The Race to Become a Digital Bank in Singapore

Applications for the coveted digital bank licences have already been submitted by serious contenders to the Monetary Authority of Singapore (MAS), all hoping to be a part of Singapore’s banking revolution. This has made market watchers sit up and take notice. Can’t the existing banks serve the country’s financial needs?

The Singapore banking industry is concentrated amongst a few local incumbents, namely DBS, OCBC and UOB. These banks have histories which are intertwined with Singapore’s growth as a trading hub. Accordingly, these traditional banks have been operating as full banks under the banking act (Cap.19), serving retail consumers as well as SMEs in Singapore. For the most part, banking needs have been sufficiently fulfilled by the incumbents. However, that statement in itself would stir up some fierce debate amongst industry watchers. Some would argue that there is an imperative need to ignite innovation and to create highly distributed solutions for retail consumers and SMEs, which may be underserved. This is an overarching theme that many digital bank hopefuls wish to take full advantage of.

While technology and big data have permeated almost every industry and taken the world by storm, finance is practically one of the last bastions to be conquered by technology. Industries such as retail, logistics and even traditional media have had technology-savvy entrants making a forced entry into these fields, and changing the status quo in every way imaginable. Today, these industries are being forced to adapt or shut down. A classic example of this is the highly publicised failure of Sears Holdings, a retailer owned by Eddie Lampert (a mega successful hedge fund manager in the US). Amazon has been a major disrupter of traditional retail businesses such as Sears, and many more are staring death in the face as we speak.

Is traditional banking dying a slow death like retail? Well, I’m on the fence. However, I am inclined to think that capital alone is no longer a competitive advantage, with subjectivity and inefficiency being the norm in our banking culture. Loans are given out sometimes arbitrarily, and many a time, dependent on the relationship one has with a banker. A company with a highly diverse customer base comprising retail customers and corporations could quite easily introduce a whole slew of incentives for customers to have a more seamless banking experience, and with more perks as well, making the transition to a digital bank easier than walking into a physical one to open an account. This instance is not a distant future, as MAS seems intent on spurring the next phase of banking innovation.

For now, the date has been set. By June 2020, expect five digital banking licences to be issued to five new players. MAS will issue two digital full bank (DFB) licences and three digital wholesale bank (DWB) licences. The digital full bank licence allows the licensee to handle deposits from retail and non-retail customers with the provision of banking services to these segments, while the digital wholesale bank licence allows the licensee to take deposits and provide banking services to SMEs and other non-retail customer segments.

At the close of 2019, 21 applicants have applied to be in the running: 7 applications were for DFB licences and the rest were for DWB licences. With so much chatter and speculation going on, we have done a short analysis of the known applicants—focusing on factors such as reputational advantage, financial strength, access to capital markets and a track record for technological implementation.

Grab & Singtel

The duo almost needs no introduction. Grab is the dominant ride-hailing service provider in South East Asia, with offshoot services such as food delivery and digital payments while Singtel is an old-school telecommunication company trying to thwart the fates of many telcos—declining cash flows and profits. But to industry watchers, the collaborative application by Grab and Singtel does have its merits.

Singtel has considerable financial strength with a market capitalisation of $53.2 billion, a large diverse base of customers and easy access to capital markets. Grab, on the other hand, has a track record of having operated a successful technology-driven marketplace and in its latest funding round, had cash injections from Softbank which valued the firm at $14 billion. Together, both parties have access to capital, the necessary technology and a combined customer base of at least 776 million consumers. That statistic alone should lend credence to its plans to operate a digital bank.

Grab is believed to hold 60% of the partnership with Singtel holding the remaining 40%. In recent times, Grab has spun off financial services such as micro loans and insurance. The foray into digital banking will give the consortium the ability to serve the underbanked.

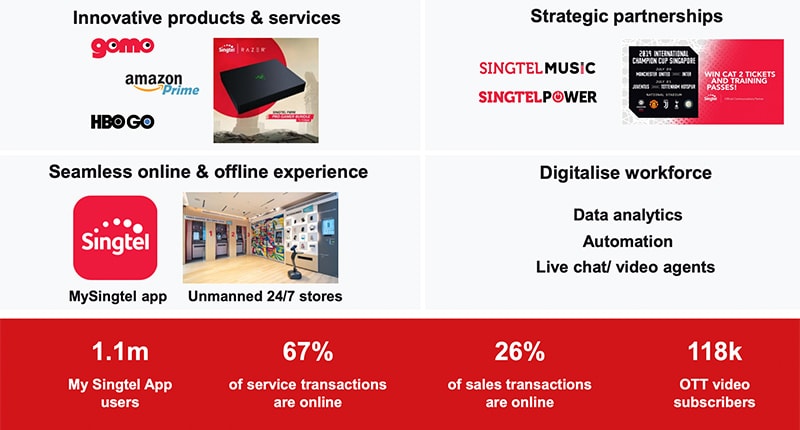

Source: Singtel 27th Annual General Meeting Presentation

Source: Singtel 27th Annual General Meeting Presentation

Singtel also has a cyber security subsidiary called Trustwave and is already in transition to become more digitised. Currently offering mobile financial services, the company’s $3.65 billion in free cash flow and expertise in cyber security will prove a boon to the partnership with Grab.

Razer Youth Bank

The Razer Youth Bank consortium consists of gaming company Razer Inc, Sheng Siong Holdings, FWD, LinkSure Global, venture capital firm Insignia Venture and automotive marketplace Carro. Gaming company Razer Inc, via Razer Fintech, is said to be leading the consortium with a 60% share. With access to capital markets and a market capitalisation of HKD$12.1 billion, Razer Inc intends to target youths and millennials between the ages of 12 and 35 years old, while providing banking services to SMEs and entrepreneurs.

It is unclear how Razer will execute and operate a digital bank along with its consortium partners. Compared to other applicants for the digital banking licence, it may not have the standing that Singtel has. Since consumers of Razer’s products and services are typically youths and millennials, Razer intends to work with reputable third parties to offer services relevant to its targeted demographic. These include Saxo Markets, Skyscanner, Visa, Justco and many others.

Beyond

Beyond is a consortium led by V3 Group whose controlling shareholder is Ron Sim, the man behind Osim. The astute businessman saw a beaten down, possibly undervalued Osim International in 2017 and borrowed $300 million to opportunistically delist the company. He has repackaged the businesses in Osim and TWG to be housed under V3 Group and has obtained the support of private equity firm KKR in the form of a $500 million injection into the company. The other parties in the Beyond consortium are EZ-Link Pte Ltd, Singapore Business Federation, MSIG Insurance (Singapore) Pte Ltd, Far East Organization Pte Ltd and a subsidiary of Temasek, Heliconia Capital Pte Ltd.

Beyond’s vision may be one of the more unique ones. The consortium has already established Beyond Lab, an entity whose sole purpose is to support SMEs skill up digitally and to eventually improve their operating efficiency and competitiveness. Ho Meng Kit, CEO of SBF, acknowledges that start-ups and smaller enterprises often face difficulties with securing funding from traditional banks. Hence, with Beyond Lab’s push to help SMEs with digitisation, the aim to provide banking solutions to underserved SMEs would naturally fall in line.

Ant Financial

Ant Financial could be one of the top contenders for a digital banking licence, even though it is not well known in Singapore. As a household name in China, the company is a giant compared to fintech firms. In 2018 alone, the amount of venture capital raised by Ant Financial was $14 billion. This was $1.9 billion less than the combined amount of venture capital raised by fintech firms in all of North America and Europe.

Ant Financial started off as Alipay in 2004 and eventually became the dominant payment platform in China. In 2013, the company surpassed PayPal as the largest mobile payment platform and rebranded themselves as Ant Financial, a year later. Currently, it operates MYbank, which has lent close to US$290 million to 16 million small businesses in China. That alone puts Ant Financial in the front-running for a digital bank licence in Singapore.

According to a report by Reuters, Ant Financial, an affiliate of Jack Ma’s Alibaba, has an implied valuation of $200 billion as shares were traded privately amongst investors. Today, the company has 1.2 billion annual active users and has a business model which consists of payment services, savings and credit products.

iFast Corporation

iFast Corporation, a wealth management platform headquartered in Singapore, has submitted a collaborative application with its Chinese partners for a DWB licence. Its partners are Yillion Group, a digital bank in China and Hande Group, a fintech company in China. The impetus for starting a digital bank is a natural complement to iFast’s wealth management activities for the masses, as its business is transactions-driven. Currently managing close to $10 billion in assets under management, the consortium intends to serve the SME market.

Advance.AI, Sheng Ye Capital & Phillip Capital

Advance.AI, a fintech company in Singapore, Sheng Ye Capital, a supply chain financing firm and PhillipCapital are in the running for a DWB licence. Sheng Ye Capital is a financial service provider listed in Hong Kong with a market capitalisation of HKD$6.24 billion and Advance.AI specialises in artificial intelligence and big data for fraud detection and prevention. The consortium intends to provide credit and banking services to small businesses in Singapore.

AMTD, Xiaomi Finance, SP Group & Funding Societies

AMTD Group is a Hong Kong-based investment bank that is teaming up with Xiaomi, SP Group and Funding Societies. According to media reports, the consortium wants to focus on green finance and IoT technology to provide financial services backed by data.

Sea

Sea Ltd, a U.S.-listed company on the NYSE, with revenues of US$827 million in FY 2018 began trading as a listed entity in 2017. With a fast-growing revenue base and operations which are still currently loss-making, Sea’s founder, Forrest Li, has been catapulted to billionaire status with a net worth of more than US$1 billion while Sea’s stock price has approximately tripled to $45 per share.

Sea is going in alone. With a market capitalisation of US$19 billion, Sea claims to have the technology, infrastructure and data through SeaMoney, Garena and Shopee to meet the banking needs of its users and SMEs in the region.

ByteDance

ByteDance Ltd, a technology firm from China, is also a contender. Founded by Zhang Yiming in 2012, the company initially operated as a content platform and eventually became a content recommendation engine, delivering personalised news feeds powered by machine learning to users.

In 2017, ByteDance launched TikTok, a video-sharing social networking service outside of China which proved to be extremely successful. By 2019, it became the 7th most downloaded mobile app of the decade. The success of TikTok has propelled Bytedance to a US$75 billion valuation with over 800 million active users across all its platforms. It has already launched ManFen, a lending app which focuses on consumer credit services in China. As such, obtaining a digital bank licence in Singapore would allow it to provide the same services in another geography.

Zall

Zall Smart Commerce Group, a B2B trade platform in South East Asia and China is reported to have submitted a bid for a wholesale banking licence with Global eTrade Services and Marubeni Corporation of Japan. These partners are said to bring with them expertise such as artificial intelligence, blockchain technologies, big data and financial experience. The consortium intends to gather insights from data to provide banking services for growth-oriented SMEs. Both Zall Smart Commerce Group and Marubeni Corporation have a combined market capitalisation of USD$14 billion.

Arival

Source: Arival

Source: Arival

Arival is a relatively newcomer to the digital banking scene. In 2017, the company spun off from Life.Sreda, a venture capital firm and their strategy seems to be well-articulated or at least well-covered. Arival intends to open up its API and work with third-party fintech service providers to provide banking services for the underbanked, catering to higher-risk customers who are often rejected by traditional banks.

Arival argues that customer acquisition costs for this segment will be low, and the result of that is higher margins. This remains to be seen but the plan sounds logical enough. Also, one of the differentiating factors is that Arival intends to offer compliance services to third-party fintech service providers, giving them a new channel to generate revenue.

Final thoughts

While balancing the ideals of banking innovation and the associated risks, loss-making financial entities backed by deep pockets pose a significant risk to our financial system, especially when we are talking about the depositors’ hard-earned savings. Loss-making banks cannot continue to exist indefinitely. There has to be a clear path to profitability and the efficiency of a digital bank must result in not only cost savings but also value creation for shareholders.

Technology behemoths such as Grab cannot impose their “growth at all costs” strategy while operating a digital bank. These digital banks must strive to be profitable at some point. Going by precedence, it appears that even the more prominent digital banks in the UK like Revolut, Starling and Monzo have a cumulative loss exceeding ₤100 million in their latest fiscal years, even though customer deposits have risen. Hence, it will be a long shot for digital bank hopefuls to be successful in the near future as experts predict that these digital banks can only hope to command a 2-3% of the Singapore’s banking assets. These figures are dim. But perhaps the ultimate goal of many of these digital bank applicants is not to be profitable immediately. These digital banks will in all likelihood use Singapore as a gateway to other regional markets which have a larger unbanked population. So who will emerge victorious? Ironically, it’s not the licensees but the underserved, underbanked and SMEs who have had difficulty obtaining traditional bank financing.