Not the First or Last Time You’ll Hear About Late Capitalism

You are not mistaken if you, like us, feel a little poor these days when we hear of people paying $120 for a plate of pasta at a certain posh café with no prices on its menu, or folks commissioning a dozen $17,000 hampers for New Year gifts, or friends buying two or three new properties in a sweep. Or read about the new Singapore company offering $3 million dollar eco-tours on an atomic superyacht, which makes Virgin Galactic’s US$250,000 space flight look cheap.

In Singapore, home sales volumes are hitting record highs as high-end condos are snapped up in Singapore and cash-over-valuations become commonplace not just in the city-state.

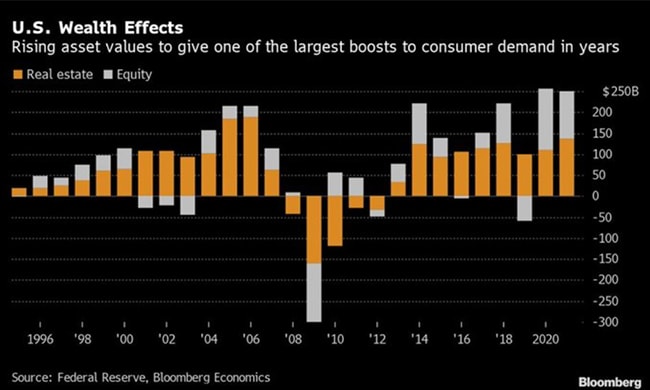

Do not be stumped by these lavish excesses and the plethora of decadence because “rising asset values look set to bring one of the largest boosts to consumer demand via wealth effects in a quarter-century. In concert, equity and home values are poised to lift spending by an additional $250bn in 2021.”

Source: Bloomberg

Source: Bloomberg

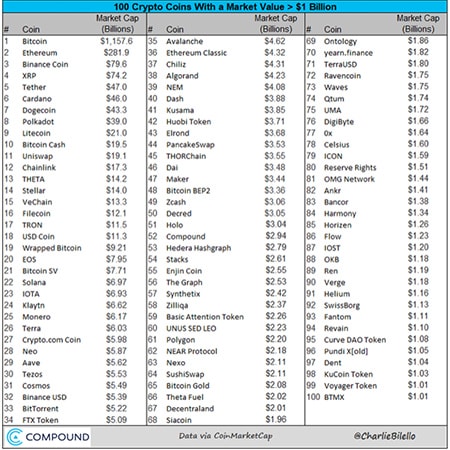

What about the US$2 trillion alt-coin market? SPACs and NFTs?

Everyone is making money fast and instant millionaires are made every other minute. We will have even more millionaires minted soon when Singapore’s Grab lists in the U.S. through a $40 billion SPAC deal, never mind their loss of $2.7 billion in 2020 as India makes history listing 6 new billion-dollar unicorn companies in four days, compared to just seven in the entire 2020.

Money grows on trees and people are splurging on jewellery, watches, furniture, sports cards, vintage cars, limited-edition Nikes and crypto art. Friends are reporting that their Batman comics have risen 500 per cent in value in just the past few months since the record-breaking auction price in January where one was sold for over $2 million.

All we read about is how a 36-year-old made $46k in 6 weeks selling NFTs and how former Disney CEO will be taking trading card company Topps public in a $1.3 billion SPAC deal besides the Grab deal. Friends are gloating on how they made money on the Coinbase (COIN US) IPO when the CFO just dumped 100 per cent of his holdings (the CEO dumped just 71 per cent).

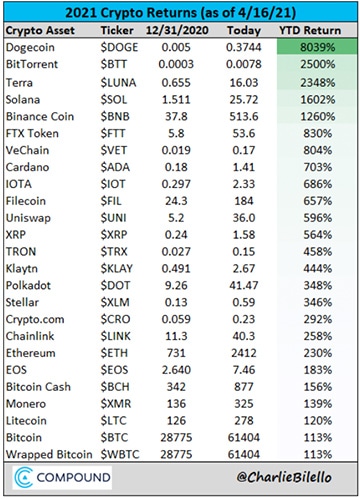

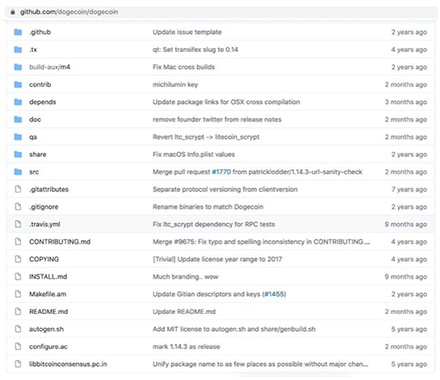

This weekend is all about Dogecoin which was just worth $9 billion in early February and now worth well over $35 billion, up 500 per cent in the past week (and at one point 8,039 per cent on the year), when there is no supply cap in the mining code which is freely available because it was created as a joke. Issuing 10,000 Dogecoin per minute in perpetuity is baffling. Even its creator and the developer community are not even doing much to maintain the system in Github.

Source: Compound Advisors on Twitter

Source: Compound Advisors on Twitter

Source: Meltem Demirors on Twitter

Folks are throwing in the towel and we are just listing a few of the comments we picked up.

“If you had put each of the 3 U.S. stimulus checks into Dogecoin, it would be worth over $300,000 right now.” — Nick Maggiuli

“The people have spoken, and the people want DOGE. the power of memes is moving markets. you absolutely love to see it. it’s gonna break people’s brains, and we’re just getting started. to all the TikTokInvestors who are now $DOGE millionaires, cheers.” — Meltem Demirors

“After learning about a digital wallet holding more than $1.3B in Dogecoin, I’ve decided to take the rest of the day off, pour myself a drink and question my existence.” — Douglas A. Boneparth

**probably referring to this particular account whose value has dropped by $500 million as we write

“Imagine wasting years of your life doing CFA to see things like Doge or a Deli being worth $100M.” — Stalingrad & Poorsky

Yes. The deli is the other story for peak absurdity this weekend with “a single New Jersey deli doing $35,000 in sales valued at $100 million in the stock market.”

Source: Mr Skilling on Twitter

Source: Mr Skilling on Twitter

Sour grapes?

False? “If you want to be successful in business (in life, actually), you have to create more than you consume. Your goal should be to create value for everyone you interact with.” — Jeff Bezos

There are now 100 crypto assets worth over $1 billion which is a new record.

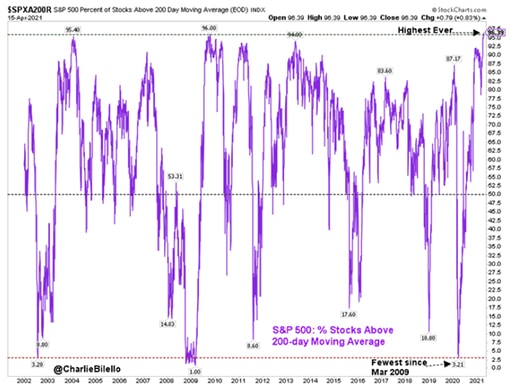

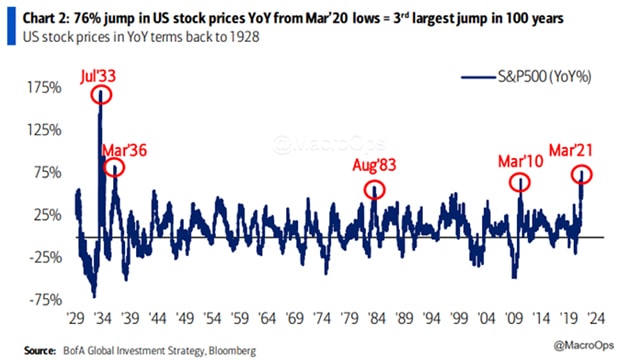

96.4 per cent of stocks in the S&P 500 closed above their 200-day moving average, the highest percentage ever for data dating to 2002 and the 76 per cent year on year rise in U.S. stocks makes it the third-largest jump in a century, according to Bank of America.

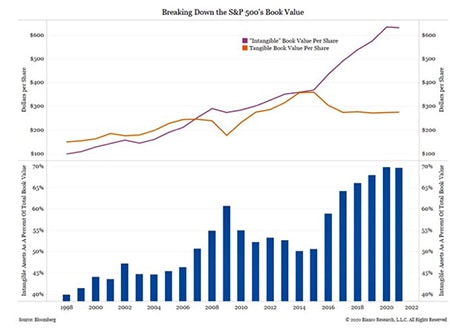

It is just as well that Charles Schwab added 3.2 million retail investor accounts in the first quarter, more than in all of 2020. Charles Schwab said Thursday it opened more than 3 million new retail brokerage accounts in the first quarter of 2021. The quarterly additions were more than what Schwab saw during all of 2020 according to CNBC, because intangible assets now make up 70 per cent of the S&P 500’s total book value.

We are starting to realise Warren Buffet could be wrong and that is why he (and us) eats at McDonald’s while folks are doing the hundred-dollar pastas.

There are people living the dream right now, and we are somehow not part of the game. It would seem that many are refusing to return to the work grind as labour shortages persist and employers are finding it hard to hire despite higher wages and benefits.

“I don’t know why anybody would work anymore, all you need to do is put a small amount of capital into the stock market and you make more money than you would ever work”, a random quote on Twitter.

We would like to think that maybe the employment shortage will ease sooner because SPACs are well down from their peak, especially those associated with SPAC king, Chamath, who had bailed out of his stake in Virgin Galactic earlier in March which should have served as a warning.

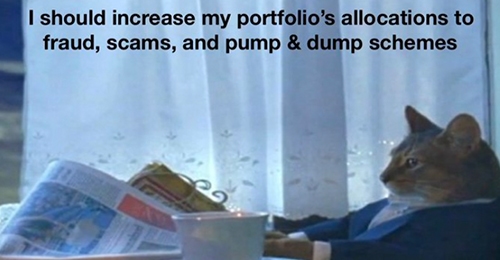

But we will not be having fun “staying poor” because home prices indicate that a dollar a year ago is worth much less today and it has been silly following traditional economic assumptions of rational behaviour when a balanced portfolio of 1/3 Tesla, 1/3 Bitcoin and 1/3 Dogecoin advocated by Elon Musk’s followers have returned just about 20 times year to date.

Yes. We would be deniers who rather be poor than going after things that make zero sense. Just this week, Fed Chair Powell thinks “cryptocurrencies are speculation vehicles like gold,” Bank of Korea chief Lee says, “Cryptocurrency volatility poses risk to financial stability,” and the Turkish central bank bans Bitcoin. Yet, the newly listed Coinbase (COIN US) is now worth more than Goldman Sachs, which labelled Bitcoin “not an asset class” last year.

“You’re Not Crazy. Money Is. Welcome to the non-fungible, memeified, cryptodenominated, degenerate future of finance. There’s nothing to do except gamble… the pandemic economy isn’t an anomaly but a heightened version of one possible future: a world where money is abundant but safe long-term investments are rare and where “getting rich quick” is less an American pathology and more the best bet for a stable life — assuming you think such a thing is possible with ecological catastrophe looming. If you’re supposed to buy stocks as a bet on the future condition of a business, why would you buy stock in a brick-and-mortar retail video-game chain unless you didn’t really believe in any future at all? How different is the stock market from betting on soccer? What’s the point of investing safely when Elon Musk can create and destroy millions of dollars of value with a couple of tweets?” Source: NYMag

For us, it figures and this will not be the first or last you will hear of it but we are living in late capitalism.

Late capitalism is currently used to refer to the “perceived absurdities, contradictions, crises, injustices, and inequality created by modern business development.” As the word “late” suggests, it is late-stage or final-stage which we would connote with a gilded age, if we ignore the historical perspectives of the two words.

The gilded age was conjured by Mark Twain in his satirical novel, The Gilded Age: A Tale of Today, for the late 1800’s era where America grew in prosperity and saw unprecedented growth along with “a more sinister side: a period where greedy, corrupt industrialists, bankers and politicians enjoyed extraordinary wealth and opulence at the expense of the working class. In fact, it was wealthy tycoons, not politicians, who inconspicuously held the most political power during the Gilded Age.”

We are probably at the second Gilded Age now, a time when society was largely defined by culture wars, according to Princeton professor, Matt Karp, where partisan politics will ensure loose populist policies for voters and even more partisanship to follow as arbitragers and speculators run rife, throwing caution to the wind and keeping regulators and politicians in handcuffs.

BofA Flow Show

1 billion vaccines + $30tn stimulus = $50 trillion stock market cap = Wall St inflation

We would challenge you to consider these two concepts, and go back and re-read the happenings of this weekend above. Have we not come to an age of a new bourgeois? Or easy money? Or unbounded risks?

Late capitalism since 2017 till 2021, till when? Of course, we are still bullish, we are just waiting for the pullback to buy.