Welcome to Bizarro Markets – A New Paradigm

Earthquake season—US Women win the World Cup and we have a repeat of 2015 in the Men’s Wimbledon Singles today. We had our own earthquake in the markets making triple record new highs on Friday as we have the endless quakes in California that continue after the largest earthquake in 20 years just like the Hong Kong protests which are not stopping even though the extradition bill was killed off earlier this week.

Source: Earthquaketrack.com

Source: Earthquaketrack.com

The other quake in the markets would be the Deutsche bank lay-offs that are leaving bankers on edge as the 18,000 staff worldwide start flooding job markets and laid-off expat bankers struggle to find jobs in Hong Kong becomes one of the top read headlines.

Don’t we all feel a little trapped in a Bizarro World, from a WSJ headline after last week’s good employment numbers in the US sparked a monstrous VAR shock, another new term, that led to a 6 standard deviation sell-off in US yields and further selling this week in the bunds, gilts and gang that most investors are blissfully unaware of? Then, S&P 500 jumps above 3,000 for the first time after the Fed chief signals a rate cut is coming.

Since then we come to learn Bizarro World is the world created by the deformed clone of Superman known as Bizarro, which in popular culture, has come to mean a situation or setting which is weirdly inverted or opposite to expectations, according to Wikipedia.

For us, there has been a paradigm shift last week since Lagarde signed up with the ECB and the ECB is now seen by the markets to be readying the pumps for a return to massive bond buying, the Turkish President firing the central banker, the Mexican Finance Minister’s resignation this week and the lightning strike that destroyed 45,000 barrels of Jim Beam last week only to kill thousands of fishes this week. It is Bizarro!

And the stock market is looking forward to infinity at this rate because as CNBC reported… “U.S. investors pulled the largest net amount of assets from mutual funds and exchange-traded funds that hold domestic stocks in more than five years last week even as the U.S. equity market hit record highs, according to data released Wednesday by the Investment Company Institute. The roughly $25.1 billion in net outflows from domestic stock funds was the largest since the $25.2 billion pulled from the category during the week that ended Feb. 5, 2014. Over the last two weeks, investors have pulled approximately $30.6 billion from U.S. stock funds.”

That means we are just as smart as them and for that matter, sovereign wealth funds too!

Sovereign wealth funds boosted their allocations to fixed income to 33% this year, the highest level in four years, making it the largest asset class for the funds while allocations to stocks fell.

And they must all be feeling “bizarro” too and thus, we decided to compile a list of things that make us uncomfortable about this “bizarro market”.

Hard Data Reasons to Recession

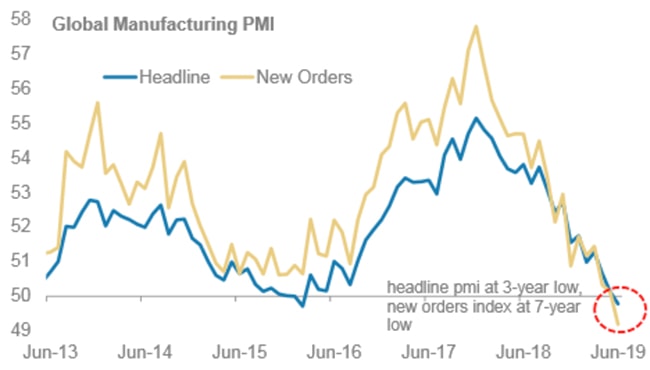

As we pointed out before, Global PMIs are in contraction for the first time since 2016 with new orders looking anaemic.

Source: Twitter feed of Daniel Lacalle

Source: Twitter feed of Daniel Lacalle

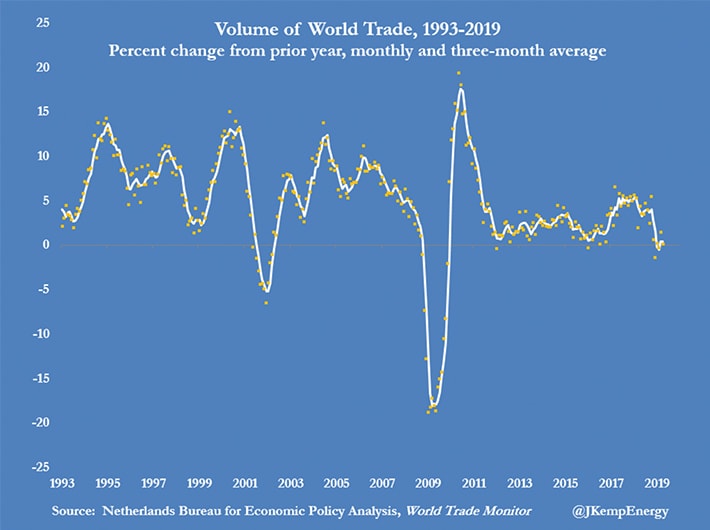

Trade is slowing in every indicator except for the Baltic Dry Index. Proxies such as the South Korea KOSPI Index, the most closely correlated with world trade is down 8% as London Heathrow’s cargo in 2Q had its worst performance since the 2009 recession.

Source: Reuters

Source: Reuters

Singapore’s GDP shows the slowest quarterly growth (hopefully 0.1% yoy) since mid-2009. GDP in export-reliant Singapore shrank an annualised 3.4% in the 2Q19 from the previous three months, the biggest decline since 2012.

Bellwether trade stocks are sinking, from chemical companies like BASF with warnings on construction to agriculture, to freight giants like Maersk and FedEx, to automotive supply chain, the share prices say it all. Even the environment is calling for a recession, as BASF blames extreme weather in the US for half its worries on crop chemical demand.

Source: Bloomberg

Source: Bloomberg

New Trade Wars

We already have the current trade war, the sanctions and sanctions to come on crazy Iran and Turkey for buying the Russian missile defense system (because it is not American). Then we have France declaring a digital tax on US tech companies this week which is asking for trouble (which means tariffs) in the days ahead. We also have the following happening right now which are not good news.

1. India raises the alarm over trade deficit with Indonesia

2. Japan-South Korea feud deepens with disputed accounts of trade meeting which threatens global supplies of microchips and smartphone displays

Bizarro Central Banks in “land of make believe”, Citibank Willem Buiter

RBA doesn’t ‘really understand’ investors. Governor Philip Lowe said he didn’t understand why the same investors who are betting on central banks cutting interest rates are also driving the sharemarket to record highs.

“There are investors who think the outlook is sufficiently weak that they expect central banks right around the world to cut interest rates but they are not worried about corporate profits or credit risk,” Dr Lowe said.

Investors do not understand as well because Trump is saying the economy has never been stronger and we need lower rates but Powell is saying the economy is a disaster and we need lower rates.

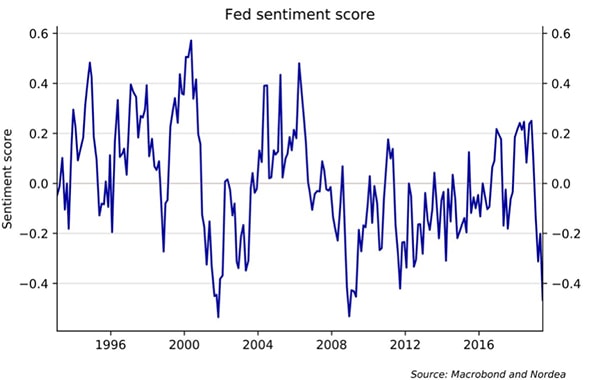

The FOMC minutes sentiment score hasn’t been this low since 2009.

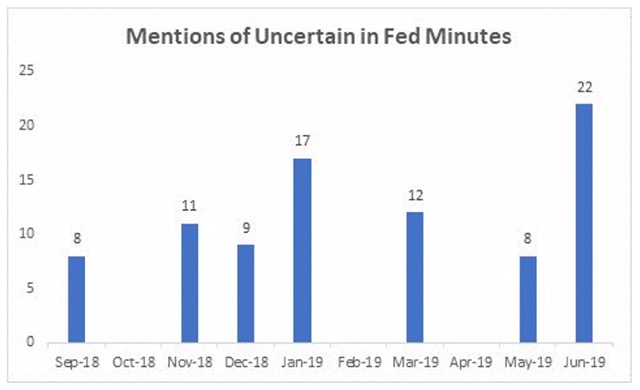

Fed watcher David Rosenberg noted Fed Chair Powell used the word “uncertainties” and “risk” a combined 6 times in his testimony to Congress on Wednesday and “uncertainties” and “risks” were ubiquitous in the FOMC minutes as well as we managed to dig from Twitter below.

Source: Twitter feed of The Long View

Source: Twitter feed of The Long View

Perhaps central bankers have lost the plot in a “land of make believe” as Citi’s Willem Buiter asserted on Bloomberg earlier this week, and we do not mean just the ones fired by the country’s president to get the country downgraded like a Turkey on Friday.

Bizarro Corporate Cracks this Week

There is something bizarre every week so far so we will just list the oddity and significant frauds for this week.

AB InBev pulls Budweiser listing, canceling year’s largest IPO that was planned for listing in Hong Kong due to “several factors, including prevailing market conditions” which is the Hang Seng near its historic highs! Why not list at the historic high?

One of China’s largest wealth managers, Noah Holdings plunges 20%, has levied accusations of fraud against a Hong Kong-listed company that said last week its chairwoman had been detained by police and that it had exposure to via an asset management product.

Then there is the massive fraud at Kangde Xin Composite Material Group that has some missing billions of US dollars in May which has extended to an investigation into the company’s auditor this week.

Finally, Punjab National Bank perhaps chose the right time to announce yet another borrowing fraud of US$ 556 mio because markets would not be too fussed in these troubled times, especially after the other PNB loss of US$ 2 bio to another fraud last year.

Bond Markets Acting Up

No, it is not negative bond yields in Czech, Hungary and Poland this week since 83% of Swiss IG bonds are negative anyway.

Nor it is the 0% coupon in German 10 year bond auction that will yield -0.26% for the next decade which means investors will get less money back in the end and not receive a cent in coupon too.

It is the yield on the 30 year US Treasury bond which briefly dipped below 2.5% as reported by CNN.

In other words, the 30Y was yielding less than the Federal Reserve’s short-term federal funds rate (FFR) of 2.5%. The inversion of the 30Y and FFR has happened only 6 times since 1980 and 5 of those times it took place just before a significant pullback in stocks—the double-dip recessions of 1980-1982, the savings and loan crisis of the late 1980s, the Asian debt crisis of 1997, the bursting of the tech bubble in 2000 and the Great Recession of 2008.

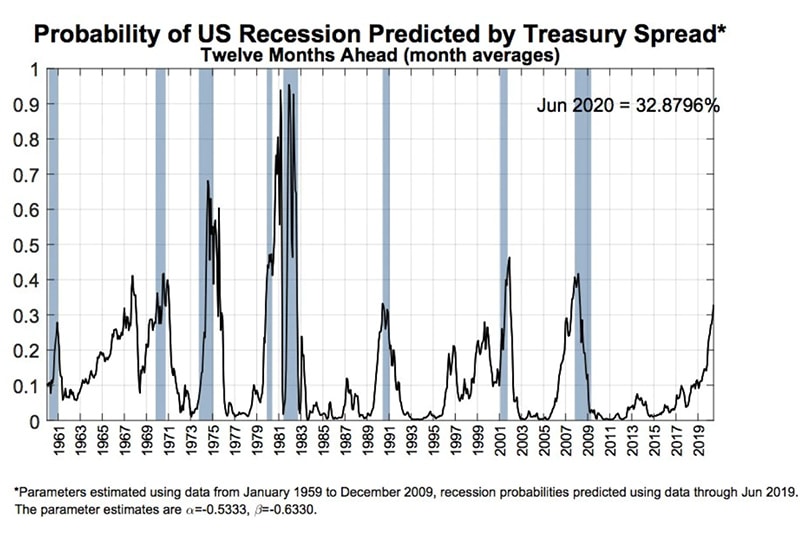

As much as we would dream of a stock market pullback, the New York Federal Reserve’s Recession Probability model has pegged recession risk at 32.9%, a 12 year high. The New York Fed’s tracker uses treasury spreads, specifically the difference between the 10 year and 3month Treasury rates. A negative spread between the two has preceded all post-war downturns, and it’s been negative since May.

Source: Business Insider

Source: Business Insider

Bond markets are screaming for stock pullbacks and recessions, it would appear. Bizarro!

The Stock Market Speaks

FT reports that S&P 500 companies are expected to enter an earnings recession for the first time since 2016, with an estimated earnings decline of 2.8% in Q2. Meanwhile, their shares are hovering around all-time highs.

Analysts have been revising their earnings expectations for the S&P from 3.3% late last year to the current negative levels as stock prices break records which means current prices are pricing in the decline? Bizarre.

We will find out in the coming week when earnings season kicks off.

Strange Bizarro World

A good friend commented she would not be surprised if one day Trump becomes a new God and create a new religion. Why not, if everyone gets accustomed to the Bizarro World?

After all, cocaine production in Colombia is at historic high just as the US seizes a record US$1.3 bio in a drug bust on the world’s second largest container ship that happens to belong to JPMorgan and the US Coast Guard nabs another US$ 569 mio-worth in a high speed submarine case which probably has nothing to do with the Catholic bishop who intends to spray holy water over an entire Colombian city from a military helicopter in an attempt to conquer the demons he believes are plaguing it.

If that does not feel strange to you, welcome to the Bizarro World!