The Big Bond Market Question Mark

It is like the final nail in the coffin when some idiot sends a message to your phone congratulating your ex-spouse and their new spouse on their new baby. But our friend feels “steamrolled,” “shell-shocked,” “drowning,” “alienated” much more by the bond market since the year began and does not look like the volatility will abate anytime soon, which makes 2021 more torturous than 2020.

Overall, the tension is at extreme levels and every trader we speak to is massively agitated and nervous as liquidity has all but dried up in an extremely skittish marketplace, wishing daily for some respite from the heightened volatility.

Digging up what we wrote about this period last year: Central Banks to the Rescue in Covid Panic and Pain, we estimate that the darkest hour is not upon us as it was this time last year—and it is looking like a long-drawn night ahead.

We had waited weeks to come to this conclusion; for the final central bank reactions to play out which ended this week with the FOMC, BoJ and rest, just like last year, when we looked to the central banks for meaningful direction and found certain solace.

What just happened to the bond markets?

The inflation rhetoric, which most of us dismissed early in the year has taken root as more evidence points to a V-shape recovery with commodities prices and employment regain lost ground.

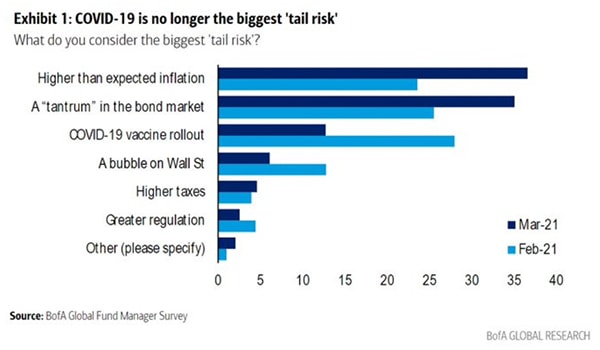

The Bank of America Global Fund Manager Survey for Feb 2021 showed that for the first time since February 2020, Covid-19 is no longer viewed as the #1 “tail risk”, supplanted by higher inflation and a bond market sell-off.

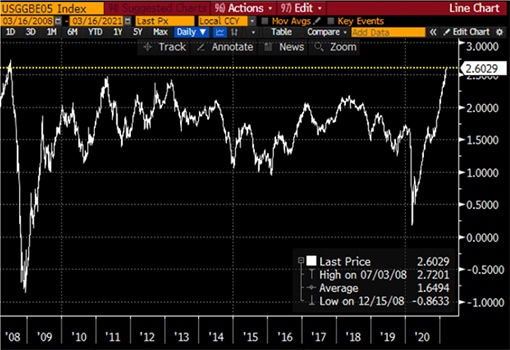

The 5-year inflation breakeven rate, calculated by subtracting the real yield of the inflation-linked maturity from the closest treasury yield, have hit their highest since 2008, a sign that inflation is expected to skyrocket.

Source: Bloomberg

Source: Bloomberg

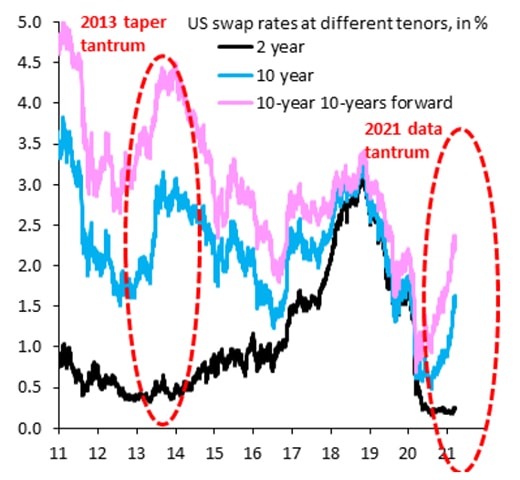

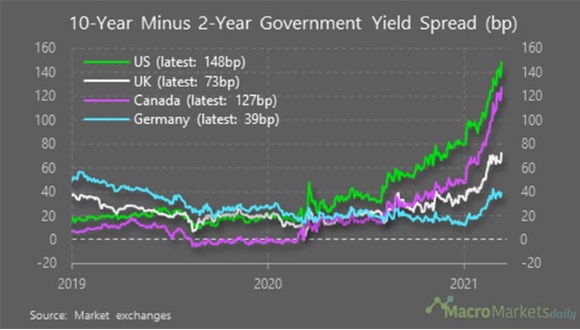

As such, we witnessed massive curve steepening all around the world which was also exacerbated by the size of the stimulus package the U.S. just unveiled that would add to government borrowings.

Source: Robin Brooks on Twitter

Source: Robin Brooks on Twitter

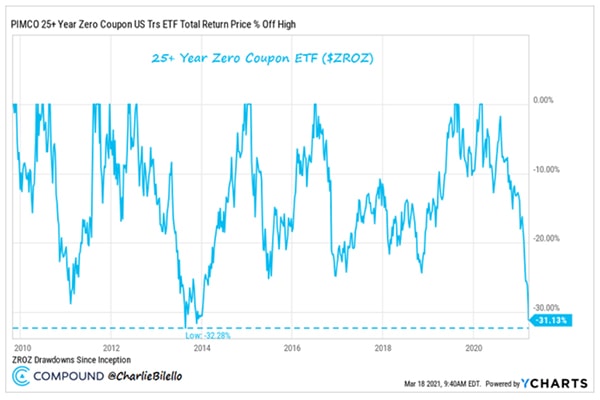

The rise in long term interest rates has resulted in large losses in bond prices with the longest duration U.S. Treasury bond ETF (ZROZ US) now down over 30 per cent from its high, approaching its largest drawdown ever (-32 per cent in 2012–13).

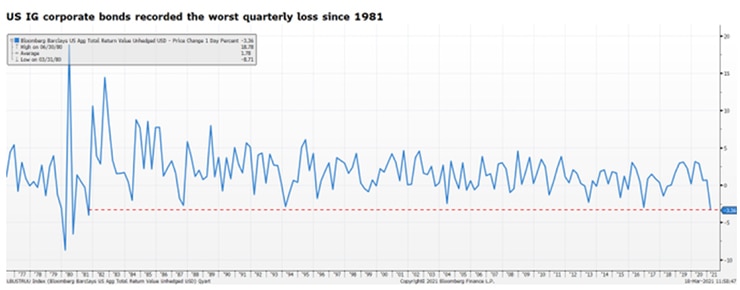

Investment-grade corporate bond was similarly not spared from the carnage with the Bloomberg Barclays US Aggregate Bond Index recording its worst quarterly loss since 1981 and the US IG ETF (LQD) down nearly 7 per cent year to date.

Source: Bloomberg

Source: Bloomberg

How about this for perspective?

It is no big deal.

Source: Visual Capitalist

Source: Visual Capitalist

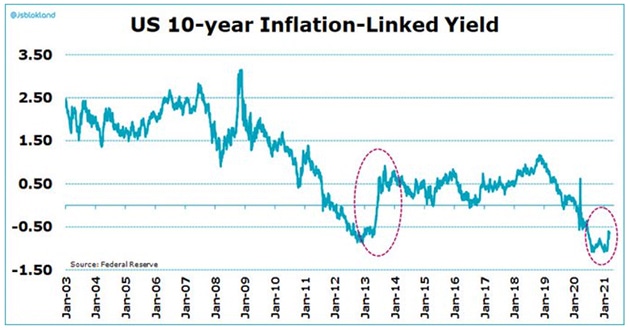

As for the inflation breakeven talk, it is a mere dent.

Source: Jeroen Blokland on Twitter

Source: Jeroen Blokland on Twitter

The main causes for concern as far as we can surmise would be uncertainty and capitulation.

How far can it go?

We had relatively peaceful years in the bond markets between 2017–2019 where volatility was low and we did not see a single week with a 0.3 per cent change in interest rates unlike last year and this year.

All of a sudden, the market is moving as if we have geniuses who know there will be exactly two rate hikes after five years behind the wheel, bulldozing the prices and ploughing down resistance.

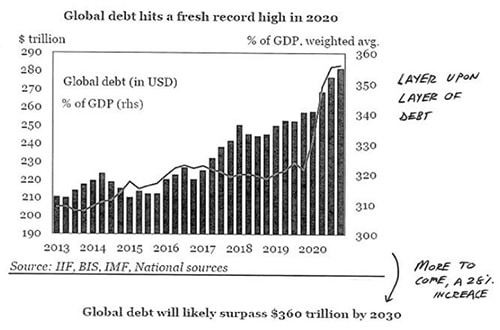

It could also be a case of capitulation because of the trillions of bonds out there with global debt hitting a fresh record high last year. There is much more to expect with the monetary and fiscal stimulus to be announced this year to challenge the market appetite for bonds in the face of economic recovery and possibly runaway growth (and inflation) after the virus, which is a conundrum indeed.

If inflation and growth materialise, which is looking increasingly likely, the case for allocation to bonds becomes weaker than ever and there will be no takers for the mass dump festival in exchange for the avalanche of equity offerings that promise a better bet for economic revival and are competing for the same precious investment dollar.

IPOs and secondary offerings hit record highs. Source: Bloomberg

IPOs and secondary offerings hit record highs. Source: Bloomberg

In any case, the biggest buyers have been the central banks in the past year that gave other buyers some assurance of a certain backstop. The central bank drug is now less assured as we exit Covid’s extenuating circumstances, resulting in the current uncertainty for investors and traders alike.

What are the central banks saying?

This is what we have been waiting for the entire time and we are not too reassured nor encouraged now.

Bank of Japan

*BOJ to Let 10-Year JGB Yield Move in Range Between -0.25% and +0.25%

*BOJ: Excessive Falls in Super-Long Yields Could Hurt Econ Activities

*KURODA: BELIEVE PRICES WILL GRADUALLY START RISING

*KURODA: PRIORITY IS TO KEEP ENTIRE YIELD CURVE LOW UNDER VIRUS

*KURODA: NOT FAVOURABLE FOR SUPERLONG YIELDS TO BE TOO DEPRESSED

*KURODA: NOT THINKING OF STEEPENING YIELD CURVE NOW

ECB

*KAZAKS SAYS YIELD GAINS WON’T ALWAYS SPUR MORE ECB BOND BUYING

*ECB Doesn’t Intend Faster Bond-Buying to Mean More Stimulus

*ECB’S MULLER: FASTER PANDEMIC PURCHASE PACE IS TEMPORARY

*LAGARDE: ECB NOT DOING YIELD-CURVE CONTROL

*ECB’S LAGARDE SAYS RISKS HAVE BECOME MORE BALANCED

FED

*FED’S BOSTIC SAYS `I AM NOT WORRIED’ ABOUT MOVE IN YIELDS

*BOSTIC: FED DOESN’T NEED TO RESPOND TO YIELDS AT THIS POINT

*7 OF 18 FED OFFICIALS SEE AT LEAST ONE ’23 RATE HIKE, DOTS SHOW

*FED REPEATS TO MAINTAIN BUYS UNTIL SUBSTANTIAL FURTHER PROGRESS

*FED: PACE OF RECOVERY IN ACTIVITY, EMPLOYMENT HAS TURNED UP

*TREASURIES FALL AFTER ANNOUNCEMENT SLR RELIEF EXPIRES MARCH 31

RBA

*RBA’s Kent Says Monetary Policy Shouldn’t Control Asset Prices

*KENT: RISING INFLATION EXPECTATIONS A GOOD NEWS STORY

*KENT: EXTENDING BOND BUYING WILL DEPEND ON ECONOMIC DATA

Rest of the World

*BOE TO MAINTAIN CURRENT PACE OF GILT PURCHASES

*BOE’S HALDANE SAYS U.K. LIKELY `IN FOR A RAPID FIRE RECOVERY’

*TURKEY’S CENTRAL BANK RAISES ONE-WEEK REPO RATE TO 19.00%

*Lira Jumps as Central Bank Delivers Bigger-Than-Expected Hike

*BRAZIL RAISES BENCHMARK LENDING RATE 75 BASIS POINTS TO 2.75%

*BRAZIL CENTRAL BANK SEES ANOTHER 75BPS RATE HIKE NEXT MEETING

*RUSSIAN CENTRAL BANK RAISES KEY RATE TO 4.50%; EST 4.25%

*BANK OF RUSSIA SEES RATE HIKE POSSIBLE AT ONE OF NEXT MEETINGS

Central banks are unfazed by the rout in the bond markets and it looks like it would take a lot more to get them to come out and say they will be buying even more bonds to support the market after BofA reported “global central banks bought $1.1bn of financial assets every hour since March, Fed balance sheet now 36% of GDP.” More recently, the ECB has become the largest central bank in the world with $8.6 trillion in assets.

PIMCO observed that China’s early reduction of stimulus has created a rift in global central banks responses and would lead to a drag on global growth and may place a burden on developed economies to keep stimulus taps open for longer. Not good news for our bond prices as well.

It was a timely warning in Warren Buffett’s annual letter to Berkshire shareholders on February 27 saying, “Fixed-income investors worldwide—whether pension funds, insurance companies or retirees – face a bleak future.”

Similarly, former bond king Bill Gross announced he was short bonds (and GameStop) and Ray Dalio posted: “The economics of investing in bonds (and most financial assets) has become stupid.”

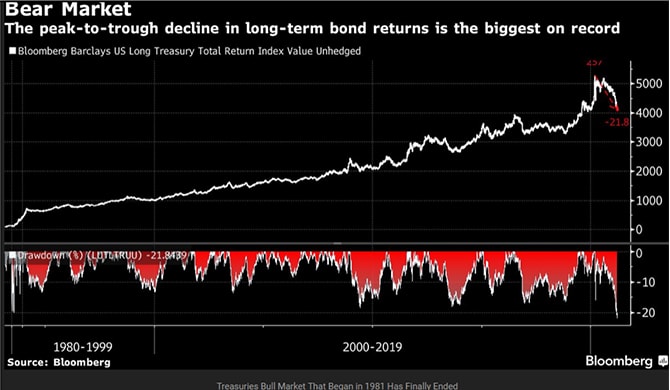

So, is this the end of the 40-year bull run in the US treasuries market that is making #BondMarketHistory with a 22 per cent drawdown from its peak last year?

Source: Bloomberg

Source: Bloomberg

It is definitely out of the ordinary for most of us, because we have not seen a bear market before.

Yet there are certain anomalies this time round.

For instance, in volatility space. Bond market volatility (MOVE US) has spiked and holding at elevated levels while equity volatility (VIX US) remains depressed.

Source: Bloomberg

Source: Bloomberg

While investment grade (IG) bonds have lost about 6.8 per cent year-to-date, using the IG ETF LQD US as a guide, junk/high yield bonds are barely down 1.42 per cent, using the HY ETF HYG US as a gauge.

High yield bond returns remain at historic lows, dropping below 4 per cent as early as last month. All this when 10yr yield has gone from 0.91 per cent to 1.75 per cent this year with the Fed buying $80 billion treasuries per month.

Yield on HYG ETF. Source: Bloomberg.

Yield on HYG ETF. Source: Bloomberg.

It is a big question mark for us although season market practitioners will say that HY bonds are more correlated with equities than interest rates and the current status quo is probably a signal that rates have not risen enough to be a problem for junk companies given the buoyant economic growth expected.

Another question mark for us to think about.

Singapore bucks the trend this time with the Markit iBoxx SGD Corporates Index up 0.24 per cent for the year against year-to-date losses exceeding 5 per cent for the Singapore Government Bond Index.

Source: Bloomberg

Source: Bloomberg

It is hard to be bullish, but there will be enough time amidst this uncertainty to make some long-term plans for those bond portfolio adjustments and positions as the Straits Times reports that “Singapore bonds’ high real yields seen drawing buyers after sell-off.”

Shortly after this time last year, markets stabilised somewhat and we had a nice breathtaking rally in both stocks and bonds and penny stocks which has now spawned a new asset classes in SPACs and NFTs and alt-coins.

The bad news is at this moment, it looks like we are just getting started on whatever that is about to happen.