What Just Happened to the Singapore Bond Market?

What strikes us these days while driving down Holland Road past the Botanic Gardens is the haunting beauty of the unkempt look of overgrown grass and shrubs as we take a moment to appreciate the unmanicured lawn, feeling like ungroomed cavemen as we prepare to come out of “hibernation.”

Friends are ranting how unprepared they are to head back to work after two months where the only time guys need to shave or women need to apply makeup is for the occasional full-face Zoom call. The pile of expensive watches and jewellery lies forgotten, folks start to feel comfortable behind masks where they are less self-conscious of their appearance and girls can even start feeling pretty.

Emerging from lockdown feeling like a ragged hillbilly who has had a hand at home farming, complete with a DIY haircut and too-tight pants will be a bewildering experience for all the things we have learnt and skills we have acquired in the past months. For some are now expert gourmets, seasoned bakers, exercise freaks (we know of at least four home gyms installed in the past month), or island adventurers (satisfying their wanderlust by driving from suburb to suburb).

For the rest, it was to learn what poor cooks they are, as a dear friend lamented how she accidentally poisoned herself with her cooking last week and the number of empty bottles of wine and whisky that could fill up the recycling bin each week.

For what it is has been worth, working from home has been a blessed distraction from the bond markets over the past three months. And that comes with accepting the dislocations and dysfunctions as part and parcel of these truly extraordinary times.

As we head back to normality, or rather, a new normality, it is time to check back on what happened to bond markets and the changes that lie ahead.

To recap, first we had a crisis in February, barely a week after the U.S. stock market hit its all-time high on February 19, with a 34 per cent drawdown from peak to its low closing on March 23, before rebounding 36 per cent to close last Friday, just 10 per cent shy of the all-time high after the U.S. Federal Reserve added US$3 trillion to its balance sheet in the short span of two months and as Covid-19 deaths in New York show signs of tapering.

Chart of the S&P 500, 10Y bond yields, Covid-19 deaths in NY and FED balance sheet. Source: Bloomberg

Chart of the S&P 500, 10Y bond yields, Covid-19 deaths in NY and FED balance sheet. Source: Bloomberg

The volatility has been nothing short of breathtaking, astounding or how about just insane? In the month of March, we had 10-year bond yields plunging to a low of 0.31 per cent intraday on Monday, March 9, before closing the week at 0.76 per cent and rising to 1.2 per cent a week later and then crashing down to spend the past eight weeks between 0.5 to 0.75 per cent, while the VIX Volatility Index has been holding above 25 for the past three months—a level that markets never saw for the whole of 2019.

What we had was a health crisis that saw more than half the world’s population in some form of home confinement, along with widespread business disruptions in the midst of an oil shock and social unrest erupting as geopolitical tensions continue to mount.

Global central banks responded in unprecedented ways, injecting insane liquidity into markets, uncoordinated globally, varying from country to country with some intervening much more than others. Like Singapore’s MAS, content to just provide ample enough Singapore dollar liquidity through primary dealers and offering U.S. dollars through a swap line with the Fed even as the Fed started buying junk bond ETFs in its bid to buy up to US$250 billion of corporate debt in its Secondary Market Corporate Credit Facility, along with US$500 billion in new bonds throughout the lifetime of its relief programmes.

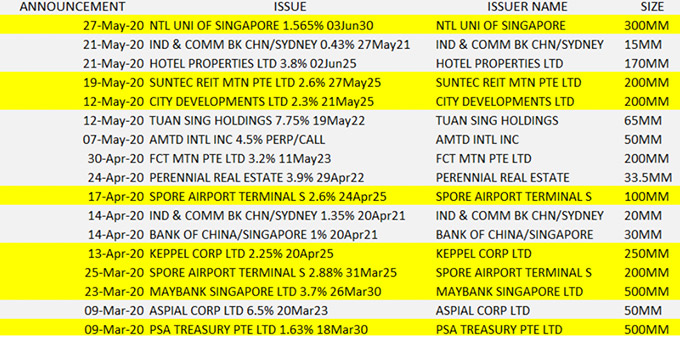

Corporate bond issuance in G3 markets has been breaking new records for the past eight weeks with trillions issued in this short span of time although Singapore bucks the trend in the absence of possibly, central bank support. On the contrary, we saw over SG$7 billion dollars of bonds mature in the past three months and just under SG$3 billion dollars worth of new issues, of which about 80 per cent are suspected to be “bailout” issues because the bonds are unavailable in the market (see highlighted issues below)—meaning they were probably privately placed.

List of new bond issues in SGD since March 2020

List of new bond issues in SGD since March 2020

Singapore Market Recap

Since we last wrote about the Covid crisis in Singapore bond markets, things got worse to a point of market decimation—according to friends we spoke to, who managed to weather through with some good fortune and a ton of experience and common sense.

The first waves of selling started early March from retail margin calls for portfolio losses which were exacerbated by the private banks pulling leverage for various bond issues causing a massive market gridlock. From the lack of buyers and market makers’ limitations to holding high-yield and subordinated issues, the mainstay of the private bank market.

As such, all the glorious and well-demanded PB favourites tanked, some to ridiculous price levels which added to market angst because price discovery was non-existent and bids were hit as long as they were firm, resulting in severe mark-to-market losses for those holding the papers. With price discovery missing, some resorted to using Bloomberg valuations to price, which was a mistake because Bloomberg’s valuation models for Singapore are highly iffy and mostly inaccurate although wielding the power to affect P&L’s and portfolio valuations.

The second wave arrived from fund redemptions and or anticipated fund redemptions with fund managers in dump mode for chunky sizes that saw the market seize up and keeled over with leading banks turning to working “on order basis”, evoking the “limited liquidity” clause in the OTC marketplace as the interest rate markets whipsawed and prices were few and far between.

We saw the retail SIA bonds trade to 8 per cent on the stock market, blue chips bonds decimated and sales brokers had a field day matching buyer and seller for decent 2-5 per cent instant profits. Yet there were those issues that simply will not be priced, like Lippo malls and gang, as well as the backlog of bonds waiting to be dumped from the PB books.

SIBOR collapsed further as government safe havens rallied into April after the various central banks stepped in and selected credits saw massive gains elsewhere, shaking off losses on confidence in central banks.

The 1-month SIBOR collapse into May would be the fastest 5-month dip in the index’s history, falling over 1.5 per cent in the shortest span of time and even swifter than the September 2008 to March 2009 period during the global financial crisis.

Graph of 1-month SGD SIBOR

Graph of 1-month SGD SIBOR

None of that translated into any gains for the Singapore corporate bond market until the May Day speech where PM Lee officially assured state support for SIA and risk appetite gradually returned albeit with unreasonable expectations of distressed prices, lagging international markets by a mile as bond issuance rolled on full steam in April and May for the international bond markets.

PSA, ST Engineering and Keppel Corp managed to print in USD while SGD bonds continued to flounder, delivering yields north of 3 per cent despite the cheap SIBOR.

While clients are picking and choosing between the Temasek-linked and remotely linked entities, they are mostly giving the rest of the field a wide berth, including unrated blue chips such as Singapore Press Holdings, Fraser Properties and all. Although anyone who had bought PIL’s distressed bonds would be a hero now that Temasek is coming to their rescue and woe to those who thought that Ascott Residence Trust was going to redeem their notes next month because the company has just set a precedent in bad form for the local perpetuals, giving every issuer a reason not to call their papers when due and probably setting off another sell-off next week.

The entire year so far has been a tale of astronomical gains for the deserving government bonds and anything safe haven in nature, minus the PM’s assurance on SIA which has not improved the prices much. I would envy the person with the foresight to buy 5-year government bonds in March at a yawn-worthy 1.2 per cent because it is last at 0.44 per cent and we cannot hope to buy anything risk-free (except SIA perhaps) for over 1.16 per cent which is the yield of the 30-year government paper given that 10-year swaps are a mere 0.78 per cent. It has all come a long way from where we started the year and we attach the table of changes below for reference (and a reality check), prompting even The Business Times to call out the Singapore Savings Bonds as having outlived their use.

Table of changes in rates and bonds (accuracy unverified). Source: Bloomberg

Table of changes in rates and bonds (accuracy unverified). Source: Bloomberg

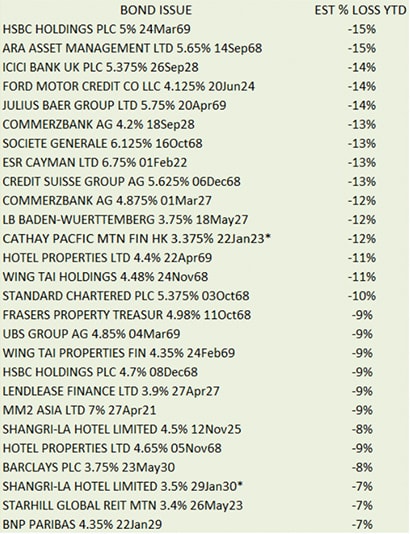

And yield chasers have been heavily punished by markets and sometimes unfairly so, because for some reason, French and Swiss bank perpetuals in Singapore are recovering more quickly than their German subordinated debt and trading more in line with their international levels whilst the German banks are yielding some 6-8 per cent over their offshore equivalents. And we have had 3 AT1 CoCo’s that have not called their bonds so far (including Lloyds and Deutsche) although it would be once in a blue moon if we were to witness a sub-debt miss a call. Nonetheless, all weathering massive losses, if stock markets are anything to go by, who says bonds are safer than stocks? We compiled a rough table of year-to-date bond price losses below.

Table of bonds with their estimated loss year to date (unverified). *Issued in 2020

Table of bonds with their estimated loss year to date (unverified). *Issued in 2020

And it is not just the riskier debt that has underperformed because rough numbers show a majority of corporates bonds down in price year-to-date despite the collapse in interest rates. These include many Temasek-linked names such as Keppel Corp, Sembcorp, Capitaland, all the REITs and SIA, of course. Additionally, we can rest assured knowing that market weakness will sustain after Ascott Residence’s stunt on Friday.

Going Forward

The good news is that Singapore markets will not be going back to normality. Perhaps because it was a flawed normal before: the lack of participants, liquidity and the murky world of private bank leverage that comes and goes as it pleases for all the investors encouraged to chase yields down and are left to hang when it is time to sell.

Yet the good news is that only the hard-pressed and highly desperate or the highly confident issuer will be brave enough to issue bonds in the days ahead and we have seen only a handful, for the 7 billion worth of maturities in the past three months of which we hear many have successfully refinanced in the loans department. That is good for the supply side story given no central bank will be coming to Singapore’s bond market rescue.

We will have no choice but to cheer long live the Fed, BoJ, ECB, RBA and gang to keep the QE going and perhaps take a page from Sweden’s central bank who has engaged BlackRock for advice on how to kick start their local debt market that has gone into deep freeze since March, considering the option of intervention.

As we said three weeks ago in our article on an unprecedented change in how we view corporate bonds, we believe the idea is just latching on as we get folks telling us they have started to relent on the idea of unrated papers and brushing up on learning the difference between capital treatments of sub-debts and perpetuals etc., encouraging signs for a new era.

There is absolutely no rush really now that we have come so far with SIBOR borrowing costs and interest rates at their all-time lows, where they are likely to be staying for a while. Meanwhile, there is good reason to cheer too because most bonds are still trading lower than where they started out the year at, leaving some scraps on the table for the discerning investor. We will find out soon enough.