Taking Stock of the Bond Market and Precious Yields in Singapore

“An ending is better than no ending,” said a frustrated friend. She had binge-watched all 25 episodes of the Berserk anime only to be left high and dry with an abrupt ending. There wasn’t even a confrontation between the protagonist and the villain in chief or even a decisive battle between any of the villain’s henchmen. Plus she couldn’t even google to find out the ending because the manga never concluded 30 odd years ago. No risk of spoiler alert there.

We see lots of endings as many familiar restaurants or bars shutter, the latest being Prima Tower Revolving Restaurant and yet alcohol retail businesses are booming. How is that for perspective?

As we come to terms with the Covid-19 crisis, the time is right for us to take stock of a world without the rose-tinted lenses and come to a reckoning that capital gains are not forever. The total return in the US long bond is +21 per cent year-to-date and this follows a +16 per cent total return in 2019 with the same for Singapore’s old 30-year bond, which is up just about 31 per cent since the start of 2019.

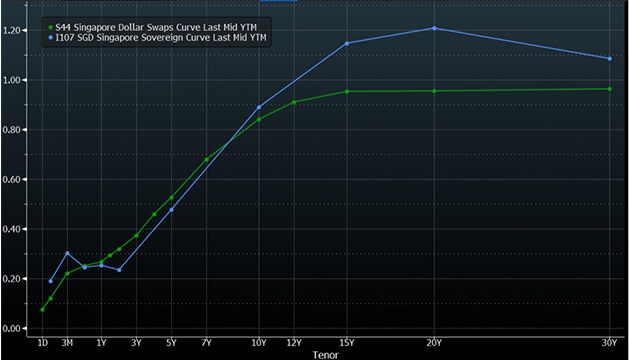

With a yield of just 1.18 per cent per annum to expect till 2046 for the 30-year Singapore government bond, Singaporeans should be grateful because Germans would lose money if they invested in their own government paper given the 2044 German bund pays negative returns, and over 80 per cent of developed market government debt yield less than 0.5 per cent.

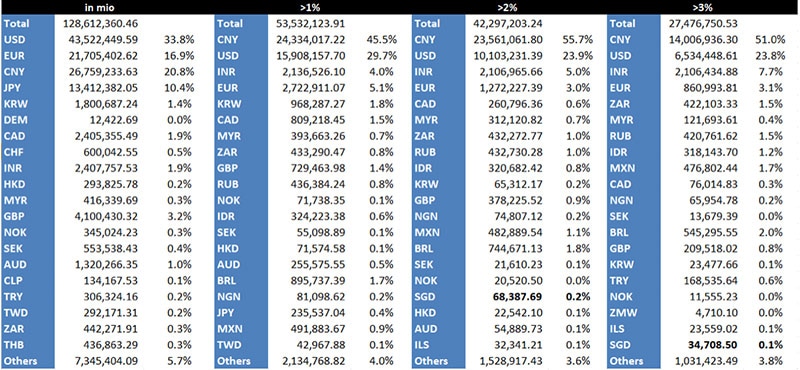

We found 2.75 million securities for about US$129 trillion worth in the world and just 41 per cent of them yield above 1 per cent and out of this 53 trillion worth of bonds, 45.5 per cent is denominated in Chinese yuan even if our data is unverified for accuracy.

Rough table of total bonds in the world grouped into yields and currencies (in USD). Source: Bloomberg

Rough table of total bonds in the world grouped into yields and currencies (in USD). Source: Bloomberg

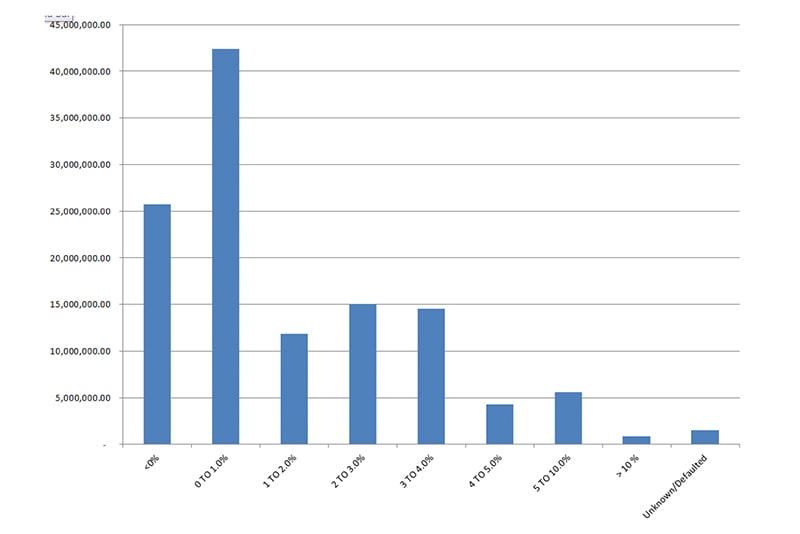

With the majority of bonds in the world yielding below 1 per cent, this is really a bad time to be saving money. If we look at the chart below, noting that over US$25 trillion of bonds are under zero per cent and losing money over time even if the number does not tie in with the Barclays Global Aggregate Negative Yielding Debt Market Value amount of US$14.4 trillion. We have to acknowledge that the reality is looking extremely bleak for savings.

Chart of amount bonds in the world grouped into yield buckets (in USD). Source: Bloomberg

Chart of amount bonds in the world grouped into yield buckets (in USD). Source: Bloomberg

What we can glean also from the previous table is that the Singapore market is in a decent position because despite just representing 0.26 per cent of global bond markets with US$335 billion in outstanding issues, which also includes S$3.5 billion worth of SIA convertible bonds, Singapore has more bonds yielding over two per cent than Sweden, Norway and Hong Kong combined.

Yet we also note there is no rush for precious yield for spoilt Singaporean investors for the fact that Singapore still has many decent bonds yielding over 2 per cent or even 3 per cent. The market is running low on supply given that we have almost S$13 billion in maturing bonds (S$3 billion in the month of August alone and over S$20 billion to mature in 2020) and just S$9 billion issued for the year so far which includes some issues that never quite surfaced like PSA, SATS, Keppel, Suntec Reit and such.

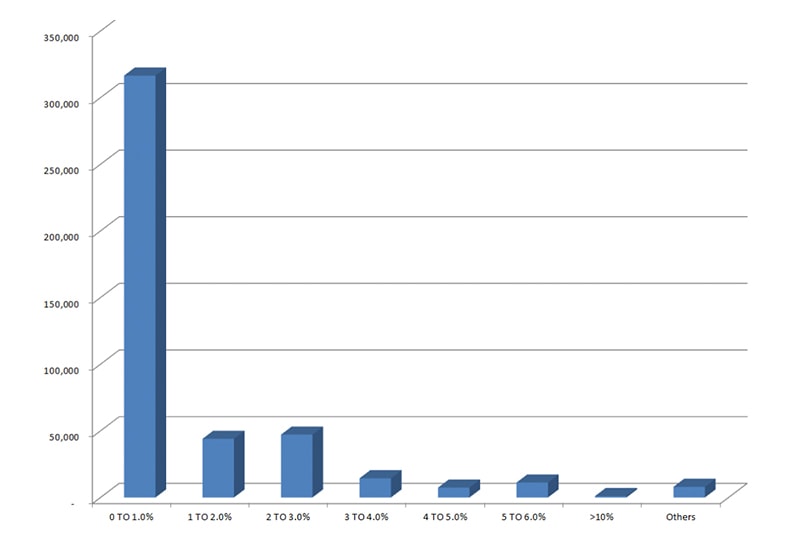

Looking at the Singapore dollar bond market, the yield distribution would look something like the chart below with nearly 70 per cent of bonds yielding between 0 to 1 per cent.

Chart of outstanding bonds in Singapore dollars grouped into yield buckets (in SGD). Source: Bloomberg

Chart of outstanding bonds in Singapore dollars grouped into yield buckets (in SGD). Source: Bloomberg

Yet we note that government bonds and bills take up the lion’s share (over 70 per cent) of the market and their yields range between 0.2 to 1.2 per cent which is still in the positive territory compared to the rest of the developed world.

Chart of the Singapore government bond yield and interest rate swap curve. Source: Bloomberg

Chart of the Singapore government bond yield and interest rate swap curve. Source: Bloomberg

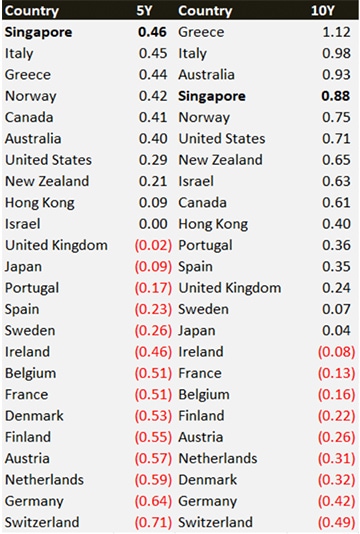

Indeed Singapore government bonds look extremely drool-worthy in yield terms when ranked against the rest of the markets. We can see from the table below that Singapore can lay claim to having the highest 5-year government bond yield in the developed world and rank 4th out of 24 countries for its close to 1 per cent 10-year bond yield.

Table of 5 and 10-year government bond yields. Source : Bloomberg

Table of 5 and 10-year government bond yields. Source : Bloomberg

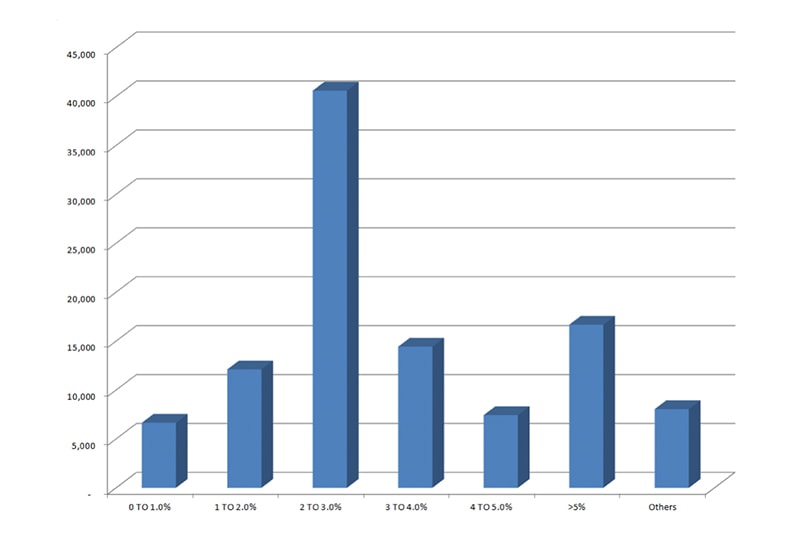

If we were to strip away the government bonds, we will pleasantly find that investors still have access to that precious 2 per cent yield that is scarce in other developed markets. A whopping 75 per cent of outstanding issues are in the >2 per cent category and about 35 per cent are >3 per cent (data unverified for accuracy). We included the “Others” category, which encompasses the S$3.4 billion odd SIA convertible bonds issued recently and the defaulting names like Hyflux that appear to be still listed just for completeness.

Chart of outstanding non-govt bonds in Singapore dollars grouped into yield buckets (in SGD). Source: Bloomberg

Chart of outstanding non-govt bonds in Singapore dollars grouped into yield buckets (in SGD). Source: Bloomberg

Interestingly, we have plenty of blue chips in the midst, with names like SIA (which was mentioned as a national asset on the Prime Minister’s May Day speech), Olam, Keppel Corp, Capitaland, ST Telemedia and Singapore Press Holdings.

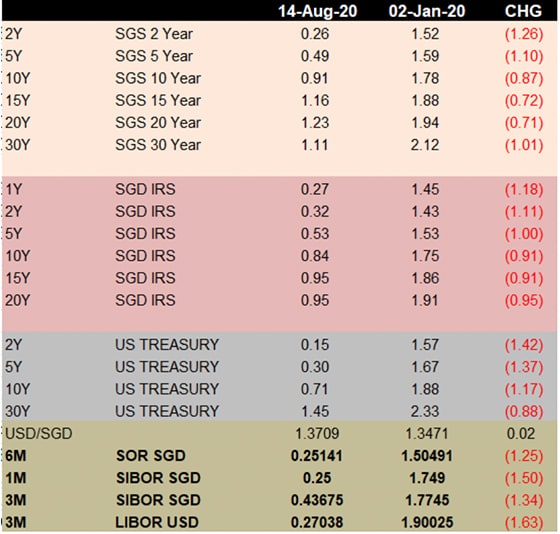

The implications are noteworthy for investors because these papers are still yielding well above their pre-meltdown levels whilst government bonds and interest rates have collapsed along with SIBOR, delivering 21 per cent returns on the old 30-year government bond year-to-date (table below for perspective).

Table of various rates and bond yields for perspective. Source: Bloomberg

Table of various rates and bond yields for perspective. Source: Bloomberg

Taking a step back to review, we realise that folks will be hit or may have been hit (like us) by the realisation that the happy capital gains story may be coming to an end for bond markets because buying the old 30-year SGD government bond today will not be returning anywhere close to 21 per cent even for the next 10 years assuming its yield remains status quo.

As the FT opined, Fed policy could leave retirees broke because “a 5 per cent yield on a $1m nest egg delivers $50,000 a year but the egg must be five times bigger to produce that at 1 per cent.” We have come to a point where there is an urgent need to examine the prospects for precious yield especially when capital gains would appear to be running out of steam after a relentless rally.

Singapore is lucky because her markets are really too small for any global fund of consequence to consider much about and thus congratulations are necessary for her sizeable representation in the “yieldy” bonds category globally.

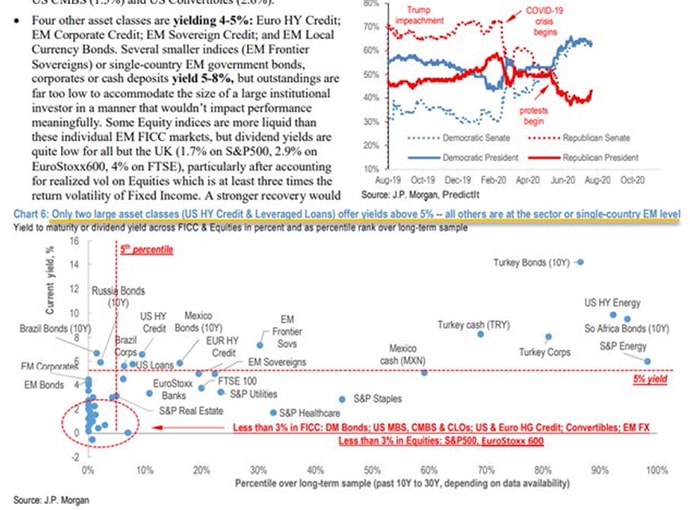

Examining the slide below, we can truly appreciate how little there is left in yields for the market where only two large (and risky) asset classes are left in the world—US High Yield Credit and Leveraged Loans that offer yields above 5 per cent in these times.

Source: McMacro on Twitter

Source: McMacro on Twitter

Let us take stock of the situation.

Capital gains on bonds have become too easy, leading folks to forget that returns will be abysmal going ahead.

There is virtually no place to put money without taking bigger risks for savers all around the world.

Singapore is in a good place because the bond market is shrinking instead of growing and it is one of the top places in the world we can still find the elusive 2 per cent yield.

We are unsure if this will be the right time to be plunging savings into bonds that yield next to nothing or bonds that yield that miserly 2 per cent but we are quite sure it is a good time right now to be taking stock of that precious yield.