markets? where a small change can cause a large effect?

Where a small change in FAAMNNG can cause a bigger impact on the markets than ever before?

What about a point of singularity in our daily lives?

As NY Times put it, Alibaba and Tencent are a spooky vision of the future, “the gatekeepers to the entire economy”, controlling everything from shopping to payments to messaging, microblogging, food delivery, entertainment, education, transport, doctor visits and investments—“the inescapable commercial universe”.

As we let Siri, Alexa and Google Assistant take over our daily lives, net neutrality has been repealed in the US, which means that “The Search Engine is the Most Powerful Source of Mind Control Ever Invented”, as psychologists have pointed out in a 2015 study.

Take them away and many people would not be able to function with many more people who would struggle to explain how we have come to this or understand how it really worked. Would anyone expect a search engine to be un-neutral? As we have come to expect them to read our minds as they keep getting better at? Or just maybe, FAAMNNG, BAT and TMD, all know you so well that they can anticipate your thoughts which they are, in turn, shaping?

If that is true, then it is no wonder that we are rushing to buy their shares as well.

The gatekeepers of the economy have always been the banks, insurances and energy producers, when America was great and when we did not have mobile phones or the internet. Now we have moved on to a new singularity—the tech behemoths which makes us feel a little bit helpless because we do not have a lot of choice for they are too big to fail.

The buzzword these days is one that the late Stephen Hawking saw as a concern for eventual human extinction—technological singularity, unrelated to the singularity that we have been discussing, but a “hypothesis that the invention of artificial intelligence will abruptly trigger runaway technological growth, resulting in unfathomable changes to human civilisation”.

Isn’t it all in line with the grand FAAMNG/BAT/TMD singularity scheme, as we plot away on how to boycott as much of America (including the cheap cherries that are coming our way via tradewars) as we can but find that we cannot live without Microsoft Office or that iPhone (because we boycott Android, Samsung and China tech, too) or Nikes, but we can live without Facebook, Amazon, Netflix and Google (use Firefox).

As Sundar Pindar, the CEO of Google who wears Lanvin sneakers, said in February this year, A.I. is more important than electricity or fire, and we can guess that is why we said goodbye to GE and Thomas Edison this week.