With All Due Disrespect to SIBOR and the Mortgage Market

With all due disrespect to drivers going down Kim Seng road in the mornings, the residents have decided to turn the left-most lane into their personal driveway for taxis, private hire cars and, of course, a fleet of international school buses. Sky-high real estate prices have minimised condo driveways which means the public road had to be used (since it is free real estate) but that leaves public buses using the second left-most lane and reduces 4 lanes into 2 usable ones in a morning comedy as we have large and small cars racing like F1 drivers to muscle their way through. The car horn comes in most handy for people who cannot afford that Ferrari.

It feels like a slap in the face for Hyflux retail bond investors not because they tried (and failed) to apportion blame to DBS and the ATM distribution of Hyflux’s final retail perpetual bond in 2016 nor because they are attempting to rewrite bond textbooks by demanding their money back before the senior bonds get paid but that there is no plan left on the table as the company’s fate hangs in limbo.

So Turks in Istanbul get a slap in their faces as they will be made to vote again (and maybe, again) until the government gets the results they want. And the Thai elections will probably deliver another slap.

Then we have all Saudi-critics getting all due disrespect as the Aramco, the state oil company, receive a 100 billion in orders for their 12 billion global bond issue just a year after the highly publicised murder and decapitation of a journalist and the not-so-lucky investors who managed to get the bond got a huge slap to their faces when the bond proceeded to tank after its IPO.

Did DBS Just Kill SIBOR?

A peeved friend was lamenting about how her home loan has been re-pegged no less than a few times in the past year, with a-designer-bag-a-year’s worth of additional interest and how DBS Bank’s fixed deposit rates have rose in the past 2 years and how she should not have been suckered into signing up for a benchmark no one but DBS knows anything about although it was the lowest rate in town at that time.

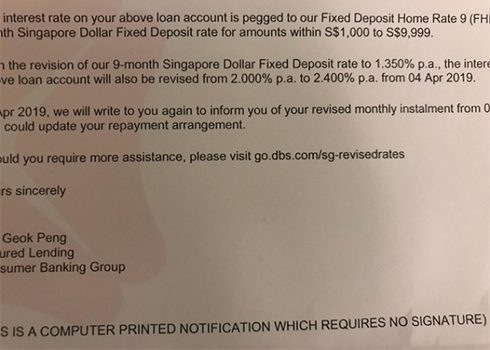

Photo of DBS’s recent letter to borrowers

Photo of DBS’s recent letter to borrowers

2.4% is a glaring number if it was just 1.3% when you signed up for the loan because the 9 months fixed deposit (9mFD) rate in May 2017 was just 0.25%. Folks start to feel the significance when the monthly payment difference nears the thousand-dollar mark.

The rudest shock of all perhaps is the discovery that DBS, Singapore’s largest local bank, does not offer SIBOR home loan packages anymore. It is an extraordinary discovery that matters to interest-rate-enthusiasts like ourselves because SIBOR is usually the first point of reference for any investor, LIBOR’s equivalent in our world.

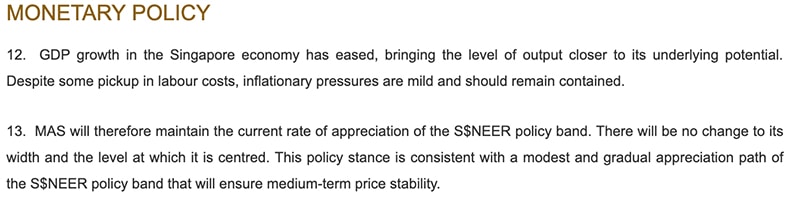

With all due disrespect to SIBOR, MAS is the only central bank in the world that does not mention anything on interest rates in their semi-annual statements like the one issued last Friday.

Source: MAS

Source: MAS

We observe that Interbank Interest Rates was published on the MAS website until end 2014. We would assume those would be SIBOR fixings. From 2014, SIBOR rates can be found on the Association of Banks in Singapore (ABS) website and the ABS is the official owner of SIBOR just as LIBOR is now owned by the Intercontinental Exchange (ICE) and formerly owned by the British Bankers’ Association, both of whom have no relationship with the U.S. central bank.

In 2017, it was decided that LIBOR would be discontinued after 2021 and so far, the market consensus is to adopt the Secured Overnight Financing Rate (SOFR) as an alternative although implementation is still far off and sceptics remain.

Therefore it is alright for DBS to take the initiative to “diss” SIBOR and go ahead to use their own interest rate benchmark and DBS leads the way because the other banks are starting to follow suit.

We Guess SIBOR is a Good Guess

SIBOR is not LIBOR which is tied to over US$350 trillion worth of derivatives and other financial products. Singapore dollar derivatives are mostly based on the Swap Offer Rate (SOR) which is derived from USDSGD forward points and LIBOR.

Other than pricing loans, SIBOR does not have much use and does not trade a lot because if we check out the SIBOR calculation methodology, it is a rate at which a bank “could borrow funds, were it to do so by asking for and then accepting the interbank offers in reasonable market size.” This means SIBOR does not have to transact at all for SIBOR to be calculated just as Barclays Bank, in 2017, estimated that 70% of Libor submissions are now made upon “expert judgement” instead of genuine transactions.

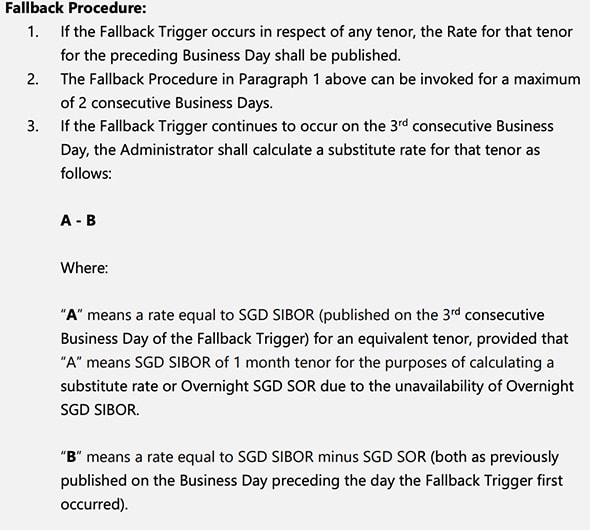

SOR would appear much more important because the calculation has to be based on “qualifying transactions”. Yet as a last resort, if no data is available, they would approximate using SIBOR over a spread!

Source: ABS

Source: ABS

If SIBOR is sometimes nothing more than a good expert’s guess, we can understand why DBS is advertising to borrowers that “DBS offers floating packages pegged to Fixed Deposit Home Rate 8 (FHR8)*, which is transparent and less volatile compared to other market benchmarks such as the one-month or three-month Singapore Interbank Offered Rate (SIBOR).”

SIBOR has risen from 1% in 2017 to 1.82283%, we remind Peeved Friend. If she had taken the 1M SIBOR home loan back in May 2017, at 1M SIBOR + 0.6%, she would be paying 2.42% now and DBS has only just raised their rate to 2.4%, using 9mFD+1.35%, although, as DBS disclaims, “packages pegged to the bank’s fixed deposit rates are still subject to change at the bank’s discretion”.

It’s a Gangsta Mortgage Market

Friends are rushing to re-financing at the latest opportunity to the lowest rate in town at the moment, which is 1M SIBOR+0.2% (2.02%) to “save” a designer bag from DBS.

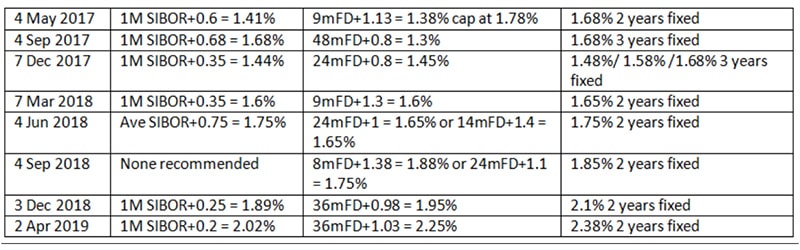

We noted something incredibly odd at that, thanks to the penchant of hogging emails and we found a ton of weekly mortgage newsletters from our favourite mortgage broker, Patrick Lee, summarising the best mortgage packages out there and we did a random table for comparison.

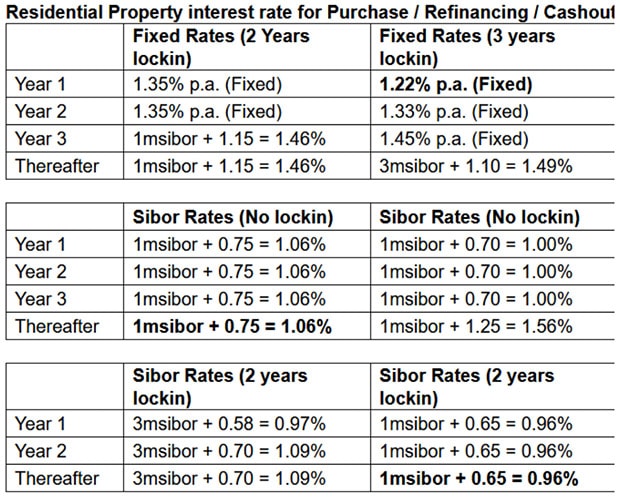

Summary of random (competitive) mortgage packages over 2 years (accuracy unverified)

Summary of random (competitive) mortgage packages over 2 years (accuracy unverified)

The first question that springs to mind is “Where did they get all those spreads from”?

Then comes, “Where are all those FD rates from, is there a common standard and how do we track them”?

And the BIG question, “Why is the SIBOR home loan spread collapsing”? It was 1M SIBOR+0.6% in 2017 and just 1M SIBOR+0.2% now.

My, we pity those folks who went in March 2018 because 9mFD was just 0.3% (1.6-0.3) then and it is 1.35% today and the winners would be those who had grabbed the 1.65% 2 year fixed rate package.

9mFD, 24mFD and all the various combinations of fixed deposit rates that are set at the “discretion” of the banks, with all due respect to borrowers, it does look like there are many creative alternatives to SIBOR out there and there will be no prizes for guessing that the bank with the largest mortgage book, who has stopped using SIBOR, will have the most important Fixed Deposit rate in town.

Ironically, we were also astounded to find that DBS’s fixed deposit base is just barely an eighth of OCBC’s and UOB’s which makes it easy for DBS to raise those fixed deposit rates without eating much into their cost.

Flashback 2012

We congratulated ourselves on digging up mortgage newsletters dating back to 2012 and the world was a much simpler place then and the emails were shorter and sweeter with none of those combinations of 8 to 48 months FD rates.

Mortgage rates taken from a newsletter in Jan 2012

Mortgage rates taken from a newsletter in Jan 2012

On closer inspection, one would realise that no one would be holding on to those mortgages today because 1M SIBOR +0.75 = 2.57%!

Those fixed deposit loans started appearing sometime in 2015 and things have gotten funkier since. It is almost as if there is something the market is telling us about SIBOR and the clout of local banks in the mortgage market, creating their own not-so-tamper-proof benchmark and getting acceptance for it.

With All Due Disrespect to SIBOR

We are not sure what the plans are for SIBOR and if it will go away like LIBOR, not that it matters to our lives as much as LIBOR because SOR is computed with LIBOR too.

As for our gleeful friends who have rushed into the latest SIBOR packages, we are not sure if they know what they are doing because SIBOR has no reason not to stay elevated because it matters little. Come on, with all due respect, the mortgage market depends on it.