2021 Singapore Corporate Bonds: The End of an Era or Endgame?

2020 Overview

Laughing and crying into the new year, wishing we could cling onto the incredible markets of 2020 yet wishing the end of the pandemic. We are at a loss for words; ceaselessly amazed at how 2020 has turned out.

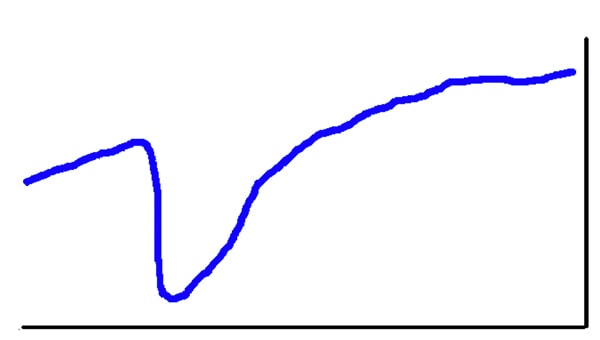

Every chart of anything in 2020 would look like the one below—just swap the title.

Therefore, the chart of S&P Singapore Corporate Bond 5+ Year index below should not be a big surprise, but here goes for that steep descent and a 7 per cent rebound to close the year at an all-time high.

Chart of the S&P Singapore Corporate Bond 5+ Year Index. Source: Bloomberg

Chart of the S&P Singapore Corporate Bond 5+ Year Index. Source: Bloomberg

The price chart of the Nikko Asset Management SGD Investment Grade Corporate Bond ETF (NIKIGCB SP) listed on the SGX also tells the same story, closing the year at an all-time high after slipping in March and rebounding nearly 9 per cent to close the year with a respectable year on year 5.62 per cent gain as local 5-year interest rates collapsed to their lifetime lows.

Price chart of the Nikko AM SGD Investment Grade Corporate Bond ETF versus the 5-year swap rates. Source: Bloomberg

Price chart of the Nikko AM SGD Investment Grade Corporate Bond ETF versus the 5-year swap rates. Source: Bloomberg

It has been the best year too for Singapore government bonds, which saw their best annual performance since at least 2003, returning 8 per cent in 2020, according to the Bloomberg Barclays index, the 12th best performer among 46 sovereign markets tracked by Bloomberg.

But how much better will it get?

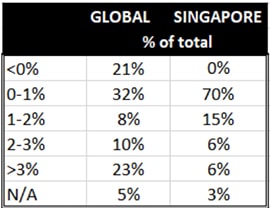

We can console ourselves that the ABF Singapore Bond index is still delivering a weighted average yield to maturity of 1.15 per cent while the corporate bond fund is still yielding a decent 2.07 per cent, according to their November factsheets compared to the rest of the world where 21 per cent of outstanding bonds are trading under 0 per cent as we have summarised using data from Bloomberg below.

There is only one place in the world to look for most of the >3 per cent bonds—and that is China which commands 58.4 per cent of outstanding bonds. There is not much yield left anyway for the Singapore dollar to show up as one of the few places left to buy those 1-3 per cent bonds as seen from the table we did for perspective.

Summary table of currencies and outstanding bond yields (data unverified). Source: Bloomberg

Summary table of currencies and outstanding bond yields (data unverified). Source: Bloomberg

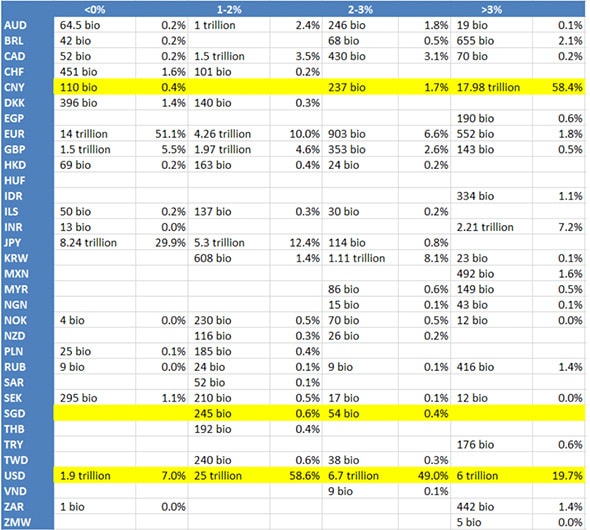

Within Singapore, there are only 750 bands to choose from worth SGD 470-odd billion of which roughly half comprises government bonds, which do not yield any more than 1.26 per cent (the highest-yielding bond on the curve). Hence, the truth is that just over 70 per cent of all SGD bonds yield between 0 to 1.5 per cent as summarised below.

SGD Bonds in their yield buckets (data unverified). Source: Bloomberg

SGD Bonds in their yield buckets (data unverified). Source: Bloomberg

Singapore Markets 2020

The good news first because there are not plenty: 2020 has few defaults in the Singapore dollar space: Century Sunshine, Pacific International Lines, Kris Energy (again), Pacific Radiance (extension of debt moratorium till April 2021) and Peking University, a USD bond that is listed in Singapore and sold to local investors. *PS: there were more issues that defaulted that were listed on SGX but we are unable to elaborate too much for now.

We have elected to stay mum about the carnage of March/April and the slaughterhouse conditions then, out of respect for the folks who were caught in the line of fire, for all our disdain for the mercenary middlemen where a ton of bad karma awaits. Suffice to say, the Fed saved Singapore markets, along with the rest of the EM bloc.

MAS did nothing is perhaps a good thing to prevent the moral hazard, but it also perhaps leaves us a market where “bankers’ careers and judgements remain sacrosanct while price discovery via capital markets is shunned,” to quote a local fund manager. We leave the audience to interpret that comment as they desire and reserve the private joke for ourselves.

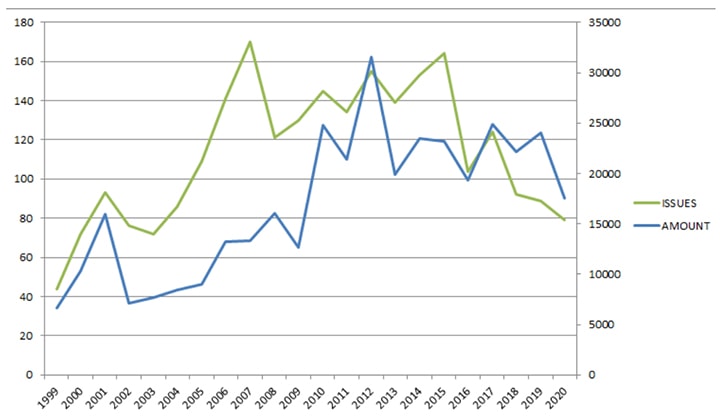

In summary, Singapore corporate bond markets have been pretty lame ducks for most of 2020. A trader we asked described it as the market is at its endgame with the fewest number of issues, (just about 79) since 2003 and the lowest amount of bonds issued since 2009 at about S$17.5 billion.

Graph of issues and amounts over the years (data unverified). Source: Bloomberg

Graph of issues and amounts over the years (data unverified). Source: Bloomberg

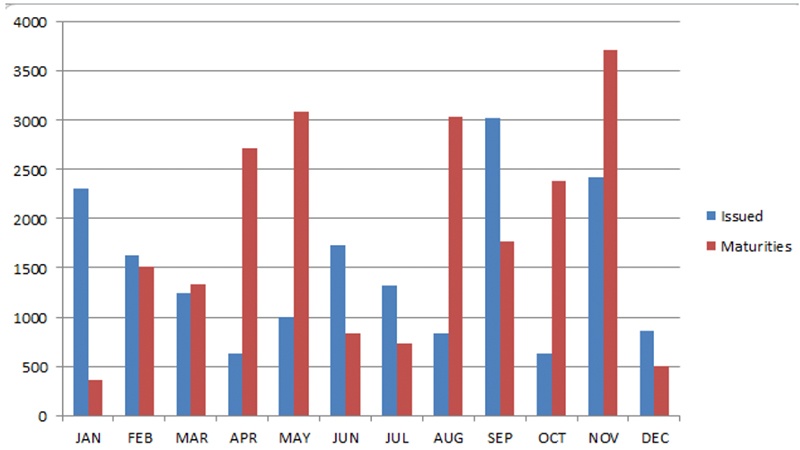

The supply simply dried up as over S$21 billion of maturities was matched by some $17.5 bio of new bonds which compounded into the year-end, with November witnessing the largest redemptions and money chasing bonds into year-end, sending some papers flying 20-35 per cent off their March lows.

Table of new issuance versus maturities (data unverified). Source: Bloomberg

Table of new issuance versus maturities (data unverified). Source: Bloomberg

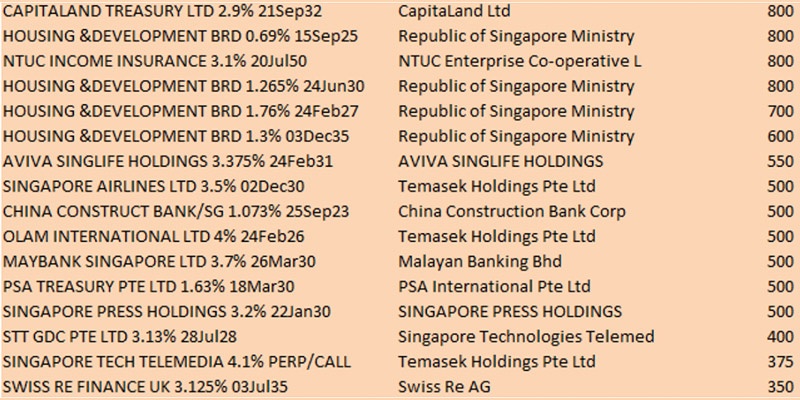

2020 would be a year without a single SGD 1 billion dollar issue since 2014, compared to 3 billion dollar or more issues in 2019, 5 in 2018, 1 in 2017, 2016 and 2015. Only 4 issues of SGD 800 billion graced the markets in the face of the wall of maturities, suggesting investors found the new supply none-too-palatable, yield-wise, for if we examine the maturing bonds, retail would make a decent proportion of investors in the perpetuals that matured.

Table of the largest issues in SGD for 2020 (data unverified). Source: Bloomberg

Table of the largest issues in SGD for 2020 (data unverified). Source: Bloomberg

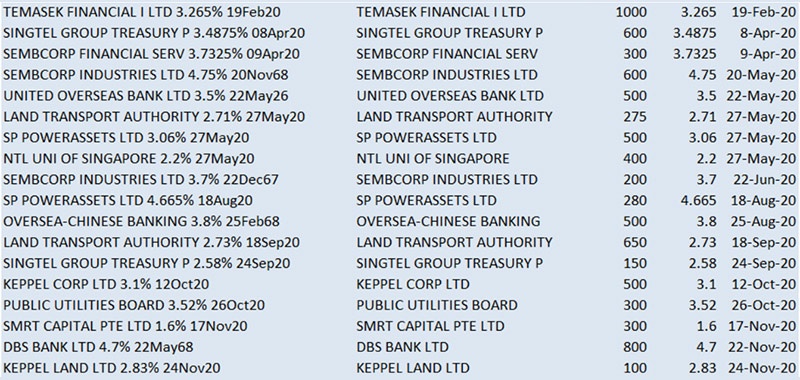

Many local GLC’s, stat boards and banks simply just did not rollover their bond maturities in 2020 and we table just some of them below, taking note of the retail-heavy perpetual bonds in UOB, DBS and OCBC.

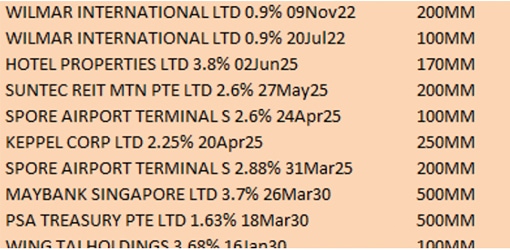

Table of some bonds that matured in 2020 and were not re-issued or partially re-issued. Source: Bloomberg

Table of some bonds that matured in 2020 and were not re-issued or partially re-issued. Source: Bloomberg

The supply situation for 2020 was further exacerbated by the “phantom” issues in the SGD space to rival last year’s SGD 1.5 billion “mystery” Sembcorp issue we would define as bonds that “do not trade” which we present below. It is possible that the bonds were issued to single or a mere handful of buyers such that they are not available to the public from our postulation which may not be accurate.

That actually makes matters worse because that would make the issuance gap even wider than the 17 billion versus 21 billion difference.

List of SGD bonds issued in 2020 which do not trade in secondary markets (unverified)

List of SGD bonds issued in 2020 which do not trade in secondary markets (unverified)

From the retail supply shortage front, we also saw the lowest amount of perpetual bonds issued since 2016 with just SGD 1.8 billion hitting the street in 9 issues.

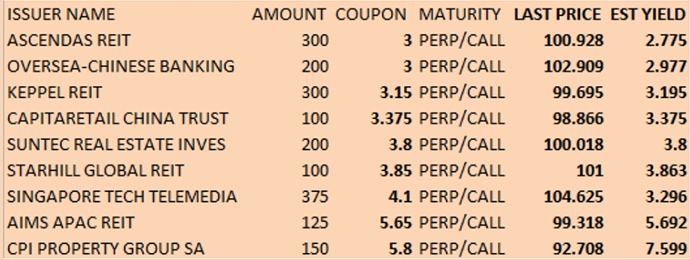

Table of perpetual bond issuance in SGD (data unverified). Source: Bloomberg

Table of perpetual bond issuance in SGD (data unverified). Source: Bloomberg

Besides the tiny perpetual bond sizes which include OCBC’s 200 million token issue in SGD dollar to replace her SGD 500 million dollar maturity, we also saw the lowest coupon ever paid at 3 per cent—a sign perhaps, of a more discerning market that is partially due to Ascott Residence Trust setting a precedent in June by not redeeming its callable perpetual?

Table of SGD perpetual bonds publicly issued in 2020. Source: Bloomberg

Table of SGD perpetual bonds publicly issued in 2020. Source: Bloomberg

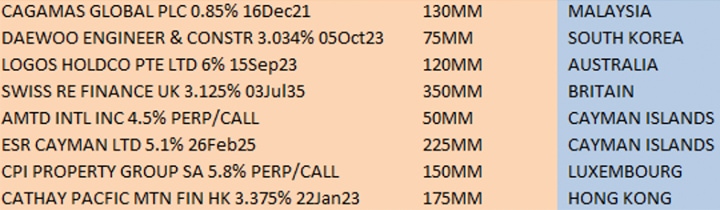

Finally, 2020 would plausibly be the year where the Singapore dollar bond market has been the least amount of foreign issuers as a percentage from the table of offshore issuers we managed to salvage from data.

Table of offshore issuers in SGD dollar in 2020 (data unverified). Source: Bloomberg

Table of offshore issuers in SGD dollar in 2020 (data unverified). Source: Bloomberg

What is happening?

Why have issuers been shunning the SGD dollar market for raising funds when inflows have been huge?

Our little conspiracy theory which may not be that unplausible is that it’s because of SORA, or that new rate that will be replacing the SOR in all derivative trades. And because of Section 757, where all offshore issuers will have to swap their SGD liabilities into another currency, there is little incentive for any offshore borrower to issue in SGD unless they need it because they would be exposing themselves to unnecessary risks when they hedge, besides the fact that they can borrow in any other currency where the government offers QE. Please do not bother to dwell too much on this if you do not understand because it is hardly important from a non-practitioner point of view.

SORA is new and untested and not a lot of issuers need SGD dollar.

It is true because, upon further examination, we noticed more than a few significant Singapore entities raising funds in USD or EUR this year.

List of 2020 offshore borrowings by significant Singapore corporates (data unverified and inexhaustive).

List of 2020 offshore borrowings by significant Singapore corporates (data unverified and inexhaustive).

2021—Endgame or End of Era?

“No support, no substance and therefore, uncertain future,” to quote a fund manager.

2021 will be the dawn of a “new era or end game” for Singapore, as a bond trader taciturnly informed us. She had dumped her entire portfolio of derivative hedges linked to SOR and is flying on empty into 2021 while strategising a new game plan, after over 20 years in the business.

It will be “fun though,” she thinks, doing things differently and having no clue on benchmarking.

Let us look at the few things we have in store for 2021.

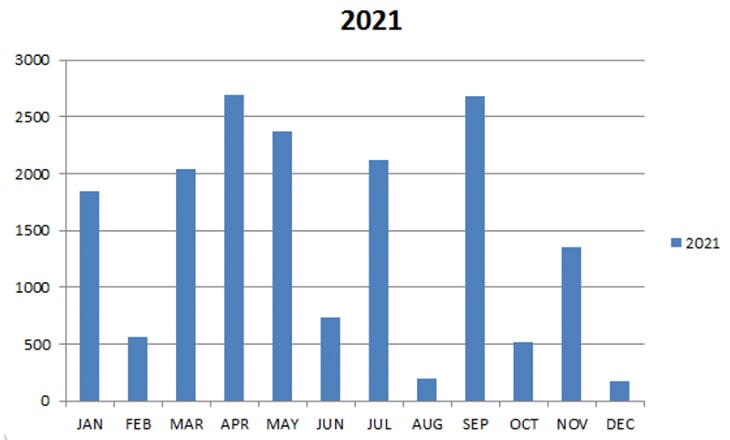

For one, the bond maturities in 2021 would be less than 2020 at just about SGD 17 billion.

Bond maturities in SGD dollar for 2021 (data unverified). Source: Bloomberg

Bond maturities in SGD dollar for 2021 (data unverified). Source: Bloomberg

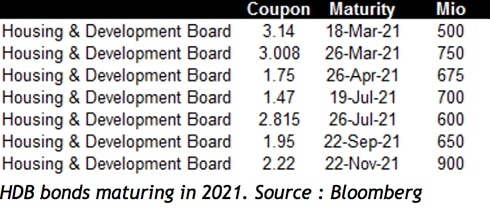

It is not a problem given that over a quarter of the maturities come from the Housing Development Board which makes 2021 the year the most amount of HDB bonds, 7 issues in all for SGD 4.775 billion, will come due. Fewer issues maturing than 2016’s 8 issues which totalled SGD 3.265 billion then.

Besides HDB, we have some chunky amounts of sub debts and perpetuals due, mainly out of UOB, Manulife, ABN Amro and Standard Chartered along with some Huarong Finance. Fortunately, none of them are billion-dollar maturities, which would make life easier in terms of hunting for yield.

As for the new decade ahead for the Singapore markets, we find, for the first time, having run out of anything left to say.