Preparing To Be Unprepared For The Minsky Moment

Help, my son wants to read Economics for his GCSE examinations much to my chagrin, arousing some of the Tiger Mom instinct in me. Tiger Mom says no difficult-to-score subjects please because the rest are hard enough to juggle, so why not pick PE ? Nobody fails in PE, even as a GCSE subject, let us get real here. Or why not Drama or Art? Subjective subjects.

“But Mommy, I want to learn what Economics is all about. Isn’t that what you do?”, the petulant whine came, and I was unsure if it was an intended jab at what he thought of my work.

My main gripe against Economics is that half of what you learn is impossible to apply in this crazy day and age of prima donna central banks and regulators, the latest being the Dodd-Frank/Glass-Steagal Act that will give the Federal Reserve even more powers.

The Economist: “The new masters of the financial universe are neither bank bosses nor hedge-fund titans. They are the regulators whose job it is to make finance safer.”

The basic assumptions in Economics 101 are :

- People have rational preferences among outcomes that can be identified and associated with a value.

- Individuals maximise utility (as consumers) and firms maximize profit (as producers).

- People act independently on the basis of full and relevant information.

The basic problem is on how to use limited resources to satisfy our preferences and unlimited wants.

Well, we know that markets are 99% irrational and irrationally maximising utility = GREED, an unquantifiable variable and people DO NOT ACT INDEPENDENTLY and DO NOT HAVE ACCESS TO FULL AND RELEVANT INFORMATION.

Even the current stark reality that we are facing – secular stagnation, that we wrote about a fortnight ago, is not a textbook chapter because the economic purists cannot agree on it.

And it is snowballing into a Minsky moment as I write, yet another non-economic term.

A Minsky moment is a sudden major collapse of asset values which is part of the credit cycle or business cycle. Such moments occur because long periods of prosperity and increasing value of investments lead to increasing speculation using borrowed money.

Sudden = unexpected.

And yes, we have a crisis as China devalued their currency and by the most in 2 decades.

Many people do not know it yet, calmly going about their work without realising that the SGD dollar has crashed through its lower NEER band, underperforming her regional peers in a very abrupt turn of events.

Perhaps I was right 2 months ago, when I wrote about the Sharpe Investor Strategy and that “conversations with friends in the past week have unveiled a variety of concerns that all converge on the same uncomfortable feeling of a certain anxiety in ourselves that we cannot seem to pinpoint to a specific source” which is the heightened volatility in the marketplace for most of 2015.

The answer then was to switch to cash because holding cash bolsters the portfolio against asset losses.

Let’s talk about China for a bit even if the root cause of this Minsky moment is not about China.

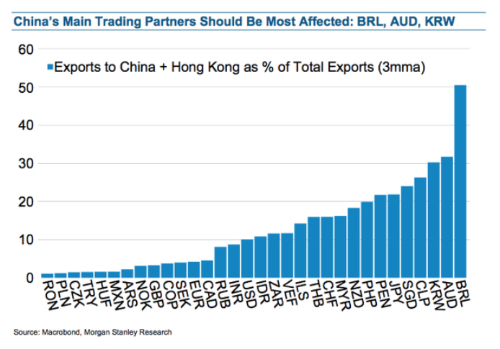

China is devaluing their currency by a mile ahead of Fed’s almost assured rate hike next month. This puts a lot of countries in a tight spot (note Singapore at No. 5).

The first reaction from investors is to bail out and rush for the exit and who could blame them after the precipitous collapse of the darling Chinese stock market in July that has left 18% of the stock market still suspended currently.

Investors bail because it is Irrational and our world is filled with financial porn that we addressed in June and we cannot help ourselves but succumb to the good and bad news that are constantly bombarding us in this golden age of social media, dealing a big blow to confidence and credibility in China.

Enter the pre-Minsky moment.

Friends from both the retail and institutional sectors have calmly informed me, separately and yet almost simultaneously in unison this morning, that they intend to liquidate part of their CNH bonds which have performed extremely well this year (until today).

There is no bid and they are not surprised.

That is because it is what everyone including the IMF but except mainstream press has been warning about since last year.

We know it is a problem when on Aug 3, “the U.S. Federal Reserve has scheduled a conference at the New York Federal Reserve on bond market liquidity on Oct. 21 and Oct. 22”.

And it is hardly China’s fault because this is a global problem now and Minsky moments are being averted because clients cannot sell and thus, cannot bring down the prices. However, they can hedge themselves, for instance, by selling stock indices as I noted last year when the Russell 2000 mid cap index was sold off to hedge the HYG, the iShares iBoxx USD High Yield Corporate Bond ETF.

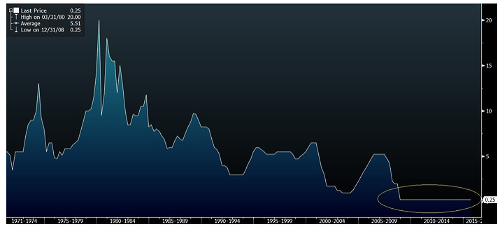

We should Prepare to be Unprepared because this time is different. Yes, because the Fed Funds rate have not seen a longer period of malaise ever in history and in times where the rest of the world smarting from a commodity fall out and slow down in growth.

The Fed Funds rate has never seen a longer period of inaction.

Investors are not in panic yet, just sitting tight, tightening belts and hoping for some good news since there is no way of knowing what to expect even if the Minsky moment arrives. Others are probably praying for the moment to come, parking themselves into those negative yielding bonds of Europe that has become commonplace, just waiting for the central banks to buy them to bankrupt themselves; like the Bank of Japan which has warned today that if interest rates on reserves rise to 2% from 0.1% currently, a number that coincides with their inflation target, the Bank of Japan would need a taxpayer bailout.

2008 vs 2015

We had a credit crisis in 2008 led by the collapse of Bear Sterns in 2007 that cumulated in the demise of Lehman Brothers in 2008. That was Minsky at work.

In 2015? It is a liquidity crisis that is playing out reasonably well, so far, with central banks still on stimulus mode which gives investors some comfort to hold on to those assets that they would like to sell but cannot.

Not very Sharpe, if you ask me.

And my son, visibly bored after my lengthy discourse, has just cheekily informed me he would rather do History next year because they will be teaching about the events leading to the Great Depression and the rise of Hitler.

So much for Economics.